South Korea Medical Plastics Market Size, Share, Trends, Industry Analysis Report

By Polymer Type (Thermoplastics, Elastomers, Biodegradable Polymers, Others), By Application, By Manufacturing – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6240

- Base Year: 2024

- Historical Data: 2020-2023

Overview

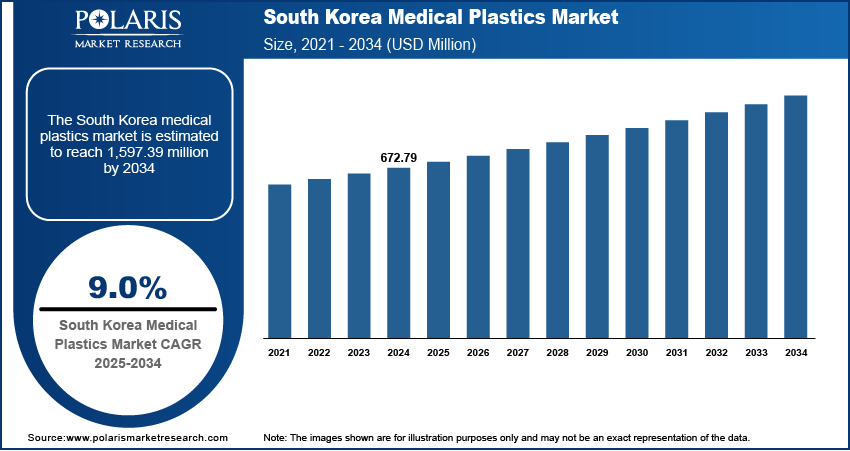

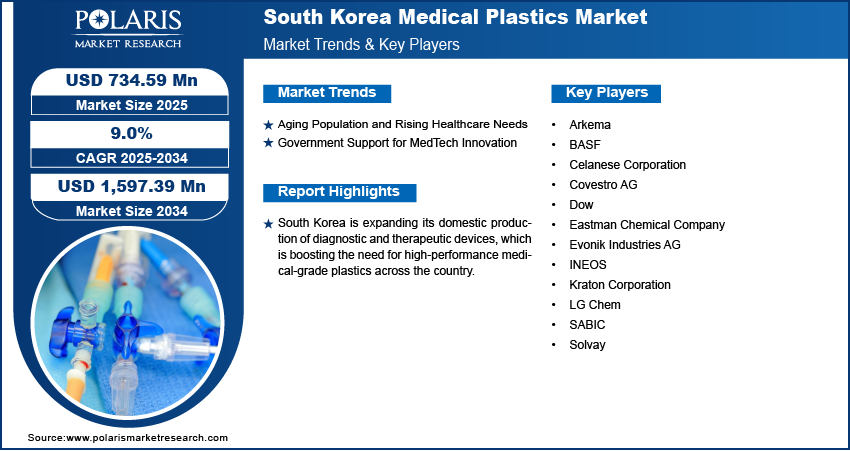

The South Korea medical plastics market size was valued at USD 672.79 million in 2024, growing at a CAGR of 9.0% from 2025 to 2034. South Korea is expanding its domestic production of diagnostic and therapeutic devices, which is boosting the need for high-performance medical-grade plastics.

Key Insights

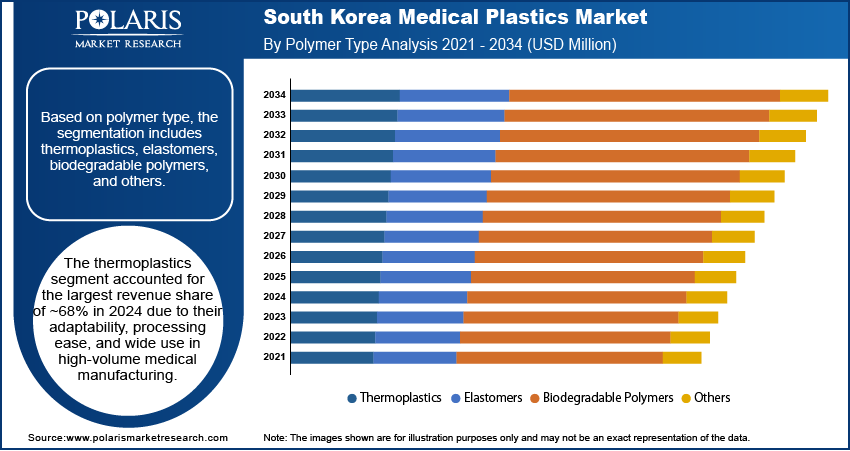

- The thermoplastics segment held the largest revenue share of ~68% in 2024, driven by its versatility, ease of processing, and widespread use in high-volume medical device manufacturing.

- The medical disposables segment is projected to register the highest CAGR of 7.8% from 2025 to 2034, fueled by growing demand for infection control and efficient, single-use healthcare solutions.

Industry Dynamics

- Rising demand for minimally invasive devices and home healthcare products is driving the adoption of advanced medical-grade plastics in South Korea.

- Government support for medtech innovation and domestic manufacturing is accelerating investments in biocompatible and sterilizable plastic materials.

- Expansion of local medtech startups and global partnerships creates demand for high-performance, regulatory-compliant plastic solutions.

- High reliance on imported raw materials increases vulnerability to supply chain disruptions and price volatility.

Market Statistics

- 2024 Market Size: USD 672.79 million

- 2034 Projected Market Size: USD 1,597.39 million

- CAGR (2025–2034): 9.0%

The medical plastics market involves the production and application of plastic materials used in the manufacture of medical devices, packaging, diagnostic tools, implants, and disposables. These plastics offer advantages such as biocompatibility, durability, sterility, and ease of molding for complex designs. National policies supporting medical technology development, including R&D subsidies and regulatory streamlining, are encouraging the use of specialized plastics in next-generation medical devices and smart healthcare systems.

A shift toward minimally invasive surgeries is creating demand for precision instruments and flexible tubing made from advanced polymers that offer excellent strength, flexibility, and chemical resistance. Moreover, South Korea’s growing medical device exports, particularly to Southeast Asia and Europe, are increasing the production of plastic-based components, given their weight advantages and regulatory compliance capabilities.

Drivers & Opportunities

Aging Population and Rising Healthcare Needs: South Korea’s rapidly aging population is placing increased pressure on the healthcare system to deliver accessible, efficient, and long-term care solutions. According to the U.S. Census Bureau, in 2024, approximately 10.2 million individuals were aged 65 and above, representing 20% of South Korea's population. This population is expected to reach 50% of the total population by 2062. Most of older adults require more frequent medical attention, surgical interventions, and chronic disease management, all of which depend heavily on reliable and cost-effective medical supplies. This growing demand is boosting the consumption of disposable products such as catheters, IV bags, syringes, and surgical tools made from medical-grade plastics. These materials offer key benefits such as biocompatibility, sterility, and ease of disposal, making them ideal for both hospital-based treatments and in-home care settings. Hence, the rising aging population and increasing healthcare needs boost the South Korea medical plastics market growth.

Government Support for MedTech Innovation: The South Korean government is actively promoting innovation in the medical technology sector through funding programs, streamlined regulatory pathways, and industry-academia collaboration. This push has created a favorable environment for the development of advanced medical devices that integrate smart features and require high-performance plastic materials. Medical plastics are essential in creating lightweight, customizable, and durable components used in imaging systems, diagnostic equipment, and wearable monitors. These supportive policies encourage domestic production and increase competitiveness in global markets, pushing manufacturers to explore newer polymers that meet evolving technical and safety standards. Therefore, government support for medtech innovation drives the South Korea medical plastics market expansion.

Segmental Insights

Polymer Type Analysis

Based on polymer type, the South Korea medical plastics market segmentation includes thermoplastics, elastomers, biodegradable polymers, and others. The thermoplastics segment accounted for the largest revenue share of ~68% in 2024 due to their adaptability, processing ease, and wide use in high-volume medical manufacturing. South Korean manufacturers prefer thermoplastics such as polyethylene, polypropylene, and polycarbonate for producing syringes, IV components, surgical instruments, and casings. These materials offer durability, chemical resistance, and sterilization compatibility, making them suitable for both reusable and single-use applications. The ability to mold thermoplastics into precise, complex shapes at a lower cost has significantly reduced production timelines. Their strong regulatory track record and recyclability also make them an appealing choice across hospital and laboratory environments.

Application Analysis

In terms of application, the South Korea medical plastics market segmentation includes medical instruments & devices, medical disposable, diagnostic instruments & tools, and others. The medical disposable segment is projected to register the highest CAGR of 7.8% from 2025 to 2034 supported by rising demand for infection-free healthcare delivery and efficiency in treatment cycles. Hospitals, clinics, and home-care providers are increasing their reliance on single-use items such as gloves, tubing, catheters, and diagnostic kits. South Korea’s emphasis on patient safety and infection control is accelerating the shift toward high-volume, plastic-based disposables that minimize cross-contamination risks. The integration of automated production lines using medical-grade plastics has enabled large-scale output to meet growing local and export demands. This trend is further supported by advancements in sterilization-ready plastics tailored for sensitive healthcare environments.

Key Players & Competitive Analysis

The competitive landscape of the South Korea medical plastics market is shaped by domestic innovation, regulatory alignment, and rapid modernization of healthcare infrastructure. Key players are implementing market expansion strategies focused on supplying materials for diagnostic devices and surgical disposables. Strategic alliances between raw material suppliers and device manufacturers are supporting the development of polymer solutions tailored to local clinical needs.

Joint ventures and localized production partnerships are becoming common as firms aim to reduce import dependency. Mergers and acquisitions are concentrated around vertical integration, allowing smoother post-merger integration and improved control over supply chains. Technology advancements in injection molding, biocompatible polymers, and sterilization-resistant plastics are driving product differentiation. The market is also benefiting from R&D collaborations between industry and academic institutions, which are enhancing material performance and regulatory compliance. These competitive dynamics are positioning South Korea as a growing hub for precision-engineered medical plastic solutions in Asia Pacific.

Key Players

- Arkema

- BASF

- Celanese Corporation

- Covestro AG

- Dow

- Eastman Chemical Company

- Evonik Industries AG

- INEOS

- Kraton Corporation

- LG Chem

- SABIC

- Solvay

South Korea Medical Plastics Industry Developments

February 2023: Covestro launched Makrolon 3638, a durable, versatile polycarbonate for healthcare and life sciences, offering high impact strength, chemical resistance, biocompatibility, sterilization compatibility, and design freedom for various applications.

South Korea Medical Plastics Market Segmentation

By Polymer Type Outlook (Revenue, USD Million, 2020–2034)

- Thermoplastics

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polyethylene (PE)

- Polycarbonate (PC)

- Polyurethane

- Acrylonitrile Butadiene Styrene (ABS)

- Others

- Elastomers

- Biodegradable Polymers

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Medical Instruments & Devices

- Medical Disposable

- Diagnostic Instruments & Tools

- Others

By Manufacturing Outlook (Revenue, USD Million, 2020–2034)

- Extrusion Tubing

- Injection Molding

- Compression Molding

- Other

South Korea Medical Plastics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 672.79 million |

|

Market Size in 2025 |

USD 734.59 million |

|

Revenue Forecast by 2034 |

USD 1,597.39 million |

|

CAGR |

9.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The South Korea market size was valued at USD 672.79 million in 2024 and is projected to grow to USD 1,597.39 million by 2034.

The South Korea market is projected to register a CAGR of 9.0% during the forecast period.

A few of the key players in the market are Dow, Covestro AG, BASF, SABIC, Evonik Industries AG, Arkema, Celanese Corporation, Eastman Chemical Company, Solvay, Kraton Corporation, INEOS, and LG Chem.

The thermoplastics segment accounted for the largest revenue share of ~68% in 2024 due to their adaptability, processing ease, and wide use in high-volume medical manufacturing.

The medical disposable segment is projected to register the highest CAGR of 7.8% from 2025 to 2034, supported by rising demand for infection-free healthcare delivery and efficiency in treatment cycles.