Orthopedic Implants Market Size, Share, Trends, Industry Analysis Report

By Product (Lower Extremity Implants, Spinal Implants), By Material, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 115

- Format: PDF

- Report ID: PM1532

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

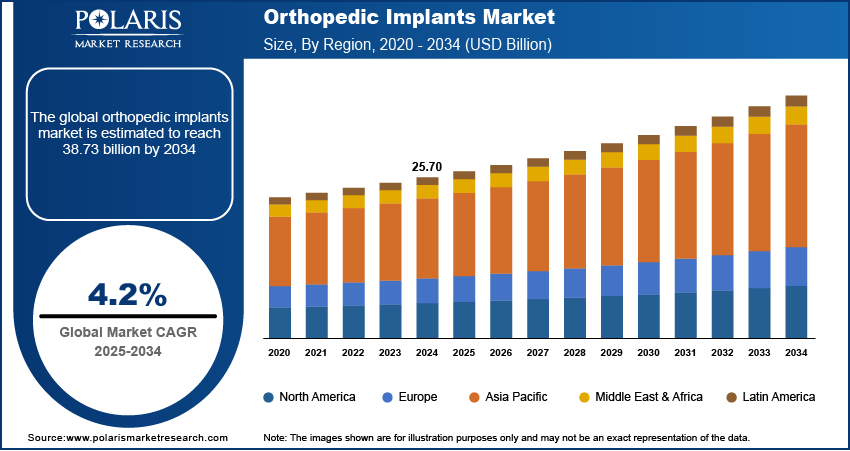

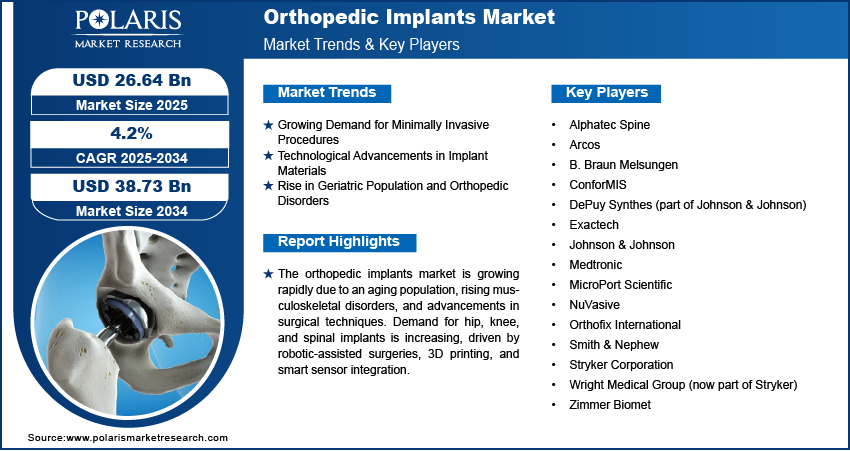

The orthopedic implants market size was valued at USD 25.70 billion in 2024 and is projected to register a CAGR of 4.2% from 2025 to 2034. The growing demand for minimally invasive surgeries and the expansion of healthcare infrastructure in emerging markets boost the industry expansion. Trends such as the development of patient-specific implants and the integration of smart technologies for better monitoring and recovery are expected to shape the industry in the coming years.

Key Insights

- The lower extremity implants segment held the largest share in 2024. The dominance is driven by the high demand for knee and hip replacement surgeries.

- The metallic materials segment accounted for the largest share in 2024. The widespread use of titanium, cobalt-chromium, and stainless steel in implant manufacturing contributes to this dominating share.

- The hospital segment led the market in 2024, due to the high volume of complex orthopedic surgeries performed in hospital settings.

- North America held the largest share in 2024, driven by the region's advanced healthcare infrastructure and the presence of key market players.

- The Asia Pacific industry is registering the highest growth rate. The growth is driven by rapidly aging population, increasing healthcare spending, and growing awareness of orthopedic conditions.

Industry Dynamics

- The demand for minimally invasive procedures rises, with technological advancements such as orthopedic surgical robots and computer-assisted navigation. This factor drives the orthopedic implants market expansion.

- The rising global geriatric population is a major contributor to the industry growth.

- The development of stronger, more durable, and biocompatible materials has enhanced the longevity and performance of orthopedic implants. Thus, rising technological advancements in implant materials are expected to offer lucrative opportunities in the coming years.

- High cost of orthopedic surgeries hinders the demand for orthopedic implants.

Market Statistics

2024 Market Size: USD 25.70 billion

2034 Projected Market Size: USD 38.73 billion

CAGR (2025–2034): 4.2%

Asia Pacific: Largest market in 2024

AI Impact on Orthopedic Implants Market

- Artificial intelligence (AI) facilitates personalized implant designs tailored to individual biomechanics and anatomy.

- Generative design, 3D modeling, and other such tools simulate implant performance under real-life conditions. It improves fit and durability, as well as reduces prototyping time.

- AI-based robotics and smart CNC machining are used to improve precision, streamline production, and reduce waste.

- Emerging agentic AI systems can autonomously solve complex design and regulatory compliance challenges.

To Understand More About this Research: Request a Free Sample Report

The orthopedic implants market refers to the sector that deals with the design, manufacturing, and distribution of medical devices used to support or replace damaged bones, joints, and other musculoskeletal structures. These implants are commonly used in procedures related to fractures, joint replacement, and spinal implants. Key drivers of orthopedic implants market growth include the increasing aging population, the rising prevalence of orthopedic diseases such as osteoarthritis, and advancements in implant materials and technology, which enhance the durability and functionality of implants.

Market Dynamics

Growing Demand for Minimally Invasive Procedures

The increasing preference for minimally invasive surgeries in the orthopedic implants market is a significant market driver. These procedures, which involve smaller incisions and reduced tissue damage, are associated with shorter recovery times, less postoperative pain, and lower risk of infection. This trend is particularly relevant in joint replacement surgeries and spine surgeries, where traditional methods often require larger incisions and longer recovery periods. According to a March 2024 study by the American Academy of Orthopaedic Surgeons (AAOS), minimally invasive total knee arthroplasty has shown reduced hospital stays and quicker rehabilitation. The demand for minimally invasive procedures is expected to rise, with technological advancements such as orthopedic surgical robots and computer-assisted navigation.

Technological Advancements in Implant Materials

The development of stronger, more durable, and biocompatible materials has enhanced the performance and longevity of orthopedic implants. Titanium and cobalt-chromium alloys, along with newer polymers, offer increased wear resistance, reduced rejection rates, and improved patient outcomes. Innovations in surface coatings, such as hydroxyapatite coatings, which promote better bone integration, are also gaining traction. The increasing focus on personalized implants, including the use of 3D printing for custom-designed solutions, is another area where material technology is advancing. A 2020 report from the Orthopedic Research Society highlights the growing trend of custom implants made using 3D printing, which offers better fit and function compared to traditional mass-produced implants. As a result, technological advancements in implant materials are a driving force in the orthopedic implants market.

Rise in Geriatric Population and Orthopedic Disorders

The rising global geriatric population is a major contributor to the orthopedic implants market growth. As people age, the risk of orthopedic conditions such as osteoarthritis, osteoporosis, and fractures increase, creating a higher demand for joint replacements, spinal implants, and fracture fixation and orthopedic devices. According to the World Health Organization (WHO), the number of people aged 60 years and older is expected to double by 2050, which will lead to an increase in the incidence of age-related musculoskeletal conditions. This demographic shift is influencing both the volume of surgeries and the need for more advanced implant solutions that can cater to older patients with different health profiles. The demand for hip and knee replacements is particularly strong, with studies showing that knee replacement surgeries have increased by nearly 200% over the past two decades due to the aging population.

Segment Insights

Market Assessment by Product

The market by product is segmented into lower extremity implants and spinal implants. The lower extremity implants segment holds the largest orthopedic implants market share, driven by the high demand for knee and hip replacement surgeries. With the increasing prevalence of osteoarthritis, particularly in aging populations, these implants are in high demand for restoring joint function and improving mobility. Technological advancements in implant designs, such as the development of personalized and minimally invasive solutions, are further supporting the growth of this segment. Additionally, the growing number of knee and hip surgeries due to lifestyle-related factors, such as obesity and increased physical activity in older adults, continues to contribute to its market dominance.

The spinal implants segment is also witnessing the highest growth, fueled by advancements in spinal surgery technologies and a rising incidence of spinal disorders, such as degenerative disc disease and scoliosis. The increasing use of spinal fusion surgeries and the adoption of minimally invasive techniques, along with the growing number of elderly patients, are key factors driving the demand for spinal implants. Innovations such as 3D-printed implants and robotic-assisted spinal surgeries are enhancing outcomes and increasing patient satisfaction, further promoting the segment’s rapid expansion. As the need for effective treatment options for spinal injuries and degenerative conditions grows, the spinal implants segment is expected to continue to register significant growth.

Market Evaluation by Material

The market by material is segmented into metallic materials and ceramic biomaterials. The metallic materials segment holds the largest market share, driven by the widespread use of titanium, cobalt-chromium, and stainless steel in implant manufacturing. These materials offer excellent strength, durability, and biocompatibility, making them ideal for use in a variety of implants, including those for joint replacements and fracture fixation. Their long-term performance and ability to withstand high-stress environments have made metallic implants the preferred choice in orthopedic procedures. Furthermore, continuous advancements in the development of high-strength alloys and surface coatings are enhancing the appeal of metallic materials in the market.

The ceramic biomaterials segment is also registering the highest growth, largely due to their increasing use in joint replacement surgeries, particularly for hip and knee implants. Ceramic materials, known for their wear resistance, biocompatibility, and lower friction properties, are gaining popularity as alternatives to metallic materials, offering extended implant life and reduced risk of wear debris-related complications. The development of advanced ceramic materials, such as bioactive ceramics and composites, has further contributed to their adoption. As the demand for higher performance and longevity in orthopedic implants continues to rise, the ceramic biomaterials segment is expected to maintain its strong growth trajectory.

Market Assessment by End Use

The market by end use is segmented into hospitals and outpatient facilities. The hospital segment holds the largest market share, primarily due to the high volume of complex orthopedic surgeries performed in hospital settings. Hospitals are equipped with advanced medical technologies and skilled surgical teams that can handle intricate procedures such as joint replacements and spinal surgeries, which require specialized care and post-operative monitoring. The extensive infrastructure, including diagnostic and rehabilitation facilities, makes hospitals the preferred choice for patients undergoing orthopedic procedures. Additionally, hospitals are often the primary healthcare providers for patients with severe or advanced orthopedic conditions, further driving the dominance of this segment.

The outpatient facilities segment is also experiencing the highest growth, driven by the increasing trend of outpatient surgeries, which offer several advantages such as lower costs, shorter recovery times, and less risk of hospital-acquired infections. The rise of minimally invasive surgeries and advancements in surgical technologies are enabling more orthopedic procedures to be performed in outpatient settings. This shift is supported by the growing demand for cost-effective healthcare options, as well as the preference for quicker discharge and recovery. The expansion of outpatient surgical centers, coupled with increasing patient awareness and demand for efficient care, is contributing to the rapid growth of this segment.

Regional Insights

By region, the study provides orthopedic implants market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, driven by the region's advanced healthcare infrastructure, high healthcare expenditure, and the presence of key market players. The demand for orthopedic implants in North America is boosted by a large aging population, the rising prevalence of orthopedic conditions, and the increasing adoption of minimally invasive procedures. The region's well-established hospitals, outpatient facilities, and research institutions contribute to its market dominance, alongside a high level of patient awareness and access to advanced treatments. Additionally, the robust reimbursement policies in the US support the widespread use of advanced orthopedic implants, further fueling the market's growth in North America.

Europe holds a significant orthopedic implants market share, driven by a growing geriatric population and increasing incidence of musculoskeletal disorders. Countries such as Germany, the UK, and France have well-established healthcare systems and are witnessing a rising demand for joint replacement surgeries and spinal implants. The market is also influenced by the adoption of advanced implant technologies and the increasing preference for minimally invasive procedures. The presence of prominent market players and ongoing research in implant materials and designs further contribute to the market's growth in Europe. Additionally, the availability of robust reimbursement schemes and favorable healthcare policies in several European nations supports the market expansion.

Asia Pacific is registering the highest growth rate in the orthopedic implants market, fueled by factors such as a rapidly aging population, increased healthcare spending, and growing awareness of orthopedic conditions. Countries such as China and India are experiencing a rise in orthopedic procedures due to the increasing prevalence of chronic conditions such as osteoarthritis and osteoporosis. The growing number of hospitals and outpatient facilities, along with advancements in medical technologies, is supporting the adoption of orthopedic implants. Furthermore, the region's expanding middle-class population is driving the demand for quality healthcare services, contributing to the market's rapid expansion. Additionally, the rising trend of medical tourism in countries including India and Thailand is boosting the region's market growth.

Key Market Players and Competitive Insights:

Key players in the orthopedic implants market include companies such as Johnson & Johnson, Zimmer Biomet, Stryker Corporation, Medtronic, Smith & Nephew, DePuy Synthes (part of Johnson & Johnson), B. Braun Melsungen, Exactech, ConforMIS, Wright Medical Group (now part of Stryker), NuVasive, MicroPort Scientific, Orthofix International, Arcos, and Alphatec Spine. These companies offer a broad range of orthopedic implants, including those for joint replacement, spinal surgeries, and fracture fixation. Some of them have a diversified portfolio, covering implants, surgical instruments, orthopedic contract manufacturing, and biologics, allowing them to target a wider patient base and cater to different needs in the orthopedic field.RetryClaude can make mistakes. Please double-check responses.

In terms of competition, the orthopedic implants industry is characterized by a mix of large, established players and emerging companies. Larger companies, such as Johnson & Johnson and Stryker, leverage their broad distribution networks, extensive product portfolios, and strong R&D capabilities to maintain a significant presence in the market. These companies focus on product innovation and technological advancements, such as robotic-assisted surgeries and minimally invasive implants, to stay competitive. Smaller players and newer entrants, such as ConforMIS and NuVasive, differentiate themselves by specializing in niche areas, offering customized implants, or pioneering specific technologies such as 3D printing or patient-specific solutions.

As the market continues to evolve, competition is shifting toward companies that can provide cost-effective and technologically advanced solutions to meet the growing demand for orthopedic procedures. With healthcare systems globally looking for ways to reduce costs while maintaining high-quality care, there is an increasing emphasis on improving implant longevity, reducing surgical time, and enhancing recovery rates. Companies that focus on integrating smart technologies, developing patient-specific implants, and expanding their presence in emerging markets are likely to strengthen their competitive position. Additionally, the ongoing trend of mergers and acquisitions within the industry indicates a strategy to enhance product portfolios and expand market reach.

Johnson & Johnson is a well-established company in the orthopedic implants market. It offers a broad range of products for joint replacement and spinal surgeries. The company operates through its DePuy Synthes division, which focuses on developing and manufacturing orthopedic solutions. Johnson & Johnson has maintained a strong market presence through continuous product innovation, including advancements in minimally invasive surgeries and implant designs.

Stryker Corporation is another major orthopedic implants market player. It is known for its comprehensive offerings in joint replacement, spine, and trauma surgery products. The company also emphasizes innovation, particularly in robotic-assisted surgery and advanced implant designs.

List of Key Companies:

- Alphatec Spine

- Arcos

- B. Braun Melsungen

- ConforMIS

- DePuy Synthes (part of Johnson & Johnson)

- Exactech

- Johnson & Johnson

- Medtronic

- MicroPort Scientific

- NuVasive

- Orthofix International

- Smith & Nephew

- Stryker Corporation

- Wright Medical Group (now part of Stryker)

- Zimmer Biomet

Orthopedic Implants Industry Developments

- August 2024: Johnson & Johnson announced the launch of a new robotic system for knee replacement surgeries. The system aims to enhance precision and improve recovery outcomes for patients.

- November 2020: Stryker expanded its portfolio by acquiring the medical device company Wright Medical Group, which enhanced its capabilities in extremities and trauma solutions. The integration of Wright Medical's technology is expected to strengthen Stryker's position in the orthopedic market, particularly in areas such as foot and ankle surgeries.

Orthopedic Implants Market Segmentation

By Product Outlook (Revenue-USD Billion, 2020 – 2034)

- Lower Extremity Implants

- Spinal Implants

By Material Outlook (Revenue-USD Billion, 2020 – 2034)

- Metallic Material

- Ceramic Biomaterials

By End-use Outlook (Revenue-USD Billion, 2020 – 2034)

- Hospitals

- Outpatient Facilities

By Regional Outlook (Revenue-USD Billion, 2020 – 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 25.70 billion |

|

Market Size Value in 2025 |

USD 26.64 billion |

|

Revenue Forecast in 2034 |

USD 38.73 billion |

|

CAGR |

4.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The orthopedic implants market has been segmented into detailed segments of product, material, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at the global and regional levels.

Growth/Marketing Strategy

The growth and marketing strategy in the orthopedic implants market focuses on product innovation, technological advancements, and expanding global reach. Companies are investing in research and development to create more durable, biocompatible, and patient-specific implants, with a focus on minimally invasive procedures and robotic-assisted surgeries. Strategic partnerships, mergers, and acquisitions also play a significant role in enhancing product portfolios and entering new markets. Additionally, companies are increasingly targeting emerging markets, where rising healthcare infrastructure and awareness are driving demand. The use of digital marketing and patient education is also becoming more prominent in promoting advanced implant solutions.

FAQ's

The orthopedic implants market size was valued at USD 25.70 billion in 2024 and is projected to grow to USD 38.73 billion by 2034.

The market is projected to register a CAGR of 4.2% during the forecast period, 2024-2034.

North America had the largest share of the market.

Key players in the orthopedic implants market include companies such as Johnson & Johnson, Zimmer Biomet, Stryker Corporation, Medtronic, Smith & Nephew, DePuy Synthes (part of Johnson & Johnson), B. Braun Melsungen, Exactech, ConforMIS, Wright Medical Group (now part of Stryker), NuVasive, MicroPort Scientific, Orthofix International, Arcos, and Alphatec Spine.

The lower extremity implants segment accounted for the largest market share.

The metallic segment accounted for the largest share of the market.

Orthopedic implants are medical devices used to replace or support damaged or diseased bones, joints, or other musculoskeletal structures. These implants are commonly used in surgeries such as joint replacements (e.g., hip, knee, or shoulder), spinal surgeries, and fracture fixation procedures. Made from materials such as metals (titanium, cobalt-chromium alloys), ceramics, and polymers, orthopedic implants are designed to restore functionality, relieve pain, and improve the quality of life for patients suffering from orthopedic conditions or injuries. They are typically used when non-surgical treatments are ineffective or when the damage to bones and joints is severe.

A few key trends in the orthopedic implants market are described below: Minimally Invasive Procedures: Increasing adoption of minimally invasive surgical techniques, which offer quicker recovery times and reduced risk of complications. Technological Advancements: Growth of robotic-assisted surgeries and computer-assisted navigation systems to enhance precision in orthopedic procedures. Patient-Specific Implants: Rising demand for customized implants, such as those made through 3D printing, to improve fit and outcomes. Material Innovation: Development of stronger, more durable, and biocompatible materials, including advanced ceramics and improved metal alloys, to extend implant life and performance.

A new company entering the orthopedic implants market could focus on developing innovative, patient-specific implants using advanced technologies like 3D printing and custom designs to ensure better fit and performance. Emphasizing minimally invasive techniques and robotic-assisted surgeries could also provide a competitive edge by offering faster recovery times and improved surgical outcomes. Additionally, focusing on durable, biocompatible materials and smart implants with embedded sensors for monitoring recovery would align with current trends. Expanding into emerging markets with rising healthcare infrastructure could provide significant growth opportunities while ensuring affordability and accessibility. Lastly, partnering with healthcare providers for education and clinical trials can help build trust and brand recognition.

Companies manufacturing, distributing, or purchasing Orthopedic Implants and related products, and other consulting firms must buy the report