U.S. Compressed Air Filter and Dryer Market Size, Share, Trends, Industry Analysis Report

By Product (Compressed Air Dryers, Compressed Air Filters), By Industry Vertical – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6254

- Base Year: 2024

- Historical Data: 2020-2023

Overview

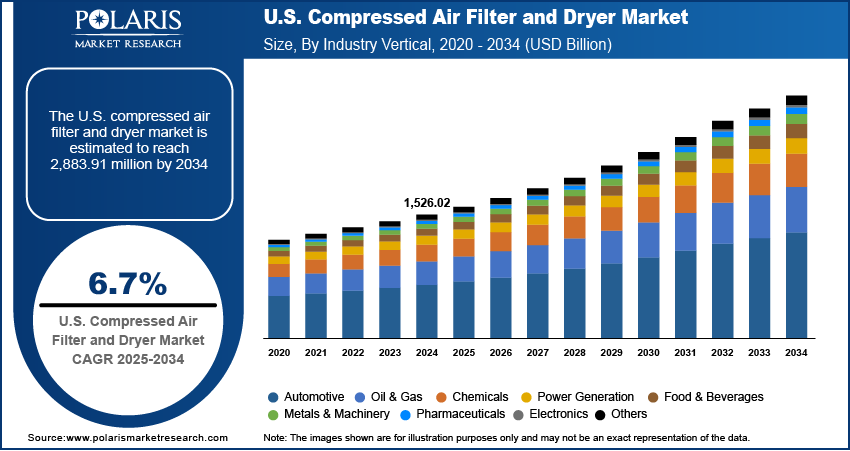

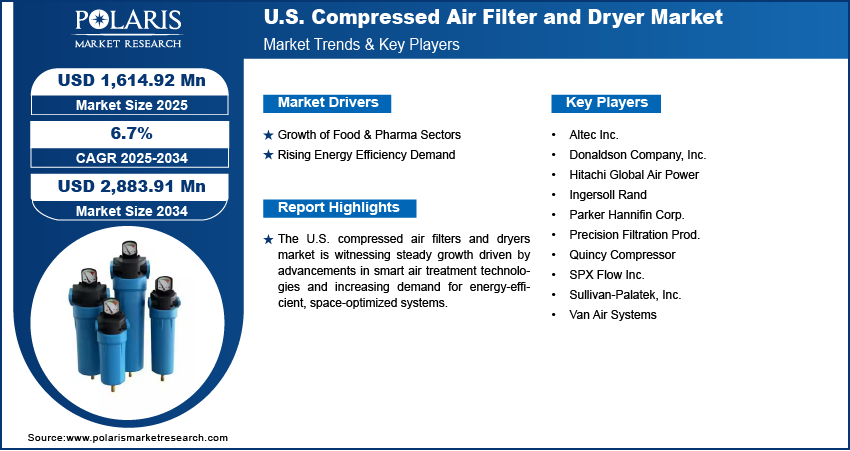

The U.S. compressed air filter and dryer market size was valued at USD 1,526.02 million in 2024, growing at a CAGR of 6.7% from 2025 to 2034. Key factors driving market demand include the expanding use of compressed air in critical end-use applications, rapid industrialization across the country, and advancements in compressed air filter and dryer technologies.

Key Insights

- The compressed air dryers segment generated USD 3.82 million in revenue in 2024, driven by rising demand for moisture-free air in critical industrial applications.

- The food & beverage sector is expected to register a CAGR of 7.2% during the forecast period, fueled by strict hygiene standards requiring ultra-clean compressed air.

Industry Dynamics

- The growing U.S. food and pharma sectors need high-purity compressed air for safe production, and strict regulations make air filtration critical for product quality and compliance.

- Industries are upgrading to energy-efficient compressed air systems to cut costs. These systems reduce energy waste while maintaining performance, aligning with sustainability goals.

- Strict EPA and OSHA regulations increase compliance costs for manufacturers, requiring frequent upgrades to meet air quality and workplace safety standards, squeezing profit margins.

- The reshoring of U.S. manufacturing boosts demand for reliable compressed air systems, as returning factories modernize operations with energy-efficient, high-performance filtration solutions.

Market Statistics

- 2024 Market Size: USD 1,526.02 million

- 2034 Projected Market Size: USD 2,883.91 million

- CAGR (2025–2034): 6.7%

AI Impact on U.S. Compressed Air Filter and Dryer Market

- Due to AI algorithms in filtration settings, real time updates on variable environmental and operational conditions can be obtained. This adaptive control enhances contaminant removal efficiency.

- AI and smart controls enable industries in the U.S. to minimize energy usage.

- Compliance with Clean Air Act standards and EPA guidelines is boosting the adoption of higher-performance filtration and dryer systems.

- New U.S. tariffs on imported components of filters and dryers in 2025 have increased their costs. AI-driven supply chain optimization helps manufacturers adopt lean manufacturing practices, shift sourcing closer to home, and stabilize prices for critical filters/dryers.

Compressed air filters and dryers are essential systems designed to eliminate contaminants and moisture from compressed air, thereby ensuring the longevity and efficiency of industrial equipment. In the U.S., the market for these systems is shaped by the ongoing expansion of the oil and gas industry. A 2025 U.S. Energy Information Administration (EIA) report stated that energy production in the country reached 103 quadrillion BTU, up 1% from 2023, driven by natural gas (38%), crude oil (27%), biofuels, solar, and wind. The growth reflects increased output across multiple energy sources. The need for reliable, clean compressed air systems grows in parallel as operations in exploration, drilling, and refining become more advanced and geographically distributed. These systems are critical in powering pneumatic tools and protecting downstream equipment from oil, water, and particulate damage, which can otherwise compromise performance and safety in high-risk environments.

The increasing integration of Industry 4.0 technologies across U.S. manufacturing sectors contributes to the U.S. compressed air filter and dryer market expansion opportunities. The demand for high-quality compressed air systems with real-time monitoring capabilities is on the rise as facilities adopt smart automation, IoT-enabled machinery, and predictive maintenance protocols. Compressed air filters and dryers, when integrated into such digitalized infrastructures, maintain air purity and also enhance operational efficiency by reducing unplanned downtime and energy consumption. This alignment with smart manufacturing goals reinforces their role as a foundational component in the evolving industrial ecosystem.

Drivers & Opportunities

Growth of Food & Pharma Sectors: The expansion of the food and pharmaceutical sectors in the U.S. is creating growth opportunities, primarily due to the strict regulatory standards that these industries must comply with. According to a 2025 U.S. Department of Agriculture report, the Consumer Price Index (CPI) for all food rose 0.3% month-over-month from May to June 2025. Compared to June 2024, food prices in June 2025 were 3.0% higher. In both sectors, compressed air comes into direct or indirect contact with products during processing, packaging, or handling, making air purity essential to maintaining product integrity and safety. Filters and dryers play a critical role in removing particulates, moisture, and oil aerosols, ensuring compliance with hygiene and contamination control guidelines. Manufacturers increasingly rely on advanced air treatment systems to safeguard operations and consumer trust as production scales and quality standards tighten.

Rising Energy Efficiency Demand: The rising demand for energy-efficient solutions across U.S. industries is driving the adoption of modern compressed air filters and dryers. According to a 2024 IEA report, by 2026, global electricity demand is set to grow 3.4% annually, with data centers consuming over 1,000 TWh. Renewables will supply 37% of power, and emissions will begin a structural decline. These systems are often among the largest consumers of energy in industrial facilities, encouraging companies to aim for solutions that optimize air usage while minimizing operational costs. Advanced filtration and drying technologies contribute to energy savings by reducing pressure drops, enhancing airflow efficiency, and supporting system-wide energy management goals. This growing focus on sustainability and cost reduction is accelerating the shift toward high-performance, energy-conscious compressed air treatment systems.

Segmental Insights

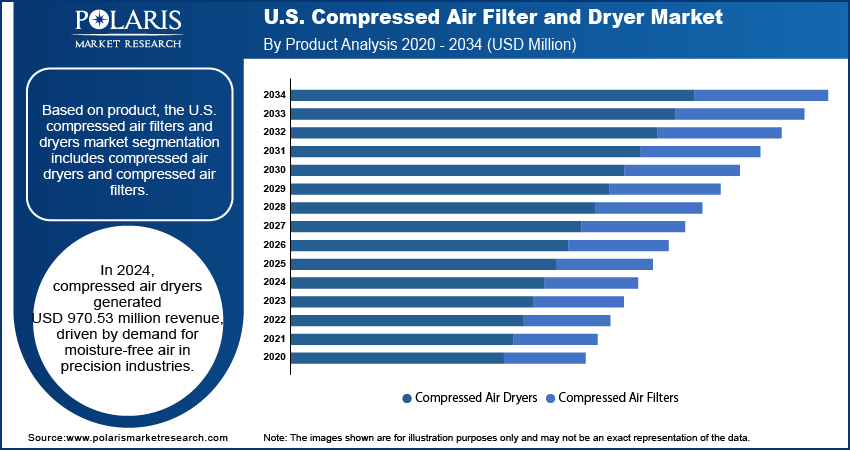

Product Analysis

Based on product, the U.S. compressed air filter and dryer market segmentation includes compressed air dryers and compressed air filters. The compressed air dryers segment accounted for USD 970.53 million revenue share in 2024, primarily driven by their critical role in ensuring moisture-free air supply across sensitive and high-precision industrial operations. These dryers are widely adopted in environments where even minimal moisture leads to equipment corrosion, product spoilage, or process inefficiencies. Industries such as electronics, pharmaceuticals, and power generation rely heavily on compressed air dryers to maintain system reliability and meet strict quality standards. The growing focus on operational safety and extended equipment life has further reinforced the preference for advanced drying technologies such as refrigerated and desiccant dryers across various industrial environments.

The compressed air filters segment is projected to register a CAGR of 6.5% during the forecast period, supported by rising concerns regarding particulate and oil contamination in compressed air systems. Filters are essential for protecting sensitive end-use equipment, maintaining air purity, and reducing maintenance intervals in manufacturing plants. The increasing deployment of automated production lines and pneumatic systems has increased the need for reliable filtration to ensure consistent performance. This demand is especially strong in industries where compressed air comes into contact with end products, driving investments in high-efficiency filters that meet industry-specific air quality requirements.

Industry Vertical Analysis

In terms of industry vertical, the U.S. compressed air filter and dryer market segmentation includes automotive, oil & gas, chemicals, power generation, food & beverages, metals & machinery, pharmaceuticals, electronics, and others. The automotive segment captured 20.5% share of the market in 2024, attributed to its widespread use of pneumatic tools, painting systems, and assembly operations that depend on clean, dry compressed air. The sector’s strong focus on process efficiency, surface finish quality, and contamination-free assembly lines has driven consistent demand for both filters and dryers. Additionally, the rise in automated manufacturing technologies within the automotive sector has reinforced the need for uninterrupted compressed air supply, pushing manufacturers to adopt robust air treatment systems to minimize equipment wear and production downtime.

The food & beverage segment is projected to witness the highest CAGR of 7.2% during the forecast period owing to the sector’s strict air quality requirements and increasing automation across production and packaging lines. In this industry, compressed air often directly contacts consumable products, making air purity critical to maintaining hygiene and complying with safety regulations. The growing preference for clean-label processing and the adoption of contamination-free production technologies are driving demand for high-performance compressed air dryers and filters. The need for compliant and efficient air treatment solutions is projected to accelerate as food and beverage manufacturers continue to expand operations and modernize facilities.

Key Players & Competitive Analysis

The U.S. compressed air filter and dryer market is highly competitive, with companies leveraging strategic investments, technological advancements, and expansion opportunities to strengthen their positions. Competitive intelligence reveals that leading companies focus on sustainable value chains and revenue growth analysis to address latent demand and opportunities in both developed markets and emerging market segments. Disruptions and trends, such as energy efficiency and IoT integration, are reshaping the industry, prompting firms to adopt future development strategies. Small and medium-sized businesses are increasingly adopting advanced filtration solutions, driven by economic and geopolitical shifts. Vendor strategies emphasize product offerings tailored to industrial needs, while growth projections highlight rising demand in manufacturing and healthcare. Expert's insight suggests that competitive positioning will hinge on innovation and adaptability to macroeconomic trends, ensuring long-term revenue opportunity in this dynamic U.S. compressed air filter and dryer market.

A few major companies operating in the U.S. compressed air filter and dryer market include Altec Inc.; Donaldson Company, Inc.; Hitachi Global Air Power; Ingersoll Rand; Parker Hannifin Corp.; Precision Filtration Prod.; Quincy Compressor; SPX Flow Inc.; Sullivan-Palatek, Inc.; and Van Air Systems.

Key Players

- Altec Inc.

- Donaldson Company, Inc.

- Hitachi Global Air Power

- Ingersoll Rand

- Parker Hannifin Corp.

- Precision Filtration Prod.

- Quincy Compressor

- SPX Flow Inc.

- Sullivan-Palatek, Inc.

- Van Air Systems

U.S. Compressed Air Filter and Dryer Industry Developments

- July 2025: Tsunami introduced a pneumatic air dryer for C1D1 hazardous locations (oil refineries, chemical plants). The electricity-free design mitigates explosion risks, addressing critical safety needs in volatile environments.

- May 2023: ELGi North America (ELGi) expanded its AB Series oil-free compressors (15-30 hp) and introduced AR Premium cycling refrigerated dryers, targeting cost-effective, energy-efficient air solutions.

U.S. Compressed Air Filter and Dryer Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Compressed Air Dryers

- Refrigeration

- Desiccant/Adsorption

- Deliquescent

- Membrane

- Compressed Air Filters

- Particulate Filters

- Coalescing Filters

- Compressed Intake Filters

- Activated Carbon Filters

By Industry Vertical Outlook (Revenue, USD Million, 2020–2034)

- Automotive

- Oil & Gas

- Chemicals

- Power Generation

- Food & Beverages

- Metals & Machinery

- Pharmaceuticals

- Electronics

- Others

U.S. Compressed Air Filter and Dryer Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1,526.02 Million |

|

Market Size in 2025 |

USD 1,614.92 Million |

|

Revenue Forecast by 2034 |

USD 2,883.91 Million |

|

CAGR |

6.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1,526.02 million in 2024 and is projected to grow to USD 2,883.91 million by 2034.

The market is projected to register a CAGR of 6.7% during the forecast period.

A few of the key players in the market are Altec Inc.; Donaldson Company, Inc.; Hitachi Global Air Power; Ingersoll Rand; Parker Hannifin Corp.; Precision Filtration Prod.; Quincy Compressor; SPX Flow Inc.; Sullivan-Palatek, Inc.; and Van Air Systems.

The compressed air dryers segment accounted for USD 970.53 million revenue share in 2024.

The food & beverage segment is projected to witness the highest CAGR of 7.2% during the forecast period.