Medical Plastic Market Size, Share, Trends, Industry Analysis Report

: By Polymer Type (Thermoplastics, Elastomers, Biodegradable Polymers, and Others), Application, Manufacturing, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 150

- Format: PDF

- Report ID: PM1378

- Base Year: 2024

- Historical Data: 2020-2023

Overview

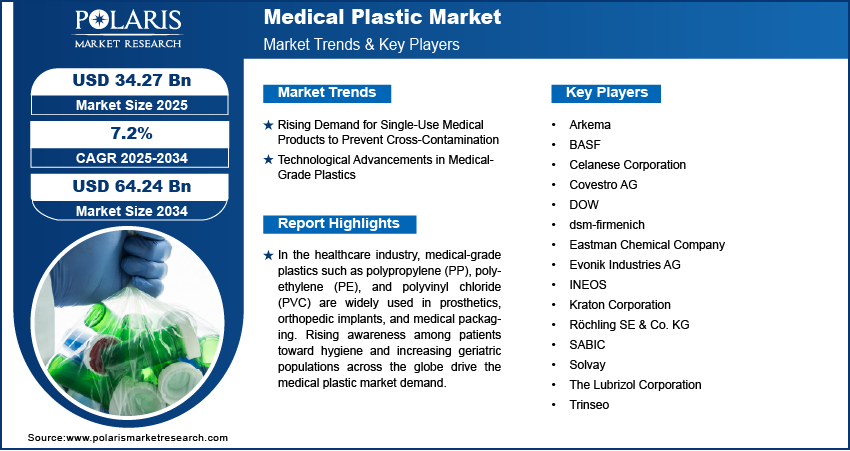

The global medical plastics market size was valued at USD 31.94 billion in 2024, growing at a CAGR of 7.23% from 2025 to 2034. Key factors driving demand for medical plastics include increasing healthcare spending, growing demand for minimally invasive surgeries, and an expanding geriatric population globally.

Key Insights

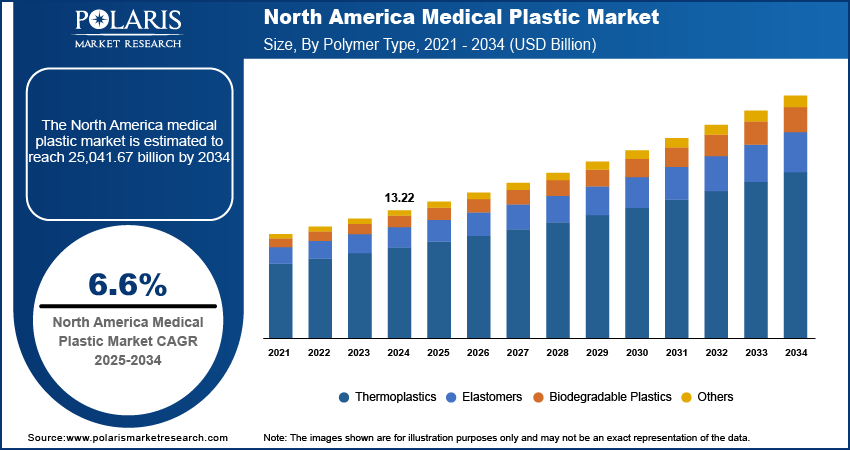

- The thermoplastics segment accounted for 67.96% of revenue share in 2024 due to its widespread use in medical device manufacturing.

- The medical instruments & devices segment held 54.42% of revenue share in 2024 due to growing demand for minimally invasive equipment.

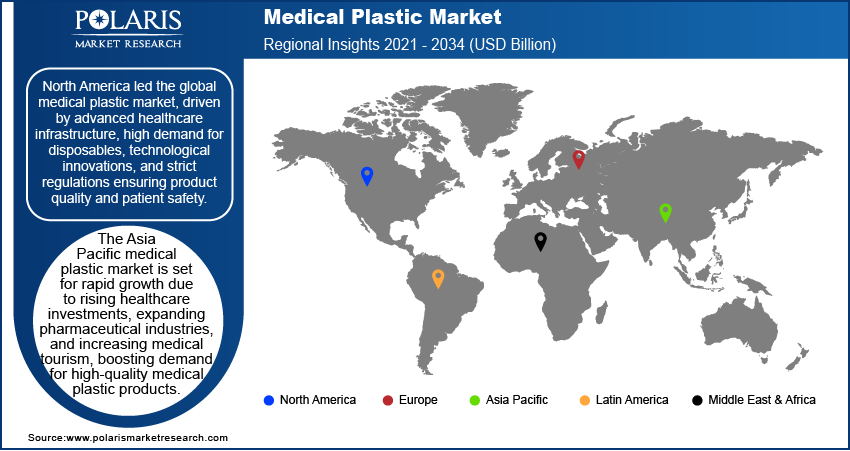

- North America accounted for 41.38% revenue share of the medical plastics market in 2024, owing to the growing aging population requiring medical devices and implants.

- The U.S. held 86.18% of the revenue share in the North America medical plastics landscape in 2024, due to widespread adoption of advanced medical technologies.

- The industry in Asia Pacific is projected to register a CAGR of 8.2% from 2025 to 2034, owing to increasing government healthcare spending.

Industry Dynamics

- The increasing healthcare spending fuels the demand for medical plastics by allowing healthcare providers to stock up on plastic-based supplies such as IV bags, tubing, and syringes.

- The growing demand for minimally invasive surgeries is increasing the adoption of medical plastics, as these surgeries require biocompatible materials.

- The expanding clinical trials for cancer research are expected to create lucrative opportunities for the market during the forecast period.

- The stringent regulatory compliance and approval processes restrain the market expansion.

Market Statistics

- 2024 Market Size: USD 31.94 Billion

- 2034 Projected Market Size: USD 64.24 Billion

- CAGR (2025–2034): 7.23%

- North America: Largest Market Share

Medical plastics are specialized polymers designed for healthcare applications, offering biocompatibility, durability, and sterilization compatibility. These materials are made to meet stringent regulatory standards, ensuring safety in medical environments. A few types of medical plastics include polyvinyl chloride (PVC), polyethylene (PE), polypropylene (PP), polystyrene (PS), and advanced engineering plastics such as polycarbonate (PC) and polyetheretherketone (PEEK). Medical plastics are widely used in devices, packaging, and equipment. Disposable items such as syringes, IV tubes, and catheters are often made of PVC or PP due to their cost-effectiveness and sterility. High-performance plastics like PEEK are employed in surgical implants and orthopedic devices owing to their strength and biocompatibility. Transparent plastics such as PC and polymethyl methacrylate (PMMA) are ideal for lenses, surgical instruments, and labware, providing clarity and impact resistance. Additionally, medical-grade silicones are used in prosthetics and wound care due to their flexibility and hypoallergenic nature.

Packaging is another critical application, where plastics ensure sterility and extend shelf life. Blister packs, clamshells, and vacuum-sealed pouches made from PP or PE protect pharmaceuticals and surgical tools from contamination. Furthermore, antimicrobial plastics infused with additives reduce infection risks in high-touch surfaces such as hospital beds and equipment housings. Advancements in medical plastics include biodegradable polymers for temporary implants and 3D-printed custom prosthetics, enhancing patient-specific care.

To Understand More About this Research: Request a Free Sample Report

The global medical plastics market demand is driven by the expanding geriatric population globally. According to the United Nations, the global population aged 65 and older is projected to surpass the number of children under age 18 by 2070. This is driving the need for items such as syringes, catheters, wound care materials, and orthopedic implants, all of which rely on medical-grade plastics. Additionally, the rising surgical procedures and long-term care needs among the elderly are further boosting demand for sterile, durable, and lightweight plastic medical supplies. Therefore, the increasing geriatric population across the globe is fueling the demand for medical plastics.

Drivers & Opportunities

Increasing Healthcare Spending: Higher budgets are allowing healthcare providers to adopt single-use plastic products for hygiene, expand surgical and diagnostic equipment, and stock up on plastic-based supplies such as IV bags, tubing, and syringes. Increasing funding is also accelerating medical research and biotechnology, which rely on medical plastics for lab equipment, drug delivery systems, and prosthetics, leading to market growth. According to the UK Census Data 2021, total healthcare expenditure increased by 5.6% in nominal terms in 2023. Therefore, as governments and private sectors allocate more resources to healthcare, manufacturers ramp up production of medical-grade plastics to meet the growing demand for safer, more efficient, and cost-effective solutions.

Growing Demand for Minimally Invasive Surgeries: Minimally Invasive surgeries require lightweight, flexible, and biocompatible materials that ensure precision, reduce infection risks, and enhance patient recovery, qualities that medical plastics provide, leading to market expansion. Additionally, advancements in robotic-assisted surgeries and smart medical devices are further driving the need for durable, high-precision plastic components, expanding the market for medical-grade polymers. Therefore, as more hospitals and clinics adopt minimally invasive surgeries to shorten hospital stays and improve outcomes, manufacturers must produce more high-performance plastics for single-use surgical tools, implantable devices, and sterile packaging.

Segmental Insights

Polymer Type Analysis

Based on polymer type, the segmentation includes thermoplastics, elastomers, biodegradable polymers, and others. The thermoplastics segment accounted for 67.96% of revenue share in 2024 due to its exceptional versatility, cost-efficiency, and widespread use in medical device manufacturing. Manufacturers prefer thermoplastics such as polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC) due to their ease of processing, chemical resistance, and ability to be sterilized. These materials meet stringent medical standards and support various applications, including tubing, syringes, catheters, and diagnostic equipment housings. The growing demand for disposable devices and single-use components has further contributed to thermoplastics' dominance, as these materials support large-scale, hygienic production while maintaining performance and regulatory compliance.

The biodegradable polymers segment is projected to register a CAGR of 8.9% from 2025 to 2034, owing to rising environmental concerns, coupled with stricter regulations on medical waste disposal. Biodegradable polymers such as polylactic acid (PLA) and polycaprolactone (PCL) are gaining adoption in drug delivery systems, surgical implants, and tissue engineering applications due to their biocompatibility and natural degradation properties. The increasing focus on eco-friendly practices in healthcare settings and advancements in bioresorbable polymer technology are further expected to fuel the shift toward these materials across a broader range of applications.

Application Analysis

In terms of application, the segmentation includes medical instruments & devices, medical disposables, diagnostic instruments & tools, and others. The medical instruments & devices segment held 54.42% of revenue share in 2024 due to rising demand for advanced and minimally invasive equipment. The segment growth is driven by the increasing prevalence of chronic diseases, growing surgical volumes, and the expanding elderly population that requires long-term care solutions. Manufacturers utilized high-performance plastics to produce components for surgical instruments, imaging systems, and implantable devices, due to their superior strength-to-weight ratio, chemical resistance, and biocompatibility. Innovations in design and material science also supported the development of durable, lightweight, and sterilizable products, making plastics the preferred choice for a wide range of medical devices & instruments.

The medical disposables segment is projected to register a CAGR of 7.8% from 2025 to 2034, owing to rising emphasis on infection control, cost containment, and the increasing usage of single-use products in hospitals and clinics. High patient turnover, especially in post-pandemic healthcare environments, is pushing institutions to adopt disposable products such as gloves, masks, IV bags, and syringes to reduce cross-contamination risks. Moreover, the global expansion of outpatient care services and home healthcare settings is fueling the demand for convenient, ready-to-use medical disposable products.

Manufacturing Analysis

In terms of manufacturing, the segmentation includes extrusion tubing, injection molding, compression molding, and others. The extrusion tubing segment was valued at USD 14.40 billion in 2024. This dominance is attributed to the upsurging need for high-performance medical tubing in applications such as catheters, IV lines, dialysis equipment, and drug delivery systems. Hospitals and outpatient care centers increasingly rely on polymer-based tubing due to its flexibility, clarity, and chemical resistance. The rise in chronic illnesses and minimally invasive procedures has also fueled demand for extrusion tubing. Advancements in co-extrusion and materials engineering enhanced the performance, allowing manufacturers to meet evolving clinical requirements and support the segment’s dominance.

The injection molding segment is estimated to record a CAGR of 7.5% from 2025 to 2034, due to its ability to produce complex and high-precision components at scale. Manufacturers prefer this method to fabricate surgical instruments, diagnostic device parts, and implantable components due to its repeatability, design flexibility, and compatibility with a broad range of medical-grade polymers. This technique is enabling efficient mass production while maintaining high tolerances, essential for patient safety and regulatory compliance, leading to segment growth.

Regional Analysis

The North America medical plastics market accounted for a 41.38% global revenue share in 2024. This dominance is attributed to advanced healthcare infrastructure, increasing surgical procedures, and a growing aging population requiring medical devices and implants. According to the Population Reference Bureau, the number of Americans aged 65 and above is projected to increase from 58 million in 2022 to 82 million by 2050. Stringent regulatory standards by the FDA and Health Canada ensured high-quality polymer applications in medical devices, drug delivery systems, and packaging. The rise in chronic diseases, such as cardiovascular disorders and diabetes, in the region further boosted demand for polymer-based medical solutions. Additionally, innovations in biocompatible and biodegradable polymers for minimally invasive surgeries and wearable medical devices contributed to market dominance.

U.S. Medical Plastics Market Insights

The U.S. held 86.18% of the revenue share in the North America medical plastics landscape in 2024, due to its strong healthcare sector, high R&D investments, and widespread adoption of advanced medical technologies. The increasing prevalence of chronic illnesses and the need for infection-resistant materials in hospitals led market growth in the region. The shift toward single-use medical devices to prevent cross-contamination also fueled medical polymer consumption in the country. Furthermore, the FDA’s supportive policies for innovative polymer-based medical products, such as bioresorbable stents and 3D-printed implants, propelled market expansion.

Europe Medical Plastics Market Trends

The market in Europe is projected to hold 29.65% of revenue share in 2034 due to stringent EU regulations promoting biocompatibility and sustainability in medical devices. The region’s aging population is increasing the need for orthopedic implants, catheters, and prosthetics made from high-performance plastics. Germany, France, and the UK are leading in medical polymer adoption due to strong healthcare systems and emphasis on advanced wound care and drug delivery systems. Additionally, the push for eco-friendly medical packaging and recyclable polymers is aligning with Europe’s sustainability goals, further driving market growth.

Germany Medical Plastics Market Overview

The demand for medical plastics in Germany is being driven by the rising need for precision-engineered implants, surgical instruments, and diagnostic equipment. The country’s strong focus on research and innovation in polymer science, along with government support for healthcare technology, is sustaining market growth. The increasing use of polymers in minimally invasive surgeries and smart drug delivery systems is also contributing to demand. Additionally, Germany’s strict sterilization and hygiene standards in hospitals is necessitating the use of high-quality plastic disposable medical products.

Asia Pacific Medical Plastics Market Outlook

The industry in Asia Pacific is projected to register a CAGR of 8.2% from 2025 to 2034, owing to expanding healthcare access, rising medical tourism, and increasing government healthcare spending. Countries such as China, India, and Japan are major contributors, driven by growing populations, rising chronic disease prevalence, and the need for affordable medical devices. The shift from traditional materials to polymers in syringes, IV tubes, and surgical gloves enhances market prospects. Additionally, the booming pharmaceutical industry in India and China is increasing demand for polymer-based drug packaging. Investments in local polymer manufacturing and partnerships with global medical device companies are further accelerating the expansion of the medical plastics market.

Key Players & Competitive Analysis

The medical plastics market is intensely competitive, driven by major players such as DOW, Covestro AG, Celanese Corporation, Eastman Chemical Company, Evonik Industries AG, SABIC, and others. These companies leverage advanced materials science, strategic collaborations, and global expansion to maintain their dominance. Innovation in biocompatible polymers, sterilizable plastics, and sustainable solutions is a key focus, aligning with regulatory demands and industry trends. Many firms are investing in R&D to develop high-performance medical polymers for applications such as implants, drug delivery systems, and diagnostic devices. Meanwhile, emerging players and tech-driven disruptors challenge incumbents with novel formulations, 3D printing capabilities, and eco-friendly alternatives. Leading firms prioritize cost efficiency, regulatory compliance, and next-generation material development, as competition intensifies, to differentiate themselves and sustain leadership in the evolving medical plastics landscape.

A few major companies operating in the medical plastics industry include DOW, Covestro AG, Celanese Corporation, Eastman Chemical Company, Evonik Industries AG, SABIC, BASF, Arkema, dsm-firmenich, Kraton Corporation, INEOS, Solvay, The Lubrizol Corporation, Trinseo, and Röchling SE & Co. KG.

Key Players

- Arkema

- BASF

- Celanese Corporation

- Covestro AG

- DOW

- dsm-firmenich

- Eastman Chemical Company

- Evonik Industries AG

- INEOS

- Kraton Corporation

- Röchling SE & Co. KG

- SABIC

- Solvay

- The Lubrizol Corporation

- Trinseo

Medical Plastics Industry Developments

September 2024: Americhem Healthcare introduced the ColorRx medical grade polymers product line in Europe. With the launch, the company aims to help molders and OEMs start their device development.

In April 2024, Evonik expanded RESOMER powder biomaterials capacity in Germany, introducing solvent-free micronization for customized particle sizes, enhancing medical device and aesthetic applications.

In March 2024, Covestro launched a new polycarbonate copolymer plant in Antwerp, using a solvent-free melt process to enable customizable properties for applications in electronics and healthcare.

In April 2022, Solvay introduced Ixef GS-5022, a lubricated medical-grade polymer for single-use surgical instruments and biopharma components.

Medical Plastics Market Segmentation

By Polymer Type Outlook (Revenue, USD Billion, 2021–2034)

- Thermoplastics

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polyethylene (PE)

- Polycarbonate (PC)

- Polyurethane

- Acrylonitrile Butadiene Styrene (ABS)

- Others

- Elastomers

- Biodegradable Polymers

- Others

By Application Outlook (Revenue, USD Billion, 2021–2034)

- Medical Instruments & Devices

- Medical Disposables

- Diagnostic Instruments & Tools

- Others

By Manufacturing Outlook (Revenue, USD Billion, 2021–2034)

- Extrusion Tubing

- Injection Molding

- Compression Molding

- Others

By Regional Outlook (Revenue, USD Billion, 2021–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Medical Plastics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 31.94 Billion |

|

Market Size in 2025 |

USD 34.27 Billion |

|

Revenue Forecast by 2034 |

USD 64.24 Billion |

|

CAGR |

7.23% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global medical plastic market size was valued at USD 31.94 billion in 2024 and is projected to grow to USD 64.24 billion by 2034.

• The global market is projected to register a CAGR of 7.2% during the forecast period.

• In 2024, North America accounted for the largest market share, driven by rising demand for safe-grade medical devices and maintaining hygiene.

• A few of the key players in the market are DOW, Covestro AG, Celanese Corporation, Eastman Chemical Company, Evonik Industries AG, SABIC, BASF, Arkema, dsm-firmenich, Kraton Corporation, INEOS, Solvay, The Lubrizol Corporation, Trinseo, and Röchling SE & Co. KG.

• In 2024, the thermoplastics segment held the largest market share due to their versatility, safety, and cost-effectiveness.

• by 2034, the medical disposable segment is expected to witness significant market growth due to the rising prevalence of diabetes, cardiovascular diseases, and cancer.