U.S. Neurology Clinical Trials Market Size, Share, Trends, Industry Analysis Report

By Phase (Phase I, Phase II, Phase III, Phase IV), By Study Design, By Indication, By Value Chain – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6423

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

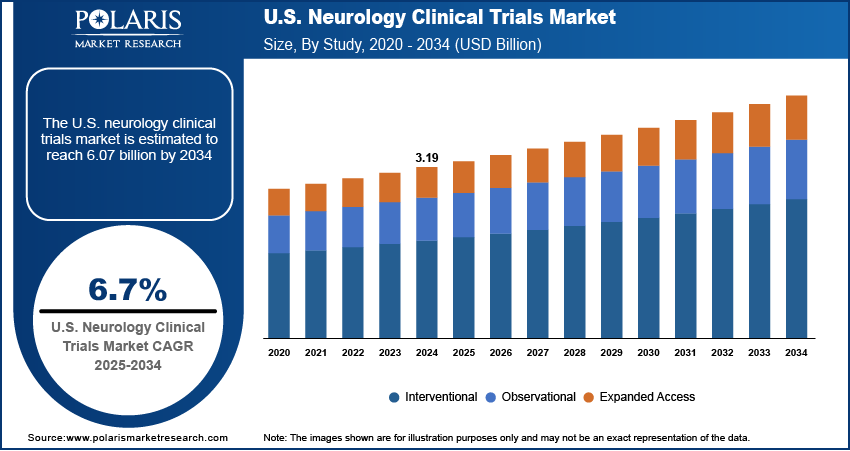

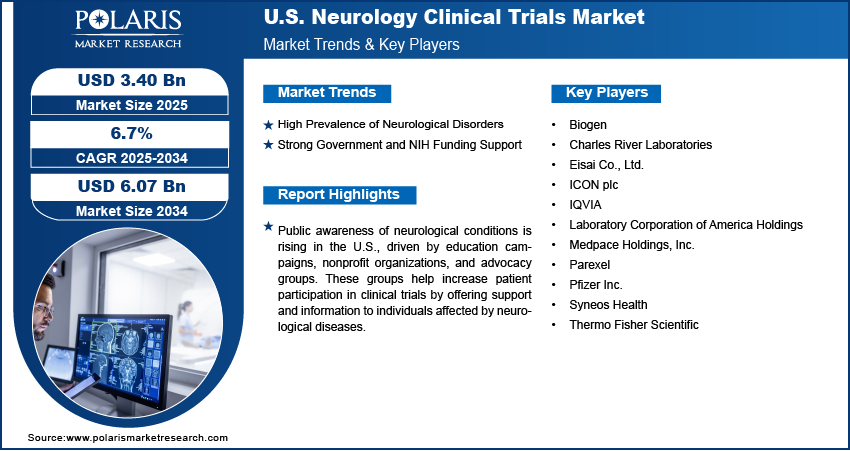

The U.S. neurology clinical trials market size was valued at USD 3.19 billion in 2024 and is anticipated to register a CAGR of 6.7% from 2025 to 2034. The growth is driven by the high prevalence of neurological disorders, and strong government and NIH funding support.

Key Insights

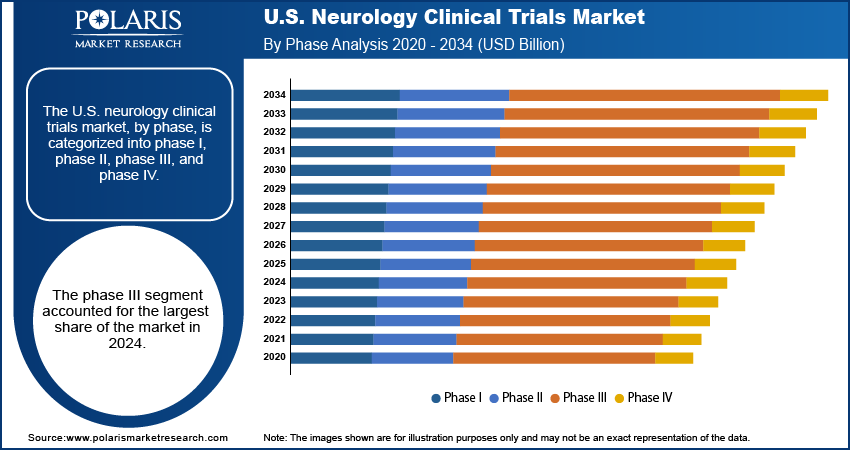

- The phase III segment dominated the market in 2024, supported by a strong emphasis on validating the safety and efficacy of neurological treatments in large patient populations.

- The observational studies segment is expected to witness the fastest growth during the forecast period, fueled by the rising need for real-world data to better understand long-term outcomes in neurology research.

- The Alzheimer’s disease segment accounted for the largest market share in 2024, driven by its increasing prevalence and the urgent demand for effective therapeutic solutions.

- The CROs segment is projected to experience the highest growth rate, as pharmaceutical and biotech companies increasingly rely on outsourcing to manage complex trials efficiently and reduce development costs and timelines.

Industry Dynamics

- High prevalence of neurological disorders is fueling the demand for clinical trial services

- Strong government and NIH funding support is fueling the growth.

- Public awareness of neurological conditions is rising in the U.S., driven by education campaigns, nonprofit organizations, and advocacy groups, which is fueling the patient participation.

- Limited patient recruitment for rare neurological disorders and complex trial protocols is restraining the growth of the industry.

Market Statistics

- 2024 Market Size: USD 3.19 billion

- 2034 Projected Market Size: USD 6.07 billion

- CAGR (2025–2034): 6.7%

AI Impact on U.S. Neurology Clinical Trials Market

- AI-powered patient recruitment tools are improving trial enrollment efficiency by identifying eligible candidates faster and more accurately through electronic health records and predictive analytics.

- Machine learning platforms are enhancing trial design by analyzing historical data to optimize protocols, reduce trial duration, and increase the likelihood of success.

- AI in drug discovery and target identification allows biotech and pharma companies to identify promising neurological compounds more rapidly and cost-effectively.

- Natural language processing (NLP) is streamlining data extraction and analysis from clinical notes, medical literature, and patient-reported outcomes, improving trial monitoring and reporting.

The neurology clinical trials involve the research and development of new drugs, therapies, and medical devices to treat conditions of the nervous system. The goal of these trials is to create and test new and more effective treatments for complex disorders related to the brain, spinal cord, and nerves.

The U.S. is home to world-renowned hospitals, research universities, and specialized neurology centers that provide the ideal environment for conducting clinical trials. Institutions such as the Mayo Clinic, Cleveland Clinic, and Johns Hopkins have dedicated neurology departments with access to advanced technologies and experienced investigators. Additionally, the availability of centralized health data and advanced diagnostic tools improves trial accuracy and efficiency. This robust infrastructure allows trials to be conducted faster, more effectively, and at a higher scientific standard, attracting global sponsors to initiate studies in the U.S.

The U.S. Food and Drug Administration (FDA) plays a critical role in supporting neurology clinical trials through programs such as Fast Track, Breakthrough Therapy, and Orphan Drug designations. These initiatives help speed up the approval process for drugs targeting serious or rare neurological conditions. The FDA’s collaborative approach reduces time, making the U.S. an attractive location for launching clinical studies. Additionally, clear regulatory guidelines and open communication channels improve trial planning and execution, thereby fueling the growth in the U.S.

Drivers and Trends

High Prevalence of Neurological Disorders: The U.S. faces a growing burden of neurological disorders such as Alzheimer’s disease, Parkinson’s disease, epilepsy, and multiple sclerosis. According to the Alzheimer’s Association, 7 million people in the country have Alzheimer’s disease. These conditions are becoming increasingly common with an aging population and lifestyle-related risk factors. This has led to greater urgency in developing effective treatments, boosting demand for clinical trials. Research institutions and pharmaceutical companies are accelerating clinical studies to meet this need as more patients seek new therapeutic options, thereby driving the growth.

Strong Government and NIH Funding Support: The U.S. government, particularly through the National Institutes of Health (NIH), provides substantial funding for neurology research and clinical trials. Initiatives such as the BRAIN Initiative and Alzheimer’s-focused programs receive billions in funding annually. This financial support enables universities, hospitals, and biotech firms to conduct extensive trials on neurological conditions. Grants and public-private partnerships reduce financial risk for sponsors and encourage long-term research. These efforts stimulate innovation and boost the growth of the industry in the country.

Segmental Insights

Phase Analysis

Based on phase, the segmentation includes phase I, phase II, phase III, and phase IV. The phase III segment held the largest share in 2024, driven by a strong focus on late-stage drug validation. These trials typically involve larger patient populations and are essential for securing FDA approval. Pharmaceutical companies are investing heavily in Phase III trials with the high prevalence of neurological disorders and rising demand for disease-modifying therapies. The presence of well-established research institutions, experienced investigators, and efficient regulatory support helps conduct large-scale, multi-center trials effectively, thereby fueling the segment growth.

Study Design Analysis

Based on study design, the segmentation includes interventional, observational, and expanded access. The observational studies segment is anticipated to register the highest growth rate during the forecast period, driven by the increasing demand for real-world evidence in neurology research. These non-interventional studies help capture valuable data on patient behavior, treatment impact, and disease progression as neurological disorders such as Alzheimer’s and Parkinson’s have long-term, progressive outcomes. Healthcare systems, insurers, and regulatory bodies in the U.S. are pushing for more data beyond traditional clinical trial results. Additionally, digital health records and patient registries in the U.S. provide an excellent foundation for conducting observational studies efficiently and at scale.

Indication Analysis

Based on indication, the segmentation includes Alzheimer’s disease, depression (MDD), Parkinson's disease (PD), epilepsy, stroke, traumatic brain injury (TBI), amyotrophic lateral sclerosis (ALS), Huntington's disease, muscle regeneration, and others. The Alzheimer’s disease segment held the largest share in 2024 due to its growing prevalence and unmet need for effective treatments. The aging U.S. population, along with increasing public awareness and government funding, has made Alzheimer’s a research priority. Major pharmaceutical companies, biotech startups, and academic institutions are actively developing potential therapies, ranging from traditional drugs to gene and antibody-based approaches. Strong advocacy from organizations such as the Alzheimer’s Association further drives funding and patient participation, thereby driving the growth.

Value Chain Analysis

Based on value chain, the segmentation includes in-house, CROs, and investigator sites/clinical sites. The CROs segment is anticipated to register the highest growth rate during the forecast period, driven by rising trial complexity and growing pressure to reduce costs and timelines. Pharmaceutical and biotech companies increasingly outsource their research to specialized CROs. U.S.-based CROs offer deep expertise in neurology, regulatory knowledge, and access to vast patient networks. Their ability to manage multi-site trials, navigate FDA requirements, and integrate new technologies such as AI and digital monitoring tools makes them major partners in accelerating neurology research and development in the U.S., thereby boosting the segment growth.

Key Players and Competitive Insights

The U.S. neurology clinical trials market is highly competitive, driven by a mix of pharmaceutical giants, biotechnology firms, and specialized Contract Research Organizations (CROs). Companies such as Biogen, Pfizer Inc., and Eisai Co., Ltd. are at the forefront of developing innovative treatments for neurological disorders such as Alzheimer’s and Parkinson’s, supported by extensive R&D investments. CROs such as IQVIA, ICON plc, Parexel, Medpace Holdings, Inc., and Syneos Health play a critical role in trial execution, patient recruitment, and regulatory compliance, helping sponsors accelerate development timelines. Charles River Laboratories, Thermo Fisher Scientific, and Laboratory Corporation of America Holdings provide essential preclinical services, laboratory testing, and diagnostics that support complex neurology studies. Strategic collaborations, use of AI-based tools, and increasing outsourcing trends define the current competitive dynamics. These companies continue to expand their service offerings to meet growing demand for faster, data-driven neurology trial execution in the U.S.

Key Players

- Biogen

- Charles River Laboratories

- Eisai Co., Ltd.

- ICON plc

- IQVIA

- Laboratory Corporation of America Holdings

- Medpace Holdings, Inc.

- Parexel

- Pfizer Inc.

- Syneos Health

- Thermo Fisher Scientific

U.S. Neurology Clinical Trials Industry Developments

February 2025: Thermo Fisher Scientific launched a new clinical registry and biorepository for Systemic Lupus Erythematosus through its CorEvitas business.

U.S. Neurology Clinical Trials Market Segmentation

By Phase Outlook (Revenue – USD Billion, 2020–2034)

- Phase I

- Phase II

- Phase III

- Phase IV

By Study Design Outlook (Revenue – USD Billion, 2020–2034)

- Interventional

- Observational

- Expanded Access

By Indication Outlook (Revenue – USD Billion, 2020–2034)

- Alzheimer’s Disease

- Depression (MDD)

- Parkinson's Disease (PD)

- Epilepsy

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Huntington's Disease

- Muscle Regeneration

- Others

By Value Chain Outlook (Revenue – USD Billion, 2020–2034)

- In-house

- CROs

- Investigator Sites/Clinical Sites

U.S. Neurology Clinical Trials Market Report Scope:

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.19 billion |

|

Market Size in 2025 |

USD 3.40 billion |

|

Revenue Forecast by 2034 |

USD 6.07 billion |

|

CAGR |

6.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to segmentation. |

FAQ's

The market size was valued at USD 3.19 billion in 2024 and is projected to grow to USD 6.07 billion by 2034.

The market is projected to register a CAGR of 6.7% during the forecast period.

A few key players in the market include IQVIA, ICON plc, Syneos Health, Laboratory Corporation of America Holdings, Charles River Laboratories, Thermo Fisher Scientific, Parexel, Medpace Holdings, and pharmaceutical companies such as Pfizer, Biogen, and Eisai Co.

The phase III segment accounted for the largest share of the market in 2024.

The observational segment is expected to witness the fastest growth during the forecast period.