Microarray Market Size, Share, Trends, Industry Analysis Report

By Product & Services (Consumables, Software & Services, Instruments), By Type, By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM6040

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

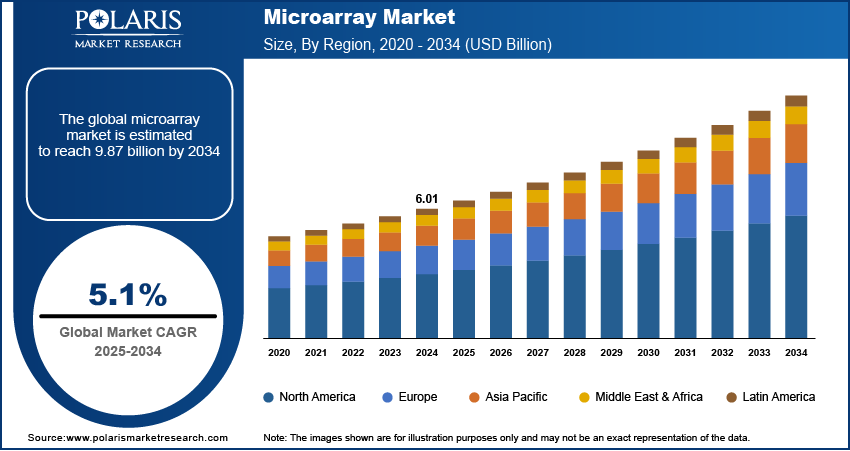

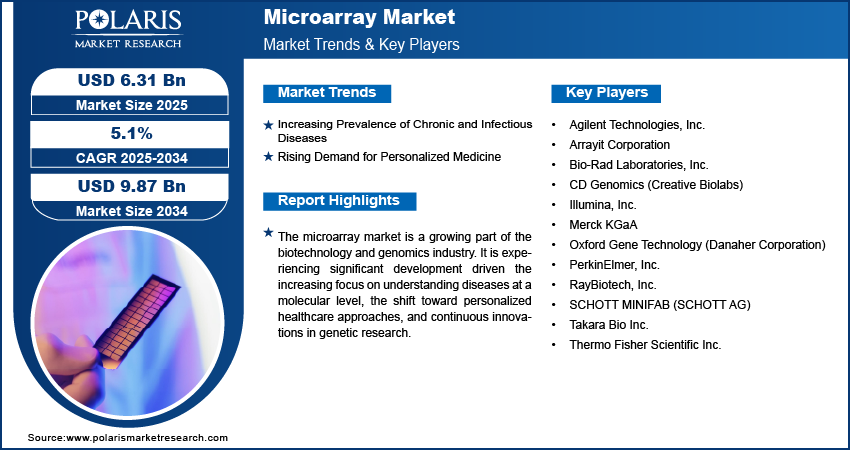

The global microarray market size was valued at USD 6.01 billion in 2024 and is anticipated to register a CAGR of 5.1% from 2025 to 2034. The market is growing due to an increasing prevalence of diseases such as cancer, which drives the need for better ways to find and understand them. There is also a growing push for personalized medicine, where treatments are made based on one’s unique genetic makeup.

Key Insights:

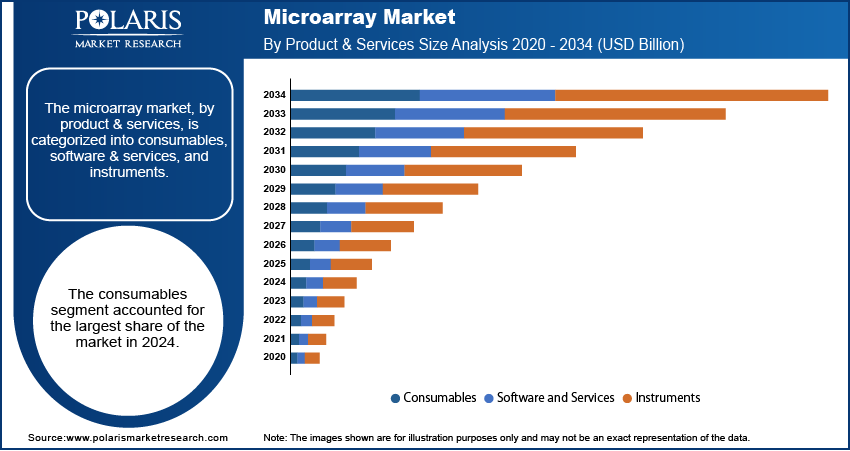

- By product & services, the consumables segment held the largest share in 2024 as these items such as reagents, probes, and slides are essential for every microarray experiment. Their recurring purchase is driven by the continuous use of microarray technology in various research and diagnostic applications.

- By type, the DNA microarrays segment held the largest share in 2024 due to their broad use in genetic research, diagnostics, and drug discovery. They are crucial for studying gene expression and identifying genetic variations, making them a fundamental tool in understanding diseases and developing personalized medicine approaches.

- By application, the research applications segment held the largest share in 2024, as microarrays are widely used in academic and scientific studies to understand complex biological processes. Their versatility in gene expression profiling, genotyping, and epigenetics research in various institutions drives this segment's leading position.

- By end use, the research and academic institutes segment held the largest share in 2024 due to their continuous engagement in fundamental scientific research and advanced genomics and proteomics studies.

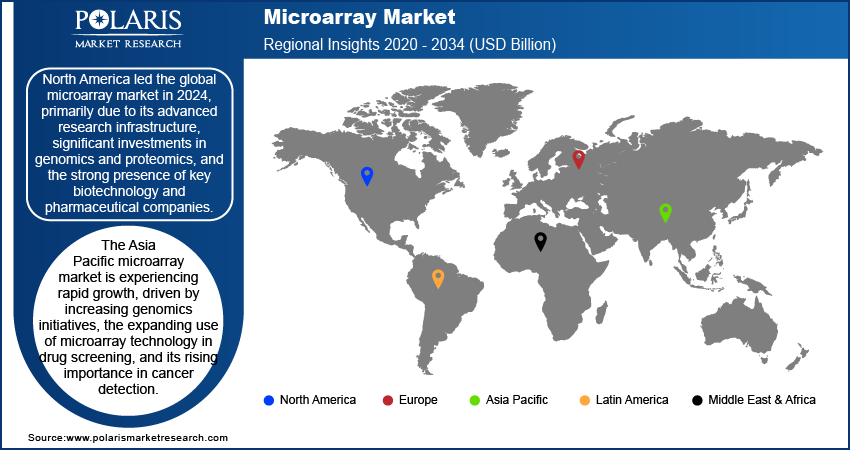

- By region, North America held the largest share in 2024, primarily due to its advanced research infrastructure, significant investments in genomics and proteomics, and the strong presence of key biotechnology and pharmaceutical companies.

Industry Dynamics

- The growing number of people affected by chronic and infectious diseases worldwide is increasing the demand for diagnostic and research tools such as microarrays.

- The increasing focus on personalized medicine, which tailors treatments to an individual's unique genetic makeup, is a major driver for the microarray demand.

- Continuous advancements in genomics and proteomics technologies are making microarray platforms more sophisticated and versatile. These improvements enhance the accuracy and efficiency of protein and genetic analysis, expanding the applications of microarrays.

- The increasing amount of research in pharmacogenomics, the study of how genes affect a person's response to drugs, is boosting the use of microarrays.

Market Statistics

- 2024 Market Size: USD 6.01 billion

- 2034 Projected Market Size: USD 9.87 billion

- CAGR (2024–2034): 5.1%

- North America: Largest market in 2024

The microarray market involves technology that allows researchers to study many genes or proteins at once. It uses a small chip with thousands of tiny spots, each holding a specific DNA or protein. By checking how samples react with these spots, scientists can obtain a lot of information about genetic activity or disease markers.

Ongoing advancements in microarray technology are a crucial driver. These advancements include improvements in array density, leading to more data points on a single chip, and enhanced sensitivity, allowing for the detection of even very low levels of target molecules. There have also been significant developments in automation, making the processes of sample preparation, hybridization, and data acquisition more efficient and less prone to human error.

The explosion of data generated by microarray experiments has made the role of bioinformatics and advanced data analysis tools increasingly important, acting as a significant driver. Microarrays produce vast and complex datasets that require sophisticated computational methods for proper interpretation, visualization, and meaningful insights. As the technology allows for higher throughput and more multiplexed assays, the need for robust software and analytical expertise to process this information efficiently becomes critical.

Drivers and Opportunities

Increasing Prevalence of Chronic and Infectious Diseases: The rising occurrence of chronic conditions, such as different types of cancer, and the ongoing challenge of infectious diseases globally are significant forces driving. These widespread health issues require fast and accurate ways to detect, classify, and monitor disease progression, as well as to develop new treatments. Microarrays offer a high-throughput method to analyze many biological markers at once, which is crucial for early detection and understanding disease mechanisms.

Cancer remains a major global health concern. The National Cancer Institute (NCI) stated in its "Cancer Statistics" update in May 2025 that there were nearly 20 million new cancer cases and 9.7 million cancer-related deaths worldwide in 2022. The report also projected that by 2050, the number of new cancer cases per year is expected to rise to 33 million. This high and increasing burden of cancer, along with other chronic and infectious diseases, directly fuels the demand for microarray technology to aid in diagnosis, prognosis, and therapeutic development, thereby driving the growth.

Rising Demand for Personalized Medicine: The shift toward personalized medicine, also known as precision medicine, is a powerful driver. This approach focuses on customizing healthcare decisions and treatments for individual patients based on their unique genetic, environmental, and lifestyle factors. Microarrays are essential in personalized medicine as they can analyze an individual's genetic profile to predict disease risk, drug response, and potential side effects, allowing for more effective and safer therapies.

A core component of personalized medicine involves understanding an individual's genetic makeup. The National Human Genome Research Institute (NHGRI) at NIH highlights personalized medicine as an emerging practice that uses a person's genetic profile to guide decisions in disease prevention, diagnosis, and treatment, as noted in their "Personalized Medicine" educational resources updated in July 2025. This growing emphasis on tailoring medical interventions to individual patients' genetic predispositions is directly increasing the adoption of microarray platforms for gene expression profiling, biomarker discovery, and drug sensitivity testing. This trend significantly contributes to the overall growth.

Segmental Insights

Product & Service Analysis

Based on product & services, the segmentation includes consumables, software & services, and instruments. The consumables segment held the largest share in 2024. This is because every microarray experiment, whether for research or diagnosis, requires a constant supply of these items. Consumables include essential products such as reagents, probes, and slides, which are used up with each test or analysis. The ongoing need for these single-use or limited-use components ensures a continuous demand, especially as more laboratories and healthcare facilities adopt microarray technology for various applications. As the use of microarrays expands into areas such as genomics, proteomics, and clinical diagnostics, the recurring purchase of these necessary items contributes significantly to the overall revenue of this segment.

The instruments segment is anticipated to register the highest growth rate during the forecast period, driven by the increasing need for more automated, precise, and scalable tools in both molecular diagnostics and advanced research. As the complexity of genetic and proteomic studies increases, there is a growing demand for instruments that can handle a higher throughput of samples while maintaining accuracy. Innovations in microarray scanners and automated systems are making processes more efficient, reducing manual labor, and improving data quality. These advancements are vital for large-scale projects such as drug discovery and personalized medicine, where the ability to quickly process and analyze vast amounts of data is critical.

Type Analysis

Based on type, the segmentation includes DNA microarrays, protein microarrays, and other microarrays. The DNA microarrays segment held the largest share in 2024. This dominance is attributed to their widespread use in many fields, especially in genetic research, diagnostics, and drug discovery. DNA microarrays are highly effective for studying gene expression, which helps scientists understand how genes are turned on or off in different conditions, such as in healthy versus diseased cells. They are also crucial for genotyping, which involves looking at variations in a person's DNA, and for identifying disease-related biomarkers. The established nature of DNA microarray technology, coupled with its broad applicability in both academic research and clinical settings, ensures its continued leading position. Its role in the foundational understanding of genetic disorders and its contribution to personalized medicine have solidified its significant presence.

The protein microarrays segment is anticipated to register the highest growth rate during the forecast period. This anticipated rapid growth is propelled by the increasing focus on proteomics, the large-scale study of proteins, which are directly involved in most biological processes and are often the targets for drug development. Protein microarrays offer a powerful way to analyze many proteins at once, which is vital for understanding protein functions, discovering new biomarkers, studying protein-protein interactions, and developing novel diagnostic tests. As researchers delve deeper into the complex world of proteins and their roles in health and disease, the demand for sophisticated tools such as protein microarrays is increasing. This growing emphasis on protein-based research and diagnostics is a key factor driving the strong future growth of the protein microarray segment.

Application Analysis

Based on application, the segmentation includes research applications, drug discovery, disease diagnostics, and other applications. The research applications segment held the largest share in 2024. This dominance stems from the widespread use of microarray technology in various scientific studies aimed at understanding biological processes at a molecular level. Researchers extensively use microarrays for gene expression profiling, which helps in identifying genes that are activated or silenced under different conditions, such as disease states or in response to specific treatments. Additionally, microarrays are vital for genotyping, enabling the analysis of genetic variations across populations, and for epigenetics research, which examines changes in gene expression without altering the underlying DNA sequence. The continuous investments in academic and scientific research, coupled with the versatility and high-throughput capabilities of microarrays in exploring complex biological systems, underpin this segment's leading position.

The disease diagnostics segment is anticipated to register the highest growth rate during the forecast period. The increasing global burden of chronic and infectious diseases, along with the growing emphasis on early and precise diagnosis, is fueling this accelerated growth. Microarrays offer a powerful tool for simultaneously detecting multiple disease markers, genetic mutations, or pathogens from a single sample, making them highly valuable in clinical settings. Their ability to provide comprehensive genetic and proteomic information rapidly assists healthcare professionals in making more informed decisions regarding patient care and treatment strategies. As personalized medicine continues to evolve and the demand for more targeted and efficient diagnostic tools rises, the application of microarrays in diagnosing a wide array of diseases is expected to expand significantly, driving the considerable growth of this segment during the forecast period.

End Use Analysis

Based on end use, the segmentation includes research & academic institutes, pharmaceutical & biotechnology companies, diagnostic laboratories, and other end users. The research & academic institutes segment held the largest share in 2024, driven by its continuous engagement in fundamental scientific research, genomics, and proteomics studies. These institutions are at the forefront of exploring gene function, understanding disease mechanisms, and developing new biological insights, all of which heavily rely on microarray technology. The consistent funding from government bodies and various research grants further enables these institutes to invest in and utilize microarray platforms extensively for large-scale projects, such as gene expression profiling, genetic variation studies, and biomarker discovery. Their role in pushing the boundaries of scientific knowledge and training the next generation of researchers ensures a steady demand for microarray products and services.

The diagnostic laboratories segment is anticipated to record the highest growth rate during the forecast period, fueled by the increasing integration of microarray technology into routine clinical diagnostics. As healthcare shifts toward more precise and personalized approaches, diagnostic laboratories are adopting microarrays for their ability to provide comprehensive genetic and proteomic information for disease diagnosis, prognosis, and treatment monitoring. The rising demand for early disease detection, particularly for complex conditions such as cancer and genetic disorders, is a key factor. Microarrays offer a high-throughput and accurate method to identify specific disease markers or genetic mutations, which helps clinicians make more informed decisions about patient care.

Regional Analysis

The North America microarray market accounted for the largest share in 2024, due to its strong research infrastructure, substantial investments in genomics and proteomics, and the presence of many key companies. The region benefits from a high adoption rate of advanced diagnostic technologies and a growing emphasis on personalized medicine. Government funding for research initiatives, particularly in areas such as cancer and genetic disorders, further boosts the demand for microarray platforms in academic institutions and biotechnology firms. The focus on developing new drugs and therapies also drives the use of microarrays for drug discovery and development.

U.S. Microarray Market Insights

The U.S. is a major contributor to the North American microarray sector, driven by a strong push for personalized medicine, particularly in cancer treatment and the understanding of how individuals respond to drugs. Significant investments from government bodies such as the NIH, universities, and biotech companies make microarrays crucial for finding disease markers, profiling gene activity, and customizing treatments to improve patient outcomes. Further, microarrays are also being used more in agriculture and environmental science in the U.S.. For example, in precision farming, they are used to study plant genomes and find traits that help plants resist pests and climate challenges. This broad application across various sectors, along with continuous innovation, keeps the U.S. a leading country in the North America microarray market.

Europe Microarray Market Trends

Europe is a notable region in the microarray landscape, driven by the increasing demand for personalized medicine, ongoing advancements in genomic research, and the need for high-throughput diagnostic methods. The growing number of genetic disorders and chronic diseases, such as various cancers, across the region also contributes to the expansion of microarray technology. Investments in research and development within the biotechnology sector are creating a favorable environment for the adoption of new microarray applications in both therapeutic and diagnostic areas. The region's well-established academic institutions and healthcare systems play a crucial role in promoting the use and development of microarrays.

The Germany microarray market dominates in Europe, owing to its strong focus on scientific research and its robust biotechnology and pharmaceutical sectors. There is a high prevalence of chronic diseases across the country, which increases the demand for advanced diagnostic tools such as microarrays. Furthermore, Germany sees considerable investments in life sciences and a strong emphasis on personalized healthcare, encouraging the adoption of sophisticated genomic and proteomic analysis tools. Research institutions and diagnostic laboratories in Germany are actively using microarrays for various applications, from basic research to clinical diagnostics, solidifying its importance in the European market.

Asia Pacific Microarray Market Overview

The Asia Pacific market for microarray is experiencing rapid growth, driven by increasing genomics initiatives, the expanding use of microarray technology in drug screening, and its rising importance in cancer detection. The growing biotechnology sector and collaborations between private businesses and academic institutions also propel this growth. As countries in this region continue to invest in medical technologies and healthcare infrastructure, the microarray is set to expand significantly. The market encompasses a wide range of consumables, instruments, software, and services, driving progress in genomics and personalized medicine across the region.

China Microarray Market Insights

China is a key country in Asia Pacific, holding a substantial share due to its significant investments in genomics and precision medicine. Initiatives such as the China Precision Medicine Initiative have boosted the adoption of microarray technology in both research and diagnostic applications. The country's large patient population, a rapidly expanding biotechnology, and increasing government support for research and development activities have further fueled the expansion. Drug discovery and development are particularly strong application areas in China, with rising pharmaceutical R&D spending and a growing demand for new therapeutic agents, which widely incorporate microarray technology.

Key Players and Competitive Insights

The microarray industry features several major players that are actively shaping its competitive landscape. These include companies such as Agilent Technologies, Illumina, Thermo Fisher Scientific, Bio-Rad Laboratories, and PerkinElmer. The competitive environment is marked by ongoing innovation, strategic partnerships, and a focus on expanding product portfolios to meet the evolving needs of research, diagnostic, and pharmaceutical sectors. Companies are constantly working on developing more advanced microarray platforms, improving data analysis software, and enhancing the sensitivity and specificity of their assays.

A few prominent companies in the industry include Agilent Technologies, Inc.; Arrayit Corporation; Bio-Rad Laboratories, Inc.; CD Genomics (Creative Biolabs); Illumina, Inc.; Merck KGaA; Oxford Gene Technology (Danaher Corporation); PerkinElmer, Inc.; RayBiotech, Inc.; SCHOTT MINIFAB (SCHOTT AG); Takara Bio Inc.; and Thermo Fisher Scientific Inc.

Key Players

- Agilent Technologies, Inc.

- Arrayit Corporation

- Bio-Rad Laboratories, Inc.

- CD Genomics (Creative Biolabs)

- Illumina, Inc.

- Merck KGaA

- Oxford Gene Technology (Danaher Corporation)

- PerkinElmer, Inc.

- RayBiotech, Inc.

- SCHOTT MINIFAB (SCHOTT AG)

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

Microarray Industry Developments

June 2025: Illumina announced its plan to acquire SomaLogic, a move aimed at boosting its proteomics business and furthering its multiomics strategy.

February 2025: PathogenDx introduced its newly rebranded D3 Array assays—offered in Combined, Bacterial, and Fungal formats—as a replacement for the previous DetectX line. The D3 Array technology supports multiplex detection of up to 100 targets in a single test, delivering rapid, cost-efficient, and high-throughput solutions across agriculture, food safety, environmental, and clinical testing applications.

Microarray Market Segmentation

By Product & Services Outlook (Revenue – USD Billion, 2020–2034)

- Consumables

- Software & Services

- Instruments

By Type Outlook (Revenue – USD Billion, 2020–2034)

- DNA Microarrays

- Protein Microarrays

- Other Microarrays

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Research Applications

- Drug Discovery

- Disease Diagnostics

- Other Applications

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Research & Academic Institutes

- Pharmaceutical & Biotechnology Companies

- Diagnostic Laboratories

- Other End Users

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Microarray Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 6.01 billion |

|

Market Size in 2025 |

USD 6.31 billion |

|

Revenue Forecast by 2034 |

USD 9.87 billion |

|

CAGR |

5.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 6.01 billion in 2024 and is projected to grow to USD 9.87 billion by 2034.

The global market is projected to register a CAGR of 5.1% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include Agilent Technologies, Inc.; Arrayit Corporation; Bio-Rad Laboratories, Inc.; CD Genomics (Creative Biolabs); Illumina, Inc.; Merck KGaA; Oxford Gene Technology (Danaher Corporation); PerkinElmer, Inc.; RayBiotech, Inc.; SCHOTT MINIFAB (SCHOTT AG); Takara Bio Inc.; and Thermo Fisher Scientific Inc.

The consumables segment accounted for the largest share of the market in 2024.

The protein microarrays segment is expected to witness the fastest growth during the forecast period.