Orthopedic Contract Manufacturing Market Share, Size, Trends, Industry Analysis Report

By Type (Implants, Instruments, Cases, Trays), By Services, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Feb-2024

- Pages: 118

- Format: PDF

- Report ID: PM4573

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

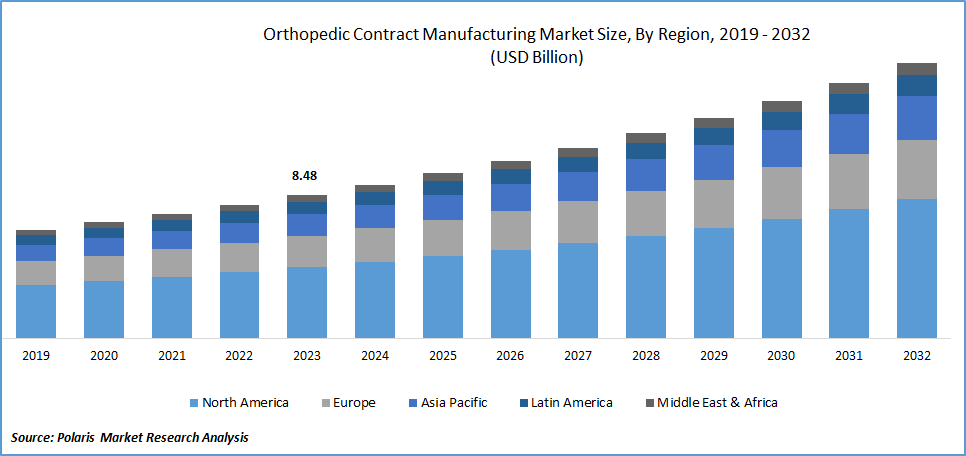

Global orthopedic contract manufacturing market size was valued at USD 7.90 billion in 2023. The market is anticipated to grow from USD 8.48 billion in 2024 to USD 15.20 billion by 2032, exhibiting a CAGR of 7.6% during the forecast period.

Market Overview

Partnerships between orthopedic device manufacturers and contract manufacturers enable the exchange of knowledge, accelerate product development, and reduce risks, which leads to the expansion of the market. The increase in orthopedic contract manufacturing market growth is mainly due to the growing pressure on OEMs to reduce costs and speed up the launch of orthopedic products. Furthermore, macroeconomic factors such as the rising number of bone injuries caused by road accidents and sports-related incidents are driving the demand for orthopedic implants and related products, thereby fueling significant growth across the global market.

The orthopedic contract manufacturing market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

To Understand More About this Research; Request a Free Sample Report

The market has experienced a surge in innovation due to transformative progressions in design, materials, and manufacturing technologies. The adoption of advanced biocompatible materials like advanced ceramics and alloys significantly improves the compatibility and durability of implants. Moreover, the increasing uptake of 3D printing technologies facilitates the creation of highly tailored and patient-specific products.

The increasing practice of outsourcing and globalization to capitalize on cost efficiencies and technological capabilities is a significant market trend driving industry expansion. OEMs are enhancing their market presence and promoting regional expansion by collaborating with contract manufacturers worldwide to access diverse economies and strengthen their positions in the market.

Growth Factors

Rising adoption of customized implants

Increasing patient expectations for personalized implants designed to fit their unique needs and anatomy are driving demand for contract manufacturers specializing in customized products. Additionally, the growth of medical tourism, where patients travel internationally for bone health treatments, is fueling the need for outsourced manufacturing of orthopedic implants. This trend is encouraging the adoption of contract manufacturing services in the orthopedic industry.

Technological advancements

Technological advancements play a key role as innovations improve the effectiveness and precision of orthopedic treatments. Additionally, there has been an increase in the prevalence of orthopedic disorders, leading to a higher demand for orthopedic surgeries and related devices. Outsourcing orthopedic device manufacturing offers cost-efficiencies for companies, driving further market growth. These combined factors contribute to the expansion of the orthopedic device market globally.

Restraining Factors

Stringent quality protocols

The global market is subject to strict regulatory standards and quality protocols, requiring contract manufacturers to adhere to regulatory guidelines to guarantee the effectiveness and safety of their products.

Report Segmentation

The market is primarily segmented based on type, services, and region.

|

By Type |

By Services |

By Region |

|

|

|

To Understand the Scope of this Report; Speak to Analyst

By Type Insights

Implants segment accounted for the largest market share in 2023

The implants segment dominated the global market. This high share is attributed to the growing demand for orthopedic implants, which is fueled by the rising prevalence of orthopedic disorders and advancements in implant materials and designs. To meet the escalating demand for orthopedic solutions, numerous companies are concentrating on the creation and introduction of innovative orthopedic implants, resulting in a noteworthy surge in new product introductions.

In February 2023, CurvaFix, unveiled its latest offering, the 7.5mm CurvaFix IM Implant, designed to simplify surgical interventions tailored for individuals with smaller bone anatomies.

The cases segment will grow rapidly over the orthopedic contract manufacturing market forecast period. The growing prevalence of bone health issues like osteoarthritis contributes significantly to the need for top-tier orthopedic implants, devices, cases, and related solutions. For instance, according to the World Health Organization, the global number of osteoarthritis sufferers has risen to 550 million individuals. Many orthopedic OEMs are engaging contract manufacturers to capitalize on their advanced technologies, specialized knowledge, and cost-efficient offerings to meet this escalating demand effectively.

By Ingredient Insights

Forging/casting segment held the largest share of orthopedic contract manufacturing market

The forging/casting segment dominated the market. Segment's dominance is driven by the rising presence of contract manufacturers in the orthopedic industry landscape. Contract manufacturers are increasingly expanding their service offerings, which contributes to the growing orthopedic contract manufacturing market demand for its services, particularly in forging and casting orthopedic products. Additionally, many contract manufacturers are focusing on developing advanced materials for innovative orthopedic products, further fueling segmental growth.

In June 2022, Tecomet recently unveiled a strategic investment totaling USD 4 million in its Cork, Ireland facility. This investment is designed to bolster the facility's capabilities in plastic and polyethylene machining, further establishing it as a premier global hub for polymeric materials utilized in orthopedic products.

The spine & trauma segment is expected to grow at the fastest rate. The rising global demand for spine and trauma products primarily drives growth. Furthermore, the increasing prevalence of sports injuries is contributing to the heightened demand for trauma devices. For instance, In September 2023, Orthofix Medical unveiled the Galaxy Fixation Gemini system in the United States. This system is designed for external fixation in trauma scenarios. The growing introduction of spine & trauma devices also drives the need for contract manufacturing services.

Regional Insights

North America region holds the largest revenue share of the market

North America dominated the global market. The region plays a pivotal role in driving orthopedic contract manufacturing market expansion, boasting a robust presence of medical device firms. Many of these companies opt to outsource certain manufacturing tasks to contract service providers, thereby bolstering market growth. The substantial expenses associated with manufacturing pose a key obstacle, prompting numerous medical device firms across the region to seek assistance from specialized third-party vendors.

Major medical device firms in the region are opting to outsource portions of their manufacturing processes to Contract Manufacturing Organizations (CMOs). This strategic move is attributed to the utilization of advanced technologies and specialized capabilities offered by CMOs, which significantly contribute to market expansion in the U.S. Moreover, the adoption of medical device outsourcing is increasingly favored due to the need for high maintenance and efficient systems in managing raw materials, ultimately reducing overall set-up costs.

Asia Pacific region is expected to expand at a significant CAGR

Asia Pacific will grow rapidly with a healthy CAGR throughout the forecast period, driven by various factors such as pricing pressures, increased scrutiny of budgets in developed economies, and fluctuations in reimbursement schemes. These factors are expected to prompt Original Equipment Manufacturers (OEMs) to adopt cost-containment measures. Contract manufacturers in these regions offer several advantages, including well-established export infrastructure, advantageous currency exchange rates, access to low-cost labor, and government incentives aimed at supporting local manufacturers.

In India, greenfield projects can benefit from 100% foreign direct investment (FDI) through the automatic route, while brownfield project investments allow for up to 100% FDI under the government route. The attraction of FDI is attributed to factors such as demand growth, cost advantages, and policy support. Between April 2000 and March 2022, sectors like hospitals and diagnostic centers, as well as medical and surgical appliances, witnessed inflows totaling US$ 7.93 billion and US$ 2.41 billion, respectively.

As per the estimates of the IBEF, India's medical device industry relies heavily on imports, accounting for 75-80% of its supply. At the same time, it recorded exports worth USD 2.53 billion in FY21, which will reach around USD 10 billion by 2025.

Key Market Players & Competitive Insights

The orthopedic contract manufacturing market development is currently experiencing rapid growth at an accelerating pace. It is marked by a significant level of innovation, regulatory factors, consistent merger and acquisition activities, market fragmentation, and expanding regional manufacturing processes aimed at capitalizing on cost benefits and specialized expertise.

Some of the major players operating in the global market include:

- ARCH Medical Solutions Corp.

- Autocam Medical

- Avalign Technologies

- Cretex companies

- LISI Medical

- Norman Noble, Inc.

- Orchid Orthopaedic Solutions

- Paragon Medical

- Tecomet, Inc

- Viant

Recent Developments in the Industry

- In October 2023, Orthofix Medical disclosed the 510k clearance for OsteoCove, an innovative bioactive synthetic graft used in orthopedic procedures. This clearance opens doors for contract manufacturers to provide large-scale manufacturing solutions.

- In June 2023, EOS, Tecomet, Orthopaedic Innovation Centre (OIC), & Precision ADM formed a collaborative alliance to offer a comprehensive solution for medical device additive manufacturing. It includes the initial design and engineering of the device, machine validation, 510k approvals, pre-clinical testing, & device commercialization.

Report Coverage

The orthopedic contract manufacturing market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, services, and their futuristic growth opportunities.

Orthopedic Contract Manufacturing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 8.48 billion |

|

Revenue Forecast in 2032 |

USD 15.20 billion |

|

CAGR |

7.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion8 and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Explore the landscape of orthopedic contract manufacturing in 2024 through detailed market share, size, and revenue growth rate statistics meticulously organized by Polaris Market Research Industry Reports. This expansive analysis goes beyond the present, offering a forward-looking market forecast till 2032, coupled with a perceptive historical overview. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

FAQ's

Tecomet, Cretex companies, Viant, ARCH Medical, Avalign Technologies, LISI Medical, Paragon Medical are the key companies in Orthopedic Contract Manufacturing Market.

Orthopedic contract manufacturing market exhibiting the CAGR of 7.6% during the forecast period.

The Orthopedic Contract Manufacturing Market report covering key segments are type, services, and region.

Technological advancements are the key driving factors in Orthopedic Contract Manufacturing Market.

The global orthopedic contract manufacturing market size is expected to reach USD 15.20 billion by 2032