Epigenetics Market Size, Share, Trends, Industry Analysis Report

By Product (Kits & Reagents, Enzymes, Equipment & Accessories, Software, Service), By Technology, By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 130

- Format: PDF

- Report ID: PM2685

- Base Year: 2024

- Historical Data: 2020 - 2023

Market Overview

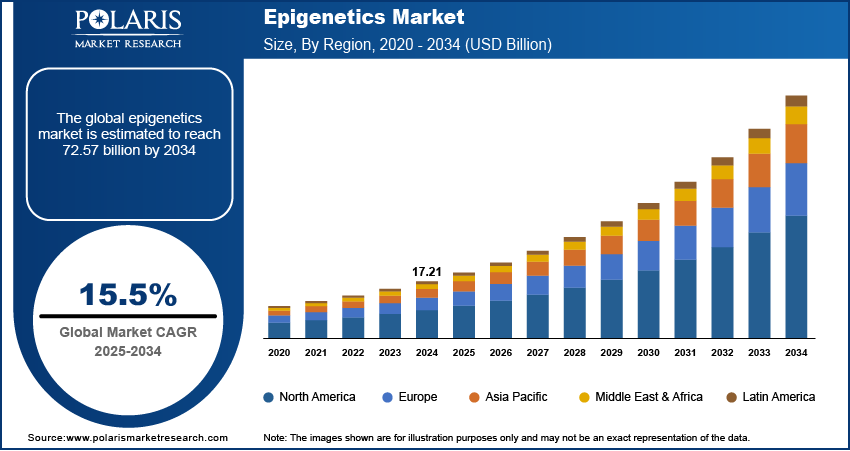

The global epigenetics market size was valued at USD 17.21 billion in 2024 and is anticipated to register a CAGR of 15.5% from 2025 to 2034. The industry is driven by the rising demand for personalized medicine and growing research in cancer treatment. Increasing government funding for epigenetic studies also supports market growth. Additionally, advancements in technology make epigenetic testing more accessible and affordable.

Key Insights

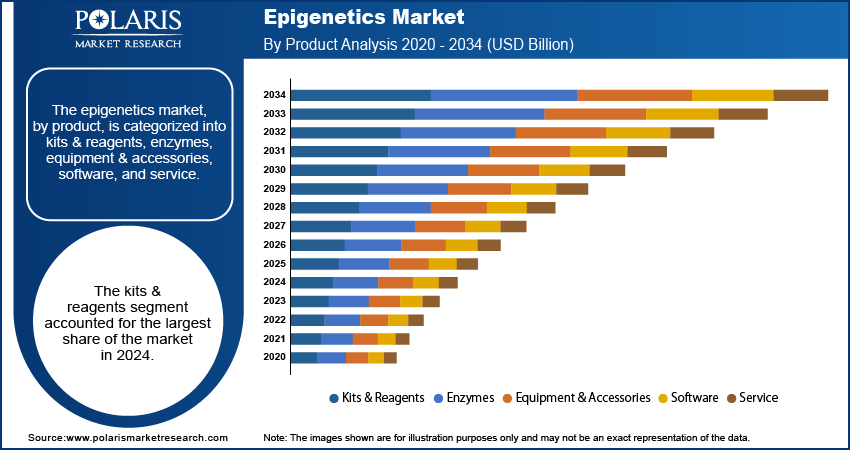

- By product, the kits & reagents segment held the largest share in 2024 as they are essential for conducting epigenetic experiments and are widely used across research and clinical labs. Their versatility and ease of use make them the most sought-after product type.

- In terms of technology, the DNA methylation segment held the largest share in 2024 due to its critical role in gene regulation and disease studies, especially cancer. It is a well-established method widely used for diagnostics and therapeutic research.

- By application, the oncology segment held the largest share in 2024 as epigenetic changes are closely linked to cancer development and treatment. The demand for epigenetic biomarkers and targeted therapies in cancer drives this segment’s dominance.

- Based on end use, the academic research segment held the largest share in 2024 since universities and research institutions are the primary users of epigenetic tools. Strong funding and ongoing studies make this segment key to market demand.

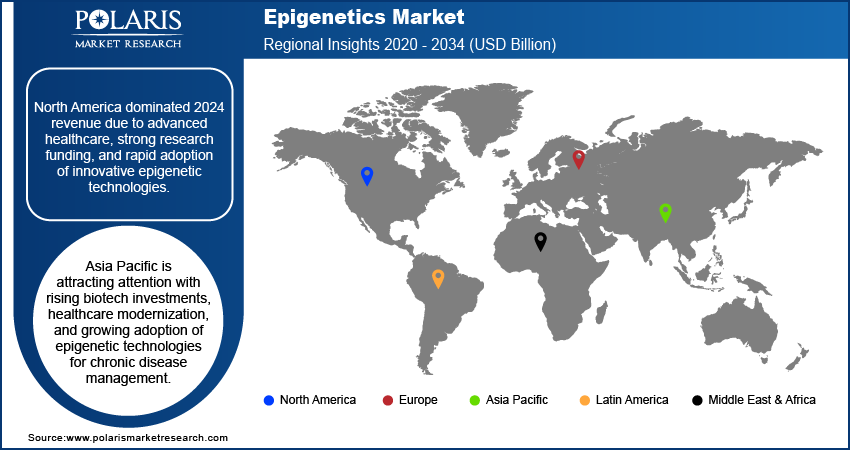

- By region, North America dominated the global revenue share in 2024, due to its advanced healthcare infrastructure, high research funding, and early adoption of innovative epigenetic technologies. It remains a global hub for epigenetics research and application.

Industry Dynamics

- Growing interest in personalized medicine is pushing research into how genes can be switched on or off, helping develop targeted therapies for diseases such as cancer. This focus improves treatment effectiveness and reduces side effects, driving the demand for epigenetic tools and technologies.

- Increasing government support and funding for research in gene regulation and epigenetics is accelerating innovation. This support helps scientists explore new ways to diagnose and treat complex diseases, encouraging the development of new epigenetic-based drugs and diagnostic tests.

- Technological advancements in sequencing and bioinformatics have made epigenetic analysis faster and more affordable. These improvements enable researchers and clinicians to better understand gene expression patterns, boosting the use of epigenetic markers in disease diagnosis and treatment monitoring.

Market Statistics

- 2024 Market Size: USD 17.21 billion

- 2034 Projected Market Size: USD 72.57 billion

- CAGR (2025–2034): 15.5%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Epigenetics involves studying changes in gene activity that don’t alter the DNA sequence but can affect how genes are turned on or off. This field helps understand how external factors influence gene expression, playing a key role in health and disease management. The market focuses on tools and technologies used to study these changes.

Growing interest in agricultural applications and increasing focus on aging research drive the market expansion. In agriculture, epigenetic techniques are being explored to improve crop yield and resistance without genetic modification. This opens new opportunities outside traditional medical uses. In aging research, epigenetics helps scientists understand how gene expression changes over time, offering potential ways to delay or treat age-related diseases.

Environmental factors such as temperature or stress can cause epigenetic changes in plants, helping them adapt better to harsh conditions. For example, certain crops show improved drought resistance through epigenetic modifications, which could help secure food supply amid climate change challenges. Government-funded research programs in several countries support these studies, promoting sustainable farming practices.

Drivers and Trends

Increasing Focus on Cancer Research and Personalized Medicine: Epigenetics plays a crucial role in cancer research as it helps identify changes in gene expression that contribute to tumor growth and resistance to treatment. Many cancer types, including breast, lung, and colorectal cancers, have shown epigenetic modifications linked to disease progression. Epigenetic markers are used to develop personalized treatment plans that improve patient outcomes by targeting specific gene alterations. This shift toward precision medicine relies heavily on understanding epigenetic changes, leading to more effective therapies.

A 2023 study published on NCBI titled "Epigenetic mechanisms in cancer: implications for diagnosis and treatment" reported that DNA methylation and histone modification patterns are widely used as biomarkers for early cancer detection and therapy monitoring. An article from PubMed, "Personalized medicine and epigenetic modifications in cancer," showed that therapies targeting epigenetic regulators improved survival rates in some cancer patients by up to 25%. These findings emphasize how advances in epigenetic research are essential in cancer treatment and are driving the demand for epigenetic tools and diagnostics in the healthcare sector.

Technological Advances in Epigenetic Analysis: Technological improvements in sequencing and bioinformatics have made it easier to study epigenetic changes at a deeper level. Techniques such as next-generation sequencing (NGS) and chromatin immunoprecipitation sequencing (ChIP-seq) allow researchers to map epigenetic modifications with high accuracy and speed. These advancements have lowered costs and increased accessibility, making epigenetic testing more routine in both research and clinical settings.

A recent article from NCBI titled "Advances in epigenetic technologies for clinical applications" in 2024 highlighted that the cost of epigenetic sequencing has dropped by more than 40% over the past five years, making it more feasible for widespread use in diagnostics and drug development. Furthermore, research published on PubMed, "Bioinformatics tools in epigenetics research," noted that improved data analysis software has helped identify novel epigenetic biomarkers for diseases such as diabetes and neurodegenerative disorders. These technological strides expand the applications of epigenetics beyond cancer and increase the demand for epigenetic products and services.

Segmental Insights

Product Analysis

Based on product, the segmentation includes kits & reagents, enzymes, equipment & accessories, software, and service. The kits & reagents segment held the largest share in 2024. These consumables are widely used in various applications such as DNA methylation analysis, histone modification studies, and chromatin remodeling assays. Their broad usage in both academic research and clinical diagnostics makes them a staple in laboratories working on gene expression and regulation. Kits and reagents provide ready-to-use, standardized solutions that simplify complex experimental procedures, which drives their steady demand. Moreover, as research into epigenetics expands across numerous disease areas such as cancer, neurological disorders, and autoimmune diseases, the need for reliable and diverse kits and reagents continues to grow. This segment’s established presence and consistent demand from a wide range of users contribute to its dominant position in the overall product category.

The software segment is anticipated to register the highest growth rate during the forecast period. Advanced bioinformatics services, tools, and software solutions are critical for analyzing and interpreting large-scale epigenetic datasets generated through sequencing and other technologies. Researchers and clinicians rely on these platforms to identify meaningful patterns in gene regulation, predict disease outcomes, and develop personalized treatment plans. The rising use of high-throughput technologies has created an urgent need for powerful software that can manage and analyze big data efficiently. Additionally, improvements in artificial intelligence and machine learning are being integrated into epigenetic software, enhancing its capability to provide deeper insights.

Technology Analysis

Based on technology, the segmentation includes DNA methylation, histone methylation, histone acetylation, large non-coding RNA, microRNA modification, and chromatin structures. The DNA methylation segment held the largest share in 2024. It involves the addition of methyl groups to DNA molecules, which can turn genes on or off without changing the DNA sequencing. This modification is widely studied because of its strong connection to various diseases, especially cancer, where abnormal DNA methylation patterns can lead to tumor growth and progression. Many diagnostic tests and therapeutic approaches focus on detecting or reversing these methylation changes, making DNA methylation analysis a foundational tool in both research and clinical settings. The established reliability and broad application of DNA methylation technology continue to keep it at the forefront of epigenetic studies and commercial use.

The microRNA modification segment is anticipated to register the highest growth rate during the forecast period. MicroRNAs are small non-coding RNA molecules that regulate gene expression by targeting messenger RNA, influencing many biological processes and disease pathways. The growing recognition of microRNAs’ role in conditions such as cancer, cardiovascular diseases, and neurological disorders has sparked significant interest in studying and manipulating these molecules. Advances in detection techniques and bioinformatics tools have made microRNA analysis more accessible, supporting its rapid adoption. Additionally, therapeutic approaches targeting microRNA are being developed to modulate gene expression more precisely, opening new possibilities for treatment. This rising focus on microRNA modification is driving innovation and investment, fueling its rapid growth within the epigenetics technology landscape.

Application Analysis

Based on application, the segmentation includes oncology, metabolic disorders, immunology, developmental biology, cardiovascular diseases, and others. The oncology segment held the largest share in 2024. Epigenetic modifications such as DNA methylation and histone alterations play a key role in turning oncogenes on or off, influencing tumor growth and resistance to treatments. These insights have led to the development of epigenetic biomarkers that assist in early diagnosis, prognosis, and monitoring of cancer therapy effectiveness. Additionally, epigenetic drugs targeting these modifications are becoming important parts of cancer treatment regimens. The urgent need for better cancer detection methods and personalized therapies keeps oncology at the forefront of epigenetic applications, ensuring steady demand for related products and services in this field.

The metabolic disorders segment is anticipated to register the highest growth rate during the forecast period. Epigenetic factors significantly impact conditions such as diabetes, obesity, and other metabolic syndromes by affecting how genes related to metabolism are expressed. For example, an unhealthy diet and lifestyle can trigger epigenetic changes that alter insulin sensitivity or fat storage. This growing understanding is driving more studies and development of diagnostic tools that can detect epigenetic markers associated with metabolic diseases. Moreover, epigenetic therapies are being explored as potential treatments to reverse harmful gene expression patterns. This increasing focus on the role of epigenetics in metabolic health is expanding the application of epigenetic technologies beyond traditional areas, pushing rapid growth in this segment.

End Use Analysis

Based on end use, the segmentation includes academic research, clinical research, hospitals & clinics, pharmaceutical & biotechnology companies, and other users. The academic research segment held the largest share in 2024. Universities and research institutions conduct extensive studies to explore how epigenetic mechanisms influence gene expression and contribute to various diseases. This segment benefits from strong funding from government grants and public health organizations, which supports basic and applied research. Academic researchers rely heavily on epigenetic tools such as kits, reagents, and sequencing technologies to investigate disease pathways, drug responses, and potential therapeutic targets. The continuous expansion of epigenetics as a scientific field keeps academic institutions at the forefront of demand, as they are the primary users of new technologies and methodologies that drive innovation.

The pharmaceutical and biotechnology companies segment is anticipated to register the highest growth rate during the forecast period, driven by the rising interest in developing epigenetic-based therapies and diagnostics. These companies invest heavily in translating epigenetic discoveries into commercial products, such as drugs that target epigenetic modifications and companion diagnostic tests. The push toward personalized medicine encourages the development of epigenetic biomarkers to tailor treatments for individual patients. Additionally, pharmaceutical companies are increasingly collaborating with academic researchers to accelerate drug discovery processes. Innovations in epigenetic drug development, especially in cancer and rare diseases, are opening new opportunities in this segment. The growing focus on bringing epigenetic solutions is fueling rapid growth among pharmaceutical and biotechnology users.

Regional Analysis

The North America epigenetics market accounted for the largest share in 2024. North America is a key region due to its strong focus on healthcare innovation and extensive funding for biomedical research. The presence of leading research institutions, advanced healthcare infrastructure, and a growing number of clinical trials supports the adoption of epigenetic technologies. This region also benefits from early adoption of new diagnostic tools and therapies, driven by both public and private sector investments. The regulatory environment encourages innovation while ensuring safety, which attracts companies to develop and launch epigenetic products. These factors collectively make North America a major hub for epigenetics research and application.

U.S. Epigenetics Market Insights

The U.S. dominates the regional landscape with its robust research ecosystem and significant government support for epigenetics studies. Federal agencies such as the NIH provide considerable funding that accelerates discoveries and technology development. Additionally, the U.S. has a large base of pharmaceutical and biotechnology companies actively involved in epigenetic drug development and personalized medicine. The availability of advanced sequencing platforms and bioinformatics infrastructure also facilitates high-quality research and clinical application. Growing awareness about the role of epigenetics in various diseases fuels demand for diagnostics and therapeutics, reinforcing the country's leadership in this field.

Europe Epigenetics Market Trends

Europe holds a strong position in the epigenetics industry due to its well-established research networks and collaborations between academia and industry. Various European countries invest in epigenetic research to understand complex diseases and develop new treatments. The region’s regulatory bodies support innovation while maintaining patient safety, which encourages the adoption of epigenetic products in clinical practice. Additionally, European initiatives focused on precision medicine are helping expand epigenetic applications across healthcare systems.

The Germany epigenetics market stands out as a major contributor to epigenetics research and development in Europe. The country’s well-funded universities and research centers are at the forefront of studying epigenetic mechanisms in cancer and other chronic diseases. German pharmaceutical companies actively pursue epigenetic drug discovery, supported by government programs aimed at advancing biotechnology. The strong collaboration between academia and industry in Germany accelerates innovation, making it a key presence within Europe.

Asia Pacific Epigenetics Market Overview

The Asia Pacific industry is gaining attention for its growing investments in biotechnology and increasing focus on healthcare modernization. Rising awareness about the benefits of epigenetic research and the expanding prevalence of chronic diseases are encouraging the adoption of epigenetic technologies. Several countries in this region are working to strengthen their research infrastructure and build collaborations with global organizations to improve capabilities in epigenetics.

China Epigenetics Market Outlook

China, as a major country in Asia Pacific, is rapidly expanding its epigenetics research and clinical applications. The government’s support through funding and strategic initiatives has accelerated growth in biomedical research, including epigenetics. China’s large patient population provides opportunities for clinical trials and biomarker discovery. Moreover, increasing collaborations between Chinese research institutions and international partners are boosting technological advancements and product development. These factors make China a crucial in the region’s epigenetics landscape.

Key Players and Competitive Insights

The epigenetics market includes major players such as Thermo Fisher Scientific, Merck KGaA, QIAGEN, New England Biolabs, Agilent Technologies, Bio-Rad Laboratories, and EpiGentek. These companies have established strong positions by offering a wide range of products, including kits, reagents, instruments, and software that support epigenetic research and clinical applications. The competitive landscape is marked by continuous innovation, strategic collaborations, and expansion of product portfolios to meet the growing demand for advanced epigenetic tools. Companies focus on developing user-friendly, high-throughput technologies and improving the accuracy and sensitivity of epigenetic assays to maintain their positions.

A few prominent companies in the industry include Thermo Fisher Scientific, Merck KGaA, QIAGEN, New England Biolabs, Agilent Technologies, Bio-Rad Laboratories, EpiGentek, Zymo Research Corporation, Diagenode, Active Motif, PerkinElmer, and Illumina, Inc.

Key Players

- Active Motif

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Diagenode S.A.

- EpiGentek Group Inc.

- Illumina, Inc.

- Merck KGaA

- New England Biolabs, Inc.

- PerkinElmer, Inc.

- QIAGEN N.V.

- Thermo Fisher Scientific Inc.

- Zymo Research Corporation

Epigenetics Industry Developments

June 2025: Thermo Fisher Scientific announced a collaboration with Ethris to accelerate the development of mRNA-based therapeutics. This partnership aims to streamline the transition from early-stage research to clinical development, enhancing the efficiency of mRNA therapeutic advancements.

September 2024: Merck KGaA, Darmstadt, Germany, and BluMaiden Biosciences announced a partnership to offer end-to-end clinical trial analytics and reporting services based on the human microbiome.

Epigenetics Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Kits & Reagents

- Enzymes

- Equipment & Accessories

- Software

- Service

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- DNA Methylation

- Histone Methylation

- Histone Acetylation

- Large Non-coding RNA

- MicroRNA Modification

- Chromatin Structures

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Oncology

- Metabolic Disorders

- Immunology

- Developmental Biology

- Cardiovascular Diseases

- Others

By End-Use Outlook (Revenue – USD Billion, 2020–2034)

- Academic Research

- Clinical Research

- Hospitals & Clinics

- Pharmaceutical & Biotechnology Companies

- Other Users

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Epigenetics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 17.21 billion |

|

Market Size in 2025 |

USD 19.84 billion |

|

Revenue Forecast by 2034 |

USD 72.57 billion |

|

CAGR |

15.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 17.21 billion in 2024 and is projected to grow to USD 72.57 billion by 2034.

The global market is projected to register a CAGR of 15.5% during the forecast period.

North America dominated the share in 2024.

A few key players include Thermo Fisher Scientific, Merck KGaA, QIAGEN, New England Biolabs, Agilent Technologies, Bio-Rad Laboratories, EpiGentek, Zymo Research Corporation, Diagenode, Active Motif, PerkinElmer, and Illumina, Inc.

The kits & reagents segment accounted for the largest share in 2024.

The microRNA segment is expected to witness the fastest growth during the forecast period.