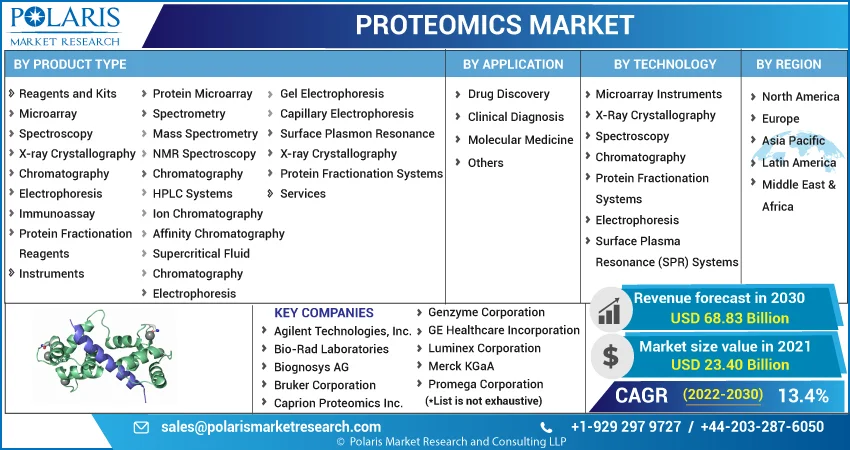

Proteomics Market Size, Share, Trends, Industry Analysis Report

: By Product Type (Instruments, Reagents & Consumables, and Services), Application, Technology, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 120

- Format: PDF

- Report ID: PM1376

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

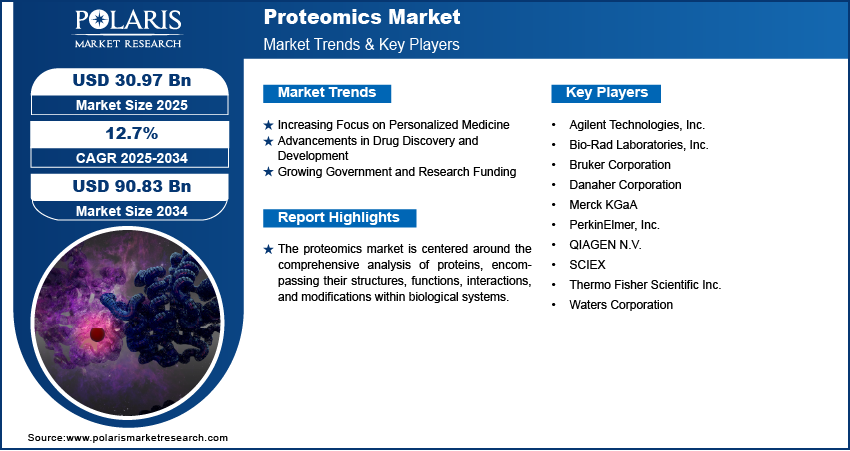

The proteomics market size was valued at USD 27.54 billion in 2024, exhibiting a CAGR of 12.7% between 2025 and 2034. The rising demand for personalized medicine and growing investments in research and development initiatives are the key factors driving market development.

Key Insights

- The reagents & consumables segment accounts for the largest market share due to their fundamental role in proteomic experiments.

- The clinical diagnosis segment is anticipated to exhibit the highest growth rate, driven by the growing application of proteomic technologies for the identification of disease-specific biomarkers.

- North America accounts for the largest share of the market revenue, primarily due to the robust research and development ecosystem in the region.

- Asia Pacific is anticipated to register the highest growth rate during the projection period. This can be attributed to the growing prevalence of chronic conditions and growing investments in healthcare infrastructure.

Industry Dynamics

- The growing focus on personalized medicine is boosting the proteomics market expansion. Proteomics plays a key role in customizing healthcare decisions and treatments for individual patients based on their unique biological characteristics.

- The rising use of proteomics in the pharmaceutical industry for drug discovery and development is fueling the expansion of the market.

- Rising funding in research and development presents significant opportunities for market expansion.

- The high initial cost of instruments may limit the growth of the market.

Market Statistics

2024 Market Size: USD 27.54 billion

2034 Projected Market Size: USD 90.83 billion

CAGR (2025-2034): 12.7%

North America: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

The proteomics market focuses on the comprehensive analysis of proteins, including their structures, functions, interactions, and modifications within biological systems. This field is crucial for understanding cellular processes and disease mechanisms at a molecular level.

The increasing demand for personalized medicine acts as a significant driver for the proteomics market growth. Proteomics enables the identification of specific protein biomarkers that can predict an individual's response to treatment. Furthermore, the rising applications of proteomics in drug discovery and development are fueling market growth. By studying protein interactions and identifying potential drug targets, proteomics helps in designing more effective and targeted therapies, contributing significantly to pharmaceutical innovation. The growing investments in research and development activities, both from government and private sectors, further propel the market development and foster technological advancements in proteomic techniques.

Proteomics Market Dynamics

Increasing Focus on Personalized Medicine

The escalating demand for therapeutic approaches boosts the proteomics market expansion. Personalized medicine aims to customize healthcare decisions and treatments for individual patients based on their unique biological characteristics, and proteomics plays a pivotal role in achieving this. By analyzing the protein profiles of individuals, researchers can identify specific biomarkers that are indicative of disease states, predict drug responses, and monitor treatment efficacy. For instance, a study published on the National Center for Biotechnology Information (NCBI) website in 2023 highlighted the use of proteomic signatures to predict the response of cancer patients to specific chemotherapy regimens. This research demonstrated how identifying unique protein expressions in tumor samples can help clinicians select the most effective treatment, thereby improving patient outcomes.

Advancements in Drug Discovery and Development

Proteomics is increasingly becoming an indispensable tool in the pharmaceutical industry, significantly driving the proteomics market development. Its applications span the entire drug discovery and development pipeline, from identifying potential drug targets to understanding drug mechanisms of action and assessing drug toxicity. For example, a research article published on the NCBI platform in 2024 described the use of quantitative proteomics to identify novel protein targets for autoimmune diseases. By comparing the protein expression profiles of healthy individuals and patients with autoimmune conditions, researchers pinpointed specific proteins that are dysregulated and could serve as therapeutic intervention points. Another study found on PubMed, published in 2021, showcased the application of high-throughput screening the effects of various drug candidates on cellular protein networks, providing valuable insights into their efficacy and potential side effects.

Growing Government and Research Funding

The increasing investments in proteomics research by government bodies and research institutions worldwide propel the proteomics market expansion. These funding initiatives aim to advance scientific understanding of biological processes, improve healthcare outcomes, and foster innovation in biotechnology. For instance, the National Institutes of Health (NIH) in the US has consistently supported numerous proteomics-based research projects focused on understanding disease mechanisms and developing new diagnostic and therapeutic tools, as evident from various project grants listed on their website since 2021. Similarly, research articles published on PubMed acknowledge the crucial role of government grants in facilitating large-scale proteomic studies that have led to significant breakthroughs in areas such as cancer biomarker research and infectious diseases.

Proteomics Market Segment Insights

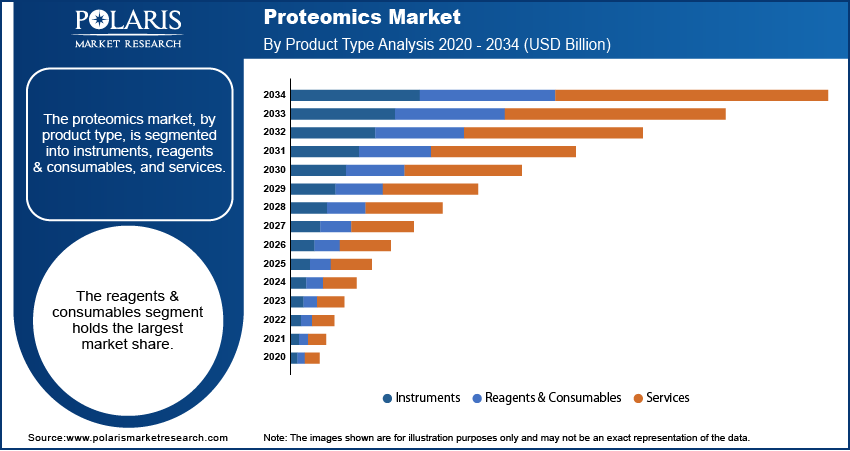

Market Assessment – By Product Type

The market, by product type, is segmented into instruments, reagents & consumables, and services. The reagents & consumables segment holds the largest proteomics market share. This is primarily attributed to the fundamental role reagents play in proteomic experiments, being essential for protein extraction, purification, labeling, and analysis. As proteomics continues to advance, the demand for specialized reagents tailored to specific techniques and applications is consistently high.

The services segment is anticipated to experience the highest growth rate during forecast period. This is driven by the increasing need for specialized expertise and advanced technologies in protein analysis. As the complexity of proteomic studies increases, the demand for core proteomics services, which include protein identification, quantification, and characterization, becomes more pronounced, further fueling the market expansion.

Market Evaluation– By Application

The market, by application, is segmented into drug discovery, clinical diagnosis, molecular medicine, and others. The drug discovery segment holds the largest share of the market. This dominance is primarily attributed to the extensive utilization of proteomics in identifying potential drug targets, understanding drug mechanisms of action, and evaluating drug efficacy and toxicity. The pharmaceutical industry's continuous investments in research and development activities, coupled with the critical role of proteomics in these processes, underpins its significant market presence.

The clinical diagnosis segment is projected to exhibit the highest growth rate. This growth is fueled by the increasing application of proteomic technologies in the identification of disease-specific biomarkers for early detection, disease monitoring, and personalized treatment strategies. The rising prevalence of chronic diseases and the growing emphasis on early and accurate diagnosis are key factors driving the expansion of proteomics in clinical settings.

Market Evaluation– By Technology

The market, by technology, is segmented into microarray instruments, x-ray crystallography, spectroscopy, chromatography, protein fractionation systems, electrophoresis, and surface plasmon resonance (SPR) systems. The spectroscopy segment accounts for the largest market share. The widespread adoption of mass spectrometry techniques, a key component of spectroscopy in proteomics, for protein identification and quantification contributes significantly to this dominance. The versatility and sensitivity of mass spectrometry in analyzing complex protein mixtures across various applications have established its central role in the market.

The surface plasmon resonance (SPR) systems segment is anticipated to demonstrate the highest growth rate during the forecast period. This growth is driven by the increasing demand for label-free detection and real-time analysis of biomolecular interactions. SPR technology's ability to provide valuable insights into protein-protein interactions, drug binding kinetics, and biomarker discovery without the need for labeling is fueling its rapid adoption and market penetration.

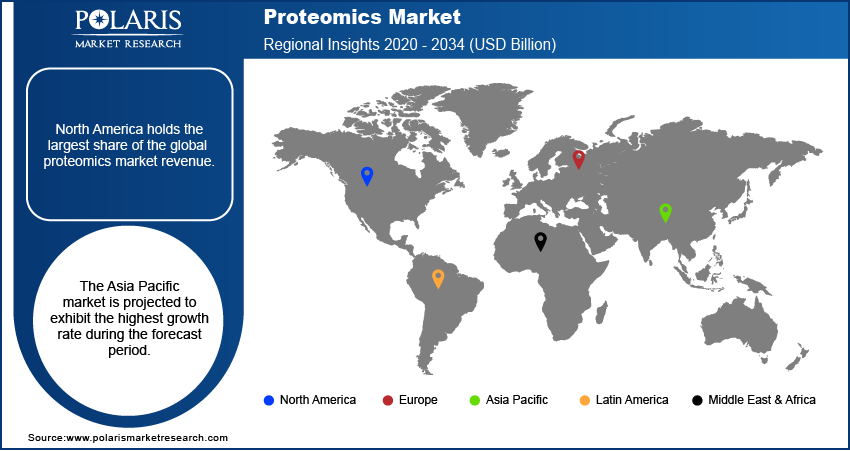

Regional Analysis

The market demonstrates varied penetration across different geographical regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America and Europe have historically held significant market presence due to well-established research infrastructure, substantial government and private funding for life sciences research, and the strong presence of key pharmaceutical and biotechnology companies. The Asia Pacific region is emerging as a high-growth area, fueled by increasing investments in healthcare and research, a growing focus on drug discovery and development, and a rising prevalence of chronic diseases. Latin America and the Middle East & Africa currently represent smaller share of the global market but hold considerable growth potential with increasing healthcare awareness and investments in research activities.

North America holds the largest share of the proteomics market revenue. This is primarily attributed to the region's robust research and development ecosystem, characterized by the presence of leading academic institutions, major pharmaceutical and biotechnology players, and significant government funding initiatives such as those from the National Institutes of Health (NIH). The high adoption rate of advanced proteomic technologies in drug discovery, clinical diagnostics, and molecular medicine, coupled with a strong focus on personalized medicine, further solidifies North America's leading position in the global market.

The Asia Pacific market is projected to exhibit the highest growth rate during the forecast period. This rapid expansion is driven by several factors, including increasing investments in healthcare infrastructure and research capabilities, a growing prevalence of chronic diseases leading to higher market demand for diagnostic and therapeutic solutions, and the expansion of the pharmaceutical and biotechnology sectors in countries such as China, India, and Japan. Furthermore, increasing government support for research and development activities and a rising focus on advancing personalized medicine initiatives are contributing significantly to the accelerated market development and penetration in Asia Pacific.

Key Players and Competitive Insights

A few major players actively contributing to the market include Thermo Fisher Scientific Inc.; Danaher Corporation; Agilent Technologies, Inc.; Bruker Corporation; PerkinElmer, Inc.; Bio-Rad Laboratories, Inc.; QIAGEN N.V.; Waters Corporation; SCIEX (part of Danaher Corporation); and Merck KGaA. These entities offer a comprehensive range of products and services essential for proteomic research and applications.

The competitive landscape of the market is characterized by continuous innovation and strategic collaborations. Companies are focused on developing advanced technologies, such as high-resolution mass spectrometry and sophisticated bioinformatics tools, to enhance the sensitivity, accuracy, and throughput of protein analysis. Furthermore, strategic partnerships, acquisitions, and the introduction of user-friendly platforms are key strategies employed by market participants to expand their market penetration and cater to the evolving needs of researchers and clinical professionals. The emphasis on providing integrated solutions, encompassing instruments, reagents, consumables, and software, is a notable trend shaping the competitive dynamics of the market.

Thermo Fisher Scientific Inc., located in Waltham, Massachusetts, USA, provides a wide array of products and services for the proteomics market. Their offerings include mass spectrometry instruments, liquid chromatography systems, electrophoresis equipment, reagents and consumables for sample preparation and analysis, and advanced software for data processing and interpretation. These comprehensive solutions cater to various applications within proteomics research, drug discovery, and clinical diagnostics.

Danaher Corporation, headquartered in Washington, D.C., USA, operates in the market through its various subsidiaries, including SCIEX and Beckman Coulter Life Sciences. SCIEX offers advanced mass spectrometry systems and separation technologies crucial for protein identification and quantification. Beckman Coulter Life Sciences provides a range of instruments and reagents used in protein analysis workflows, contributing significantly to the market's technological infrastructure.

List of Key Companies

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Bruker Corporation

- Danaher Corporation

- Merck KGaA

- PerkinElmer, Inc.

- QIAGEN N.V.

- SCIEX

- Thermo Fisher Scientific Inc.

- Waters Corporation

Proteomics Industry Developments

- July 2024: Thermo Fisher Scientific Inc. completed the acquisition of Olink Holding AB for USD 3.1 billion, strengthening its portfolio of next-generation proteomics products.

- May 2024: Bruker Corporation opened a new manufacturing facility in Bremen, Germany, aimed at fostering innovation, sustainability, and collaboration in the field of mass spectrometry.

Proteomics Market Segmentation

By Product Type Outlook (Revenue-USD Billion, 2020–2034)

- Instruments

- Protein Microarray

- Spectrmetry

- Mass Spectrometry

- NMR Spectroscopy

- Chrmatography

- HPLC Systems

- Ion Chromatography

- Affinity Chromatography

- Supercritical Fluid Chromatography

- Electrphoresis

- Gel Electrophoresis

- Capillary Electrophoresis

- Surface Plasmon Resonance

- X-ray Crystallography

- Protein Fractionation Systems

- Reagents & Consumables

- Micrarray

- Spectrscopy

- X-ray Crystallography

- Chrmatography

- Electrphoresis

- Immunassay

- Protein Fractionation Reagents

- Services

By Application Outlook (Revenue-USD Billion, 2020–2034)

- Drug Discovery

- Clinical Diagnosis

- Molecular Medicine

- Others

By Technology Outlook (Revenue-USD Billion, 2020–2034)

- Microarray Instruments

- X-Ray Crystallography

- Spectroscopy

- Chromatography

- Protein Fractionation Systems

- Electrophoresis

- Surface Plasmon Resonance (SPR) Systems

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Proteomics Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 27.54 billion |

|

Market Size Value in 2025 |

USD 30.97 billion |

|

Revenue Forecast by 2034 |

USD 90.83 billion |

|

CAGR |

12.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The proteomics market has been segmented on the basis of product type, application, and technology. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

A key growth strategy in the proteomics market centers on continuous technological innovation, particularly in enhancing the sensitivity, speed, and automation of analytical instruments such as mass spectrometers. Expanding applications beyond traditional research into clinical diagnostics and personalized medicine also presents significant growth avenues. Strategic collaborations between technology providers, research institutions, and pharmaceutical companies can accelerate market penetration. Furthermore, focusing on user-friendly software and integrated solutions that streamline workflows and data analysis will be crucial for broader market adoption. Educational initiatives and increasing awareness about the power of proteomics in various fields will also drive market demand and expansion.

FAQ's

The market size was valued at USD 27.54 billion in 2024 and is projected to grow to USD 90.83 billion by 2034.

The market is projected to register a CAGR of 12.7% during the forecast period.

North America held the largest share of the market in 2024.

A few key players in the market include Thermo Fisher Scientific Inc.; Danaher Corporation; Agilent Technologies, Inc.; Bruker Corporation; PerkinElmer, Inc.; Bio-Rad Laboratories, Inc.; QIAGEN N.V.; Waters Corporation; SCIEX (part of Danaher Corporation); and Merck KgaA.

The spectroscopy segment accounted for the largest share of the market in 2024.

Following are a few of the market trends: ? Increasing Adoption of Advanced Mass Spectrometry: Next-generation mass spectrometry technologies are enhancing the sensitivity, speed, and resolution of protein analysis, allowing for the identification and quantification of a larger number of proteins from smaller sample sizes. ? Integration of Artificial Intelligence (AI) and Machine Learning (ML): AI and ML algorithms are being increasingly used to analyze complex proteomic datasets, enabling more efficient biomarker discovery, drug target identification, and disease prediction. ? Growing Emphasis on Personalized Medicine: Proteomics plays a crucial role in the development of personalized medicine biomarkers and therapies by identifying individual-specific protein biomarkers for diagnosis, prognosis, and treatment monitoring.

Proteomics is the comprehensive and large-scale study of proteins, focusing on their roles, structures, interactions, and modifications within a biological system. It aims to understand the entire set of proteins, known as the proteome, expressed by an organism, cell, or tissue at a particular time. This dynamic field provides critical insights into cellular processes, disease mechanisms, and potential therapeutic targets, complementing genomic information by revealing the functional molecules of life.