U.S. Petroleum Sorbent Pads Market Size, Share, Trends, Industry Analysis Report

By Material Type (Organic, Inorganic, Synthetic), By Absorbency, By End Use– Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5991

- Base Year: 2024

- Historical Data: 2020-2023

Overview

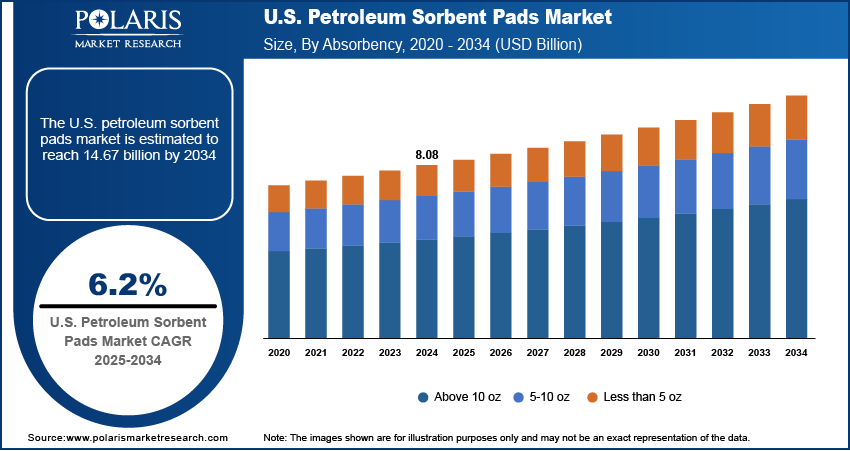

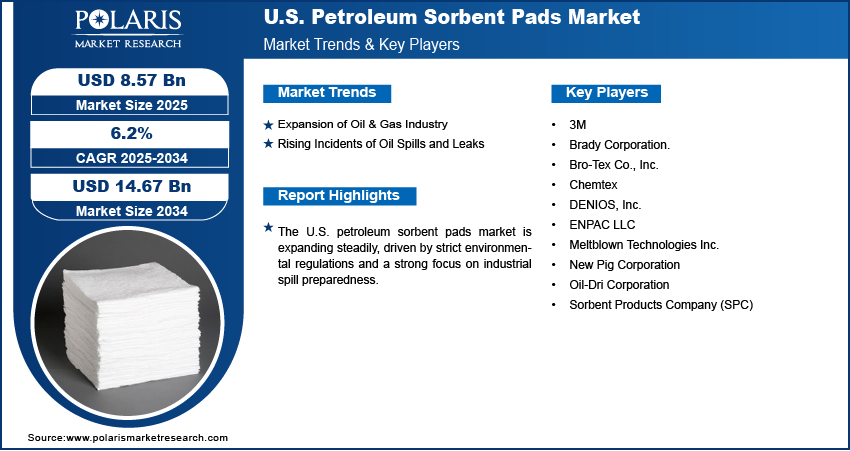

The U.S. petroleum sorbent pads market size was valued at USD 8.08 billion in 2024, growing at a CAGR of 6.2% from 2025 to 2034. The market is growing due to stricter environmental regulations, increased oil and gas operations, and rising spill incidents. Technological advancements in absorption materials are further driving demand as industries seek more efficient cleanup solutions.

Key Insights

- The synthetic sorbents segment accounted for largest revenue share in 2024

- The transportation & logistics segment is expected to witness the fastest growth during the forecast period

- The above 10 oz segment is projected to witness robust growth by 2034.

Petroleum sorbent pads are absorbent materials designed specifically to contain and clean up oil and petroleum-based fluids without absorbing water. In the U.S., the market is being driven by technological advancements and ongoing product innovations that aim to improve absorption efficiency, durability, and ease of deployment. Manufacturers are increasingly developing lightweight, high-capacity pads using advanced polymers and composite materials that enhance oil retention while minimizing waste. In January 2024, Finite Fiber launched PurAbsorb Industrial Super Absorbent, an advanced, 100% natural solution for industrial spill cleanups, reinforcing high-performance absorption technologies. These innovations are also making sorbent pads more versatile and cost-effective for use across various industries, including marine, automotive, and industrial sectors. As a result, product performance improvements are directly contributing to broader market adoption and application diversity.

The enforcement of strict environmental regulations surrounding oil spill prevention and remediation further contributes to growth opportunities. Federal and state agencies have set rigorous standards for spill response and environmental protection, encouraging industries to adopt reliable and compliant cleanup solutions. Petroleum sorbent pads, being both effective and easy to deploy, are increasingly favored as part of mandated spill response protocols. In January 2025, the US EPA reinforced SPCC rules for the oil exploration and production sectors, mandating spill prevention plans to protect waterways. Facilities must maintain and implement SPCC Plans to prevent and control oil discharges, thereby minimizing environmental and public health risks associated with potential spills. This regulatory pressure reinforces the demand for efficient sorbent technologies while also encouraging ongoing improvements in product performance to meet evolving environmental compliance criteria. Therefore, as regulatory frameworks continue to evolve, the use of high-quality sorbent materials remains essential to sustainable spill management strategies across the U.S. industrial landscape.

Industry Dynamics

- The ongoing expansion of oil and gas operations across the U.S. is proportionally increasing demand for high-performance spill containment products, particularly in shale regions and offshore drilling sites.

- Frequent spill incidents, caused by equipment failures, transportation accidents, and operational errors, are driving urgent upgrades to more reliable secondary containment systems across industrial facilities.

- Strict EPA spill response regulations are accelerating adoption of eco-friendly sorbent pads, forcing manufacturers to reformulate products while balancing compliance costs.

- Expanding oil production in the U.S. is boosting specialized demand for heavy-duty sorbent solutions, particularly around transport corridors and well sites, opening new segments for advanced absorbent technologies.

Expansion of Oil & Gas Exploration and Production: The expansion of oil and gas exploration and production activities is driving opportunities for the U.S. petroleum sorbent pads market, as it significantly increases the risk of operational spills and leaks across the upstream, midstream, and downstream segments. According to the U.S. Energy Information Administration's June 2025 forecast, American crude production is projected to average over 13.4 million barrels per day in 2025. The demand for efficient and portable spill containment solutions has increased as exploration moves into more remote and offshore environments. Petroleum sorbent pads offer a practical and effective means of managing minor leaks and routine maintenance discharges, making them essential tools at drilling sites, refineries, and transportation hubs. Their ability to provide quick responses and localized containment supports environmental safety and regulatory compliance, driving their adoption alongside the expansion of oil and gas operations.

Increasing Oil Spills and Industrial Accidents: The increasing frequency of oil spills and industrial accidents propels the need for reliable spill response materials such as petroleum sorbent pads. In 2024, ITOPF reported six spills involving tankers that exceeded 700 tonnes and four spills that were between 7 and 700 tonnes in volume. These incidents, whether caused by equipment failure, transportation mishaps, or human error, pose serious environmental and safety risks that demand immediate containment and cleanup. Sorbent pads serve as a first line of defense due to their rapid absorbency, ease of use, and adaptability across different surfaces and operating conditions. Additionally, the integration of sorbent pads into emergency protocols is becoming standard practice as industries prioritize spill preparedness and response capabilities, reinforcing their critical role in mitigating the impact of accidental discharges.

Segmental Insights

Material Type Analysis

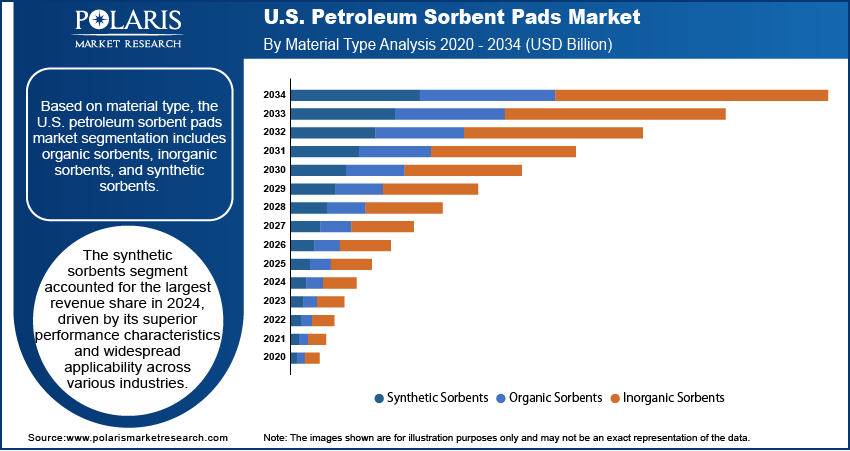

Based on material type, the U.S. petroleum sorbent pads market segmentation includes organic sorbents, inorganic sorbents, and synthetic sorbents. The synthetic sorbents segment accounted for the largest revenue share in 2024, driven by its superior performance characteristics and widespread applicability across various industries. Synthetic materials, such as polypropylene, are favored for their high oil absorbency, water repellency, and durability under harsh conditions. These sorbents are engineered to absorb several times their weight in hydrocarbons, making them highly efficient for large-scale industrial use. Their lightweight nature, chemical resistance, and the ability to be reused or incinerated after use further enhance their operational convenience and cost-effectiveness, positioning them as the preferred choice for spill response and environmental management applications.

Absorbency Analysis

In terms of absorbency, the U.S. petroleum sorbent pads market segmentation includes less than 5 oz, 5–10 oz, and above 10 oz. The above 10 oz segment is projected to witness robust growth by 2034, driven by an increasing need for high-capacity spill response products in heavy-duty industrial and transportation operations. Larger-scale oil handling facilities and high-risk environments require sorbent pads that absorb substantial quantities of petroleum products in a single application. These high-absorbency pads reduce the amount of material needed during spill events, thereby improving response efficiency and lowering labor costs. Moreover, the expanding scale of industrial infrastructure and a focus on rapid containment are reinforcing the demand for sorbents with higher fluid retention capacities.

End Use Insights

The U.S. petroleum sorbent pads market segmentation, based on end use, includes oil & gas, transportation & logistics, industrial & manufacturing, and others. The transportation & logistics segment is expected to witness fastest growth during the forecast period fueled by an increase in the movement of petroleum-based products via road, rail, and maritime routes. The potential for spills during loading, unloading, and transit has grown with the expansion of supply chains. Companies are increasingly prioritizing preventive safety measures and spill response tools to comply with environmental regulations and maintain operational continuity. Petroleum sorbent pads offer an effective and immediate solution for managing accidental spills during transportation, making them essential in warehouses, shipping yards, and freight terminals.

Key Players and Competitive Analysis

The U.S. petroleum sorbent pads market is shaped by strategic investments and competitive intelligence, with major players leveraging technological advancements to enhance product efficacy and sustainability. Industry trends highlight rising demand from small and medium-sized businesses in manufacturing and logistics, driven by stricter environmental regulations and economic shifts. Major vendors focus on expansion opportunities through optimized sustainable value chains, targeting latent demand in spill-prone sectors such as oil & gas and transportation. Disruptions and trends, including bio-based materials and IoT-technology integrated pads, are reshaping future development strategies. Revenue growth is concentrated in regions with high industrial activity, while supply chain disruptions challenge cost structures. Competitive positioning relies on innovation, with leaders such as 3M and New Pig Corporation dominating through wide product offerings and robust distribution. Expert insights suggest untapped potential in emerging applications, reinforcing the need for agile business transformation to capitalize on growth opportunities in this evolving landscape.

A few major companies operating in the U.S. petroleum sorbent pads market include 3M; Brady Corporation; Chemtex; DENIOS, Inc.; ENPAC LLC; Bro-Tex Co., Inc.; Meltblown Technologies Inc.; New Pig Corporation; Oil-Dri Corporation; and Sorbent Products Company (SPC).

Key Players

- 3M

- Brady Corporation.

- Bro-Tex Co., Inc.

- Chemtex

- DENIOS, Inc.

- ENPAC LLC

- Meltblown Technologies Inc.

- New Pig Corporation

- Oil-Dri Corporation

- Sorbent Products Company (SPC)

Industry Developments

- June 2025: Sellars, a Milwaukee-based manufacturer of absorbents and wipers, invested USD 15 million to open a 100,000-sq-ft production facility in Milwaukee. The site includes two machines and will create 20 jobs in operations, maintenance, and logistics.

U.S. Petroleum Sorbent Pads Market Segmentation

By Material Type Outlook (Revenue, USD Billion, 2020–2034)

- Organic Sorbents

- Inorganic Sorbents

- Synthetic Sorbents

By Absorbency Outlook (Revenue, USD Billion, 2020–2034)

- Less than 5 oz

- 5–10 oz

- Above 10 oz

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Oil & Gas

- Transportation & Logistics

- Industrial & Manufacturing

- Others

U.S. Petroleum Sorbent Pads Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 8.08 Billion |

|

Market Size in 2025 |

USD 8.57 Billion |

|

Revenue Forecast by 2034 |

USD 14.67 Billion |

|

CAGR |

6.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 8.08 billion in 2024 and is projected to grow to USD 14.67 billion by 2034.

The market is projected to register a CAGR of 6.2% during the forecast period.

A few of the key players in the market are 3M; Brady Corporation; Chemtex; DENIOS, Inc.; ENPAC LLC; Bro-Tex Co., Inc.; Meltblown Technologies Inc.; New Pig Corporation; Oil-Dri Corporation; and Sorbent Products Company (SPC).

The synthetic sorbents segment accounted for the largest revenue share in 2024

The transportation & logistics segment is expected to witness the fastest growth during the forecast period.