Orthopedic Surgical Robots Market Share, Size, Trends, Industry Analysis Report

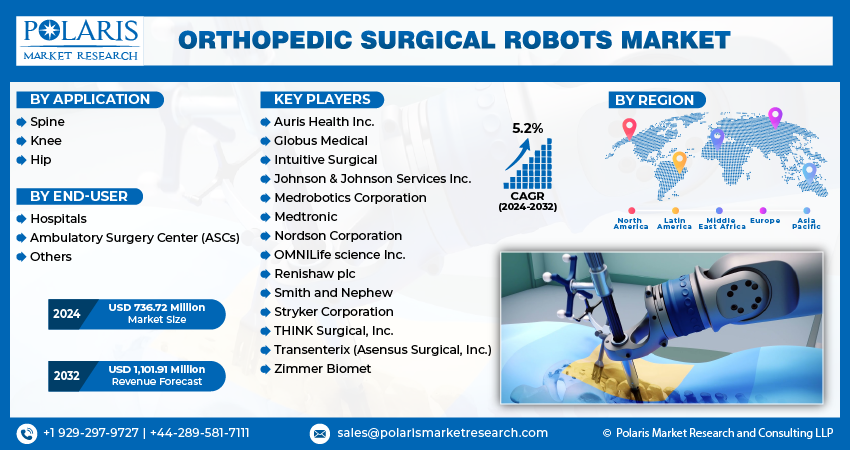

By Application (Spine, Knee and Hip); By End-User (Hospitals, Ambulatory Surgery Centers); By Region; Segment Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 116

- Format: PDF

- Report ID: PM4834

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

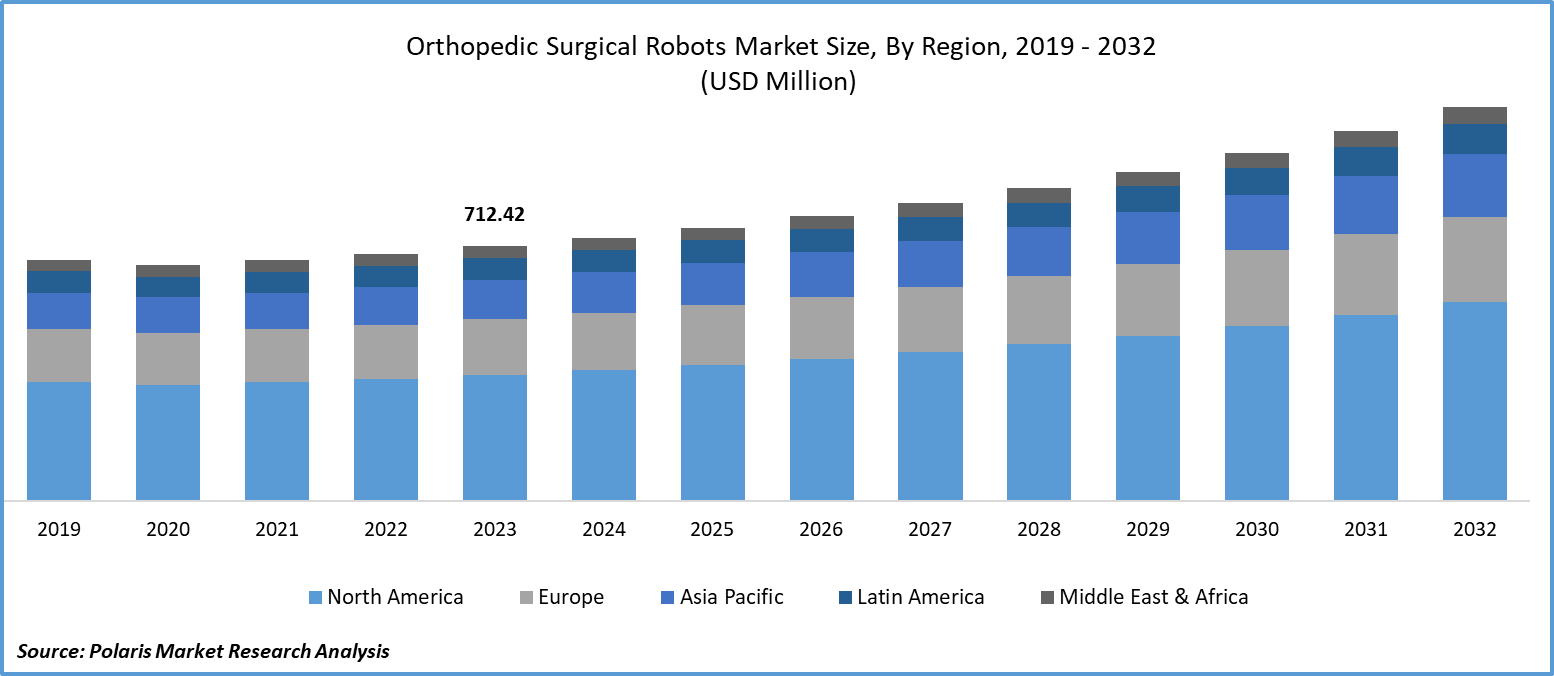

Global orthopedic surgical robots market size was valued at USD 712.42 million in 2023. The market is anticipated to grow from USD 736.72 million in 2024 to USD 1,101.91 million by 2032, exhibiting the CAGR of 5.2% during the forecast period

Orthopedic Surgical Robots Market Overview

The orthopedic surgical robots market growth can be attributed to the increasing incidence of knee and hip replacement surgeries, the emergence of new players in the healthcare robotics sector, and enhanced patient outcomes. Additionally, the rise in joint replacement procedures is driven by the growing prevalence of osteoarthritis in affluent countries. According to WHO data from July 2022, approximately 528 million individuals worldwide are affected by osteoarthritis, while an estimated 1.71 billion people globally are believed to suffer from musculoskeletal disorders.

For instance, in February 2024, Stryker demonstrates its dedication to innovation and technological progress in joint replacement by unveiling the Triathlon Hinge and showcasing the ongoing development of Mako SmartRobotics at the American Academy of Orthopaedic Surgeons (AAOS) annual meeting 2024 in San Francisco.

To Understand More About this Research:Request a Free Sample Report

The global orthopedic surgical robots market development is experiencing significant growth due to several factors. Primarily, there is a rise in the prevalence of orthopedic disorders worldwide, driving the demand for advanced treatment options. Additionally, there is a growing trend toward clinical digitization in healthcare, which includes the adoption of surgical robots in orthopedic procedures. These robots are typically compact and operated with precision by medical therapy specialists. As the aging population continues to increase, there is a heightened susceptibility to conditions such as arthritis and joint discomfort, further fueling the demand for orthopedic surgical robots. Consequently, the industry is expected to witness lucrative expansion opportunities in the near future.

Orthopedic Surgical Robots Market Dynamics

Market Drivers

Outcome of Functional Ability After Surgery

Functional outcomes for patients post-surgery improve the orthopedic surgical robots market growth. Compared to traditional procedures, orthopedic robotic surgery offers surgeons greater flexibility, control, and precision in performing complex treatments. A study published in the journal Cureus highlights the transformative impact of robotic systems such as the Robotic Arm, Mako, NAVIO, and Stryker Mako Total Hip Arthroplasty on orthopedic surgery. These systems provide surgeons with real-time feedback and advanced imaging capabilities, aiding in precise implant placement and bone preparation. Consequently, patients experience improved joint function and alignment, leading to better postoperative outcomes.

Increasing Incidence of Osteoporosis

A long-term condition called osteoporosis weakens the bones. An individual with osteoporosis is more likely to experience unexpected and unanticipated bone fractures. According to estimates from the World Health Organization (WHO), 200 million or so people are expected to develop osteoporosis in 2021. Both males and females can develop osteoporosis, though females are at a higher risk compared to males. Common treatments for osteoporosis include hip fractures and knee replacements, highlighting the importance of understanding preexisting physical health conditions such as reduced bone mass and fragility, particularly in older individuals. As osteoporosis becomes more prevalent, the surgical approach to its treatment is expanding. Orthopedic surgeons utilize a specialized hand tool known as an irrigator-reamer aspirator, with tools like the high torque power tool being used in the treatment of osteoporosis. Globally, the incidence of osteoporosis is rising, which is driving up orthopedic surgical robots market demand for early detection of the condition and for the treatment, services, and technologies needed to treat chronic disorders in older age.

Market Restraints

Limited Knowledge and Risk Regarding Orthopedic Surgical Procedures

In underdeveloped nations, orthopedic procedures are uncommon, even though orthopedic surgical energy devices have become established in the minimally invasive device industry. This lack of procedures could result in delayed diagnosis of orthopedic conditions and a decrease in the orthopedic surgical robots market share. Additionally, challenges such as lack of awareness and low self-efficacy can further hinder progress and lead to suboptimal execution.

Orthopedic surgeons utilize orthopedic surgical energy devices to treat various orthopedic conditions, repair blood vessels, suture tissue, and control bleeding. These devices are portable and must be used in conjunction with surgical instruments. While they do not provide a diagnosis, they enhance treatment outcomes. However, orthopedic surgeries carry risks and potential health consequences, sometimes requiring additional surgeries to address these issues. As a result, the global orthopedic surgical robots market opportunity is expected to face limitations due to the health risks associated with orthopedic procedures.

Report Segmentation

The market is primarily segmented based on application, end-user, and region.

|

By Application |

By End-User |

By Region |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Orthopedic Surgical Robots Market Segmental Analysis

By Application Analysis

The spine segment is projected to grow at fastest CAGR during the orthopaedic surgical market forecast period. The market is anticipated to grow as spinal cord injuries become more common. In older people, the prevalence of adult spinal deformities (ASD) is almost 68.0%, according to a report published by NCBI in October 2022. Spinal fusion injuries are frequently caused by trauma, collisions falls, and auto accidents. Over 3 million nonfatal injuries are reported in the United States each year, according to the American Association for the Surgery of Trauma. Over the course of the projection period, it is anticipated that the increase in trauma incidences will drive market expansion.

The knee segment led the industry market with substantial revenue share in 2023. The growth in the segment can be attributed to several factors. Primarily, there is a notable increase in the prevalence of osteoarthritis, a condition affecting millions worldwide. According to a study by the World Health Organization (WHO), approximately 344 million individuals are currently suffering from osteoarthritis globally. Among these cases, the knee is reported as the most commonly affected joint, followed by the hip and hand. This high prevalence of osteoarthritis underscores the urgent need for effective treatment options, driving demand for innovative approaches such as robotic surgery. Additionally, there is a growing patient preference for robotic surgery due to its perceived greater efficiency and effectiveness compared to traditional surgical methods. Robotic surgery offers several advantages, including enhanced precision, minimally invasive techniques, and shorter recovery times, leading to improved patient outcomes. As a result, patients are increasingly opting for robotic-assisted procedures when available.

By End-User Analysis

Based on end-user analysis, the market has been segmented on the basis of hospitals and ambulatory surgery centers. The hospitals segment dominated market share in revenue share in 2023. Hospitals and other inpatient institutions are often well-equipped to invest in expensive surgical robotic equipment due to their resources and patient volume. The growth of the inpatient market is further supported by the presence of skilled personnel and the necessary infrastructure for the operation and maintenance of these advanced technologies. The increasing popularity of robotic-assisted surgery among both patients and surgeons can be attributed to the reliability and reputation of hospitals. To improve patient care, surgeons and other medical professionals in hospital settings are increasingly integrating surgical robots into their practices, highlighting the growing importance of these technologies in modern healthcare.

The ambulatory surgery centers segment is expected to grow at the fastest CAGR during the orthopaedic surgical robots market forecast period. The rise in demand for robotically assisted treatments in surgical centers and ambulatory surgical centers (ASCs) is driven by the advantages these technologies offer. Surgical robots enable precise and minimally invasive surgeries, which can result in shorter recovery times and cost savings. This is particularly beneficial for patients, as they experience less pain and scarring compared to traditional surgeries. Additionally, surgeons benefit from enhanced precision and control during procedures, leading to better outcomes. As a result, surgical centers and ASCs are increasingly adopting robotic technology to meet the growing demand for advanced and efficient medical care

Orthopedic Surgical Robots Market Regional Insights

The North America Region Dominated the Global Market with the Largest Market Share in 2023

The North America region dominated the global market with the largest market share in 2023 and is expected to maintain its dominance over the anticipated period. Enhancements in surgical methods and healthcare infrastructure for various conditions are prime market drivers. The rising preference for robot-assisted surgeries is fueled by their superior outcomes compared to open procedures, leading to shorter hospital stays and faster recovery times, particularly in pediatric cases. This trend is expected to fuel orthopedic surgical robots market growth. Furthermore, the ability to work in smaller spaces with increasingly compact instruments is likely to improve further market expansion. Increased research and development (R&D) for innovative medicines, growing disease awareness, and the expanding prevalence of orthopedic surgical robots are vital drivers of market expansion. Additionally, increased funding for medical robot research, technological advancements, and greater understanding of the benefits of robotic-assisted surgery contribute to the nation's increasing acceptance of surgical robots. Together, these factors support the market's growth.

The Asia Pacific region is expected to be the fastest growing region with a healthy CAGR during the orthopedic surgical robots market forecast period. During the forecast period, the adoption of robotic-assisted surgeries is anticipated to be propelled by the aging population, which is more prone to orthopedic conditions. Moreover, government regulatory approvals are fostering additional market growth. For instance, in July 2023, China's National Medical Products Administration (NMPA) approved Beijing Tinavi Medical Technologies Co. Ltd.'s surgical robot. This approval expands the company's product line to include spine, trauma, and joint procedures in orthopedic surgery, enhancing the capability for total knee replacement surgeries.

Competitive Landscape

The orthopedic surgical robots market is fragmented and is anticipated to witness competition due to several players' presence. Major surgical robots providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product innovations, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Auris Health Inc.

- Globus Medical

- Intuitive Surgical

- Johnson & Johnson Services Inc.

- Medrobotics Corporation

- Medtronic

- Nordson Corporation

- OMNILife science Inc.

- Renishaw plc

- Smith and Nephew

- Stryker Corporation

- THINK Surgical, Inc.

- Transenterix (Asensus Surgical, Inc.)

- Zimmer Biomet

Recent Developments

- In February 2024, THINK Surgical announced a collaboration with Maxx Orthopedics, through which Think Surgical will incorporate Maxx Orthopedic implants into the TMINITM Miniature Robotic system. This collaboration is intended to create an open platform for orthopedic surgical robots that supports a variety of implants.

- In November 2023, Monogram Orthopaedics Inc. announced the launch of its first surgical robot into the global market. This development by Monogram is designed to enhance orthopedic joint replacement surgery through the use of advanced, next-generation surgical robots.

Report Coverage

The orthopedic surgical robots market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, application, end-user, and their futuristic growth opportunities.

Orthopedic Surgical Robots Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 736.72 million |

|

Revenue forecast in 2032 |

USD 1,101.91 million |

|

CAGR |

5.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Application, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global orthopedic surgical robots market size is expected to reach USD 1,101.91 million by 2032

Key players in the market are Medrobotics Corporation, Medtronic, Renishaw plc, Smith and Nephew, Stryker Corporation

North America contribute notably towards the global Orthopedic Surgical Robots Market

Orthopedic Surgical Robots Market , exhibiting the CAGR of 5.2% during the forecast period

The Orthopedic Surgical Robots Market report covering key segments are application, end-user, and region.