China Medical Plastics Market Size, Share, Trends, Industry Analysis Report

By Polymer Type (Thermoplastics, Elastomers, Biodegradable Polymers, Others), By Application, By Manufacturing – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM6242

- Base Year: 2024

- Historical Data: 2020-2023

Overview

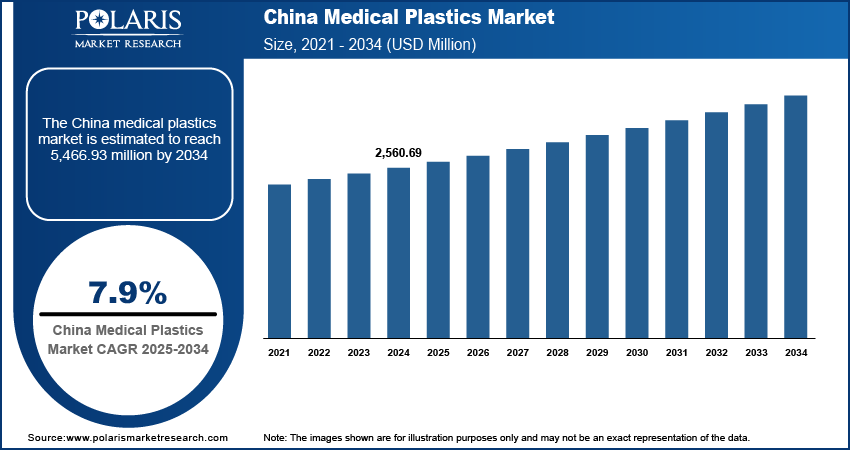

The China medical plastics market size was valued at USD 2,560.69 million in 2024, growing at a CAGR of 7.9% from 2025 to 2034. Hospitals and clinics are increasingly shifting to disposable plastic-based products to reduce infection risk and streamline sterilization, which boosts the demand for high-performance medical-grade plastics in surgical equipment, syringes, catheters, and diagnostic components.

Key Insights

- The thermoplastics segment captured ~72.4% of the revenue share in 2024, driven by their versatility in precision manufacturing and growing compliance with international medical device standards.

- The medical disposables segment is expected to register the highest CAGR of 7.0% from 2025 to 2034, fueled by rising demand for infection control, hygiene, and efficient healthcare delivery.

Industry Dynamics

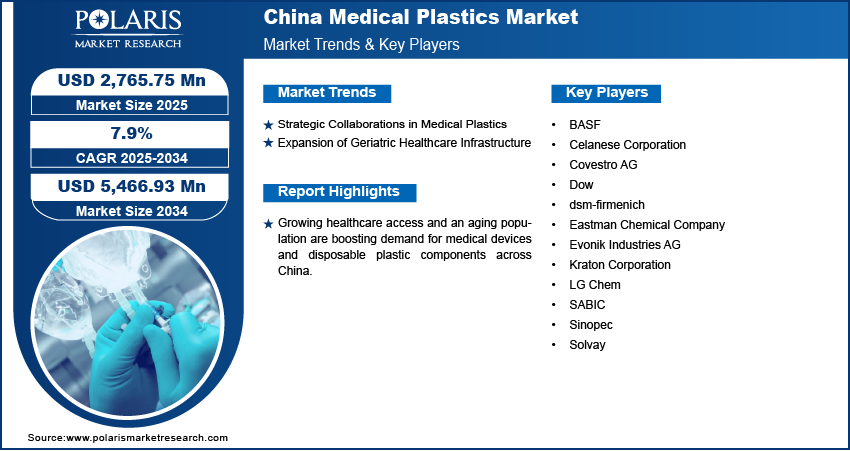

- Growing healthcare access and an aging population are boosting demand for medical devices and disposable plastic components across China.

- Increased focus on domestic self-reliance in healthcare manufacturing is accelerating the localization of medical plastic production and innovation.

- Surge in medical device exports and expansion of GMP-certified facilities drive demand for ISO-compliant medical polymers.

- Stringent environmental regulations on plastic use and recycling create compliance challenges for manufacturers.

Market Statistics

- 2024 Market Size: USD 2,560.69 million

- 2034 Projected Market Size: USD 5,466.93 million

- CAGR (2025–2034): 7.9%

The medical plastics market involves the production and application of plastic materials used in the manufacture of medical devices, packaging, diagnostic tools, implants, and disposables. These plastics offer advantages such as biocompatibility, durability, sterility, and ease of molding for complex designs. Government incentives are encouraging domestic medical manufacturing by boosting investments in plastic-based innovations. This support enables local companies to enhance the quality and cost-efficiency of medical-grade polymers, benefiting both public and private healthcare sectors.

Improvements in injection molding, extrusion, and 3D printing are enabling precision production of complex medical components using polymers, creating new possibilities in patient-specific devices and wearable medical systems. Moreover, the increase in remote patient monitoring and home-based medical services is driving demand for user-friendly, compact, and disposable plastic-based devices, including oxygen delivery tools and portable diagnostics.

Drivers & Opportunities

Expansion of Geriatric Healthcare Infrastructure: China’s aging population is creating strong pressure on the healthcare system to expand elderly care services and facilities. According to the United Nations, by 2050, the population of older adults in China will reach approximately 366 million. Chronic diseases such as cardiovascular disorders, diabetes, and arthritis are more prevalent among older adults, increasing the demand for durable and biocompatible medical devices. Healthcare providers are investing in advanced mobility aids, diagnostic tools, and therapeutic equipment that rely heavily on lightweight and high-strength plastics. These materials help in reducing the overall weight of devices while maintaining safety and performance. The shift toward home-based and long-term care solutions is also boosting demand for plastic-based disposable and portable medical products.

Strategic Collaborations in Medical Plastics Industry: Chinese manufacturers and international suppliers are forming partnerships to accelerate innovation in medical-grade plastic solutions. These collaborations involve raw material providers, device manufacturers, and academic institutions working together to create high-performance, cost-effective plastic components for a variety of applications. Joint ventures and research agreements are enabling faster prototyping, better regulatory compliance, and smoother commercialization of advanced plastic materials. Companies are leveraging shared resources and expertise to develop specialized formulations suited for minimally invasive devices, drug delivery systems, and surgical instruments. This cooperative ecosystem is strengthening the competitiveness of China’s medical plastics market in local and global contexts. Hence, the rising strategic collaborations among market players drive the China medical plastics market expansion.

Segmental Insights

Polymer Type Analysis

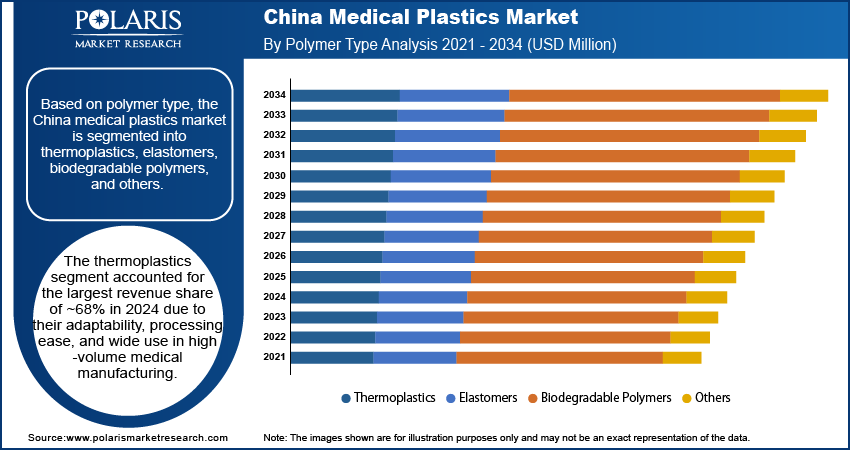

Based on polymer type, the China medical plastics market segmentation includes thermoplastics, elastomers, biodegradable polymers, and others. The thermoplastics segment accounted for the largest revenue share of ~68% in 2024 due to their adaptability, processing ease, and wide use in high-volume medical manufacturing. Manufacturers in China prefer thermoplastics such as polyethylene, polypropylene, and polycarbonate for producing syringes, IV components, surgical instruments, and casings. These materials offer durability, chemical resistance, and sterilization compatibility, making them suitable for both reusable and single-use applications. The ability to mold thermoplastics into precise, complex shapes at a lower cost has significantly reduced production timelines. Their strong regulatory track record and recyclability also make them an appealing choice across hospital and laboratory environments.

Application Analysis

In terms of application, the China medical plastics market segmentation includes medical instruments & devices, medical disposable, diagnostic instruments & tools, and others. The medical disposable segment is projected to register the highest CAGR of 7.8% from 2025 to 2034, supported by rising demand for infection-free healthcare delivery and efficiency in treatment cycles. Hospitals, clinics, and home-care providers are increasing their reliance on single-use items such as gloves, tubing, catheters, and diagnostic kits. China’s emphasis on patient safety and infection control is accelerating the shift toward high-volume, plastic-based disposables that minimize cross-contamination risks. The integration of automated production lines using medical-grade plastics has enabled large-scale output to meet growing local and export demands. This trend is further supported by advancements in sterilization-ready plastics tailored for sensitive healthcare environments.

Key Players and Competitive Analysis

The China medical plastics market is evolving rapidly through aggressive industrialization and government-backed healthcare modernization. Industry analysis highlights strong domestic competition supported by cost-effective manufacturing and strategic regional clustering. Market expansion strategies are driven by vertical integration and mass production capabilities, targeting growing internal demand and export markets. Joint ventures between local and foreign firms are supporting technology upgrades and regulatory compliance. Mergers and acquisitions are taking place across resin supply, component molding, and device assembly, enabling streamlined post-merger integration and efficient scale-up. Strategic alliances with public health institutions are fostering rapid prototyping and field validation of disposable products.

Players are investing heavily in automation and high-throughput manufacturing to meet evolving volume and quality demands. Technology advancements in biodegradable polymers, precision extrusion, and sterilization-safe materials are enhancing product performance and shelf life. These competitive dynamics are reinforcing China's position as both a manufacturing powerhouse and an emerging innovator in medical plastics.

Key Players

- BASF

- Celanese Corporation

- Covestro AG

- Dow

- dsm-firmenich

- Eastman Chemical Company

- Evonik Industries AG

- Kraton Corporation

- LG Chem

- SABIC

- Sinopec

- Solvay

China Medical Plastics Industry Developments

September 2024: Avient Corporation showcased its portfolio of medical-grade materials at Medtec China 2024, announcing expanded manufacturing in China for its NEU Custom Capabilities and NEUSoft TPU solutions for catheter applications.

China Medical Plastics Market Segmentation

By Polymer Type Outlook (Revenue, USD Million, 2020–2034)

- Thermoplastics

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polyethylene (PE)

- Polycarbonate (PC)

- Polyurethane

- Acrylonitrile Butadiene Styrene (ABS)

- Others

- Elastomers

- Biodegradable Polymers

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Medical Instruments & Devices

- Medical Disposable

- Diagnostic Instruments & Tools

- Others

By Manufacturing Outlook (Revenue, USD Million, 2020–2034)

- Extrusion Tubing

- Injection Molding

- Compression Molding

- Other

China Medical Plastics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2,560.69 million |

|

Market Size in 2025 |

USD 2,765.75 million |

|

Revenue Forecast by 2034 |

USD 5,466.93 million |

|

CAGR |

7.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The China market size was valued at USD 2,560.69 million in 2024 and is projected to grow to USD 5,466.93 million by 2034.

The China market is projected to register a CAGR of 7.9% during the forecast period.

A few of the key players in the market are SABIC, Dow, BASF, Covestro AG, Solvay, Evonik Industries AG, Celanese Corporation, Eastman Chemical Company, DSM-Firmenich, Kraton Corporation, LG Chem, and Sinopec.

The thermoplastics segment accounted for the largest revenue share of ~68% in 2024 due to their adaptability, processing ease, and wide use in high-volume medical manufacturing.

The medical disposable segment is projected to grow at the highest CAGR of 7.8% from 2025 to 2034, supported by rising demand for infection-free healthcare delivery and efficiency in treatment cycles