U.S. Antibody Specificity Testing Market Size, Share, Trends, Industry Analysis Report

By Product & Services (Products, Antibody Validation & Specificity Testing Services), By Technology, By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 126

- Format: PDF

- Report ID: PM6460

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

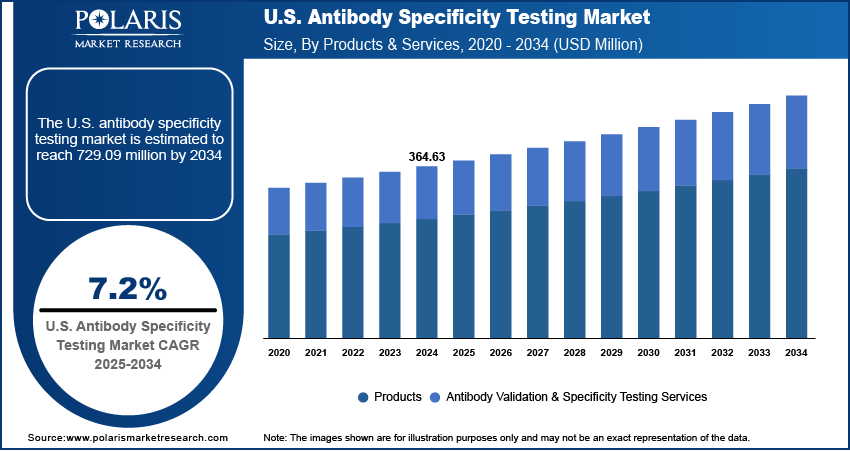

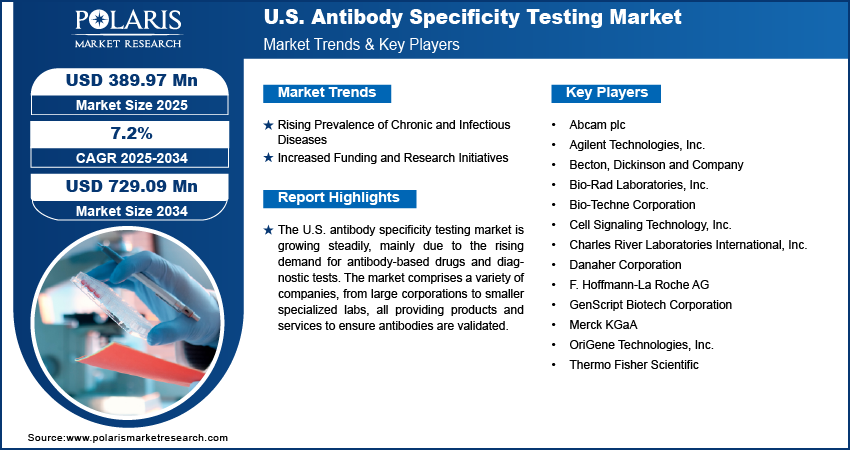

The U.S. antibody specificity testing market size was valued at USD 364.63 million in 2024 and is anticipated to register a CAGR of 7.2% from 2025 to 2034. The rising need for better antibodies in life science research drives the market expansion. Also, the growing use of antibody-based treatments for diseases such as cancer and autoimmune disorders is increasing the demand for testing. Another major growth factor is the focus on personalized medicine, which requires specific antibodies for accurate diagnosis and therapy.

Key Insights

- By product & services, the products segment held the largest share in 2024, with primary and secondary antibodies being essential tools for research and diagnostics.

- By technology, the immunoassay-based technologies segment dominated in 2024, mainly due to their long-standing use and reliability in research and clinical labs across the U.S.

- By application, the research and development segment held the largest share as antibody specificity testing is a core part of the drug discovery services and scientific research ecosystem.

- By end use, the pharmaceutical and biotechnology companies segment accounted for the largest share in 2024 as they are the main drivers of innovation and development in antibody-based drugs.

Industry Dynamics

- The growing number of clinical trials for new antibody-based drugs, particularly for treating conditions such as cancer and autoimmune disorders, is a major growth factor. These trials require extensive testing to make sure the antibodies are safe and work as they should.

- Increased focus on personalized medicine is a key demand trend. This approach requires highly specific and validated antibodies to help doctors and researchers find the right treatments for a person's unique genetic makeup and disease type.

- There are growing concerns about getting reliable results in biomedical research. This has made it more important for scientists and labs to use validated, high-quality antibodies, which drives the need for better testing services.

Market Statistics

- 2024 Market Size: USD 364.63 million

- 2034 Projected Market Size: USD 729.09 million

- CAGR (2025–2034): 7.2%

AI Impact on U.S. Antibody Specificity Testing Market

- Artificial intelligence (AI) models are used to analyze vast datasets, which helps predict antibody-antigen interactions.

- The technology enables antibody selection tailored to individual biomarkers. It aligns with the rising shift toward personalized healthcare across the U.S.

- Biotech startups in the country integrate AI to gain a competitive edge.

- AI adoption helps diagnostic laboratories deliver more reliable and reproducible results.

Antibody testing is used to verify if an antibody can bind to the selected target and does not react with other molecules. This is also a verification step for the research and documentation for the development of targeted drugs and therapies. The main goal of this test is to verify a specific antibody for diagnosing and treating the patient.

An increasing shift toward custom and personalized protein therapeutics boosts the industry expansion. Such treatments involve the application of monoclonal antibodies tailored to the patient's individual genetic and disease profile. This growing trend drives the demand for more advanced antibody validation services. Another important driver is the increasing concentration on applied research and the development of strategic collaborations. Such collaborations between research organizations and the industry create a continuous demand for antibodies of high quality and reliability. The National Institutes of Health (NIH) supports biomedical research, and part of the funding is allocated to the development of antibodies, which drives the need for specificity testing.

Drivers and Trends

Rising Prevalence of Chronic and Infectious Diseases: In the U.S., there is an increase in the number of chronic and infectious disease cases. Conditions such as cancer and certain autoimmune diseases often require therapeutic solutions that are frequently based on antibodies. New drug developments for such conditions depend on reliable and accurate antibody specificity testing. This process determines the effectiveness and the safety of new treatments for the patients.

The Centers for Disease Control and Prevention (CDC), in its "Trends in Multiple Chronic Conditions Among US Adults, By Life Stage, Behavioral Risk Factor Surveillance System, 2013-2023" report from 2025, noted that in 2023, about 194 million adults in the U.S. had one or more chronic conditions. This growing number of people affected by long-term illnesses increases the demand for new treatments and the development of new antibody-based drugs. The need to check these new drugs for accuracy and effectiveness drives the market growth.

Increased Funding and Research Initiatives: Growing investments in research and development boost the industry expansion. Antibody-based targeted therapies are receiving more funding from the government and educational institutions. This funding assists in the advancement of basic research and clinical trials, which require robust testing of antibody specificity.

A 2024 report titled "Cancer Facts & Figures" from a government-adjacent organization shows that cancer is the second leading cause of death in the U.S. The need for new treatments for such a high-impact disease leads to more investment in research. The National Cancer Institute (NCI), a part of the NIH, provides significant funding for cancer research, including for the development of new immunotherapies. This ongoing support for R&D in areas with high medical need directly drives the need for antibody specificity testing to validate research and therapeutic candidates.

Segmental Insights

Product & Service Analysis

Based on product & service, the U.S. antibody specificity testing market is bifurcated into products and antibody validation & specificity testing services. The products segment held the largest share in 2024 as primary and secondary antibodies are widely used in research, diagnostics, and therapeutics. They are essential tools in clinical and research laboratories used for the detection and quantification of specific proteins and other biomolecules. The increased research activities in the fields of oncology, immunology, and infectious diseases are the main drivers of the demand for such products. These are products that both researchers and the pharmaceutical companies need to conduct experiments, validate findings, and improve the drug development process.

The antibody validation and specificity testing segment is anticipated to register the highest growth rate during the forecast period. This is a result of advancements in research and the need for accurate and reliable outcomes. An increasing number of research institutes and small biotechnology companies are outsourcing their testing to complete complicated validation processes.

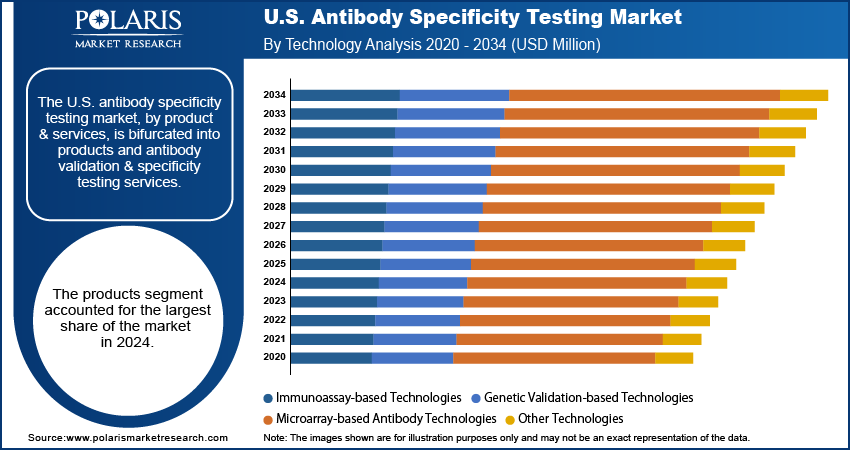

Technology Analysis

Based on technology, the U.S. antibody specificity testing market is segmented into immunoassay-based technologies, genetic validation-based technologies, microarray-based antibody technologies, and other technologies. The immunoassay-based technologies segment held the largest share in 2024. Technologies such as ELISA, western blotting, and immunohistochemistry fall under immunoassay-driven techniques. These are considered the gold standard methods for many labs.

The genetic validation proved techniques segment is anticipated to register the highest growth rate during the forecast period. This is due to the growing adoption of sophisticated genetic methodologies and tools such as the CRISPR/Cas9 and the RNA interference (RNAi) systems. With the need for reproducibility in research becoming more compelling, the ability to confirm an antibody's function at the genetic level is becoming important.

Application Analysis

Based on application, the segmentation includes research & development and clinical diagnostics. The research & development segment held the largest share in 2024. Performing specificity testing on antibodies is a milestone in the earliest phases of drug and antibody discovery and development. During the initial stage, a high volume of testing is done in various research environments to discover and ascertain the efficacy of a clinically applicable novel antibody. The increasing number of research and development projects, along with the ever-increasing demand for carefully validated antibodies in the genomics, proteomics, and immunology domains, are among the primary contributors to this segment’s larger market share.

The clinical diagnostics segment is anticipated to register the highest growth rate during the forecast period. There is a clear shift in the healthcare sector toward personalized medicine, which has led to more demand for accurate diagnostic tools employing antibodies. This is critical in the detection and monitoring of conditions such as cancer and other autoimmune disorders. Furthermore, with the expansion of biopharmaceuticals and the constant need for novel therapeutics, clinical antibodies are continuing to experience growth as more antibody specificity testing will be required for treatments.

End Use Analysis

Based on end use, the segmentation includes pharmaceutical & biotechnology companies, academic & research institutes, diagnostic laboratories, and other end uses. The pharmaceutical & biotechnology companies segment held the largest share in 2024. These companies are known to spend heavily on R&D to develop therapies for a number of diseases, and thus require a high volume of antibody testing services to ensure the efficacy and safety of their products. In the cases of drug development, the stringent regulations are the major factors that lead to a huge reliance on accurate and dependable testing. This ensures their products are validated before clinical trials and before being commercially available.

The academic and research institutes segment is anticipated to register the highest growth rate during the forecast period. This is the result of the increase in research activities across the country, especially in proteomics, genomics, and immunology. Such institutes and research centers usually receive sponsorship from government agencies and other institutions to conduct research. This research requires a constant flow of approved antibodies.

Key Players and Competitive Insights

The U.S. antibody specificity testing market is a focused market for pharmaceutical and biotechnology companies and there are several key companies at the forefront. All companies, including large pharma companies as well as small, niche providers, compete in this area. These firms are active in everything from technology development to custom solutions, to compete. Every competitor in this landscape invests a significant amount in R&D to test methods to patent.

A few prominent companies in the U.S. antibody specificity testing market include Thermo Fisher Scientific; Bio-Rad Laboratories, Inc.; F. Hoffmann-La Roche AG; Abcam plc; Merck KGaA; Becton, Dickinson and Company; Agilent Technologies, Inc.; Danaher Corporation; Bio-Techne Corporation; Cell Signaling Technology, Inc.; and GenScript Biotech Corporation.

Key Players

- Abcam plc

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Bio-Techne Corporation

- Cell Signaling Technology, Inc.

- Charles River Laboratories International, Inc.

- Danaher Corporation

- F. Hoffmann-La Roche AG

- GenScript Biotech Corporation

- Merck KGaA

- OriGene Technologies, Inc.

- Thermo Fisher Scientific

U.S. Antibody Specificity Testing Industry Developments

August 2025: Thermo Fisher's next-generation sequencing assay, HERNEXEOS received approval from the U.S. Food and Drug Administration (FDA). This approval was for its use as a companion diagnostic for a new non-small cell lung cancer treatment.

July 2025: Thermo Fisher Scientific introduced the Oncomine Comprehensive Assay Plus on the Ion Torrent Genexus System. This product is designed to advance precision medicine by helping to profile tumors more accurately.

U.S. Antibody Specificity Testing Market Segmentation

By Product & Services Outlook (Revenue – USD Million, 2020–2034)

- Products

- Antibody Validation & Specificity Testing Services

By Technology Outlook (Revenue – USD Million, 2020–2034)

- Immunoassay-Based Technologies

- Genetic Validation-Based Technologies

- Microarray-Based Antibody Technologies

- Other Technologies

By Application Outlook (Revenue – USD Million, 2020–2034)

- Research & Development

- Clinical Diagnostics

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Diagnostic Laboratories

- Other End Use

U.S. Antibody Specificity Testing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 364.63 million |

|

Market Size in 2025 |

USD 389.97 million |

|

Revenue Forecast by 2034 |

USD 729.09 million |

|

CAGR |

7.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 364.63 million in 2024 and is projected to grow to USD 729.09 million by 2034.

The market is projected to register a CAGR of 7.2% during the forecast period.

A few key players in the market include Thermo Fisher Scientific; Bio-Rad Laboratories, Inc.; F. Hoffmann-La Roche AG; Abcam plc; Merck KGaA; Becton, Dickinson and Company; Agilent Technologies, Inc.; Danaher Corporation; Bio-Techne Corporation; Cell Signaling Technology, Inc.; and GenScript Biotech Corporation.

The products segment accounted for the largest share of the market in 2024.

The genetic validation-based technologies segment is expected to witness the fastest growth during the forecast period.