Biomarker Discovery Outsourcing Services Market Size, Share, Trends, Industry Analysis Report

: By Type (Predictive Biomarkers, Prognostic Biomarkers, Safety Biomarkers, and Surrogate Endpoints), Therapeutic Area, Discovery Phase, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM4075

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

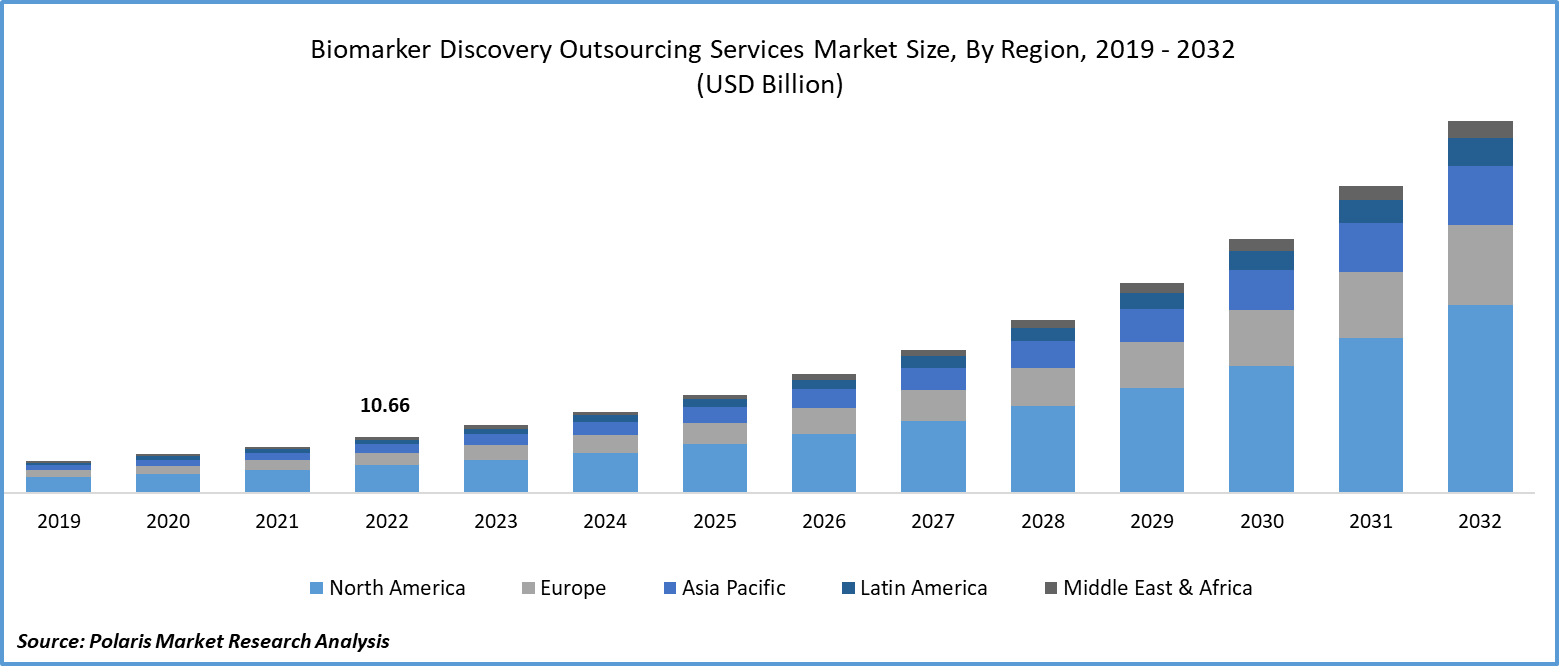

The biomarker discovery outsourcing services market size was valued at USD 14.40 billion in 2024, exhibiting a CAGR of 19.3% during 2025–2034. The market is driven by the rising demand for precision medicine, the growing prevalence of chronic diseases, pharmaceutical growth, advancements in genomics, and AI integration.

Key Insights

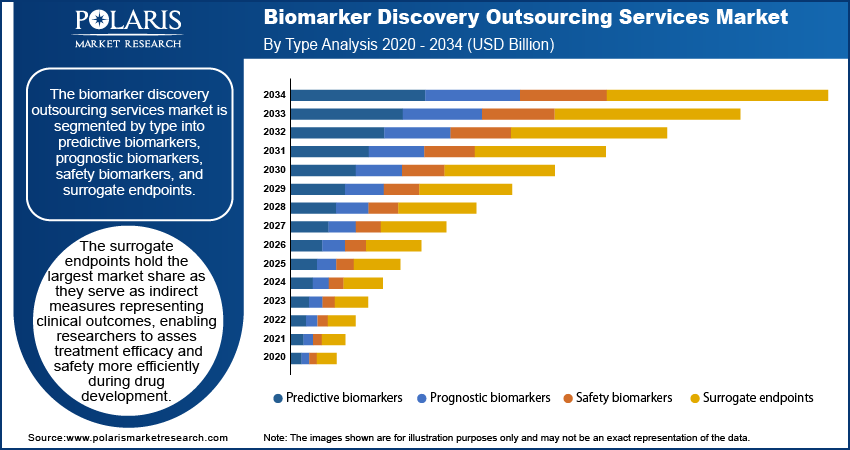

- Surrogate endpoints dominate the biomarker discovery outsourcing services market, helping to streamline clinical trials and reduce drug development time and costs.

- The oncology segment leads in market share due to the increasing prevalence of cancer and the need for targeted therapies, precision medicine, and early detection.

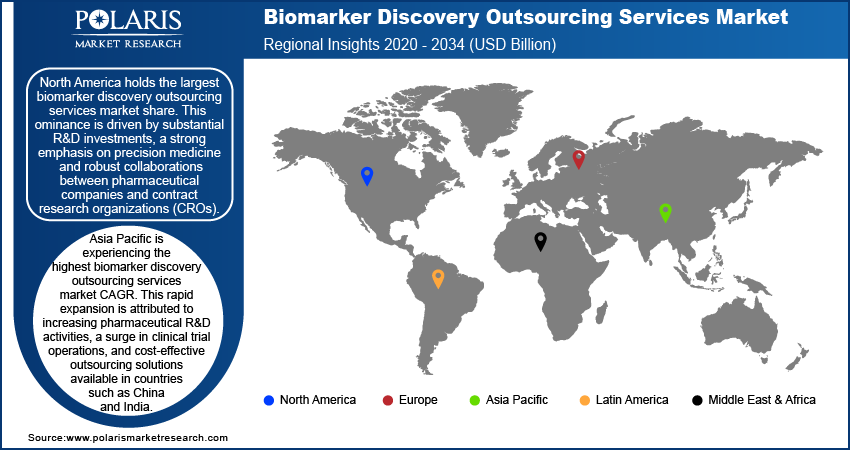

- North America holds the largest market share, driven by significant R&D investments, advanced healthcare infrastructure, and strong collaborations between pharmaceutical companies and CROs.

- Asia Pacific is experiencing the highest growth, fueled by cost-effective outsourcing, growing pharmaceutical R&D, government support for precision medicine, and advancements in genomics and AI technologies.

Industry Dynamics

- The rising need for faster drug development and cost efficiency in clinical trials is driving demand for surrogate endpoints.

- Increasing cancer prevalence and the shift towards personalized medicine are driving growth in oncology biomarker discovery outsourcing services.

- Strong R&D investments and collaborations between pharmaceutical companies and CROs in North America fuel market growth.

- Cost-effective solutions and government support in Asia Pacific are accelerating biomarker research outsourcing in the region.

- Regulatory challenges, limited skilled labor, and infrastructure gaps in certain regions may hinder the market's expansion.

Market Statistics

2024 Market Size: USD 14.40 billion

2034 Projected Market Size: USD 83.93 billion

CAGR (2025–2034): 19.3%

North America: Largest market in 2024

AI Impact on Biomarker Discovery Outsourcing Services Market

- The rising need for faster drug development and cost efficiency in clinical trials is driving demand for surrogate endpoints.

- Increasing cancer prevalence and the shift towards personalized medicine are driving growth in oncology biomarker discovery outsourcing services.

- Strong R&D investments and collaborations between pharmaceutical companies and CROs in North America fuel market growth.

- Cost-effective solutions and government support in Asia Pacific are accelerating biomarker research outsourcing in the region.

- Regulatory challenges, limited skilled labor, and infrastructure gaps in certain regions may hinder the market's expansion.

To Understand More About this Research: Request a Free Sample Report

The biomarker discovery outsourcing services market refers to the industry that provides research and analytical services for identifying biological indicators used in disease diagnosis, drug development, and personalized medicine. These services help pharmaceutical companies, biotechnology firms, and research institutions streamline the process of biomarker identification without investing in expensive infrastructure. The market is growing as healthcare providers and researchers increasingly rely on biomarkers to improve early disease detection and treatment outcomes. Outsourcing these services enables organizations to access specialized expertise, advanced technologies, and cost-effective solutions, driving efficiency and innovation in medical research.

The rising demand for precision medicine and the increasing prevalence of chronic diseases such as cancer and cardiovascular disorders are driving the market growth. The growth of pharmaceutical and biotechnology industries, coupled with advancements in genomics and proteomics, is further fueling the biomarker discovery outsourcing services market demand. Additionally, regulatory agencies are encouraging the use of biomarkers in drug development to enhance treatment efficacy and patient safety. The integration of artificial intelligence and big data analytics in biomarker discovery is also improving accuracy and accelerating research, fueling the market expansion.

Market Dynamics

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases, such as cancer, has significantly amplified the demand for biomarker discovery outsourcing services. Biomarkers are essential tools in early disease detection, diagnosis, and monitoring, enabling healthcare providers to implement timely and targeted interventions. For instance, the American Cancer Society projected that in 2022, an estimated 1.9 million new cancers were diagnosed in the US, highlighting the growing burden of this disease. This escalating prevalence underscores the urgent need for advanced biomarker discovery to facilitate early detection and personalized treatment strategies. Consequently, pharmaceutical companies and research institutions are increasingly outsourcing biomarker discovery to specialized service providers with the requisite expertise and technological capabilities, driving the biomarker discovery outsourcing services market growth.

Growing Emphasis on Personalized Medicine

The shift towards personalized medicine, which tailors medical treatment to individual genetic profiles and disease characteristics, has heightened the demand for precise and reliable biomarkers. Biomarkers are instrumental in identifying patient subgroups, predicting therapeutic responses, and monitoring treatment outcomes, thereby facilitating customized healthcare interventions. The U.S. Food and Drug Administration (FDA) has approved numerous targeted therapy drugs, such as atezolizumab (Tecentriq) and avelumab (Bavencio) for bladder cancer, reflecting the growing emphasis on personalized approaches in healthcare. Developing and validating these biomarkers necessitates sophisticated methodologies and adherence to regulatory standards. Pharmaceutical and biotechnology companies are increasingly outsourcing these tasks to specialized service providers. This trend accelerates the development of personalized therapies and fuels the biomarker discovery outsourcing services market expansion.

Segment Insights

Assessment by Type

The biomarker discovery outsourcing services market is segmented by type into predictive biomarkers, prognostic biomarkers, safety biomarkers, and surrogate endpoints. The surrogate endpoints hold the largest biomarker discovery outsourcing services market share. Surrogate endpoints serve as indirect measures representing clinical outcomes, enabling researchers to assess treatment efficacy and safety more efficiently during drug development. Their ability to streamline clinical trials by providing early indications of therapeutic success reduces both time and costs associated with bringing new drugs to market. This efficiency has led to their widespread adoption, particularly in areas like oncology, where timely evaluation of treatment impact is critical.

Evaluation by Therapeutic Area

The biomarker discovery outsourcing services market segmentation, based on therapeutic area, includes oncology, neurology, cardiology, autoimmune diseases, and others. The oncology segment holds the largest market share. The increasing prevalence of cancer worldwide has intensified the demand for advanced biomarkers to facilitate early detection, accurate diagnosis, and effective treatment planning. Biomarkers are pivotal in identifying cancer subtypes, predicting patient responses to specific therapies, and monitoring disease progression. The shift towards precision medicine in oncology has further amplified the reliance on biomarkers, as they enable the development of targeted therapies tailored to individual patient profiles. Outsourcing services specializing in oncology biomarker discovery provide pharmaceutical and biotechnology companies with access to advanced technologies and expertise, expediting the drug development process and enhancing clinical trial efficiency.

Regional Analysis

By region, the study provides the biomarker discovery outsourcing services market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Each region's market dynamics are shaped by factors such as research and development (R&D) investments, healthcare infrastructure, regulatory frameworks, and the prevalence of chronic diseases.

North America holds the largest market share. This dominance is driven by substantial R&D investments, a strong emphasis on precision medicine, and robust collaborations between pharmaceutical companies and contract research organizations (CROs). The presence of established CROs, such as Laboratory Corporation of America Holdings and ICON plc, further bolsters the region's market position. Technological advancements in omics technologies and artificial intelligence (AI)-driven biomarker analysis, coupled with supportive regulatory frameworks from agencies such as the US Food and Drug Administration (FDA), improve the efficiency and reliability of biomarker discovery processes.

Asia Pacific is experiencing the highest biomarker discovery outsourcing services market CAGR. This rapid expansion is attributed to increasing pharmaceutical R&D activities, a surge in clinical trial operations, and cost-effective outsourcing solutions available in countries such as China and India. Government initiatives promoting biotechnology and precision medicine, along with a large patient population, accelerate biomarker research, particularly in oncology and infectious diseases. Advancements in genomics, AI-powered data analytics, and next-generation sequencing technologies further contribute to the region's growth.

Key Players and Competitive Insights

The biomarker discovery outsourcing services market features several prominent companies actively offering specialized services. Key players include Laboratory Corporation of America Holdings (Labcorp); Charles River Laboratories International, Inc.; Eurofins Scientific; Celerion; ICON plc; Parexel International (MA) Corporation; Proteome Sciences; Thermo Fisher Scientific Inc.; Evotec; WuXi AppTec; GenScript ProBio; and Fujirebio Holdings Inc.

The competitive landscape of this market is characterized by a mix of established contract research organizations (CROs) and specialized biotechnology firms. These entities focus on strategic initiatives such as mergers, acquisitions, and partnerships to enhance their service offerings and global presence. For instance, in March 2023, Fujirebio Holdings Inc. partnered with AriBio Co., Ltd. to develop specialized biomarkers for Alzheimer's disease and other neurodegenerative ailments. Additionally, companies are investing in advanced technologies like artificial intelligence (AI)-driven biomarker analysis and next-generation sequencing to strengthen their competitive edge. Emerging players and regional CROs are gaining traction by offering specialized biomarker validation and bioinformatics services, contributing to a dynamic and evolving market environment.

Laboratory Corporation of America Holdings (Labcorp), headquartered in Burlington, North Carolina, USA, offers comprehensive biomarker discovery services. Their offerings include biomarker identification, validation, and clinical trial support, utilizing advanced technologies to accelerate drug development processes. Labcorp's extensive global network and expertise make it a significant contributor to the biomarker discovery outsourcing services market.

Charles River Laboratories International, Inc., based in Wilmington, Massachusetts, USA, provides a wide range of preclinical and clinical laboratory services, including biomarker discovery and development. Their services encompass biomarker identification, assay development, and validation, supporting clients in enhancing the predictability and efficiency of their drug development programs. Charles River's focus on scientific excellence and client collaboration underscores its relevance in the biomarker discovery outsourcing services market.

List of Key Companies

- Celerion

- Charles River Laboratories International, Inc.

- Eurofins Scientific

- Evotec

- Fujirebio Holdings Inc.

- GenScript ProBio

- ICON plc

- Laboratory Corporation of America Holdings (Labcorp)

- Parexel International (MA) Corporation

- Proteome Sciences

- Thermo Fisher Scientific Inc.

- WuXi AppTec

Biomarker Discovery Outsourcing Services Industry Developments

- January 2023: Charles River Laboratories International, Inc. acquired SAMDI Tech, Inc., a leading provider of label-free high-throughput screening (HTS) solutions for drug discovery research. This acquisition strengthened the company’s operational capabilities and expanded its presence in the growing market.

- January 2022: Inotiv, Inc. and Synexa Life Sciences signed a Letter of Intent to establish a Center of Excellence for Biotherapeutics and Biomarkers, enhancing global bioanalytical services and accelerating biomarker development.

Biomarker Discovery Outsourcing Services Market Segmentation

By Type Outlook (Revenue-USD Billion, 2020–2034)

- Predictive Biomarkers

- Prognostic Biomarkers

- Safety Biomarkers

- Surrogate Endpoints

By Therapeutic Area Outlook (Revenue-USD Billion, 2020–2034)

- Oncology

- Neurology

- Cardiology

- Autoimmune Diseases

- Others

By Discovery Phase Outlook (Revenue-USD Billion, 2020–2034)

- Biomarker Identification

- Biomarker Validation

- Biomarker Profiling

- Biomarker Panel Development

- Biomarker Selection

By End Use Outlook (Revenue-USD Billion, 2020–2034)

- Pharmaceutical Companies

- Biotechnology Companies

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Biomarker Discovery Outsourcing Services Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 14.40 billion |

|

Market Size Value in 2025 |

USD 17.15 billion |

|

Revenue Forecast by 2034 |

USD 83.93 billion |

|

CAGR |

19.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is Report Valuable for Organization?

Workflow/Innovation Strategy

The biomarker discovery outsourcing services market has been segmented into detailed segments of type, therapeutic area, discovery phase, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The biomarker discovery outsourcing services market is expanding through strategic collaborations, technological advancements, and service portfolio diversification. Companies are investing in artificial intelligence (AI)-driven biomarker analysis and next-generation sequencing to enhance discovery and validation processes. Partnerships between pharmaceutical firms, biotechnology companies, and contract research organizations (CROs) are fostering innovation and improving research efficiency. Additionally, market players are expanding their global footprint by establishing research facilities in emerging regions with cost-effective outsourcing solutions. Regulatory compliance, quality assurance, and accelerated drug development timelines remain key focus areas to strengthen market competitiveness and drive growth.

FAQ's

? The biomarker discovery outsourcing services market size was valued at USD 14.40 billion in 2024 and is projected to grow to USD 83.93 billion by 2034.

The market is projected to register a CAGR of 19.3% during the forecast period, 2025-2034.

North America had the largest share of the market.

Key players in the biomarker discovery outsourcing services market include Laboratory Corporation of America Holdings (Labcorp); Charles River Laboratories International, Inc.; Eurofins Scientific; Celerion; ICON plc; Parexel International (MA) Corporation; Proteome Sciences; Thermo Fisher Scientific Inc.; Evotec; WuXi AppTec; GenScript ProBio; and Fujirebio Holdings Inc.

The surrogate endpoints segment accounted for the larger share of the market in 2024.

Biomarker discovery outsourcing services refer to specialized research and analysis solutions provided by external organizations to identify, validate, and develop biomarkers for various applications.