Computer Numerical Control Machine Market Size, Share, Trends, Industry Analysis Report

: By Type, Industry Vertical (Automotive, Aerospace & Defense, Construction, Power & Energy, Healthcare, and Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM1401

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

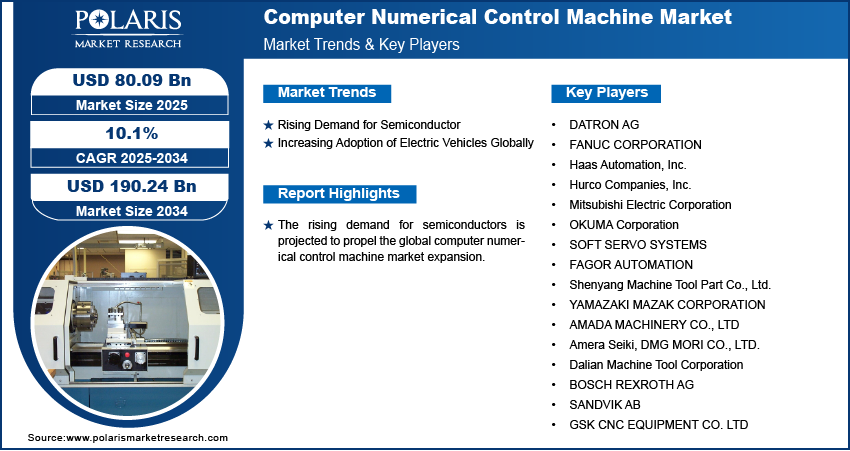

The computer numerical control machine market size was valued at USD 72.85 billion in 2024. The market is projected to grow from USD 80.09 billion in 2025 to USD 190.24 billion by 2034, exhibiting a CAGR of 10.1% during 2025–2034. The ability of CNC technology to improve manufacturing efficiency by enabling high accuracy and the development of complex shapes drives market demand.

Key Insights

- The lathe machines segment held the largest market share in 2024.

- The automotive segment dominated the market in 2024 due to the need for precision manufacturing and production of high-quality components at scale.

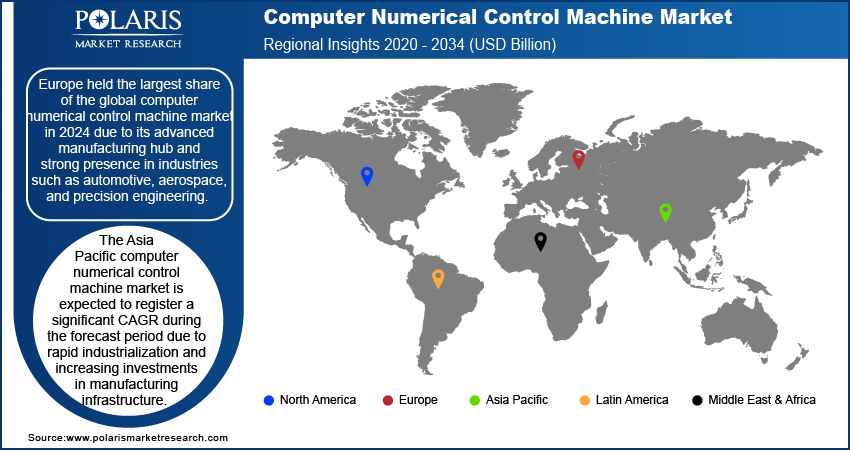

- Europe accounted for the largest market share in 2024 due to its advanced manufacturing hub and robust presence in industries such as automotive, aerospace, and precision engineering.

- Asia Pacific is projected to register a significant CAGR during the forecast period due to rapid industrialization and growing funding in the manufacturing sector.

Industry Dynamics

- The growing demand for semiconductors is expected to drive market growth.

- The increased adoption of EVs worldwide is anticipated to fuel the market expansion.

- Increased demand for automation and efficiency in manufacturing across industries presents significant market opportunities.

- High initial investment costs and workforce skill gaps may present market challenges.

Market Statistics

2024 Market Size: USD 72.85 billion

2034 Projected Market Size: USD 190.24 billion

CAGR (2025-2034): 10.1%

Europe: Largest Market in 2024.

AI Impact on Computer Numerical Control Machine Market

- AI optimizes machining operations by analyzing real-time data to improve tool paths and enhance precision.

- Predictive maintenance powered by AI detects tool wear and machine anomalies early. This minimizes unplanned downtime and repair costs.

- AI-driven quality control systems identify defects during production. These systems ensure higher consistency and reduce material waste.

- Integration of AI enables adaptive manufacturing processes that respond to design changes and customization needs with minimal human input.

Machine Market.png)

Computer numerical control machine (CNC) is a technology that automates the operation of machine tools using computer programs. In simple terms, CNC machines follow precise instructions written in a special programming language called G-code, which instructs the machine exactly how to move and what actions to perform. CNC technology enhances manufacturing efficiency by allowing for high precision and producing complex shapes consistently, making it essential in various industries such as aerospace, automotive, medical, and electronics.

The increasing automation in manufacturing plants is propelling the global computer numerical control machine market growth. Automation relies on consistent and repeatable operations, which CNC machines offer by using programmed instructions to control complex machining tasks. These machines reduce the reliance on manual labor, minimize human error, and enable the production of high-quality components at faster rates. Therefore, as manufacturers shift toward automation to optimize productivity and meet growing customer demands, CNC machines become crucial equipment for automated workflows, integrating seamlessly with robotics and other advanced systems.

The growing advancements in technology boost the computer numerical control machine market demand. Innovations such as IoT integration, AI-driven optimization, and advanced software enable CNC machines to perform complex tasks with greater speed and minimal human intervention. These improvements reduce operational costs and enhance customization and scalability, making CNC machines critical across industries such as aerospace, automotive, healthcare, and electronics. The growing emphasis on sustainability further drives demand, as CNC technology enables resource-efficient production with minimal waste.

Market Dynamics

Rising Demand for Semiconductor

The rising demand for semiconductors is projected to propel the global computer numerical control machine market expansion. As per the data published by the Semiconductor Industry Association (SIA), global semiconductor-industry sales hit USD 49.1 billion in May 2024, a massive 19.3% increase on May 2023’s total sales of USD 41.2 billion. Semiconductors are intricate components that require ultra-precise cutting, shaping, and finishing of materials such as silicon wafers, which are used in chips and integrated circuits. CNC machines, known for their high precision, automation, and repeatability, are ideal for producing the complex designs needed in semiconductor components. Moreover, as the semiconductor industry evolves to support advanced technologies such as 5G, artificial intelligence, and IoT, the need for more sophisticated and specialized CNC machines increases.

Increasing Adoption of Electric Vehicles Globally

The rising adoption of electric vehicles globally is estimated to fuel the global computer numerical control machine market revenue during the forecast period. According to a report published by the, International Energy Agency, almost 14 million new electric cars were registered globally in 2023. Electric vehicles (EVs) rely on complex and high-performance parts, including electric motors, battery housings, lightweight chassis, and intricate drivetrain systems, which require precise machining and fabrication. CNC machines are essential for producing these components with high accuracy, consistency, and efficiency, especially as manufacturers focus on enhancing performance and reducing weight to improve EV range and efficiency. Furthermore, the growing emphasis on innovation and mass production in the EV industry fuels the need for advanced CNC machinery capable of handling diverse materials such as aluminum, composites, and specialized alloys.

Segment Analysis

Assessment by Type

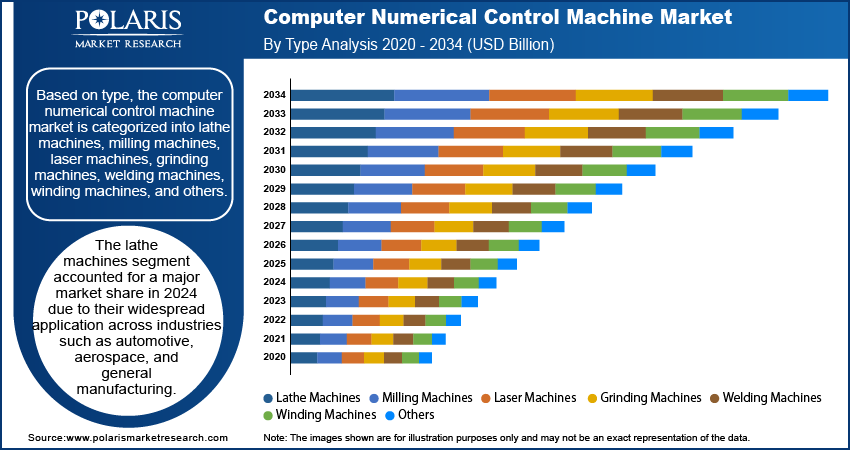

Based on type, the computer numerical control machine market is categorized into lathe machines, milling machines, laser machines, grinding machines, welding machines, winding machines, and others. The lathe machines segment accounted for a major computer numerical control machine market share in 2024 due to their widespread application across industries such as automotive, aerospace, and general manufacturing. The ability of lathe machines to perform multiple operations such as turning, threading, and facing with exceptional precision makes them crucial for producing cylindrical components. Additionally, the increasing use of automation and the integration of advanced technologies, such as IoT-enabled systems, enhanced their efficiency and appeal, solidifying their dominant position in the market.

The milling machines segment is expected to grow at a robust pace in the coming years owing to their versatility and ability to perform complex cutting, drilling, and shaping tasks. The rise in demand for intricate and customized components in industries, including aerospace, electronics, and medical devices, has accelerated the adoption of milling machines. Innovations such as multi-axis capabilities and smart controls have also made milling machines more efficient, precise, and suitable for high-tech applications, further contributing to their adoption.

Evaluation by Industry Vertical

In terms of industry vertical, the computer numerical control machine market is segmented into automotive, aerospace & defense, construction, power & energy, healthcare, and others. The automotive segment dominated the market share in 2024 due to the need for precision manufacturing and producing high-quality components at scale. Automakers increasingly relied on advanced machining solutions such as CNC machines to manufacture engine parts, transmission systems, and structural components with exceptional accuracy and efficiency. The growing demand for electric vehicles also contributed to this dominance, as manufacturers required specialized equipment to produce lightweight components and complex battery housings. Additionally, the industry's emphasis on improving production efficiency and meeting stringent emission standards further propelled the adoption of automated and high-precision CNC machinery.

Regional Insights

By region, the study provides the computer numerical control machine market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe held the largest market share in 2024 due to its advanced manufacturing hub and strong presence in industries such as automotive, aerospace, and precision engineering. Germany dominated the regional market share due to its well-established industrial base, technological advancements, and significant investments in automation and smart manufacturing. German companies' emphasis on innovation and high-quality production processes played a critical role in maintaining Europe's leadership position. The region's focus on sustainability and energy efficiency further spurred the adoption of precision machinery, including CNC machines, for producing lightweight components and reducing material waste.

The Asia Pacific computer numerical control machine market is expected to register a significant CAGR during the forecast period due to rapid industrialization and increasing investments in manufacturing infrastructure. China and India lead the growth in this region due to their expanding automotive, electronics, and consumer goods industries. China, in particular, plays a crucial role as it continues to scale its manufacturing capabilities while adopting advanced technologies to improve efficiency and precision. The rise of small and medium enterprises (SMEs) in countries such as India and Vietnam further contributes to the demand for advanced machinery. Moreover, the growing focus on high-tech industries such as aerospace and renewable energy propels the adoption of computer numerical control machines, making Asia Pacific a key region for future market growth.

Key Players and Competitive Analysis

Major market players are investing heavily in research and development to expand their offerings, which will boost the computer numerical control machine market growth in the coming years. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The computer numerical control machine market is fragmented, with the presence of numerous global and regional market players. A few major players in the computer numerical control machine market are DATRON AG; FANUC CORPORATION; Haas Automation, Inc; Hurco Companies, Inc.; Mitsubishi Electric Corporation; OKUMA Corporation; SOFT SERVO SYSTEMS; FAGOR AUTOMATION; Shenyang Machine Tool Part Co., Ltd.; YAMAZAKI MAZAK CORPORATION; AMADA MACHINERY CO., LTD; Amera Seiki; DMG MORI CO., LTD.; Dalian Machine Tool Corporation; BOSCH REXROTH AG; SANDVIK AB; and GSK CNC EQUIPMENT CO. LTD.

OKUMA Corporation, founded in 1898, is a prominent Japanese manufacturer specializing in computer numerical control (CNC) machines and machine tools. Initially starting as a producer of noodle-making machines, Okuma transitioned to manufacturing machine tools in 1904, evolving into a leader in the CNC sector over the decades. Headquartered in Niwa-gun, Aichi Prefecture, Japan, Okuma operates globally with a significant presence in countries such as the US, Germany, Singapore, and India. The company employs approximately 3,800 people and is known for its commitment to innovation and quality in machine tool production. Okuma's product lineup includes a diverse range of CNC machines, such as lathes, multitasking machines, machining centers, and grinders. These machines are equipped with advanced CNC controls that enhance their precision and efficiency.

Haas Automation, Inc., founded in 1983 by Gene Haas, is a major American manufacturer of computer numerical control (CNC) machines and machine tools, headquartered in Oxnard, California. The company has established itself as the largest machine tool builder in the Western world. It is renowned for producing a comprehensive range of CNC equipment, including vertical machining centers (VMCs), horizontal machining centers (HMCs), CNC lathes, and rotary products.

List of Key Companies

- AMADA MACHINERY CO., LTD

- Amera Seiki

- BOSCH REXROTH AG

- Dalian Machine Tool Corporation

- DATRON AG

- DMG MORI CO., LTD.

- FAGOR AUTOMATION

- FANUC CORPORATION

- GSK CNC EQUIPMENT CO. LTD

- Haas Automation, Inc.

- Hurco Companies, Inc.

- Mitsubishi Electric Corporation

- OKUMA Corporation

- SANDVIK AB

- Shenyang Machine Tool Part Co., Ltd.

- SOFT SERVO SYSTEMS

- YAMAZAKI MAZAK CORPORATION

Computer Numerical Control Machine Industry Developments

July 2024: Meltio and its partners introduced new hybrid CNC machines. After integrating the Meltio Engine CNC with JMT's products, it became possible to produce accurate metal parts from wire feedstock. This technique makes all material usefully utilized and provides a safer method of working.nd its partners introduced new hybrid CNC machines. After integrating the Meltio Engine CNC with JMT's products, it became possible to produce accurate metal parts from wire feedstock. This technique makes all material usefully utilized and provides a safer method of working.

September 2023: DMG MORI CO., LTD., a global manufacturer of machine tools and related products, announced the acquisition of KURAKI, a CNC machine manufacturer, to expand the demand for CNC horizontal boring and milling machines.

August 2023: OKUMA Corporation, a comprehensive machine tool manufacturer that manufactures CNC machines, announced the launch of the company’s next-generation machine control OSP-P500 for its expansive line of CNC (computer numeric control) machine tools.

Computer Numerical Control Machine Market Segmentation

By Type Outlook (Volume, Thousand Units, Revenue, USD Billion, 2020–2034)

- Lathe Machines

- Milling Machines

- Laser Machines

- Grinding Machines

- Welding Machines

- Winding Machines

- Others

By Industry Vertical Outlook (Volume, Thousand Units, Revenue, USD Billion, 2020–2034)

- Automotive

- Aerospace & Defense

- Construction

- Power & Energy

- Healthcare

- Others

By Regional Outlook (Volume, Thousand Units, Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 72.85 billion |

|

Market Size Value in 2025 |

USD 80.09 billion |

|

Revenue Forecast by 2034 |

USD 190.24 billion |

|

CAGR |

10.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Thousand Units, Revenue in USD Billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global computer numerical control machine market size was valued at USD 72.85 billion in 2024 and is projected to grow to USD 190.24 billion by 2034.

The global market is projected to register a CAGR of 10.1% during the forecast period

Europe held the largest share of the global market in 2024.

A few of the key players in the market are DATRON AG; FANUC CORPORATION; Haas Automation, Inc; Hurco Companies, Inc.; Mitsubishi Electric Corporation; OKUMA Corporation; SOFT SERVO SYSTEMS; FAGOR AUTOMATION; Shenyang Machine Tool Part Co., Ltd.; YAMAZAKI MAZAK CORPORATION; AMADA MACHINERY CO., LTD; Amera Seiki; DMG MORI CO., LTD.; Dalian Machine Tool Corporation; BOSCH REXROTH AG; SANDVIK AB; and GSK CNC EQUIPMENT CO. LTD.

The milling machines segment is projected to register a significant growth rate in the global market during the forecast period.

The automotive segment dominated the market in 2024.