Japan Neurology Clinical Trials Market Size, Share, Trends, Industry Analysis Report

By Phase (Phase I, Phase II, Phase III, Phase IV), By Study Design, By Indication, By Value Chain – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 124

- Format: PDF

- Report ID: PM6422

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

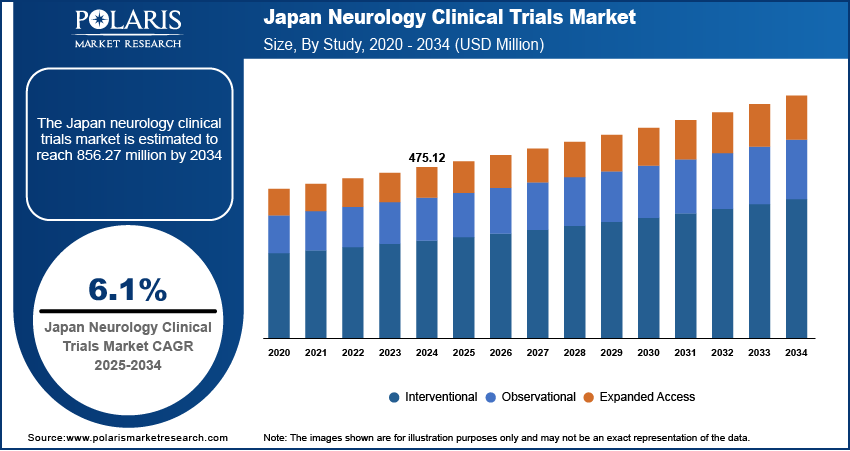

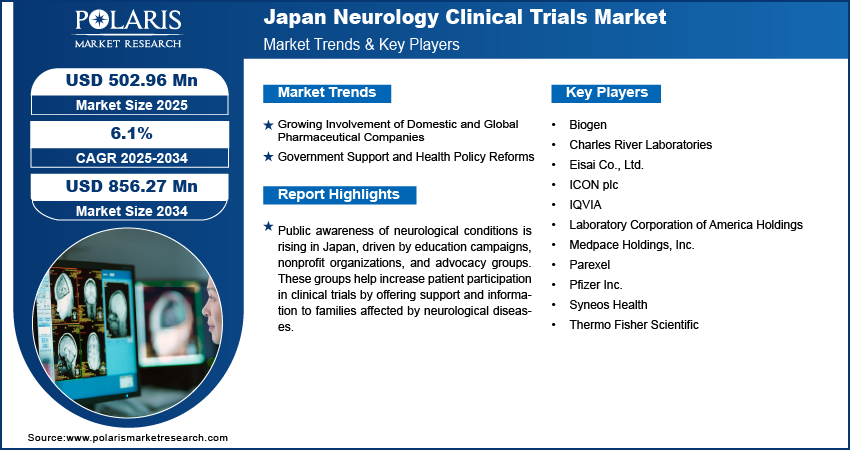

The Japan neurology clinical trials market size was valued at USD 475.12 million in 2024 and is anticipated to register a CAGR of 6.1% from 2025 to 2034. The growth is driven by the growing involvement of domestic and global pharmaceutical companies, government support, and health policy reforms.

Key Insights

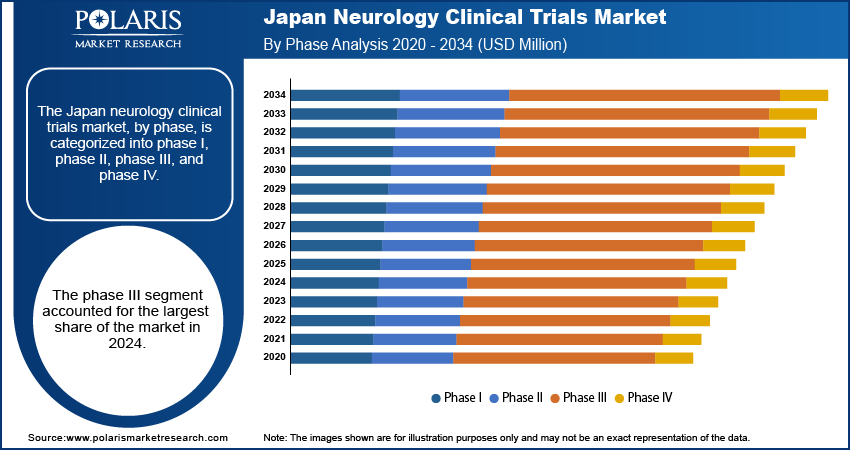

- The phase III segment accounted for the largest share in 2024, driven by Japan’s strong focus on confirming the safety and efficacy of neurological treatments before regulatory approval.

- The observational studies segment is projected to witness the fastest growth during the forecast period, fueled by the rising demand for real-world evidence to better understand the progression and impact of neurological disorders.

Industry Dynamics

- Growing involvement of domestic and global pharmaceutical companies is fueling the demand for clinical trial services

- Government support and health policy reforms are fueling the growth.

- Public awareness of neurological conditions is rising in Japan, driven by education campaigns, nonprofit organizations, and advocacy groups, fueling patient participation.

- Limited patient recruitment for rare neurological disorders and complex trial protocols is restraining the growth of the industry.

Market Statistics

- 2024 Market Size: USD 475.12 million

- 2034 Projected Market Size: USD 856.27 million

- CAGR (2025–2034): 6.1%

AI Impact on Japan Neurology Clinical Trials Market

- AI-powered patient recruitment tools are improving trial enrollment efficiency by identifying eligible candidates faster and more accurately through electronic health records and predictive analytics.

- Machine learning platforms are enhancing trial design by analyzing historical data to optimize protocols, reduce trial duration, and increase the likelihood of success.

- AI in drug discovery and target identification allows biotech and pharma companies to identify promising neurological compounds more rapidly and cost-effectively.

- Natural language processing (NLP) is streamlining data extraction and analysis from clinical notes, medical literature, and patient-reported outcomes, improving trial monitoring and reporting.

The neurology clinical trials involve the research and development of new drugs, therapies, and medical devices to treat conditions of the nervous system. This includes diseases of the brain, spinal cord, and nerves. The goal of these trials is to create and test new and more effective treatments for these complex illnesses.

Public awareness of neurological conditions is increasing in Japan, supported by advocacy groups, awareness campaigns, and education programs. Organizations such as the Japan Alzheimer’s Association and patient advocacy networks play a crucial role in informing the public about clinical trial opportunities. This has led to improved patient recruitment and participation, which is often a challenge in other countries. Higher engagement from patients and caregivers supports faster trial enrollment and contributes to the success of ongoing studies, particularly in chronic neurological conditions that require long-term monitoring.

Japan is utilizing its strong technology base to improve neurology clinical trials through digital health solutions. Tools such as electronic health records (EHRs), wearable devices, and AI-based analytics are being used to monitor symptoms, track patient progress, and collect real-time data. These technologies help improve trial accuracy and efficiency, particularly in conditions with variable symptoms such as epilepsy or cognitive decline. The integration of these tools into neurology trials is expected to improve data quality, patient monitoring, and overall trial outcomes as Japan continues to invest in health tech innovation, thereby fueling the growth.

Drivers and Trends

Growing Involvement of Domestic and Global Pharmaceutical Companies: Japan’s pharmaceutical industry is increasingly investing in neurology drug development, with both domestic giants such as Eisai and Takeda and global companies such as Pfizer and Roche expanding their clinical trial presence in the country. These companies are targeting Japan for its high patient pool, skilled workforce, and regulatory clarity. Joint ventures, licensing deals, and collaborative trials are becoming more common, especially in Alzheimer’s and Parkinson’s research. This surge in corporate involvement is accelerating the pace of innovation and significantly contributing to the growth of the neurology clinical trials industry in Japan.

Government Support and Health Policy Reforms: The Japanese government actively promotes clinical research through policies aimed at accelerating drug development and improving access to advanced therapies. Programs such as the Sakigake designation system offer fast-track regulatory pathways for novel drugs, especially in areas such as neurology where unmet needs are high. Additionally, funding from agencies such as AMED (Japan Agency for Medical Research and Development) supports clinical trials in neuroscience. These efforts reduce barriers for companies and researchers, enabling faster trial initiation and encouraging both domestic and international investment in neurology clinical trials in Japan, thereby driving the growth.

Segmental Insights

Phase Analysis

Based on phase, the segmentation includes phase I, phase II, phase III, and phase IV. The phase III segment held the largest share in 2024 due to the country’s strong emphasis on validating safety and effectiveness before drug approval. There is a greater demand for large-scale, late-stage studies to support regulatory submissions with a rising number of neurological cases such as Alzheimer’s and Parkinson’s. Japan’s well-established hospitals, experienced research networks, and collaboration between academia and industry make it ideal for conducting complex Phase III trials. Additionally, government-backed fast-track approval systems such as Sakigake encourage companies to carry out advanced-phase neurology trials within Japan, thereby fueling the growth.

Study Design Analysis

Based on study design, the segmentation includes interventional, observational, and expanded access. The observational studies segment is anticipated to register the highest growth rate during the forecast period due to the increasing need for real-world data on neurological disorders. Long-term monitoring is essential to understand patient outcomes as conditions such as dementia and stroke progress over time. Japan’s aging population, coupled with its advanced healthcare infrastructure and national health data systems, makes it easier to conduct such studies effectively. Additionally, growing collaboration between hospitals, universities, and public health agencies is encouraging the use of patient registries and electronic records to support observational neurology research, fueling the growth in the segment.

Key Players and Competitive Insights

The Japan neurology clinical trials market is competitive and evolving, with the presence of both domestic and global players. Eisai Co., Ltd., a leading Japanese pharmaceutical company, plays a major role in Alzheimer’s research and drug development within the country. Global pharma giants such as Pfizer Inc. and Biogen are actively involved in late-stage neurology trials, often in partnership with local institutions. Leading CROs such as IQVIA, Parexel, ICON plc, Syneos Health, and Medpace Holdings, Inc. support multinational trials by managing operations, patient recruitment, and regulatory processes across Japan. Companies such as Charles River Laboratories, Thermo Fisher Scientific, and Laboratory Corporation of America Holdings provide crucial lab testing, diagnostics, and preclinical support. With Japan’s aging population and strong R&D infrastructure, these firms are increasing their focus on the region through strategic collaborations, localized operations, and investments in digital trial technologies to accelerate neurology research and development

Key Players

- Biogen

- Charles River Laboratories

- Eisai Co., Ltd.

- ICON plc

- IQVIA

- Laboratory Corporation of America Holdings

- Medpace Holdings, Inc.

- Parexel

- Pfizer Inc.

- Syneos Health

- Thermo Fisher Scientific

Japan Neurology Clinical Trials Industry Developments

February 2025: Thermo Fisher Scientific launched a new clinical registry and biorepository for Systemic Lupus Erythematosus through its CorEvitas business.

Japan Neurology Clinical Trials Market Segmentation

By Phase Outlook (Revenue – USD Million, 2020–2034)

- Phase I

- Phase II

- Phase III

- Phase IV

By Study Design Outlook (Revenue – USD Million, 2020–2034)

- Interventional

- Observational

- Expanded Access

By Indication Outlook (Revenue – USD Million, 2020–2034)

- Alzheimer’s Disease

- Depression (MDD)

- Parkinson's Disease (PD)

- Epilepsy

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Huntington's Disease

- Muscle Regeneration

- Others

By Value Chain Outlook (Revenue – USD Million, 2020–2034)

- In-house

- CROs

- Investigator Sites/Clinical Sites

Japan Neurology Clinical Trials Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 475.12 million |

|

Market Size in 2025 |

USD 502.96 million |

|

Revenue Forecast by 2034 |

USD 856.27 million |

|

CAGR |

6.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to segmentation. |

FAQ's

The market size was valued at USD 475.12 million in 2024 and is projected to grow to USD 856.27 million by 2034.

The market is projected to register a CAGR of 6.1% during the forecast period.

A few key players in the market include IQVIA, ICON plc, Syneos Health, Laboratory Corporation of America Holdings, Charles River Laboratories, Thermo Fisher Scientific, Parexel, Medpace Holdings, and pharmaceutical companies such as Pfizer, Biogen, and Eisai Co.

The phase III segment accounted for the largest share of the market in 2024.

The observational segment is expected to witness the fastest growth during the forecast period.