Germany Medical Plastics Market Size, Share, Trends, Industry Analysis Report

By Polymer Type (Thermoplastics, Elastomers, Biodegradable Polymers, Others), By Application, By Manufacturing – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6241

- Base Year: 2024

- Historical Data: 2020-2023

Overview

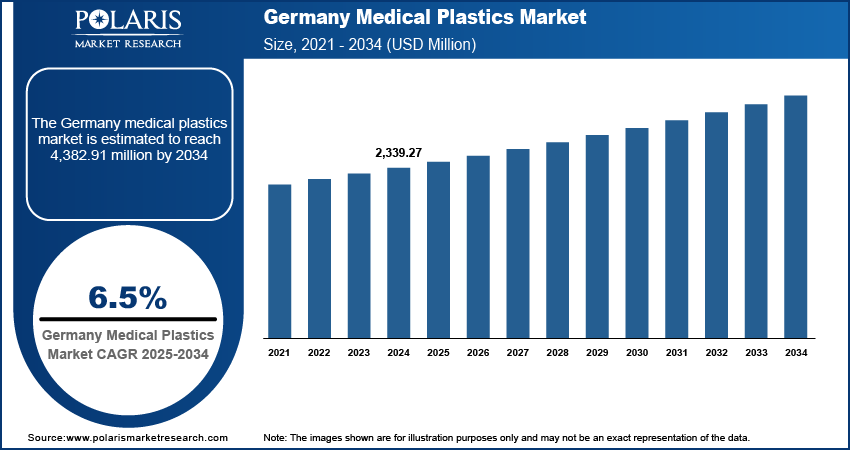

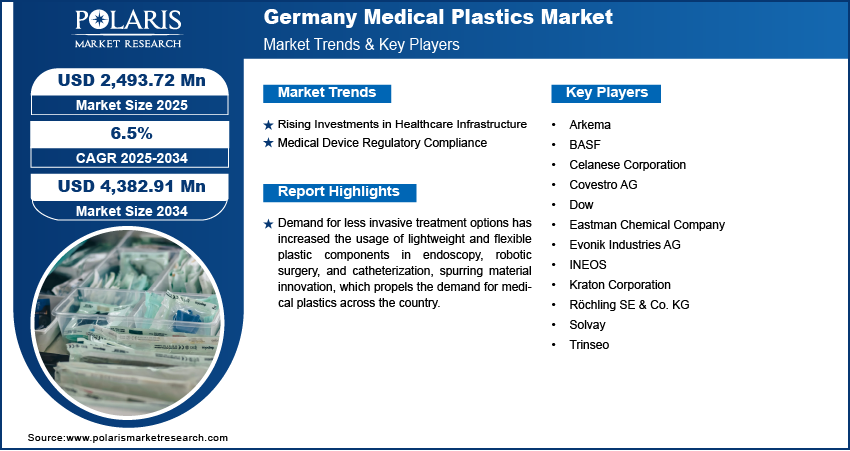

The Germany medical plastics market size was valued at USD 2,339.27 million in 2024, growing at a CAGR of 6.5% from 2025 to 2034. Stringent European regulations are pushing companies to adopt medical-grade plastics that ensure traceability, biocompatibility, and product consistency, supporting market growth through quality-driven material selection.

Key Insights

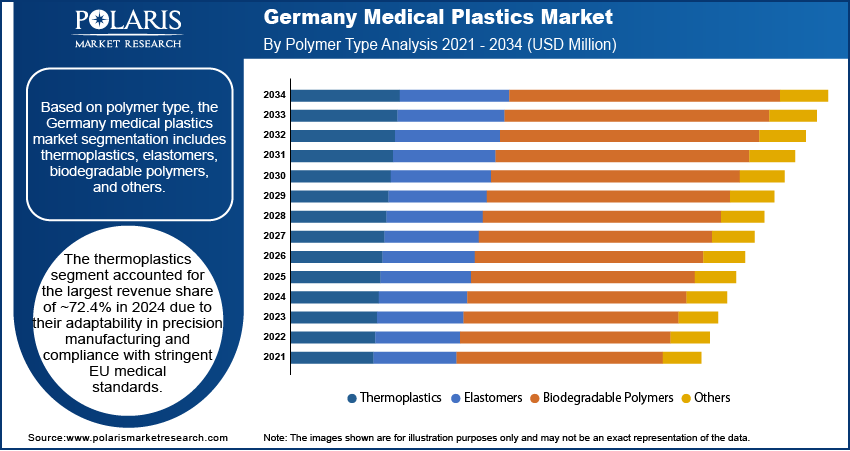

- The thermoplastics segment held ~72.4% revenue share in 2024, driven by their precision, processability, and compliance with strict EU medical standards.

- The medical disposables segment is projected to register a CAGR of 7.0% from 2025 to 2034, due to rising focus on hygiene, safety, and efficient healthcare delivery.

Industry Dynamics

- Strong medtech industry and high R&D spending drive demand for high-performance, biocompatible plastics in precision devices.

- Strict EU MDR regulations push manufacturers to adopt certified, traceable, and sustainable medical-grade plastic materials.

- Integration of smart devices and digital health technologies increases demand for advanced plastic materials with sensor compatibility.

- High production costs and regulatory complexity slow down new material adoption and market entry timelines.

Market Statistics

- 2024 Market Size: USD 2,339.27 million

- 2034 Projected Market Size: USD 4,382.91 million

- CAGR (2025–2034): 6.5%

The medical plastics market involves the production and application of plastic materials used in the manufacture of medical devices, packaging, diagnostic tools, implants, and disposables. These plastics offer many advantages such as biocompatibility, durability, sterility, and ease of molding for complex designs. Medical device manufacturers are adopting high-performance thermoplastics and elastomers due to their durability, chemical resistance, and sterilizability, driving innovation in implants, drug delivery systems, and surgical equipment.

Healthcare facilities are emphasizing stringent infection prevention protocols, creating strong demand for plastic-based disposable products such as gloves, IV sets, and tubing that meet hygiene and cost-efficiency standards. Moreover, demand for less invasive treatment options has increased the usage of lightweight and flexible plastic components in endoscopy, robotic surgery, and catheterization, spurring material innovation.

Drivers & Opportunities

Rising Investments in Healthcare Infrastructure: Germany is undergoing steady growth in healthcare spending aimed at upgrading diagnostic centers, surgical facilities, and rehabilitation clinics. According to the German Federal Ministry of Health, in June 2024, Germany allocated USD 4.5 billion to modernize hospital infrastructure, digital health systems, and medical technology under the new Hospital Future Act. These improvements are driving higher demand for plastic components used in imaging equipment, diagnostic cartridges, and surgical disposables. Medical plastics are favored for their low cost, ease of processing, and ability to meet high hygiene standards. Hospitals are also emphasizing efficiency and infection control, leading to the widespread adoption of single-use plastic tools and devices. Infrastructure modernization is creating opportunities for plastic suppliers to introduce innovative materials that support automation, reduce maintenance, and enhance patient outcomes across various clinical settings. Thus, Rising investments in healthcare infrastructure are expected to boost the Germany medical plastics market expansion during the forecast period.

Medical Device Regulatory Compliance: The German medical device industry operates under strict EU regulations that require high levels of material traceability, safety, and performance. To meet these requirements, manufacturers are increasingly relying on specialized medical-grade plastics that offer consistent quality and proven biocompatibility. Regulatory frameworks such as MDR (Medical Device Regulation) are pushing companies to carefully select polymers that can withstand sterilization and meet long-term implantation standards when needed. This regulatory-driven approach is encouraging material innovation, prompting suppliers to develop advanced plastics that comply with audits and certifications while supporting evolving device design needs. The emphasis on compliance is fueling demand for trusted, approved plastic solutions, which fuels the Germany medical plastics market growth.

Segmental Insights

Polymer Type Analysis

Based on polymer type, the Germany medical plastics market segmentation includes thermoplastics, elastomers, biodegradable polymers, and others. The thermoplastics segment accounted for the largest revenue share of ~72.4% in 2024 due to their adaptability in precision manufacturing and compliance with stringent EU medical standards. These polymers are widely used in producing housings for diagnostic equipment, surgical trays, IV components, and protective enclosures. Their resistance to sterilization processes such as gamma radiation and steam autoclaving makes them suitable for hospital environments. The German medical device sector benefits from local access to high-quality thermoplastic materials that ensure consistency and reliability. Process efficiency, coupled with strong demand for lightweight, durable materials, reinforced the dominant position of the thermoplastics segment.

Application Analysis

In terms of application, the Germany medical plastics market segmentation includes medical instruments & devices, medical disposable, diagnostic instruments & tools, and others. The medical disposable segment is projected to register the highest CAGR of 7.0% from 2025 to 2034 due to the rising emphasis on hygiene, safety, and efficiency in care delivery. Single-use plastics are being increasingly adopted across hospitals and outpatient centers for items such as surgical masks, catheters, collection bags, and tubing systems. Regulatory focus on infection control and pressure to reduce hospital-acquired infections are pushing healthcare providers to transition from reusable instruments to sterile disposables. Domestic innovation in automated production and sustainable plastic alternatives is also supporting this growth, helping manufacturers meet safety and environmental performance goals.

Key Players & Competitive Analysis

The Germany medical plastics market reflects a competitive structure anchored in precision manufacturing and strict regulatory compliance. Industry analysis points to sustained investments in high-grade thermoplastics and engineering polymers used in surgical tools, implants, and diagnostic equipment. Market expansion strategies are centered on high-performance, customizable polymers for complex medical applications. Players are pursuing mergers and acquisitions to strengthen material innovation capabilities and expand downstream device manufacturing operations. Post-merger integration efforts focus on harmonizing quality control, regulatory processes, and automation standards. Strategic alliances with research institutes and healthcare providers are fostering next-generation material development. Joint ventures with European and Asian firms are enabling technology transfers and product localization. Technological advancements in additive manufacturing, antimicrobial plastics, and bio-based polymers are contributing to enhanced market competitiveness. These combined efforts help maintain Germany’s leadership in medical-grade material innovation while aligning with sustainability and precision care trends.

Key Players

- Arkema

- BASF

- Celanese Corporation

- Covestro AG

- Dow

- Eastman Chemical Company

- Evonik Industries AG

- INEOS

- Kraton Corporation

- Röchling SE & Co. KG

- Solvay

- Trinseo

Germany Medical Plastics Industry Developments

September 2024: Evonik launched a new spray drying facility for EUDRAGIT polymers in Darmstadt, enhancing supply security, reducing delivery times, and supporting sustainable production for pharmaceutical oral drug delivery solutions.

April 2024: Evonik expanded RESOMER powder biomaterials capacity in Germany, introducing solvent-free micronization for customized particle sizes, enhancing medical device and aesthetic applications.

March 2024: Covestro launched a new polycarbonate copolymer plant using a solvent-free melt process to enable customizable properties for applications in electronics and healthcare.

Germany Medical Plastics Market Segmentation

By Polymer Type Outlook (Revenue, USD Million, 2020–2034)

- Thermoplastics

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polyethylene (PE)

- Polycarbonate (PC)

- Polyurethane

- Acrylonitrile Butadiene Styrene (ABS)

- Others

- Elastomers

- Biodegradable Polymers

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Medical Instruments & Devices

- Medical Disposable

- Diagnostic Instruments & Tools

- Others

By Manufacturing Outlook (Revenue, USD Million, 2020–2034)

- Extrusion Tubing

- Injection Molding

- Compression Molding

- Other

Germany Medical Plastics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2,339.27 million |

|

Market Size in 2025 |

USD 2,493.72 million |

|

Revenue Forecast by 2034 |

USD 4,382.91 million |

|

CAGR |

6.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The Germany market size was valued at USD 2,339.27 million in 2024 and is projected to grow to USD 4,382.91 million by 2034.

The Germany market is projected to register a CAGR of 6.5% during the forecast period.

A few of the key players in the market are Evonik Industries AG, BASF, Covestro AG, Solvay, Dow, Celanese Corporation, Eastman Chemical Company, Arkema, Kraton Corporation, INEOS, Röchling SE & Co. KG, and Trinseo.

The thermoplastics segment accounted for the largest revenue share of ~72.4% in 2024 due to their adaptability in precision manufacturing and compliance with stringent EU medical standards.

The medical disposable segment is projected to register the highest CAGR of 7.0% from 2025 to 2034 due to rising emphasis on hygiene, safety, and efficiency in care delivery.