DNA Manufacturing Market Size, Share, Trends, & Industry Analysis Report

By Type (Plasmid DNA, Synthetic DNA), By Grade, By Application, End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM5837

- Base Year: 2024

- Historical Data: 2020-2023

Overview

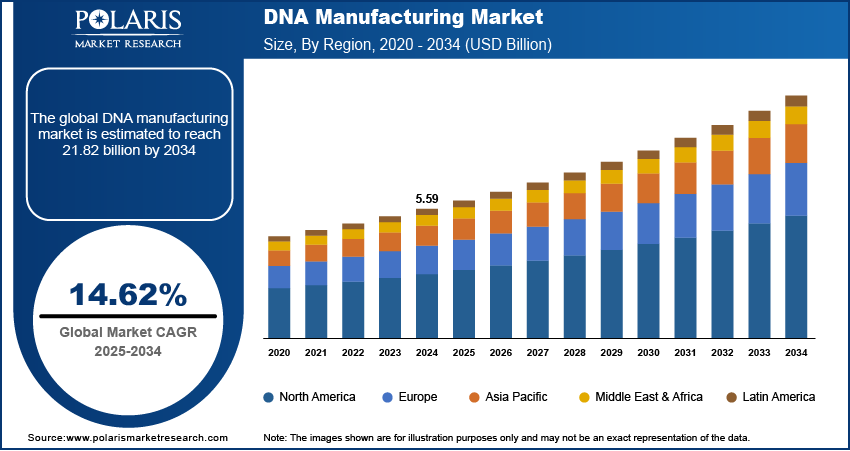

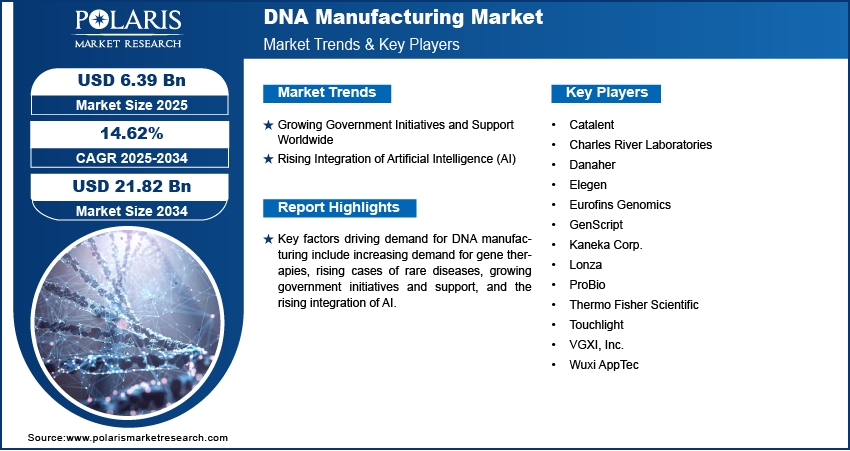

The global DNA manufacturing market size was valued at USD 5.59 billion in 2024, growing at a CAGR of 14.62% from 2025 to 2034. Key factors driving demand for DNA manufacturing include increasing demand for gene therapies across the world, rising cases of rare diseases, growing government initiatives and support, and the rising integration of artificial intelligence (AI).

Key Insights

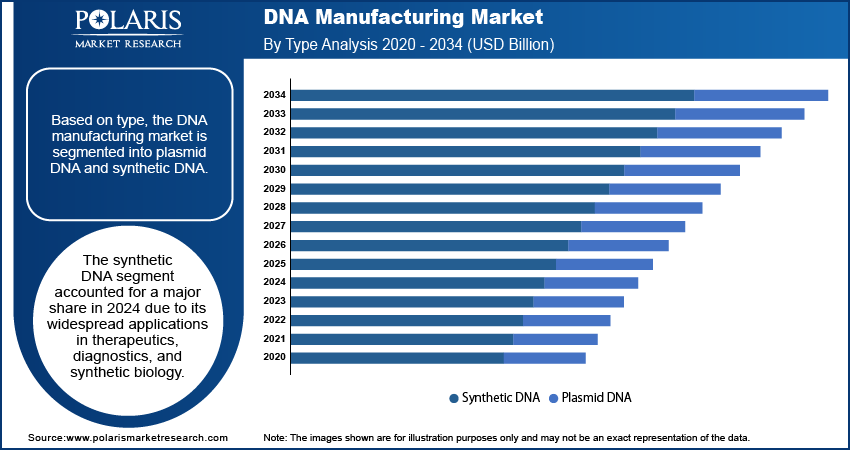

- The synthetic DNA segment held the largest market share in 2024, driven by its extensive use across therapeutic development, diagnostic assays, and synthetic biology applications, where precise and scalable DNA constructs are essential.

- The GMP-grade segment dominated the market in 2024, as clinical-grade DNA is increasingly required for use in gene and cell therapy pipelines, as well as DNA-based vaccines undergoing clinical trials or regulatory approval.

- The cell and gene therapy segment led in revenue share in 2024, supported by a surge in R&D investments, expanding clinical pipelines, and growing commercial demand for advanced therapies across oncology, rare diseases, and regenerative medicine.

- The contract research organizations (CROs) segment is projected to grow significantly, driven by outsourcing trends among biopharmaceutical companies seeking to reduce development timelines and leverage specialized DNA manufacturing capabilities.

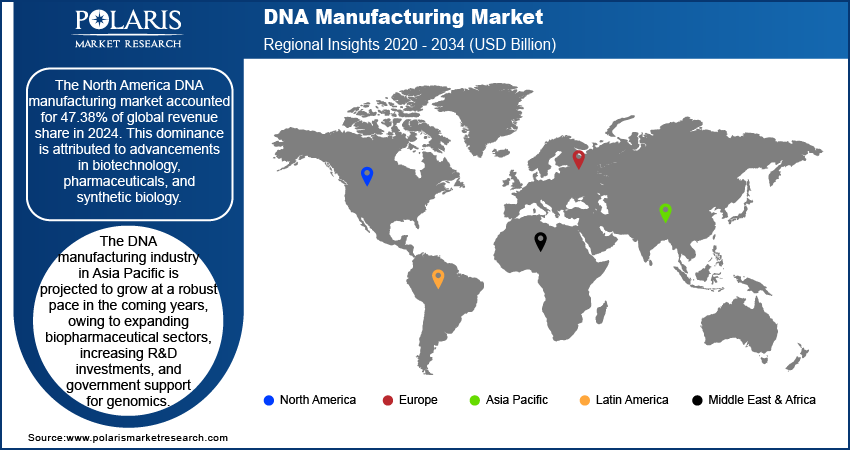

- North America accounted for 47.38% of the global DNA manufacturing market revenue in 2024, primarily due to its mature biotechnology ecosystem, early adoption of synthetic biology tools, and substantial funding for gene-based therapeutic innovation.

Industry Dynamics

- Rapid progress in synthetic biology and rising demand for DNA-based vaccines are driving the adoption of precise, scalable DNA manufacturing. This shift enables pharmaceutical and biotech firms to innovate gene therapies, diagnostics, and personalized medicine in global healthcare markets.

- The expanding use in agriculture and biopharmaceutical R&D increases demand for high-purity DNA constructs. The role of genetic engineering in crop improvement and drug discovery drives organizations to seek efficient and cost-effective DNA synthesis and amplification services.

- High production costs and complex regulatory hurdles slow innovation and accessibility, particularly affecting smaller biotech startups and research institutions with limited budgets and compliance capabilities.

- Emphasis on decentralized manufacturing and cell-free DNA synthesis presents opportunities to streamline production, reduce costs, and address the rising demand for customized DNA products in emerging markets and the personalized medicine sector.

Market Statistics

- 2024 Market Size: USD 5.59 billion

- 2034 Projected Market Size: USD 21.82 billion

- CAGR (2025-2034): 14.62%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

DNA manufacturing refers to the creation and production of DNA molecules for use in biotechnology, medicine, and research. DNA is manufactured to serve as the backbone for a wide range of applications. In medicine, it enables the development of gene therapies, mRNA vaccines and therapeutics, including those for COVID-19 and cancer treatments, where the DNA acts as a template for producing therapeutic proteins or correcting genetic defects. Researchers also utilize manufactured DNA for genetic engineering in agriculture, creating crops with enhanced traits, and in basic research to investigate gene function and regulation.

The increasing demand for gene therapies globally is driving the market growth. Pharmaceutical and biotechnology companies are driving the development of gene therapies to meet the growing demand, fueled by the rising prevalence of genetic disorders, cancers, and rare diseases. This increasing development of gene therapies is creating a need for DNA molecules, which is increasing DNA production, including plasmid DNA, synthetic DNA, and other DNA vectors. Therefore, the rising demand for gene therapies is propelling the market expansion.

The demand for DNA manufacturing is driven by the increasing number of rare disease cases globally. According to the National Library of Medicine report, global rare disease prevalence is estimated to be 3.5–5.9% of the world's population. Rare diseases often have a genetic origin, requiring precise DNA molecules for gene therapy, diagnostic tools, and therapeutic development. Pharmaceutical and biotech companies are heavily investing in customized DNA manufacturing to create plasmids, viral vectors, and synthetic genes that can correct or replace faulty genes in rare disease patients. Hence, the demand for DNA manufacturing is rapidly increasing with the rising cases of rare diseases globally.

Industry Dynamics

Growing Government Initiatives and Support Worldwide

Governments across the world are investing in national genomics projects, personalized medicine strategies, and pandemic preparedness, driving the production of plasmid and synthetic DNA, as genomic projects and personalized medicine require customized DNA molecules. Public health agencies in various regions are also collaborating with academic and private institutions to advance gene therapies, DNA-based vaccines, and diagnostic tools, creating a demand for DNA manufacturing. Moreover, favorable policies, tax incentives, and grants are further motivating biotechnology companies to expand their manufacturing capabilities, directly contributing to the global growth of the DNA manufacturing market.

Rising Integration of Artificial Intelligence (AI)

Artificial intelligence algorithms help scientists identify optimal gene constructs, predict biological outcomes, and streamline the development of synthetic DNA with greater precision and efficiency. This enhanced speed and accuracy are enabling faster progress in areas such as gene therapy, vaccine development, and personalized medicine, thereby increasing the volume of DNA required for experiments and production. Therefore, the rising integration of AI tools in DNA manufacturing is propelling the market growth, by creating a pipeline of projects that rely on DNA molecules.

Segmental Insights

Type Analysis

Based on type, the segmentation includes plasmid DNA and synthetic DNA. The synthetic DNA segment accounted for a major market share in 2024 due to its widespread applications in therapeutics, diagnostics, and synthetic biology. The increasing demand for customized gene synthesis, particularly for CRISPR-based gene editing and mRNA vaccine development, fueled the segment dominance. Pharmaceutical and biotech companies heavily invested in synthetic DNA in 2024 to accelerate drug discovery and personalized medicine. Advancements in oligonucleotide synthesis technologies reduced production costs and improved scalability, leading to its high adoption. Additionally, the rise of AI-driven DNA design tools enhanced the precision and efficiency of synthetic DNA, further contributing to the segment's prominence.

Grade Analysis

In terms of grade, the segmentation includes GMP grade and R&D grade. The GMP grade segment held a larger market share in 2024 due to rising demand for clinical-grade DNA used in advanced therapeutic applications such as gene therapy, cell therapy, and DNA-based vaccines. Biopharmaceutical companies prioritized GMP-grade DNA to meet stringent regulatory requirements imposed by agencies such as the FDA and EMA. The segment also benefited from the increasing number of gene therapy clinical trials, which required high-purity, contaminant-free DNA manufactured under strict quality controls. Moreover, the surge in demand for mRNA vaccines and the expansion of cell and gene therapy led to greater adoption of GMP-grade DNA.

Application Analysis

In terms of application, the segmentation includes cell & gene therapy, vaccines, oligonucleotide-based drugs, and others. The cell & gene therapy segment dominated the revenue share in 2024, owing to the rapid expansion of clinical and commercial activity in advanced therapeutic platforms. Pharmaceutical and biotech companies increasingly leverage plasmid and synthetic DNA as essential raw materials for developing viral vectors, engineered cells, and genome editing tools. The growing number of FDA approvals and clinical trials for gene therapies targeting rare diseases and cancer boosted demand for DNA manufacturing. Moreover, technological advancements in gene delivery systems and rising investments in regenerative medicine fuel the adoption of DNA manufacturing.

The oligonucleotide-based drugs segment is projected to grow at a rapid pace during the forecast period, owing to the rapid development of mRNA vaccines, antisense oligonucleotides, and RNA interference therapies. Innovations in synthetic biology and cost-effective production methods are projected to accelerate the adoption of DNA manufacturing in the development of oligonucleotide-based drugs. Moreover, the shorter development timelines and lower manufacturing complexities compared to traditional biologics are making oligonucleotide therapies an attractive choice for companies aiming to launch treatments faster.

End Use Analysis

In terms of end use, the segmentation includes pharmaceutical and biotechnology companies, academic & research institutes, and contract research organizations. The contract research organizations segment is projected to grow at a robust pace in the coming years. CROs offer specialized expertise, scalable manufacturing, and faster turnaround times, making them essential partners for drug development. The rise in preclinical and clinical research, particularly for novel modalities such as CRISPR-based therapies and synthetic DNA vaccines, is projected to further drive the segment. Additionally, smaller biotech firms, lacking large-scale production infrastructure, are relying heavily on contract research organizations to meet regulatory and commercial demands, ensuring sustained segment expansion in the coming years.

Regional Analysis

The North America DNA manufacturing market accounted for 47.38% global revenue share in 2024. This dominance is attributed to advancements in biotechnology, pharmaceuticals, and synthetic biology. The region being a hub for genetic research, personalized medicine, and CRISPR-based therapies, increased the need for high-quality synthetic DNA in 2024, leading to market expansion. Government funding for genomics projects and strong investments from biotech firms propelled the DNA manufacturing demand in the region. Additionally, the growing adoption of mRNA vaccines and gene therapies contributed to market expansion in North America in 2024.

U.S. DNA Manufacturing Market Insight

The U.S. dominated the revenue share in North America DNA manufacturing industry in 2024 due to its robust biotech industry, academic research institutions, and strong regulatory framework supporting genetic engineering and testing. The rise of precision medicine, next-generation sequencing (NGS), and gene-editing technologies, such as CRISPR, in the U.S. has fueled the demand for DNA manufacturing. Moreover, federal initiatives such as the Cancer Moonshot and DARPA’s bioengineering programs drove innovation in the market.

Asia Pacific DNA Manufacturing Market Trends

The DNA manufacturing industry in Asia Pacific is projected to grow at a robust pace in the coming years, owing to expanding biopharmaceutical sectors, increasing R&D investments, and government support for genomics. Countries such as China, Japan, and South Korea are leading the market with increasing gene therapy and vaccine production. The region’s cost-effective manufacturing capabilities are attracting global biotech firms to invest in DNA manufacturing facilities in the region. Additionally, initiatives such as China’s precision medicine project and Japan’s focus on regenerative medicine are contributing to market expansion in the region.

India DNA Manufacturing Market Overview

Demand for DNA manufacturing is growing in India, due to its rising biopharmaceutical and vaccine industries. The country is a major producer of generic drugs and biosimilars, requiring synthetic DNA for drug development. Government programs such as “Make in India” and increased funding for biotechnology research are supporting the domestic production of DNA synthesis. The rise of startups in synthetic biology, coupled with collaborations with global pharmaceutical companies, is further driving market demand. Additionally, India’s focus on agricultural biotechnology and disease diagnostics is contributing to the expanding industry.

Europe DNA Manufacturing Market Outlook

The industry in Europe is projected to hold a substantial share by 2034, due to strong academic research, biotech innovation, and supportive regulatory policies. The European Union’s Horizon Europe program is funding genomics and synthetic biology projects, driving market revenue. Countries such as Germany, the UK, and Switzerland are a few key countries in the region. These countries have pharmaceutical giants that are investing in mRNA and CRISPR technologies. Strict regulatory standards in the region are also ensuring high-quality DNA production, contributing to market expansion.

The UK DNA manufacturing is projected to hold a substantial share by 2034 due to its robust biotechnology ecosystem, supported by world-class academic research institutions and strong government funding in genomics. The country benefits from a well-established regulatory framework that accelerates innovation while ensuring compliance, making it an attractive hub for advanced bio manufacturing. Additionally, strategic collaborations between pharmaceutical giants, biotech startups, and NHS-driven genomic initiatives create a competitive advantage in precision medicine and synthetic biology. The presence of specialized contract manufacturing organizations (CMOs) further strengthens the UK’s capacity to meet global demand for high-quality DNA-based therapeutics and diagnostics.

Key Players and Competitive Analysis

The DNA manufacturing sector is rapidly driven by increasing demand for synthetic DNA in applications such as gene therapy, mRNA vaccines, CRISPR-based therapeutics, and synthetic biology. Key players such as Thermo Fisher Scientific, Danaher, and Lonza dominate the industry with their end-to-end solutions, leveraging advanced production technologies, regulatory expertise, and global supply chains. Charles River Laboratories and Catalent provide specialized services in plasmid DNA production, catering to biopharma and cell & gene therapy developers. Emerging players such as Elegen, Touchlight, and VGXI, Inc. are disrupting the industry with novel enzymatic DNA synthesis and cell-free manufacturing platforms, enabling faster, more scalable production compared to traditional plasmid-based methods.

A few major companies operating in the DNA Manufacturing industry include Catalent; Charles River Laboratories; Danaher; Elegen; Eurofins Genomics; GenScript; Kaneka Corp.; Lonza; ProBio; Thermo Fisher Scientific; Touchlight; VGXI, Inc.; and Wuxi AppTec.

Key Players

- Catalent

- Charles River Laboratories

- Danaher

- Elegen

- Eurofins Genomics

- GenScript

- Kaneka Corp.

- Lonza

- ProBio

- Thermo Fisher Scientific

- Touchlight

- VGXI, Inc.

- Wuxi AppTec

Industry Developments

May 2025: VGXI, Inc., a CDMO focused on nucleic acid therapeutics, successfully passed an FDA inspection at its Conroe, Texas site. This achievement enables its client to file a Biologics License Application (BLA) for plasmid DNA in gene therapies and mRNA vaccines, underscoring VGXI’s leadership in scalable, high-purity plasmid DNA production.

April 2025: ProBio, a global CDMO, announced the launch of a GMP Plasmid DNA manufacturing service at its facility in Hopewell, NJ.

January 2025: Touchlight, a contract development and manufacturing organization (CDMO), announced that its facility in Hampton, UK, received GMP certification to produce active pharmaceutical ingredients (API) to support its growing customer base in developing DNA vaccines and non-viral gene therapies.

January 2025: Elegen, a global company in next-generation DNA manufacturing, announced the launch of ENFINIA Plasmid DNA, a faster, cost-effective solution for clonal synthesis of long and complex genes.

DNA Manufacturing Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Plasmid DNA

- Synthetic DNA

- Gene Synthesis

- Oligonucleotide Synthesis

By Grade Outlook (Revenue, USD Billion, 2020–2034)

- GMP Grade

- R&D Grade

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Cell & Gene Therapy

- Vaccines

- Oligonucleotide-Based drugs

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Pharmaceutical and Biotechnology Companies

- Academic & Research Institutes

- Contract Research Organizations

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

DNA Manufacturing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.59 Billion |

|

Market Size in 2025 |

USD 6.39 Billion |

|

Revenue Forecast by 2034 |

USD 21.82 Billion |

|

CAGR |

14.62% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.59 billion in 2024 and is projected to grow to USD 21.82 billion by 2034.

The global market is projected to register a CAGR of 14.62% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Catalent; Charles River Laboratories; Danaher; Elegen; Eurofins Genomics; GenScript; Kaneka Corp.; Lonza; ProBio; Thermo Fisher Scientific; Touchlight; VGXI, Inc.; and Wuxi AppTec.

The synthetic DNA segment dominated the market share in 2024.

The contract research organizations segment is expected to witness the fastest growth during the forecast period.