Europe Neurology Clinical Trials Market Size, Share, Trends, Industry Analysis Report

By Phase (Phase I, Phase II, Phase III, Phase IV), By Study Design, By Indication, By Value Chain, By Country – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM6424

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

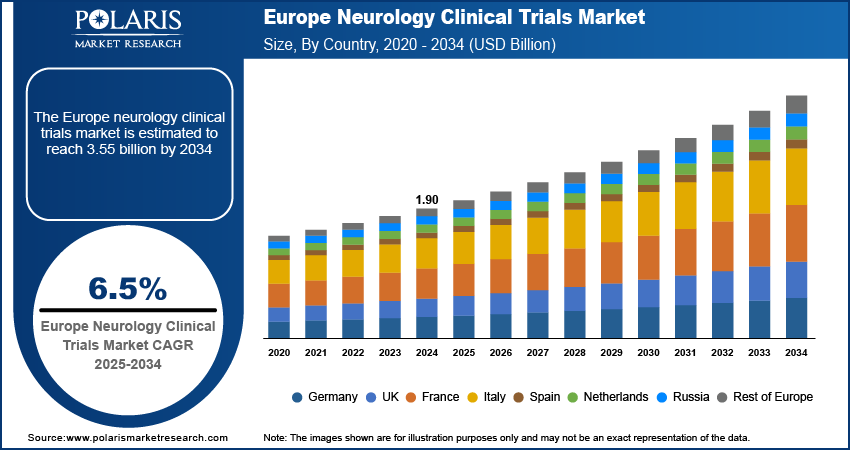

The Europe neurology clinical trials market size was valued at USD 1.90 billion in 2024 and is anticipated to register a CAGR of 6.5% from 2025 to 2034. The growth is driven by growing investment from biotech and pharma companies, increasing aging population, and rising prevalence of neurological disorders.

Key Insights

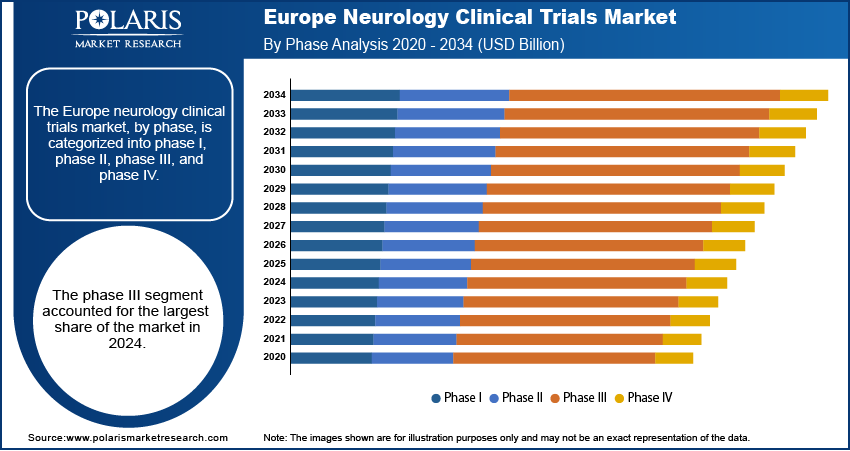

- The phase III segment dominated the market in 2024, primarily due to Europe’s strong emphasis on advanced-stage drug development and large-scale clinical validation.

- The observational studies segment is projected to experience the fastest growth during the forecast period, driven by increasing demand for real-world data and extended patient outcome tracking.

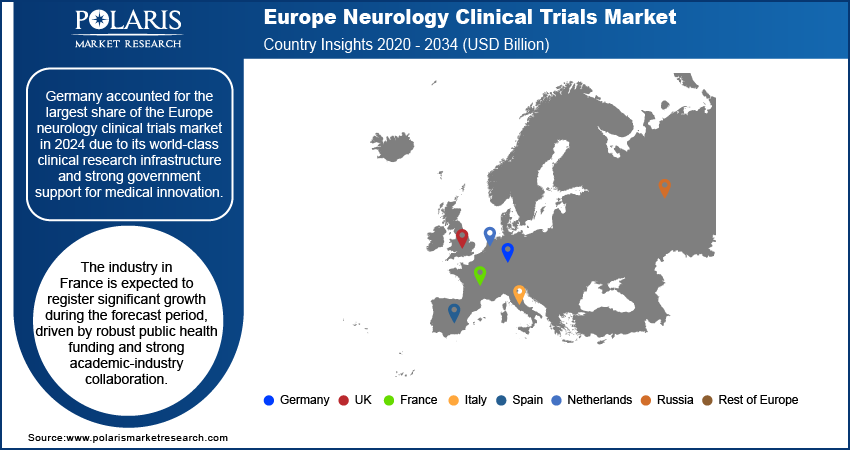

- Germany held the largest share of the Europe neurology clinical trials market in 2024, supported by its exceptional clinical research infrastructure and substantial government backing for medical research.

- France is expected to witness notable growth, fueled by generous public healthcare funding and strong collaboration between academic institutions and the pharmaceutical industry.

Industry Dynamics

- Growing Investments from biotech and pharma companies fuel the demand for clinical trial services across Europe.

- Aging population and rising neurological disorders boost the demand for therapies related to neurological disorders.

- Public awareness of neurological conditions is rising in Europe, driven by education campaigns, nonprofit organizations, and advocacy groups, fueling patient participation.

- Limited patient recruitment for rare neurological disorders and complex trial protocols restrains the growth of the industry.

Market Statistics

- 2024 Market Size: USD 1.90 billion

- 2034 Projected Market Size: USD 3.55 billion

- CAGR (2025–2034): 6.5%

- Germany: Largest market in 2024

AI Impact on Europe Neurology Clinical Trials Market

- AI-powered patient recruitment tools are improving trial enrollment efficiency by identifying eligible candidates faster and more accurately through electronic health records and predictive analytics.

- Machine learning platforms are enhancing trial design by analyzing historical data to optimize protocols, reduce trial duration, and increase the likelihood of success.

- AI in drug discovery and target identification allows biotech and pharma companies to identify promising neurological compounds more rapidly and cost-effectively.

- Natural language processing (NLP) is streamlining data extraction and analysis from clinical notes, medical literature, and patient-reported outcomes, improving trial monitoring and reporting.

The neurology clinical trials involve the research and development of new drugs, therapies, and medical devices to treat conditions of the nervous system. This includes diseases of the brain, spinal cord, and nerves. The goal of these trials is to create and test new and more effective treatments for these complex illnesses.

Europe offers a harmonized and transparent regulatory framework through the European Medicines Agency (EMA), which simplifies the clinical trial approval process. The new EU Clinical Trials Regulation (CTR), implemented to streamline multinational trials, has made it easier and faster to conduct neurology trials across several European countries at once. This regulatory clarity and efficiency reduce delays and attract both domestic and international sponsors. Consequently, Europe becomes a preferred region for conducting neurology-related clinical trials, thereby fueling the growth.

Public awareness of neurological conditions is rising in Europe, driven by education campaigns, nonprofit organizations, and advocacy groups. These groups help increase patient participation in clinical trials by offering support and information to families affected by neurological diseases. Countries such as the UK and France have strong networks of advocacy groups focused on Alzheimer’s, epilepsy, and rare neurological disorders. Their efforts encourage patient engagement, improve recruitment for trials, and improve the overall success rate of neurology studies, further fueling the expansion.

Drivers and Trends

Growing Investment from Biotech and Pharma Companies: Biotechnology and pharmaceutical companies across Europe are increasingly investing in neurology research due to the unmet need for effective treatments. In February 2025, EG 427 a biotechnology company based in Pairs raised EUR 27 million or USD 31.3 million to tackle chronic diseases in neurology. Additionally, the region is seeing a rise in partnerships, mergers, and funding rounds focused on neuroscience innovations. Countries such as Switzerland, Belgium, and Sweden are becoming hotspots for neuroscience startups. These investments fund drug discovery and help expand clinical trial capacity, supporting the development and testing of advanced therapies for neurological conditions across the region.

Aging Population and Rising Neurological Disorders: Europe has one of the oldest populations globally, with a growing number of people over the age of 65. According to the European Commission, 449.3 million people in the region are 65 years and older. This aging demographic is more prone to neurological conditions such as Alzheimer’s disease, Parkinson’s disease, and stroke. There is increasing demand for new treatments as these disorders become more widespread. This pushes both public and private sectors to invest heavily in neurology clinical trials. Countries such as Germany, Italy, and France are seeing more trials being initiated to address this healthcare burden, thereby driving the growth in the region.

Segmental Insights

Phase Analysis

Based on phase, the segmentation includes phase I, phase II, phase III, and phase IV. The phase III segment held the largest share in 2024, driven by the region’s strong focus on late-stage drug development. Pharmaceutical companies are prioritizing large-scale trials to validate safety and efficacy before regulatory approval, with the increasing prevalence of complex neurological diseases such as Alzheimer’s and Parkinson’s. Europe’s advanced healthcare infrastructure, combined with access to diverse patient populations and strong funding support from the EU, enables efficient execution of large Phase III trials. Moreover, streamlined regulatory pathways through the European Medicines Agency (EMA) encourage multinational phase III studies across Europe, thereby fueling the segment growth.

Study Design Analysis

Based on study design, the segmentation includes interventional, observational, and expanded access. The observational studies segment is anticipated to register the highest growth rate during the forecast period due to rising interest in real-world evidence and long-term patient monitoring. European health authorities and research institutions are increasingly valuing data collected from non-interventional studies to understand disease progression, treatment adherence, and quality-of-life impacts. In neurology, where conditions such as multiple sclerosis and epilepsy vary widely in symptoms and outcomes, observational trials help gather meaningful insights. Additionally, patient registries and collaborations with academic medical centers across Europe support the rise of observational research as a complementary tool alongside traditional clinical trial, thereby boosting the segment growth.

Indication Analysis

Based on indication, the segmentation includes Alzheimer’s disease, depression (MDD), Parkinson's disease (PD), epilepsy, stroke, traumatic brain injury (TBI), amyotrophic lateral sclerosis (ALS), Huntington's disease, muscle regeneration, and others. The Alzheimer’s disease segment held the largest share in 2024, driven by the region’s aging population and the urgent need for effective treatments for dementia-related illnesses. Countries such as Germany, France, and Italy are seeing rising incidence rates, prompting increased public and private investment in Alzheimer’s research. EU-backed funding programs and partnerships between biotech firms and universities are facilitating large-scale trials targeting disease modification and early diagnosis. The high societal and economic burden of Alzheimer’s fuels robust trial activity across Europe.

Value Chain Analysis

Based on value chain, the segmentation includes in-house, CROs, and investigator sites/clinical sites. The CROs segment is anticipated to register the highest growth rate during the forecast period, driven by the increasing trend among pharmaceutical companies to outsource trial management for greater efficiency, reduced costs, and regulatory expertise. CROs operating in Europe benefit from deep knowledge of EMA requirements, multilingual capabilities, and access to diverse patient populations. Sponsors rely on CROs for seamless coordination and compliance as neurology trials often span multiple countries. The growing complexity of neurology studies, especially those involving biomarkers and advanced imaging, further increases demand for specialized CRO services, thereby driving the growth in the segment.

Country Analysis

The Germany neurology clinical trials market accounted for the largest share in 2024 due to its world-class clinical research infrastructure and strong government support for medical innovation. The country hosts numerous specialized neurology centers, research hospitals, and academic institutions with expertise in neurodegenerative disorders. High patient availability, especially among the aging population, supports trial recruitment. Additionally, Germany’s efficient ethics review process and alignment with European Medicines Agency (EMA) standards make it a favorable destination for both early and late-phase neurology trials. Pharmaceutical and biotech companies frequently choose Germany for large-scale trials in Alzheimer’s, Parkinson’s, and multiple sclerosis, thereby driving the growth in Germany.

France Europe Neurology Clinical Trials Market Insights

The industry in France is expected to register significant growth during the forecast period, driven by robust public health funding and strong academic-industry collaboration. The French government and health agencies actively invest in neurological disease research through national programs and grants. Institutions such as INSERM and AP-HP lead numerous clinical initiatives in Alzheimer’s, epilepsy, and stroke. France’s well-established national health data system further aids in patient recruitment and observational research. The country’s centralized regulatory system and growing biotech ecosystem make it attractive for neurology trials, especially those focused on aging-related cognitive decline and rare neurological disorders.

UK Neurology Clinical Trials Market Trends

The market demand in the UK is rising due to its strong innovation pipeline and adaptive regulatory environment post-Brexit. The UK’s National Health Service offers centralized access to a large patient population, while organizations such as the NIHR support clinical research in neurological diseases. Investments in precision medicine, brain health, and dementia research backed by initiatives such as the UK Dementia Research Institute further drive growth. Flexible regulatory policies and a strong emphasis on data-driven trials fuels the growth in early-phase neurology studies, particularly in Alzheimer's and motor neuron disease.

Netherlands Europe Neurology Clinical Trials Market Overview

The Netherlands is a rapidly growing country for neurology clinical trials, as it stands out for its efficient trial execution and patient-centric research environment, making it an attractive location for neurology clinical trials. The country benefits from a streamlined regulatory process, early ethics approval systems, and tight collaboration between hospitals, academia, and industry. Dutch research institutions have a strong track record in brain and neurodegenerative disorder studies, supported by EU and national funding. Additionally, the Netherlands’ small yet diverse population and advanced healthcare digitalization help accelerate recruitment and real-world data collection, particularly in observational and long-term neurology studies.

Key Players and Competitive Insights

The industry features a highly competitive landscape with the presence of global pharmaceutical companies, Contract Research Organizations (CROs), and clinical research specialists. Key players such as Biogen, Pfizer Inc., and Eisai Co., Ltd. are leading the development of novel therapies for neurodegenerative diseases such as Alzheimer’s and Parkinson’s, leveraging Europe’s advanced research infrastructure. CROs such as IQVIA, Parexel, ICON plc, and Medpace Holdings, Inc. play a critical role in managing trials efficiently across multiple countries, offering services ranging from patient recruitment to data management. Charles River Laboratories, Laboratory Corporation of America Holdings, and Syneos Health further support preclinical and clinical operations with specialized neurological expertise. Companies such as Thermo Fisher Scientific provide essential lab and diagnostic tools for biomarker analysis and advanced imaging. Strategic collaborations, growing outsourcing trends, and a focus on personalized neurology solutions continue to define the competitive dynamics of this evolving market

Key Players

- Biogen

- Charles River Laboratories

- Eisai Co., Ltd.

- ICON plc

- IQVIA

- Laboratory Corporation of America Holdings

- Medpace Holdings, Inc.

- Parexel

- Pfizer Inc.

- Syneos Health

- Thermo Fisher Scientific

Europe Neurology Clinical Trials Industry Developments

February 2025: Thermo Fisher Scientific launched a new clinical registry and biorepository for Systemic Lupus Erythematosus through its CorEvitas business.

September 2024: Thermo Fisher Scientific's PPD clinical research business announced an expansion of its bioanalytical laboratory services in Europe.

Europe Neurology Clinical Trials Market Segmentation

By Phase Outlook (Revenue – USD Billion, 2020–2034)

- Phase I

- Phase II

- Phase III

- Phase IV

By Study Design Outlook (Revenue – USD Billion, 2020–2034)

- Interventional

- Observational

- Expanded Access

By Indication Outlook (Revenue – USD Billion, 2020–2034)

- Alzheimer’s Disease

- Depression (MDD)

- Parkinson's Disease (PD)

- Epilepsy

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Huntington's Disease

- Muscle Regeneration

- Others

By Value Chain Outlook (Revenue – USD Billion, 2020–2034)

- In-house

- CROs

- Investigator Sites/Clinical Sites

By Country Outlook (Revenue - USD Billion, 2020–2034)

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Neurology Clinical Trials Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.90 billion |

|

Market Size in 2025 |

USD 2.02 billion |

|

Revenue Forecast by 2034 |

USD 3.55 billion |

|

CAGR |

6.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.90 billion in 2024 and is projected to grow to USD 3.55 billion by 2034.

The market is projected to register a CAGR of 6.5% during the forecast period

North America dominated the market share in 2024.

A few key players in the market include IQVIA, ICON plc, Syneos Health, Laboratory Corporation of America Holdings, Charles River Laboratories, Thermo Fisher Scientific, Parexel, Medpace Holdings, and pharmaceutical companies like Pfizer, Biogen, and Eisai Co.

The phase III segment accounted for the largest share of the market in 2024.

The observational segment is expected to witness the fastest growth during the forecast period.