Glass Interposers Market Size, Share, Trend, Industry Analysis Report

By Wafer Size (Less Than 200 mm, 200 mm, 300 mm), By Substrate Technology, By Application, By End-Use Industry, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM6034

- Base Year: 2024

- Historical Data: 2020-2023

Overview

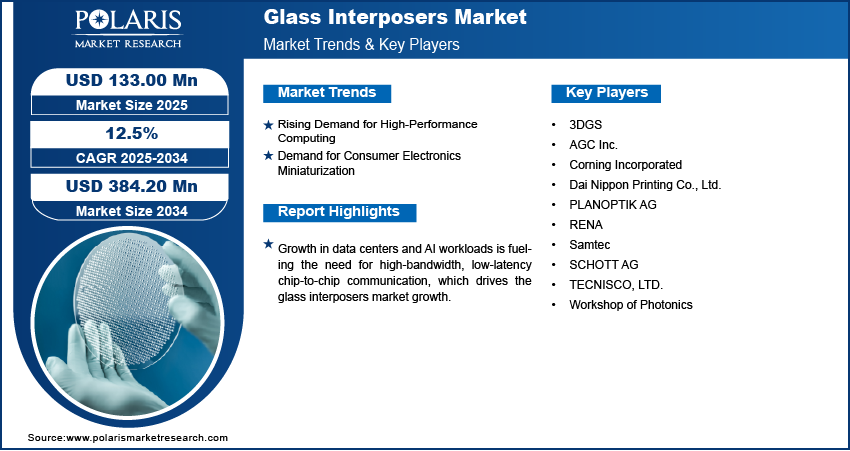

The global glass interposers market size was valued at USD 118.26 million in 2024, growing at a CAGR of 12.5% from 2025 to 2034. Growth in data centers and artificial intelligence (AI) workloads is fueling the need for high-bandwidth, low-latency chip-to-chip communication. Glass interposers enable dense interconnections and thermal control, supporting these complex computing environments.

Key Insights

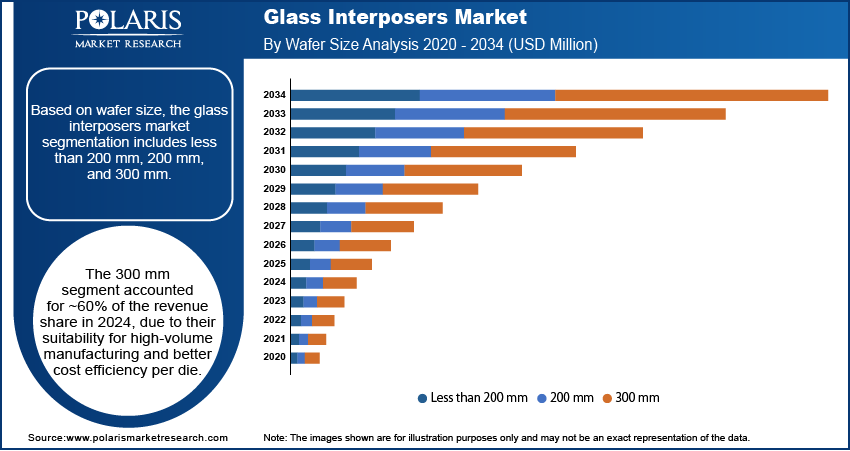

- The 300 mm segment accounted for ~60% of the revenue share in 2024.

- The through-glass vias segment held the largest revenue share in 2024.

- The consumer electronics segment accounted for the largest revenue share in 2024.

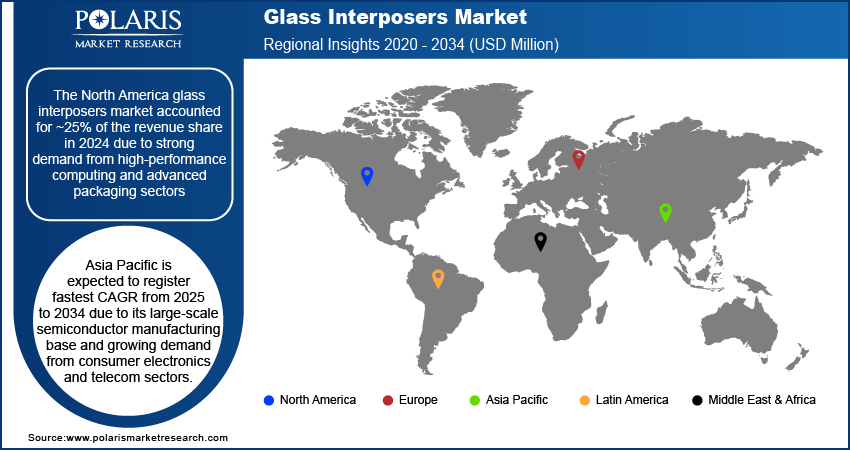

- North America accounted for ~25% of the glass interposers market revenue share in 2024.

- In 2024, the market in the U.S. accounted for the largest revenue share.

- Asia Pacific is expected to register the highest CAGR from 2025 to 2034.

- The market growth in Europe is supported by rising investments in automotive electronics, especially for electric and autonomous vehicles.

.webp)

The glass interposers market refers to the industry focused on the production and application of thin glass substrates used to electrically connect semiconductor components in advanced packaging. Glass interposers offer superior electrical insulation, thermal stability, and high-density interconnection, making them essential in high-performance computing, 5G, AI, and miniaturized electronics. Expanding 5G infrastructure for technology requires miniaturized, high-frequency components. Glass interposers offer low signal loss and impressive RF performance, making them ideal for antenna-in-package and RF module integration in 5G base stations and devices.

Trends such as 2.5D and 3D IC packaging are accelerating the shift toward glass interposers. Their flatness, scalability, and high I/O density make them ideal for advanced semiconductor integration. Moreover, ADAS and autonomous driving technologies require high-speed data processing. Glass interposers support the integration of high-frequency components, enabling reliable signal transmission in automotive radar and sensor systems.

Industry Dynamics

- High-performance computing environments such as data centers, AI accelerators, and high-speed processors are placing increasing demands on semiconductor packaging.

- Consumer electronics continue to evolve toward thinner, lighter, and more powerful devices, driving the need for compact packaging technologies.

- Growing demand for AI accelerators and 5G devices is driving the adoption of glass interposers for advanced semiconductor packaging in high-performance computing and consumer electronics.

- High manufacturing costs and technical complexity in mass production limit the adoption of glass interposers, especially among small and mid-sized semiconductor firms.

Rising Demand for High-Performance Computing: High-performance computing environments such as data centers, AI accelerators, and high-speed processors are placing increasing demands on semiconductor packaging. According to the U.S. Department of Commerce Bureau of Economic Analysis, data center investments in the U.S. grew by 14% in 2024, reaching a record USD 108 billion, driven by demand for AI and cloud infrastructure. These systems require components that support high bandwidth, low latency, and strong thermal performance to function efficiently under heavy workloads. Glass interposers are well-suited for this need due to their ability to provide dense interconnections between chips while maintaining signal integrity. Their thermal stability ensures heat is managed effectively, reducing the risk of failure during intensive operations. As the demand for faster computing and parallel processing grows, glass interposers are becoming critical for building advanced chip architectures that can meet modern performance expectations.

Demand for Consumer Electronics Miniaturization: Consumer electronics continue to evolve toward thinner, lighter, and more powerful devices, driving the need for compact packaging technologies. According the States Council Information Office, in 2024, China’s production reached 249 million microcomputers, 1.184 billion mobile phones, and 150 million color TVs, with growth rates of 2.9%, 9.8%, and 2.5%, respectively. Exports rebounded, with 580 million mobile phones, 110 million laptops, and 81.29 million TVs exported in the first nine months in 2024, showing increases of 3.5%, 0.7%, and 8%, respectively. Glass interposers support this trend by enabling multiple chips to be stacked or placed side by side in a reduced footprint without sacrificing electrical or thermal performance. Their flatness and excellent dimensional stability make them ideal for tight spaces found in smartphones, augmented reality headsets, and wearable devices. This enables manufacturers to integrate more functions into smaller devices while improving speed and efficiency. The miniaturization of electronics is expected to continue, propelling the demand for glass interposers in the consumer tech segment.

Segmental Insights

Wafer Size Analysis

Based on wafer size, the segmentation includes less than 200 mm, 200 mm, and 300 mm. The 300 mm segment accounted for ~60% of the revenue share in 2024 due to their suitability for high-volume manufacturing and better cost efficiency per die. Foundries and OSATs prefer 300 mm substrates for producing advanced interposers used in high-performance computing, AI, and advanced packaging. The larger wafer size allows higher chip density and better utilization of processing capacity, reducing material waste. Consistent quality, better flatness, and scalability across production lines further boost adoption. As demand for complex semiconductor packages increases, manufacturers continue to invest in 300 mm glass interposer capabilities to improve throughput and meet performance requirements.

The 200 mm segment is expected to register a significant CAGR during the forecast period, due to its increasing relevance in mid-range semiconductor applications. Foundries focusing on consumer electronics, sensors, and IoT devices use 200 mm wafers for cost-effective, lower-complexity interposer production. Growth in applications that don’t require large-scale integration, such as wearables, mobile peripherals, and edge devices, is encouraging demand for 200 mm substrates. This wafer size also offers flexibility in prototyping and early-stage development, making it attractive for fabless semiconductor startups and small-volume customers. Enhanced process maturity and availability of refurbished equipment contribute to the rising adoption of this format.

Substrate Technology Analysis

In terms of substrate technology, the segmentation includes through-glass vias (TGV), redistribution layer (RDL)-first/last, and glass panel level packaging (PLP). The through-glass vias segment accounted for the largest revenue share in 2024 due to its ability to provide high-density vertical interconnections while maintaining signal integrity and low thermal expansion mismatch. TGV allows fine-pitch routing and dense via placements, making it ideal for 2.5D and 3D integration in high-performance chipsets. The technology supports precise alignment, thin profiles, and superior electrical isolation, which are essential for RF, AI, and memory modules. TGV's maturity in manufacturing and compatibility with high-frequency signal transmission provide it a distinct advantage over other substrate technologies. Growing interest in miniaturized, multilayer packages further supports TGV's widespread use.

The glass panel level packaging segment is projected to witness the highest CAGR over the forecast period due to its potential for improving throughput and lowering cost per unit in semiconductor packaging. PLP uses large glass panels instead of circular wafers, enabling better space utilization and high-volume production. Its scalability is especially valuable for applications in consumer electronics, where cost and performance must align. Manufacturers are adopting PLP to increase yield, reduce edge loss, and support larger form factors. Advancements in panel processing and alignment accuracy are accelerating its adoption. This approach holds strong potential for mass-market applications such as display drivers, power management, and sensors.

Application Analysis

In terms of application, the segmentation includes 3D packaging, 2.5D packaging, and fan-out packaging. The 2.5D packaging segment led the market in 2024 as it offers a balance between performance, cost, and complexity. It allows multiple dies to be mounted side by side on an interposer, enabling high-bandwidth communication without requiring full 3D stacking. Glass interposers are ideal in this architecture due to their dimensional stability and ability to handle dense I/O routing. Demand from AI accelerators, GPUs, and server processors is driving 2.5D adoption in both advanced computing and data center environments. Lower thermal stress and ease of manufacturing compared to full 3D packaging make it a preferred option for high-performance yet cost-sensitive designs.

The fan-out packaging segment is expected to grow significantly from 2025 to 2034 due to its capability to deliver compact form factors while maintaining performance and thermal efficiency. This packaging method enables redistribution of I/Os without using an interposer, making it ideal for space-constrained devices. The integration of glass interposers within fan-out architectures improves mechanical stability and heat dissipation, particularly in mobile and wearable electronics. Demand from smartphones, RF modules, and edge computing is pushing manufacturers to explore fan-out technologies for thinner, lightweight solutions. The shift toward heterogeneous integration and system-in-package (SiP) designs is likely to further accelerate adoption over the coming years.

End-Use Industry Analysis

In terms of end-use industry, the segmentation includes consumer electronics, telecommunications, automotive, defense & aerospace, and healthcare. The consumer electronics segment accounted for the largest revenue share in 2024, due to the high adoption of advanced packaging in smartphones, tablets, AR/VR headsets, and wearables. These devices require high-speed processing, compact size, and efficient thermal management, making glass interposers a suitable solution. Glass substrates enable multi-chip integration while maintaining low power consumption and signal integrity. Major OEMs are pushing for thinner, multifunctional devices, which is driving the use of glass-based interposer solutions. Strong demand for premium and performance-focused gadgets also encourages semiconductor manufacturers to adopt advanced glass interposer-based packaging that meets the rigorous performance expectations of tech-savvy consumers.

The automotive segment is projected to register the highest CAGR during the forecast period, driven by the electrification of vehicles and rising adoption of advanced driver-assistance systems (ADAS). These applications require reliable, high-speed data transmission between sensors, processors, and control units, which glass interposers can support through low signal loss and high thermal stability. The integration of radar, LiDAR, infotainment, and autonomous driving modules demands miniaturized, high-performance packaging solutions. Glass interposers help meet safety and reliability standards crucial in automotive environments. Increased semiconductor content per vehicle and the push toward intelligent mobility systems are expected to fuel long-term growth in this segment.

Regional Analysis

The North America glass interposers market accounted for ~25% of the revenue share in 2024 due to strong demand from high-performance computing and advanced packaging sectors. Major investments in AI, data centers, and cloud infrastructure require highly efficient and reliable semiconductor integration. In June 2025, Governor Josh Shapiro announced Amazon’s plan to invest USD 20 billion in Pennsylvania to develop AI infrastructure. This investment aims to enhance AI technologies, boost data processing, expand machine learning resources, and support AI applications across various sectors, positioning Pennsylvania as a leader in AI innovation. The region’s mature semiconductor ecosystem, backed by well-established foundries and OSATs, supports the adoption of glass interposer solutions for 2.5D and 3D packaging. Additionally, the region’s focus on defense, aerospace, and telecom innovation encourages the adoption of advanced interposer technologies. Research institutions and public-private partnerships are also playing a key role in supporting new packaging methods, further strengthening the market position across North America.

U.S. Glass Interposers Market Insights

In 2024, the U.S. leads the North American market driven by rapid innovation in AI chips, advanced packaging, and system-in-package solutions. Leading semiconductor and tech companies continue to invest in custom chip architectures that demand reliable and scalable interconnect technologies. Demand for advanced consumer electronics, high-performance processors, and data center hardware creates a strong market pull for glass interposers. Strategic initiatives around reshoring semiconductor manufacturing and supporting domestic foundries through federal funding are further strengthening U.S. capabilities. A strong presence of technology hubs, innovation clusters, and research programs positions the country as a key adopter of next-generation interposer materials and packaging formats.

Asia Pacific Glass Interposers Market Trends

Asia Pacific is expected to register the highest CAGR from 2025 to 2034 due to its large-scale semiconductor manufacturing base and growing demand from consumer electronics and telecom sectors. Foundries and OSATs in the region are adopting advanced packaging solutions to meet evolving client needs across 5G, AI, and IoT devices. Governments in countries such as South Korea, Taiwan, and India are offering financial and infrastructure support to strengthen domestic chip manufacturing, which accelerates the demand for glass interposer technology. According to the U.S. International Trade Commission, Taiwan accounts for 21% of semiconductor manufacturing capacity and 92% of advanced chip manufacturing. Additionally, increasing R&D activity, rising exports of electronics, and growing adoption of miniaturized packaging formats support rapid market development across Asia Pacific landscape.

China Glass Interposers Market Overview

The market in China is witnessing strong growth in glass interposers due to its strategic push to localize semiconductor supply chains and reduce dependence on imports. Domestic foundries are ramping up investments in advanced packaging technologies to support the growing needs of consumer electronics, EVs, and 5G infrastructure. Expanding fabrication capacity and favorable policy initiatives are encouraging local production of high-end interposer substrates. Increased focus on developing AI, computing, and edge processing hardware is further boosting the need for high-density, thermally stable interconnect solutions. This national emphasis on tech self-sufficiency is driving large-scale adoption and innovation in the glass interposer segment.

Europe Glass Interposers Market Outlook

The market growth in Europe is supported by rising investments in automotive electronics, especially for electric and autonomous vehicles. The region’s focus on developing semiconductor manufacturing capacity under initiatives such as the EU Chips Act is encouraging adoption of advanced packaging solutions. Demand for reliable, thermally efficient interposer materials in ADAS, power modules, and infotainment systems is increasing. Strong R&D infrastructure and collaboration between academia and industry are helping develop high-performance interposer technologies tailored to European use cases. Companies in the region are also targeting sustainability in electronics manufacturing, where glass interposers offer a recyclable and stable substrate option.

Key Players and Competitive Analysis

The competitive landscape of the glass interposers market is evolving rapidly due to advancements in semiconductor packaging, rising demand for heterogeneous integration, and the increasing need for high-performance interconnect solutions. Industry analysis highlights a growing emphasis on market expansion strategies, including capacity scaling and geographic diversification to serve high-growth regions in Asia Pacific and North America.

Key players are engaging in mergers and acquisitions to strengthen their technological edge and integrate vertically across the interposer value chain. Strategic alliances and joint ventures are being formed to co-develop through-glass via (TGV) processes, panel-level packaging, and redistribution layer innovations. Post-merger integration efforts focus on streamlining supply chains and enhancing R&D efficiency. Technological advancements in glass handling, etching precision, and thermal stability are defining a competitive advantage. As demand increases across AI, 5G, and automotive electronics, companies are prioritizing innovation, cost control, and time-to-market to maintain leadership in this high-density packaging and interconnection segment.

Key Players

- 3DGS

- AGC Inc.

- Corning Incorporated

- Dai Nippon Printing Co., Ltd.

- PLANOPTIK AG

- RENA

- Samtec

- SCHOTT AG

- TECNISCO, LTD.

- Workshop of Photonics

Glass Interposers Industry Developments

April 2025: LPKF Laser & Electronics SE became a member of onto Innovation's Packaging Applications Center of Excellence (PACE). This initiative is focused on advancing the seamless integration of processes and establishing a robust supply chain to expedite the mass production of panel-level packages utilizing glass core technology.

March 2025: AGC Glass Europe S.A. launched a refurbished flat glass production line at the AGC Barevka plant in Teplice, which significantly reduces the carbon footprint. Named the “Volta R&D Project,” this initiative, developed in collaboration with Saint-Gobain, features a pioneering pilot furnace with innovative flat glass production technology, supported by the EU Innovation Fund.

Glass Interposers Market Segmentation

By Wafer Size Outlook (Revenue, USD Million, 2020–2034)

- Less than 200 mm

- 200 mm

- 300 mm

By Substrate Technology Outlook (Revenue, USD Million, 2020–2034)

- Through-Glass Vias (TGV)

- Redistribution Layer (RDL)-First/Last

- Glass Panel Level Packaging (PLP)

By Application Outlook (Revenue, USD Million, 2020–2034)

- 3D Packaging

- 2.5D Packaging

- Fan-Out Packaging

By End-Use Industry Outlook (Revenue, USD Million, 2020–2034)

- Consumer Electronics

- Telecommunications

- Automotive

- Defense & Aerospace

- Healthcare

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Glass Interposers Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 118.26 million |

|

Market Size in 2025 |

USD 133.00 million |

|

Revenue Forecast by 2034 |

USD 384.20 million |

|

CAGR |

12.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 118.26 million in 2024 and is projected to grow to USD 384.20 million by 2034.

The global market is projected to register a CAGR of 12.5% during the forecast period.

North America glass interposers market accounted for ~25% of the revenue share in 2024 due to strong demand from high-performance computing and advanced packaging sectors.

A few of the key players in the market are 3DGS; AGC Inc.; Corning Incorporated; Dai Nippon Printing Co., Ltd.; PLANOPTIK AG; RENA; Samtec; SCHOTT AG; TECNISCO, LTD.; and Workshop of Photonics.

The 300 mm segment accounted for approximately 60% of the revenue share in 2024 due to their suitability for high-volume manufacturing and better cost efficiency per die.

Through-glass vias segment accounted for the largest revenue share in 2024 due to its ability to provide high-density vertical interconnections while maintaining signal integrity and low thermal expansion mismatch.