U.S. Plasmid DNA Manufacturing Market Size, Share, Trends, Industry Analysis Report

By Grade (R&D Grade, GMP Grade), By Development Phase, By Application, By Disease – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 118

- Format: PDF

- Report ID: PM6251

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

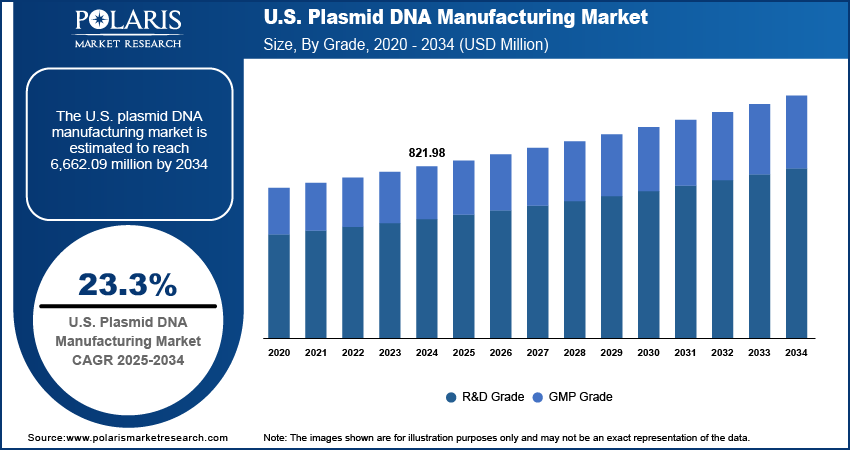

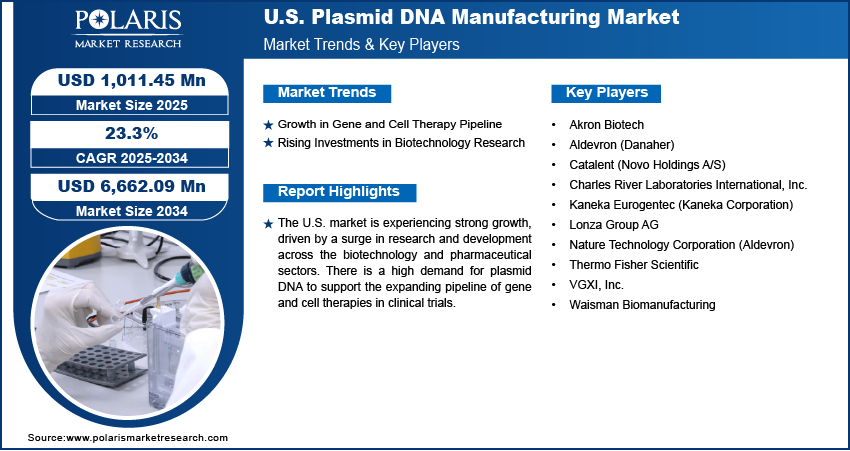

The U.S. plasmid DNA manufacturing market size was valued at USD 821.98 million in 2024 and is anticipated to register a CAGR of 23.3% from 2025 to 2034. The rising use of plasmid DNA in gene therapies, DNA vaccines, and other advanced treatments is a major growth driver. Additionally, the increasing focus on personalized medicine and a growing number of clinical trials for advanced therapies are boosting the demand.

Key Insights

- By grade, the GMP grade segment held the largest share in 2024. This is because of the strict regulatory needs for advanced therapies in clinical trials and commercial production, which drives demand for high-quality, compliant manufacturing.

- In terms of development phase, the clinical therapeutics segment held the largest share in 2024. This is a result of the high number of gene and cell therapies currently in human clinical trials, which require a substantial amount of plasmid DNA for large-scale manufacturing.

- By application, the cell and gene therapy segment held the largest share in 2024. Plasmid DNA plays an essential role in producing the viral vectors used to deliver genetic material in these cutting-edge therapies, a field that is seeing massive growth.

- By disease, the cancer segment held the largest share in 2024. This is because of the widespread use of plasmid DNA in developing immunotherapies, gene therapies, and DNA vaccines to treat various forms of cancer, a disease with high global prevalence.

Industry Dynamics

- The rising number of clinical trials for gene and cell therapies drives the U.S. plasmid DNA manufacturing market growth. These advanced treatments are heavily dependent on a large and consistent supply of high-quality plasmid DNA to support their development and manufacturing processes.

- Another key driver is the growing demand for DNA vaccines. Plasmid DNA is a critical component in these vaccines, and their ability to be developed quickly has made them a popular focus for research and development, especially for infectious diseases.

- The increasing focus on personalized medicine and targeted therapies is also boosting the market. As researchers and companies work on treatments tailored to individual patients, the demand for specialized and high-purity plasmid DNA is expanding.

Market Statistics

- 2024 Market Size: USD 821.98 million

- 2034 Projected Market Size: USD 6,662.09 million

- CAGR (2025–2034): 23.3%

AI Impact on U.S. Plasmid DNA Manufacturing Market

- AI technology is used to adjust various parameters, including pH, temperature, and nutrient flow, in real time to maximize plasmid DNA output.

- AI algorithms help detect anomalies in plasmid structure, contamination risks, and supercoiling.

- The technology enables early intervention and assists in ensuring compliance with Good Manufacturing Practice (GMO) standards.

- Lack of skilled personnel who can manage AI platforms and interpret outputs restrains the adoption of AI in plasmid DNA manufacturing.

The U.S. plasmid DNA manufacturing market focuses on the large-scale production of plasmid DNA molecules. These molecules, which are small and circular, are essential as vectors in genetic analysis, engineering, and biotechnology. They play a critical part in developing advanced therapies, such as gene therapies, DNA vaccines, and cell-based treatments. The manufacturing process involves several complex steps, including fermentation, purification, and quality control to meet strict standards for therapeutic and research use.

One of the factors driving the U.S. plasmid DNA manufacturing market expansion is the increasing trend of outsourcing manufacturing to contract development and manufacturing organizations, also known as CDMOs. As more biotech and pharmaceutical companies, especially startups, enter the advanced therapeutics space, they often lack the internal infrastructure and expertise to produce plasmid DNA. Outsourcing to specialized CDMOs allows them to accelerate their research and development timelines and get their products to market faster. Another important factor is the rise of academic and government-funded research. These institutions often require high-quality plasmid DNA for their studies, which helps boost demand and support innovations in the field.

A key driver with a growing impact is the adoption of new manufacturing technologies. Traditional methods can be a bottleneck due to their high cost and long production times. However, new technological advancements are helping to overcome these challenges. For example, innovations in automated platforms and continuous manufacturing processes are improving production efficiency, consistency, and scalability. This is making it possible to produce high-quality plasmid DNA faster and at a lower cost. These advancements are crucial for meeting the rising demand from clinical trials and commercial manufacturing. This is an important step in making a wide range of advanced therapies more accessible to patients.

Drivers and Trends

Growth in Gene and Cell Therapy Pipeline: The expanding number of clinical trials and approved products for gene and cell therapies is a major factor driving the market. These advanced treatments, which aim to correct genetic defects or use a patient's own cells to fight disease, require high-quality plasmid DNA as a key starting material for manufacturing. As the number of therapies in development grows, so does the demand for the foundational materials needed to produce them. The U.S. Food and Drug Administration's focus on speeding up the approval process for these life-saving treatments has also contributed to this rapid development.

According to the article "Clinical Development of Gene Therapies: The First Three Decades and Counting," published in the Journal Human Gene Therapy (2020), a gradual increase in investigational new drug applications for gene therapy products was submitted to the FDA between 1988 and 2019. This growing pipeline of clinical trials for gene and cell therapies directly increases the demand for plasmid DNA as a critical component in their development and manufacturing.

Rising Investments in Biotechnology Research: Another important driver is the increase in funding and investments in the biotechnology and biopharmaceutical sectors. Both private and public funding sources are allocating significant funding for research for new therapies, especially in areas such as gene editing and immunotherapy. This financial support helps companies and research institutions advance their programs from the discovery phase to clinical trials, all of which require a steady supply of plasmid DNA. This funding supports research and development, and the scaling of manufacturing capabilities to meet future demand.

According to a study in Nature Biotechnology titled "The estimated annual financial impact of gene therapy in the United States" (2023), the number of U.S.-based patients expected to be treated with gene or stem cell therapy was estimated to reach over 340,000 by 2030, a large increase from 12,000 in 2020. This indicates a strong confidence in the field and a willingness to invest, which fuels the need for plasmid DNA to produce these therapies on a commercial scale. This expanding financial commitment to the field of advanced medicine is a key force behind the growth of the U.S. plasmid DNA manufacturing market.

Segmental Insights

Grade Analysis

Based on grade, the segmentation includes R&D grade and GMP grade. The GMP grade segment held the largest share in 2024. This is primarily due to the strict regulatory requirements for advanced therapies such as gene and cell therapies, which are the main end-use for this grade of plasmid DNA. To be used in clinical trials and commercial products, plasmid DNA must meet Good Manufacturing Practice, or GMP, standards to ensure safety, purity, and consistency. This makes GMP grade production highly technical and costly, but it is a non-negotiable step for therapeutic applications. The growing number of therapies moving from early research to clinical stages is directly fueling the demand for this high-quality product.

The R&D grade segment is anticipated to register the highest growth rate during the forecast period, driven by the expansion of early-stage research and development activities across academia and the biotech sector. R&D grade plasmid DNA is used in discovery-phase programs and preclinical studies where the stringent regulatory controls of GMP are not yet required. It allows researchers to quickly and affordably test new concepts and optimize vectors before moving on to more expensive, regulated manufacturing. As new companies and research initiatives are launched to explore potential treatments, the demand for this foundational, lower-cost material is increasing rapidly. The widespread interest in gene editing, novel vaccines, and synthetic biology is a key factor supporting the fast growth of this segment.

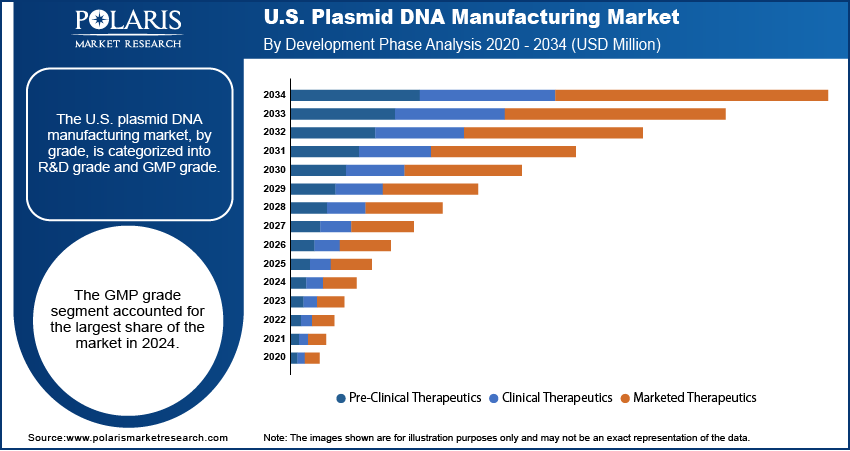

Development Phase Analysis

Based on development phase, the segmentation includes pre-clinical therapeutics, clinical therapeutics, and marketed therapeutics. The clinical therapeutics segment held the largest share in 2024. This is a result of the large number of gene and cell therapies currently in various stages of human clinical trials. These trials require significant quantities of GMP-grade plasmid DNA to produce the viral vectors and other delivery systems needed for a broad range of investigational medicines. As a therapy moves through phase I, II, and III trials, the manufacturing needs for plasmid DNA increase dramatically to support larger patient cohorts. This constant and rising demand from companies and research institutions with products in clinical development makes this segment the most prominent contributor to the overall market. The ongoing investments in these promising new therapies ensure that this segment will continue to dominate the industry in the near future.

The pre-clinical therapeutics segment is anticipated to register the highest growth rate during the forecast period, as it represents the initial and most numerous stage of drug development. Before a potential therapy can enter human trials, it must undergo extensive preclinical research and testing in a laboratory setting. This involves a vast number of new ideas and experiments for which researchers need plasmid DNA. The fast growth is driven by the fact that many more new therapies are in the discovery and preclinical phases than in later clinical stages. The high volume of research from both academic institutions and biotech startups, fueled by strong financial backing, creates a constant and growing demand for plasmid DNA at this early phase. This trend is a strong sign of a healthy pipeline for future gene and cell therapies.

Application Analysis

Based on application, the segmentation includes DNA vaccines, cell & gene therapy, immunotherapy, and others. The cell & gene therapy segment held the largest share in 2024. Plasmid DNA is a foundational component for viral vectors and plasmid DNA manufacturing that are used to deliver genetic material in these advanced therapies. As the number of gene and cell therapies in clinical trials and on the market grows, so does the need for large quantities of high-quality plasmid DNA to support their manufacturing. The critical role of plasmid DNA in producing these life-changing treatments for a wide range of genetic and acquired diseases solidifies its dominant position in the market.

The DNA vaccines segment is anticipated to register the highest growth rate during the forecast period. This growth is largely influenced by the recent successes and rapid development of nucleic acid-based vaccines, especially in response to global health crises. Plasmid DNA is a key material in creating DNA vaccines, which are known for their speed of development, ease of modification, and strong immune responses. As research and development in this area continues to expand, driven by a need for new vaccines for both existing and emerging infectious diseases, the demand for plasmid DNA will rise quickly. This is making the DNA vaccines segment the fastest growing application for plasmid DNA manufacturing.

Disease Analysis

Based on disease, the segmentation includes infectious disease, cancer, genetic disorder, and others. The cancer segment held the largest share in 2024. This is primarily due to the widespread application of plasmid DNA in developing a variety of cancer treatments, including gene therapies, DNA-based vaccines, and immunotherapies. The high prevalence of cancer and the constant need for new and more effective treatments have made oncology a major area of research and development. The complexity and duration of clinical trials for cancer therapies require a consistent and large-scale supply of high-quality plasmid DNA, which drives the market share for the cancer segment.

The infectious disease segment is anticipated to register the highest growth rate during the forecast period. The rapid development of DNA vaccines, especially in response to recent global pandemics and the threat of emerging pathogens, has significantly boosted this segment. Plasmid DNA is a key component for creating these vaccines, as it allows for a fast, flexible, and scalable production process. This speed is crucial for public health needs when a quick response is required. The ongoing efforts in research and development to create new vaccines for a variety of infectious diseases, along with rising government and private funding in this area, are the main factors behind this segment's fast growth.

Key Players and Competitive Insights

The U.S. plasmid DNA manufacturing market is highly competitive, with a mix of large global life science companies and smaller, specialized contract manufacturing organizations. Key players include Thermo Fisher Scientific, Lonza, Charles River Laboratories, Catalent, Aldevron, and VGXI. The competitive landscape is defined by the need for high-quality, GMP-compliant manufacturing at scale to support the rapidly growing advanced therapies sector. Companies compete on factors such as technological expertise, speed of delivery, production capacity, and the ability to offer a full range of services from process development to large-scale commercial manufacturing. Many players are also expanding their facilities and entering into partnerships to meet the increasing demand from both biotech and pharmaceutical clients.

A few prominent companies in the industry include Aldevron (a Danaher company), VGXI, Lonza, Charles River Laboratories, Catalent, Thermo Fisher Scientific, Akron Biotech, Nature Technology Corporation, Waisman Biomanufacturing, and Kaneka Eurogentec.

Key Players

- Akron Biotech

- Aldevron (Danaher)

- Catalent (Novo Holdings A/S)

- Charles River Laboratories International, Inc.

- Kaneka Eurogentec (Kaneka Corporation)

- Lonza Group AG

- Nature Technology Corporation (Aldevron)

- Thermo Fisher Scientific

- VGXI, Inc.

- Waisman Biomanufacturing

U.S. Plasmid DNA Manufacturing Industry Developments

October 2024: Lonza acquired a large-scale biologics manufacturing site in Vacaville, California, from Genentech, a member of the Roche Group. The acquisition, valued at $1.2 billion, significantly expands Lonza's U.S. manufacturing capabilities for mammalian-based biotherapeutics.

U.S. Plasmid DNA Manufacturing Market Segmentation

By Grade Outlook (Revenue – USD Million, 2020–2034)

- R&D Grade

- GMP Grade

By Development Phase Outlook (Revenue – USD Million, 2020–2034)

- Pre-Clinical Therapeutics

- Clinical Therapeutics

- Marketed Therapeutics

By Application Outlook (Revenue – USD Million, 2020–2034)

- DNA Vaccines

- Cell & Gene Therapy

- Immunotherapy

- Others

By Disease Outlook (Revenue – USD Million, 2020–2034)

- Infectious Disease

- Cancer

- Genetic Disorder

- Others

U.S. Plasmid DNA Manufacturing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 821.98 million |

|

Market Size in 2025 |

USD 1,011.45 million |

|

Revenue Forecast by 2034 |

USD 6,662.09 million |

|

CAGR |

23.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 821.98 million in 2024 and is projected to grow to USD 6,662.09 million by 2034.

The market is projected to register a CAGR of 23.3% during the forecast period.

A few key players in the market include Aldevron (a Danaher company), VGXI, Lonza, Charles River Laboratories, Catalent, Thermo Fisher Scientific, and Akron Biotech, Nature Technology Corporation, Waisman Biomanufacturing, and Kaneka Eurogentec.

The GMP grade segment accounted for the largest share of the market in 2024.

The pre-clinical therapeutics segment is expected to witness the fastest growth during the forecast period.