Spinal Implants Market Size, Share, Trends, Industry Analysis Report

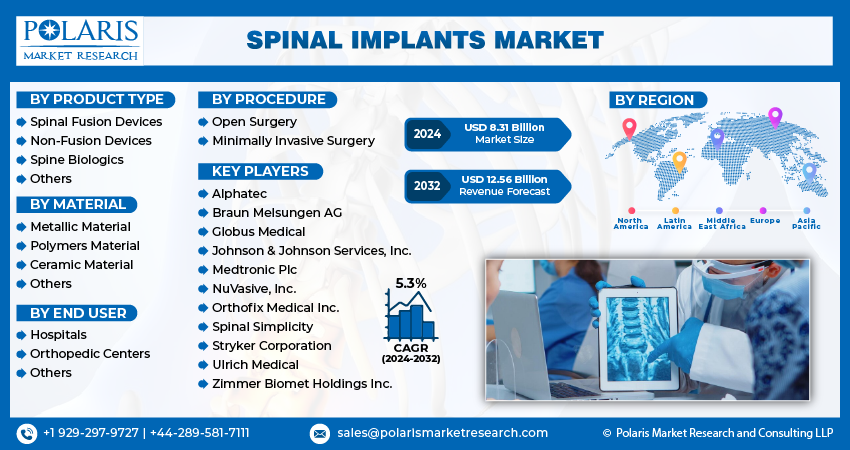

: By Product Type (Spinal Fusion Devices, Non-Fusion Devices, Spine Biologics, and Others), By Material, By Procedure, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 125

- Format: PDF

- Report ID: PM4465

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

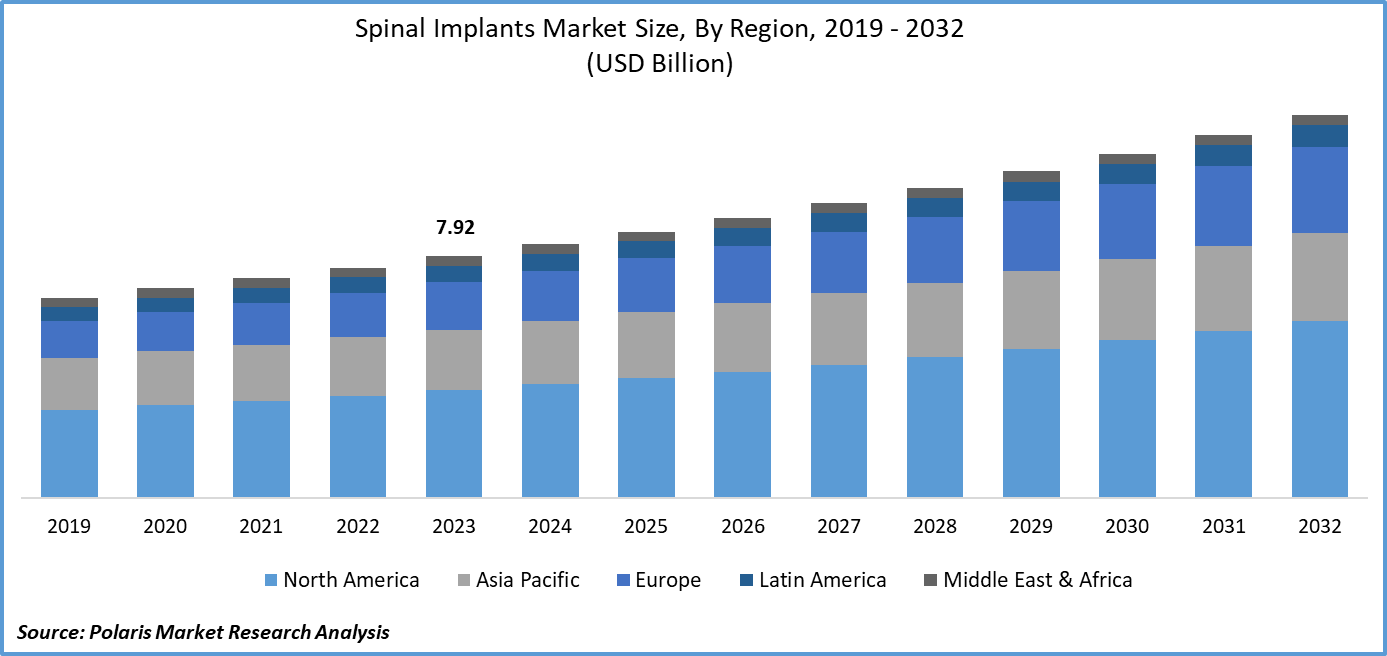

The global spinal implants market size was valued at USD 11.96 billion in 2024. It is projected to grow from USD 12.58 billion in 2025 to USD 19.99 billion by 2034, exhibiting a CAGR of 5.29% during 2024–2035.

Spinal implants are medical devices used to support and stabilize the spine during or after spinal surgery, often to treat conditions such as fractures, deformities, or degenerative disc diseases. These implants include rods, screws, plates, and cages, and are designed to help maintain proper alignment and promote spinal fusion.

The increasing prevalence of spinal diseases such as degenerative disc disease, scoliosis, and spondylolisthesis propels the demand for spinal implants. Additionally, the rising geriatric population, who are more susceptible to spinal disorders, is contributing to the growth of the spinal implants market. Advancements in technologies and innovative product launches are driving spinal implant appeal to the general population, which fuels the market growth. In November 2023, Spinal Elements launched the Ventana 3D-Printed Interbody Portfolio, featuring innovative design maximizing bone graft volume and providing clear radiographic visualization for spinal fusion procedures. These product launches are driving the growth of the spinal implant industry.

To Understand More About this Research: Request a Free Sample Report

The development of advanced technologies, such as minimally invasive techniques and biodegradable materials, provides patients with safer and more effective treatment options, which boosts the adoption of spinal implants. This growing demand for spinal implants is expected to continue, driven by advancements in medical technology.

Market Dynamics

Growing Incidents of Spinal Disorders

The growing number of spinal disorders, such as degenerative disc disease, scoliosis, spinal stenosis, and herniated discs, is significantly driving the spinal implant demand. According to a report published by NCBI, incidents of herniated discs are 5 to 20 cases per 1,000 adults annually in the US alone. These conditions cause severe pain and mobility issues, requiring surgical treatment involving implants. Sedentary lifestyles, poor posture, and increased screen time are further contributing to the rise in spinal problems among all age groups. The demand for reliable and effective spinal implants grows as more people experience these health issues, thereby boosting the industry growth.

Growth of Elderly Population

The growth in the global aging population is boosting the demand for spinal implants. According to the Statistics Canada, 7,820,121 persons aged 65 years and above in Canada alone as of July 2024, showcasing the growth in the elderly population. With the growing age, bones and spinal structures weaken naturally, making older people more vulnerable to conditions such as osteoporosis and spinal degeneration. Older adults often require surgical interventions to relieve pain and restore mobility, and spinal implants play a key role in these procedures. More elderly individuals are opting for surgeries to maintain their quality of life with improved life expectancy and better access to healthcare, thereby propelling the spinal implants market growth.

Segment Analysis

Market Assessment by Procedure

The spinal implants market segmentation, based on procedure, includes open surgery and minimally invasive surgery. The minimally invasive surgery is expected to witness significant growth during the forecast period. MIS techniques offer benefits such as reduced damage to surrounding tissues, shorter hospital stays, and quicker recovery times compared to traditional open surgeries. Growing patient preference for less painful and faster procedures is driving demand for spinal implants designed for MIS. Advancements in surgical equipment and improved imaging methods are improving the precision and accessibility of these procedures, thereby driving the segment growth.

Market Evaluation by Product Type

The market segmentation, based on product type, includes spinal fusion devices, non-fusion devices, spine biologics, and others. The spinal fusion segment dominated the market in 2024. As spinal fusion surgeries are commonly performed to treat various spinal conditions such as degenerative disc disease, spondylolisthesis, and fractures. These surgeries involve the use of spinal fusion devices, which help stabilize and align the spine, promoting bone growth and healing. Additionally, advancements in technology have led to the development of innovative fusion devices, such as motion-preserving devices and minimally invasive, which have increased their adoption rate among orthopedic surgeons. Further, the aging population and increasing prevalence of spinal disorders also contribute to the high demand for spinal fusion devices, contributing to the dominance of this segment.

Regional Insights

By region, the study provides the spinal implants market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market due to the increasing prevalence of spinal disorders and injuries in the region, which has led to a growing demand for advanced spinal implant technologies. The National Spinal Cord Injury Statistical Center reports an annual incidence of around 54 cases of spinal cord injury per one million people in the US, leading to ∼17,500 new SCI cases each year. The presence of well-established healthcare infrastructure, high healthcare expenditure, and favourable reimbursement policies contributed to the spinal implants market expansion in North America. Additionally, the region is home to many prominent players in the spinal implant industry, which has boosted innovation and advancements in technology, leading to increased adoption rates among patients and healthcare professionals.

Asia Pacific is expected to record the highest CAGR during the forecast period due to a rising elderly population, increasing cases of spinal disorders, and growing awareness of advanced treatment options. Countries such as China, Japan, South Korea, and Australia are investing heavily in healthcare infrastructure and technology. Economic development in the region has improved access to quality medical care, while medical tourism is further boosting demand for spinal surgeries. Additionally, increasing adoption of minimally invasive procedures and technological advancements in spinal implants are attracting both domestic and international companies, thereby driving the market growth in Asia Pacific.

Indian spinal implant demand is growing rapidly, due to its large population, rising healthcare awareness, and a growing number of spine-related conditions. Urbanization, changing lifestyles, and longer life expectancy are leading to more cases of back and spinal problems. The country is also reporting a rise in the number of skilled spine surgeons and specialty hospitals offering affordable yet advanced surgical procedures. Government initiatives and private investments are improving healthcare access, particularly in tier 2 and tier 3 cities. Furthermore, India’s cost-effective treatment options are attracting international patients, making it a hub for medical tourism and boosting demand for spinal implants.

Key Players and Competitive Analysis

The market opportunity is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific sectors. The competitive trend is amplified by continuous progress in product offerings. A few major players in the industry include Alphatec; Braun Melsungen AG; Globus Medical; Johnson & Johnson Services, Inc.; Medtronic Plc; NuVasive, Inc.; Orthofix Medical Inc.; Spinal Simplicity; Stryker Corporation; and Ulrich Medical.

Medtronic plc is a developer, manufacturer, and seller of device-based medical therapies. The company's business operations are divided into the Cardiovascular Portfolio, Medical Surgical Portfolio, Neuroscience Portfolio, and Diabetes Operating Unit. Medtronic's cardiovascular portfolio segment specializes in implantable cardiovascular devices such as defibrillators, pacemakers, and resynchronization therapy devices. Additionally, it offers insertable cardiac monitor systems, cardiac ablation products, TYRX products, and remote patient-centered and monitoring software. The Medical Surgical Portfolio segment provides a range of surgical products, including vessel sealing instruments, surgical stapling devices, wound closure and electrosurgery products, hernia mechanical devices, surgical artificial intelligence and robotic-assisted surgery products, mesh implants, lung products, gynecology, and various therapies to treat diseases. It also offers products in the fields of minimally invasive gastrointestinal and hepatologic diagnostics and therapies. The Neuroscience Portfolio segment offers products for various medical professionals, including neurosurgeons, spinal surgeons, neurologists, anesthesiologists, pain management specialists, orthopedic surgeons, urologists, interventional radiologists, urogynecologists, and throat specialists. The segment also provides intra-operative imaging systems, image-guided surgery systems, and robotic guidance systems used in robot-assisted spine procedures. The Diabetes Operating Unit segment specializes in continuous glucose monitoring systems, insulin pumps and consumables, smart insulin pen systems, and consumables and supplies.

Johnson & Johnson Services, Inc. is a multinational corporation based in New Brunswick, New Jersey, USA. The company operates through pharmaceuticals, medical devices, and consumer health products operations. The company's subsidiary, Janssen Pharmaceuticals, Inc., develops and markets drugs in various therapeutic areas, including neuroscience, oncology, infectious diseases, and immunology. Janssen Pharmaceuticals, Inc. is creating many well-known drugs, such as Risperdal (risperidone), Remicade (infliximab), and Zytiga (abiraterone). The company also has a medical devices division, which develops and markets a wide range of products, including surgical instruments, orthopedic implants, and diabetes care products. It also has a consumer health division, which develops and markets over-the-counter products such as Band-Aids, Tylenol, and Listerine. The company's consumer health business also includes subsidiaries such as Neutrogena, Aveeno, and Johnson's Baby. The company was founded in 1886. Johnson & Johnson sells its products under the brand The DePuy Synthes, an orthopedic company that was acquired in 1998. DePuy Synthes under J&J offers advanced spinal implants and devices, including personalized surgical solutions, deformity correction, trauma fixation, and innovative materials for craniomaxillofacial and orthopedic procedures.

List of Key Companies in Spinal Implants Market

- Alphatec

- Braun Melsungen AG

- Globus Medical

- Johnson & Johnson Services, Inc.

- Medtronic Plc

- NuVasive, Inc.

- Orthofix Medical Inc.

- Spinal Simplicity

- Stryker Corporation

- Ulrich Medical

Spinal Implants Industry Developments

In January 2024, Accelus launched a modular-cortical spinal implant system, designed to enhance surgical flexibility and visibility while reducing tray requirements, optimizing workflows in spinal procedures and improving patient outcomes.

In November 2024, Carlsmed launched digital production line, enabling delivery of aprevo personalized spinal fusion implants to hospitals in under ten days, significantly reducing lead times and increasing surgical accessibility.

Spinal Implants Market Segmentation

By Product Type Outlook (Revenue USD Billion, 2020–2034)

- Spinal Fusion Devices

- Thoracic Fusion & Lumbar Fusion Devices

- Cervical Fusion Devices

- Expandable Fusion Cages

- Others

- Non-Fusion Devices

- Dynamic Stabilization Devices

- Artificial Discs

- Annulus Repair Devices

- Nuclear Disc Prostheses

- Others

- Spine Biologics

- Others

By Material Outlook (Revenue USD Billion, 2020–2034)

- Metallic Material

- Polymers Material

- Ceramic Material

- Others

By Procedure Outlook (Revenue USD Billion, 2020–2034)

- Open Surgery

- Minimally Invasive Surgery

By End User Outlook (Revenue USD Billion, 2020–2034)

- Hospitals

- Orthopedic Centers

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Spinal Implants Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 11.96 billion |

|

Market Size Value in 2025 |

USD 12.58 billion |

|

Revenue Forecast by 2034 |

USD 19.99 billion |

|

CAGR |

5.29% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 11.96 billion in 2024 and is projected to grow to USD 19.99 billion by 2034.

The global market is projected to register a CAGR of 5.29% during the forecast period.

North America held the largest share of the global market in 2024.

A few key players in the market are Alphatec; Braun Melsungen AG; Globus Medical; Johnson & Johnson Services, Inc.; Medtronic Plc; NuVasive, Inc.; Orthofix Medical Inc.; Spinal Simplicity; Stryker Corporation; and Ulrich Medical.

The spinal fusion segment dominated the market in 2024, since spinal fusion surgeries are commonly performed to treat various spinal conditions such as degenerative disc disease, spondylolisthesis, and fractures.

The minimally invasive surgery segment is expected to witness significant growth during the forecast period as minimally invasive surgeries are associated with less tissue damage, reduced blood loss, and faster recovery times compared to traditional open surgeries.