Spine Biologics Market Share, Size, Trends, Industry Analysis Report

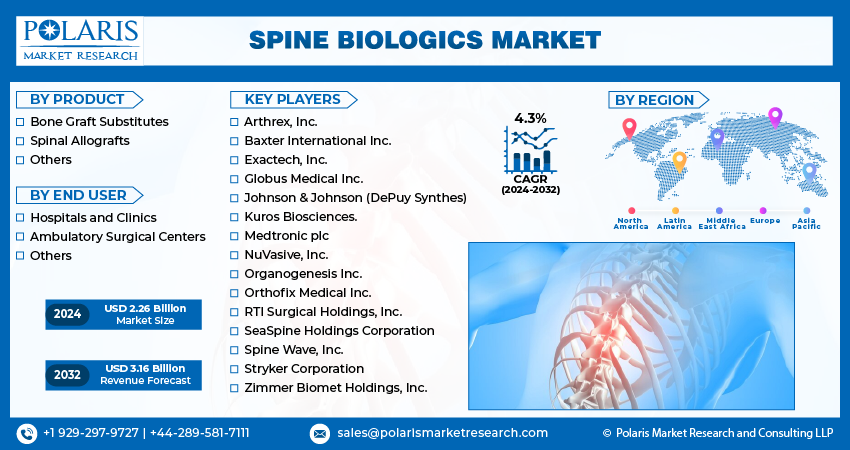

By Product (Bone Graft Substitutes, Spinal Allografts, Others); By End User; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 116

- Format: PDF

- Report ID: PM4665

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

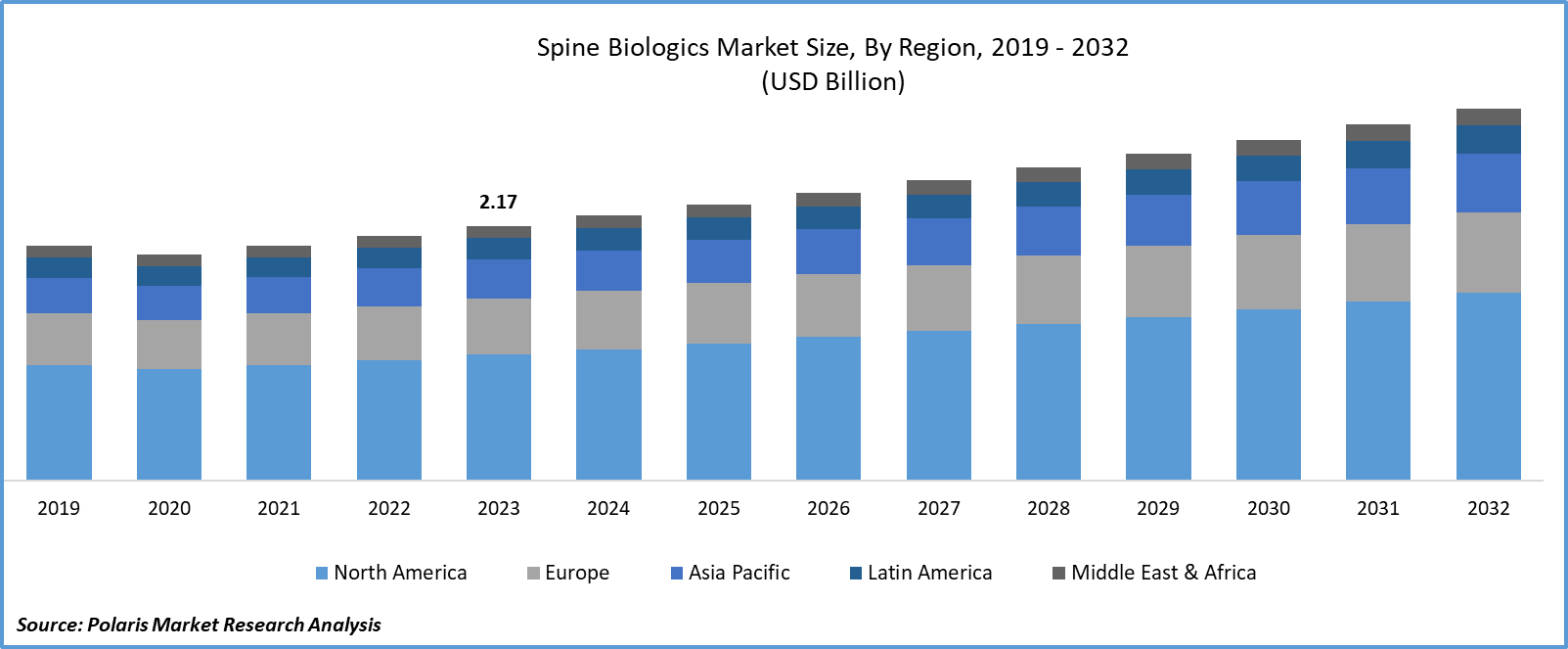

- Spine Biologics Market size was valued at USD 2.17 billion in 2023.

- The market is anticipated to grow from USD 2.26 billion in 2024 to USD 3.16 billion by 2032, exhibiting the CAGR of 4.3% during the forecast period.

Market Introduction

The spine biologics market is growing due to increasing awareness and acceptance of biologic therapies for spinal disorders. Advances in medical knowledge and technology have led to greater recognition of the benefits of biologics in supporting spinal fusion and bone healing. Healthcare professionals are integrating biologic products into treatment strategies to improve patient outcomes, while patients seek treatments offering better results and faster recovery. Continued innovation in biotechnology and regenerative medicine is driving the development of enhanced biologic products. Regulatory approvals for biologic treatments in spinal applications are also contributing to market expansion. As awareness and acceptance of biologic therapies continue to rise, the spine biologics market is poised for significant growth.

In addition, companies operating in the market are introducing new products to expand market reach and strengthen their presence.

- For instance, in February 2022, Orthofix Medical Inc. revealed the complete introduction of Opus BA to the market, a synthetic bioactive bone graft solution designed for spinal fusion procedures in both the cervical and lumbar regions.

To Understand More About this Research:Request a Free Sample Report

Technological advancements are driving the spine biologics market growth, transforming spine care. Breakthroughs in biotechnology have yielded advanced biologic products like bone graft substitutes and stem cell therapies, aiding spinal fusion and tissue regeneration. Imaging technologies such as MRI and CT scans enable precise diagnosis and treatment planning, enhancing treatment efficacy. Minimally invasive surgical techniques reduce trauma and recovery times, paired with spine biologics, offer less invasive alternatives to open surgeries, improving patient outcomes.

Industry Growth Drivers

Increasing incidence of spinal disorders is projected to spur the product demand

The spine biologics market is expanding due to the rising incidence of spinal disorders globally. Factors such as aging populations, sedentary lifestyles, and occupational hazards contribute to conditions like degenerative disc disease and spinal fractures, leading to severe pain and reduced mobility. Spine biologics, including bone graft substitutes and stem cell therapies, offer innovative treatments by promoting spinal fusion and tissue regeneration. Recent advancements in biotechnology have enhanced the efficacy and safety of these therapies, providing enhanced alternatives to traditional spinal surgeries. As awareness grows among healthcare providers and patients, the demand for spine biologics is increasing, driving market growth in the coming years.

Growing preference for minimally invasive procedures is expected to drive spine biologics market growth

The spine biologics market is growing due to the increasing preference for minimally invasive spinal surgeries. Surgeons are opting for biologic products to support spinal fusion and bone healing, meeting patient demands for reduced post-operative pain and quicker recovery. These biologics, sourced from natural materials or developed through biotechnology, stimulate bone growth and fusion. Minimally invasive procedures offer advantages such as smaller incisions and reduced tissue damage, while biologic products like bone graft substitutes and growth factors promote bone regeneration, reducing the need for extensive hardware fixation. The aging population and prevalence of degenerative spine conditions further fuel demand, driving growth in the spine biologics market.

Industry Challenges

High cost of treatment is likely to impede the market growth

The spine biologics market faces limitations due to the high cost of treatment, hindering access for many patients. Expenses associated with research, development, manufacturing, and regulatory compliance contribute to the overall price of advanced biologic products used in spine care. Additionally, the complexity of spine biologics procedures, coupled with the need for specialized equipment and trained professionals, further increases treatment costs. Patients sometimes struggle with additional expenses for diagnostic tests, consultations, and post-operative care.

Report Segmentation

The spine biologics market analysis is primarily segmented based on product, end user, and region.

|

By Product |

By End User |

By Region |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Product Analysis

Spinal allografts segment held significant revenue share in 2023

The spinal allografts segment held significant revenue share in 2023. They are favored for their proven efficacy in promoting spinal fusion and tissue regeneration, along with their widespread availability from tissue banks. Their use reduces surgical morbidity compared to autografts and offers customization options to match patients' anatomical needs. Moreover, spinal allografts are often more cost-effective than alternative biologics, enhancing their appeal to healthcare facilities aiming for efficiency. Rigorous screening and processing protocols minimize the risk of disease transmission, ensuring patient safety. Supported by clinical evidence and guidelines, spinal allografts have gained widespread acceptance in the medical community.

By End User Analysis

Hospitals and clinics segment held significant revenue share in 2023

The hospitals and clinics segment held significant revenue share in 2023. Hospitals and clinics play a pivotal role in the spine biologics market, serving as primary destinations for spinal treatments. These facilities offer comprehensive care, encompassing diagnostics, surgeries, and post-operative management, attracting patients seeking spine biologics. The presence of specialized spinal care centers within hospitals enhances their appeal and expertise. Integrated healthcare systems streamline spine biologics utilization across treatment stages, ensuring efficient care delivery. Academic hospitals drive innovation through research and development. Their proficiency in navigating reimbursement policies enables effective procurement and administration of spine biologics. Moreover, established trust and robust referral networks sustain a consistent flow of spine biologics utilization, significantly contributing to segment growth.

Regional Insights

North America region accounted for a significant market share in 2023

In 2023, North America region accounted for a significant market share. The region’s advanced healthcare infrastructure, strong research and development sector, and high prevalence of spinal disorders contribute to the demand for spine biologics. Favorable reimbursement policies and technological advancements further drive market growth. Additionally, the region's well-established regulatory framework ensures the safety and efficacy of spine biologics, enhancing confidence among healthcare professionals and patients. Collaboration between industry and academia further accelerates innovation and the development of spine biologics.

Asia-Pacific is expected to experience significant growth during the forecast period. The region's aging population contributes to a higher prevalence of spinal disorders, driving demand. Increased healthcare expenditure in countries like China, India, and Japan enables investment in advanced treatments. Technological advancements and improving healthcare infrastructure support the adoption of spine biologics. Growing awareness among healthcare professionals and patients further boosts market growth. Government initiatives aimed at enhancing healthcare access and infrastructure also play a significant role. Additionally, the expanding healthcare industry and rising medical tourism create opportunities for spine biologics market expansion in the Asia-Pacific region.

Key Market Players & Competitive Insights

The spine biologics encompasses various participants, and the anticipated entry of new competitors is set to heighten competition. Established frontrunners consistently upgrade their technologies to sustain a competitive edge, focusing on efficiency, dependability, and safety. These companies prioritize strategic maneuvers like forging partnerships, enhancing product arrays, and engaging in collaborative ventures. Their objective is to surpass rivals within the industry, solidifying a substantial spine biologics market share.

Some of the major players operating in the global spine biologics market include:

- Arthrex, Inc.

- Baxter International Inc.

- Exactech, Inc.

- Globus Medical Inc.

- Johnson & Johnson (DePuy Synthes)

- Kuros Biosciences.

- Medtronic plc

- NuVasive, Inc.

- Organogenesis Inc.

- Orthofix Medical Inc.

- RTI Surgical Holdings, Inc.

- SeaSpine Holdings Corporation

- Spine Wave, Inc.

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

Recent Developments

- In October 2023, Orthofix Medical Inc. disclosed the 510k clearance and complete commercial release of OsteoCove, a bioactive synthetic graft.

- In April 2023, PUR Biologics introduced PURcore, a moldable synthetic material with an interlinked micro-pore architecture tailored for spinal surgery. PURcore facilitates rapid colonization by the patient's cells and growth factors, fostering bone regeneration and healing.

- In April 2023, Bone Biologics Corporation declared that the Human Research Ethics Committee (HREC) has granted approval to Monash Health as the initial site for a scheduled multicenter pilot clinical trial in Australia. This trial aims to assess the safety and efficacy of the Company's NB1 bone graft. The pilot study will involve 30 adult participants undergoing transforaminal lumbar interbody fusion (TLIF) for the treatment of degenerative disc disease (DDD).

Report Coverage

The spine biologics market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, products, end users, and their futuristic growth opportunities.

Spine Biologics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.26 billion |

|

Revenue forecast in 2032 |

USD 3.16 billion |

|

CAGR |

4.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Spine Biologics Market report covering key segments are product, end user, and region.

Spine Biologics Market Size Worth $3.16 Billion By 2032

Spine Biologics Market exhibiting the CAGR of 4.3% during the forecast period.

North America is leading the global market

key driving factors in Spine Biologics Market are Increasing incidence of spinal disorders