Europe Antibody Specificity Testing Market Size, Share, Trends, Industry Analysis Report

By Product & Services (Products, Antibody Validation & Specificity Testing Services), By Technology, By Application, By End Use, By Country– Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 126

- Format: PDF

- Report ID: PM6461

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

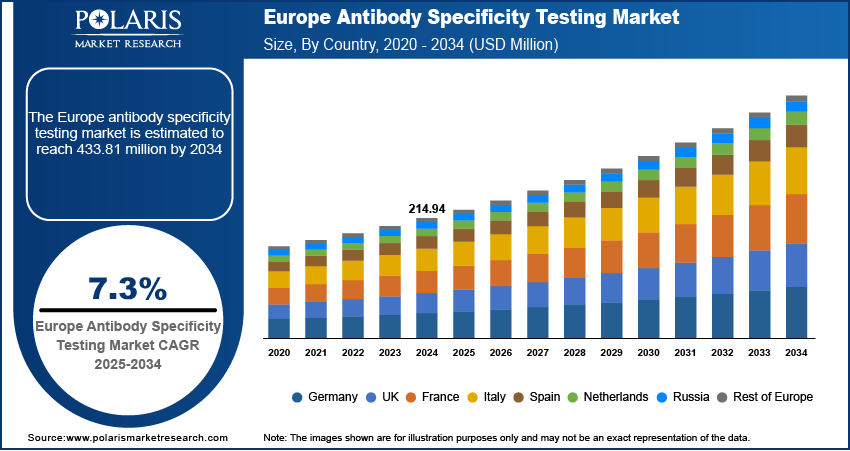

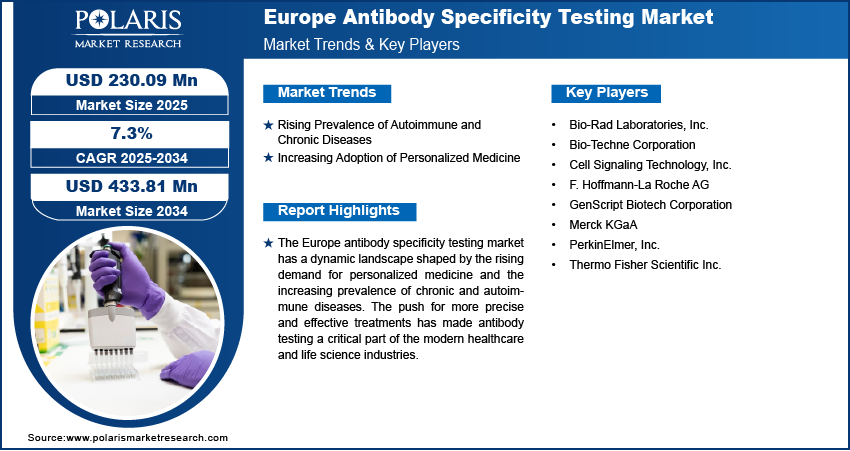

The Europe antibody specificity testing market size was valued at USD 214.94 million in 2024 and is anticipated to register a CAGR of 7.3% from 2025 to 2034. The demand for antibody specificity testing is growing due to the increasing research and development in life sciences and proteomics, as well as rising government funding for these areas.

Key Insights

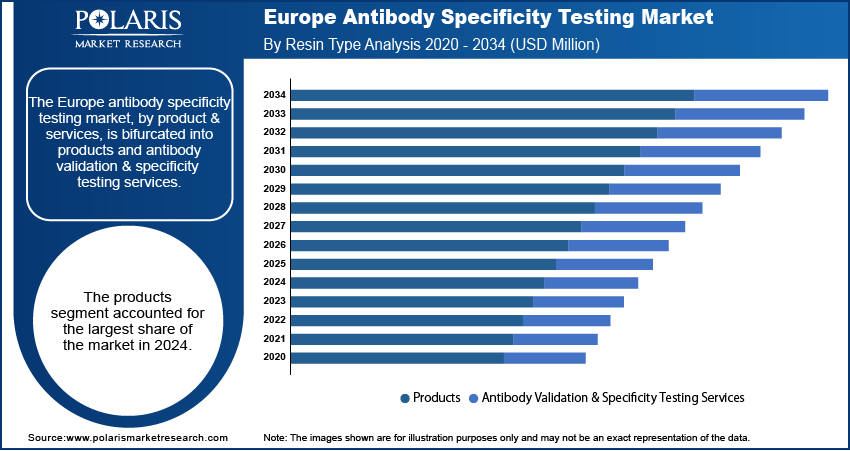

- By product & services, the products segment held the largest share in 2024. The segment is driven by the consistent demand from research and diagnostic labs.

- By technology, the immunoassay-based technologies segment held the largest share as they are widely adopted due to their reliability and sensitivity.

- By application, the research and development application segment held the largest share in 2024, as ongoing R&D activities in the pharmaceutical and biotech sectors require constant and high-volume antibody specificity testing.

- By end use, the pharmaceutical & biotechnology companies segment held the largest share in 2024, as they have extensive research, drug discovery services and efforts, and therapeutic development programs.

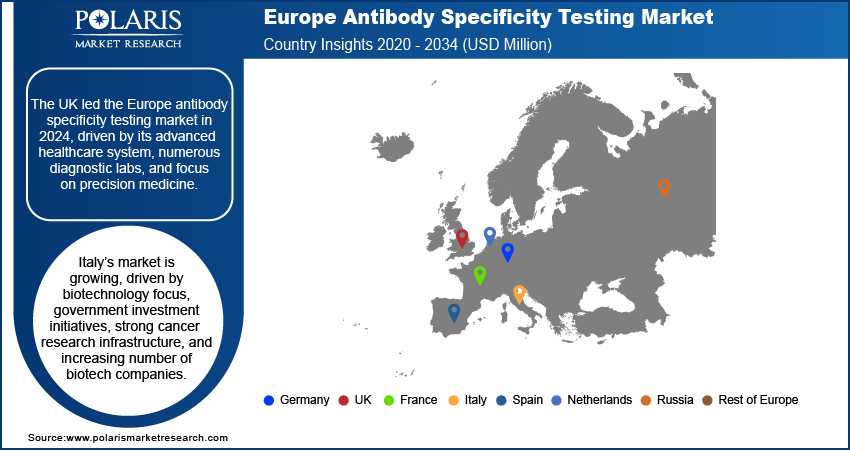

- By country, the UK held the largest share in Europe in 2024 due to its strength that comes from a highly developed healthcare system.

Industry Dynamics

- An increase in research and development activities is a major driver, fueled by growing investments from both public and private sectors in life sciences and proteomics. This rising focus on understanding diseases at a molecular level boosts the need for accurate tools.

- The rising demand for therapeutic antibodies is also a key growth factor. These are used to treat various diseases such as cancer and autoimmune disorders. Their effectiveness relies on precise binding to their targets, which requires extensive specificity testing.

- The emerging trend toward personalized medicine and customized therapies is expected to propel the need for more specific and sensitive diagnostic tools. This approach requires identifying unique biomarkers in individual patients, which increases the demand for highly validated antibodies.

Market Statistics

- 2024 Market Size: USD 214.94 million

- 2034 Projected Market Size: USD 433.81 million

- CAGR (2025–2034): 7.3%

- UK: Largest market in 2024

AI Impact on Europe Antibody Specificity Testing Market

- Artificial intelligence (AI) technology is reshaping the Europe antibody specificity testing market landscape. Its adoption empowers market players with faster, smarter, and scalable solutions.

- Biotech firms in Europe are adopting AI to streamline antibody discovery, from sequence design to specificity validation.

- AI-based models can predict binding sites and cross-reactivity risks. It helps labs design antibodies with higher specificity. This step is crucial for therapeutic applications, as off-target effects compromise efficacy and safety.

- Regulatory bodies across Europe push for validated, reproducible antibodies in therapeutics and diagnostics. AI helps comply with these standards by generating consistent, traceable data across various platforms.

The specificity testing of antibodies includes multiple techniques to confirm that an antibody only binds to its specific target. The testing is critical in R&D, drug discovery, and diagnostics to ensure that the findings are as accurate and reliable as possible. This process is critical for a safe and effective deployment of any new medicine based on monoclonal antibodies and for the development of accurate diagnostic tools.

An increase in the focus on reproducibility of scientific findings and the methods that led to them is driving the Europe antibody specificity testing market growth. The lack of rigorous in-house or external validation of antibodies used in experiments led to an increased reliance on these tests. As a result, researchers and institutions are increasingly using only highly reliable and specific monoclonal antibodies.

Growing economy increases the initiatives from educational and research organizations and biotechnology companies. Such initiatives are increasingly observed in Europe to accelerate the development of new therapies and research instruments. As these organizations undertake collaborative projects related to drug discovery and biomarker analysis, there is a growing demand for standardized and high-quality antibodies. Such collaborative efforts and standard-setting initiatives boost the demand for specificity testing services and representative products.

Drivers and Trends

Rising Prevalence of Autoimmune and Chronic Diseases: Chronic and autoimmune conditions such as rheumatoid arthritis, multiple sclerosis, and type 1 diabetes are prominent in European population. The diagnosis and management of such illnesses depend on the analysis of particular autoimmune antibodies in a patient’s blood. These patients are more likely to suffer from these chronic ailments, and the demand for proper testing becomes high. In order to make an accurate diagnosis and implement the suitable treatment, it is important to carry out antibody specificity testing to determine the presence of a disease marker.

The growing complexity of autoimmune and chronic diseases and the development of new treatments require highly specific testing. The use of therapeutic antibodies to treat autoimmune diseases and cancer necessitates testing to ensure the drug targets the right proteins in the body. This is crucial for patient safety and treatment effectiveness. The overall increase in disease burden across Europe is directly linked to the need for better diagnostic and therapeutic tools, and specificity testing is a core part of that process. Therefore, the rising prevalence of these conditions is boosting the demand for antibody specificity testing products and services.

Increasing Adoption of Personalized Medicine: Targeted medicine consists of treatments tailored to the unique biology of a patient. Organizational strategy relies on genetic and molecular profiling of a patient to develop a treatment designed for them. The utilization of these targeted treatments relies on the identification of specific markers for which antibodies are important.

Antibody specificity testing ensures that the antibodies used in diagnostic tests or as part of a treatment are precise and reliable. For example, in oncology, antibody testing can confirm the expression of specific proteins on cancer cells, helping doctors select a targeted therapy. This move away from "one-size-fits-all" treatments toward more customized care is a strong factor propelling the demand for advanced testing tools and services. Therefore, the greater adoption of personalized medicine contributes to the expansion of antibody specificity testing.

Segmental Insights

Product & Service Analysis

Based on product & service, the segmentation includes products and antibody validation & specificity testing services. The products segment held the largest share in 2024. This is primarily driven by the increased consumption of antibodies, kits, and reagents that support research and diagnostics. This is also increased by the continuous advancement in life science research and the increasing demand for accurate and reliable experimental tools. The primary consumers of these products are academic & research institutions and pharmaceutical & biotechnology firms, as their applications span from fundamental research to drug discovery and development.

The antibody validation & specificity testing services segment is anticipated to register the highest growth rate during the forecast period. The demand for testing validation services is continuously rising because of increased scientific research on reliability and specificity of antibodies for treatment. Many small to mid-sized businesses and academic institutions outsource complex antibody validation and testing services as such services require specialized facilities and skills that are economically not feasible to perform in-house. In addition, the surge in dependable antibodies for clinical use and drug development is motivating more businesses to collaborate with service providers to guarantee their results.

Technology Analysis

Based on technology, the segmentation includes immunoassay-based technologies, genetic validation-based technologies, microarray-based antibody technologies, and other technologies. The immunoassay-based technologies segment held the largest share in 2024. These technologies, such as ELISAs and other immunoassay techniques, utilize methods that are highly sensitive and specific. Consequently, these methods and technologies have become the primary standard in diagnostics and research for infectious diseases, therapeutic drug monitoring, and biomarker discovery. The dominance of these technologies is increased by their adoption by hospitals, clinical laboratories, and other research institutions. In addition to their reliable performance, the ongoing evolution of immunoassay-based technologies toward automation and high-volume throughput makes them attractive.

The microarray-based antibody technologies segment is anticipated to register the highest growth rate during the forecast period. These technologies are used for more crucial purposes, which is why they are necessary for researchers and drug developers. Antibody microarrays enable the simultaneous testing of numerous antibodies with many targets in a single experiment, which is time-saving and resource-efficient. This approach is greatly needed when it comes to biomarker research or drug discovery, where a large number of targets must be screened and then validated. With the increasing field of personalized medicine, there is a growing demand for advanced levels of proteomic assessment, and microarray technologies are accomplishing these requirements.

Application Analysis

Based on application, the segmentation includes research & development and clinical diagnostics. The research & development segment held the largest share in 2024. This is attributed to the large and constant funding of R&D in the biotechnology and pharmaceutical areas in Europe. Companies and academic institutions developing new drugs, vaccines, and diagnostic tools for their antibody experiments need to ensure the quality and performance of the antibodies used. Specificity testing is an essential part of this process to eliminate unsupported claims. The large amount of research in proteomics, genomics, drug and antibody discovery in particular, creates a strong and constant demand for the corresponding specificity testing products and services.

The clinical diagnostics segment is anticipated to register the highest growth rate during the forecast period. With the shift to personalized medicine in some European health systems, there is a greater demand for tests that can identify some critical biomarkers that can help tailor treatment. This growth is fueled by the increasing demand for timely results from point-of-care (PoC) testing and the need for streamlined diagnostic workflows within clinical environments.

End Use Analysis

Based on end use, the segmentation includes pharmaceutical & biotechnology companies, academic & research institutes, diagnostic laboratories, and other end uses. The pharmaceutical & biotechnology companies segment held the largest share in 2024 due to the large-scale R&D activities that are persistent in nature. Therapeutic antibodies for various diseases such as cancer and autoimmune disorders are in constant development, which further increases the share of companies. The commercialization of novel drugs is often accompanied by extensive testing and validation regarding their research, preclinical, and clinical phases.

The diagnostic laboratories segment is anticipated to register the highest growth rate during the forecast period. This is because of the rise in demand for antibodies that are specific and accurate in clinical diagnostic tests. As the healthcare system shifts toward increased diagnosis and personalized treatment, the demand for performing the tests in diagnostic laboratories also increases. The demand for these diagnostic services in Europe is also quite high, and is fueled by the need for multi-test labs to work on reliable, rapid, and sensitive throughput analysis.

Country Analysis

The UK antibody specificity testing market accounted for the largest share in 2024. There is an abundance of biopharmaceutical companies alongside top-tier universities, which contributes to a high demand for antibody specificity testing. The UK government has also dedicated its efforts to the life science sector by devising strategies to fund and nurture its research and innovation. For instance, the government will spend ~$2 billion in the coming years, as claimed in a news on the 'Life Sciences Sector Plan to grow economy and transform NHS' released by the government in July 2025. The funds will also be directed toward health data services, along with accelerating clinical trials, which will increase the demand for reliable antibodies, along with the requisite testing to validate their precision.

Germany Antibody Specificity Testing Market Insights

In Germany, the well-established and technologically advanced healthcare system serves as a backbone for globalization. The number of diagnostic laboratories and the increasing focus on precision medicine and advanced diagnostics technologies also strengthen its position. The emphasis on digital health and the subsequent modernization of hospital infrastructure are also the growth drivers, as they aid in the rapid assimilation of novel testing techniques and technologies.

Italy Antibody Specificity Testing Market Trends

The industry in Italy is growing due to an increasing focus on the biotechnology sector and investments from the government. The country has a long-standing tradition in cancer research, and there is a growing number of biotechnology firms. The government is focusing on developing the biotech sector in the country. The Italian Ministry of Foreign Affairs’ 2024-2025 Final Report of the Working Group for the Internationalization of Industries in the Biotechnology Sector has outlined a strategic plan for the country aimed at expanding the national biotech ecosystem. The plan emphasizes international investment and active participation in research and development. This type of governmental attention to the biotechnology industry boosts the expansion of the antibody specificity testing market in Italy, as many new R&D projects require these essential tools.

Key Players and Competitive Insights

Bio-Rad Laboratories, Inc.; F. Hoffmann-La Roche Ltd.; Merck KGaA; PerkinElmer, Inc.; and Thermo Fisher Scientific Inc. are among the dominant players in the Europe antibody specificity testing market. Companies in the market compete on multiple fronts, including product and service offerings for antibody quality and validation, integrated solution capabilities, and strategic collaborations. The market is also influenced by the concentration of international players with dominant portfolios, which fuels collaborations, mergers, and acquisitions.

A few prominent companies in the Europe antibody specificity testing market include Bio-Rad Laboratories, Inc.; Cell Signaling Technology, Inc.; Merck KGaA; PerkinElmer, Inc.; Thermo Fisher Scientific Inc.; F. Hoffmann-La Roche AG; Bio-Techne Corporation; and GenScript Biotech Corporation.

Key Players

- Bio-Rad Laboratories, Inc.

- Bio-Techne Corporation

- Cell Signaling Technology, Inc.

- F. Hoffmann-La Roche AG

- GenScript Biotech Corporation

- Merck KGaA

- PerkinElmer, Inc.

- Thermo Fisher Scientific Inc.

Europe Antibody Specificity Testing Industry Developments

October 2023: Thermo Fisher Scientific Inc. announced the acquisition of Olink Holdings to develop and standardize advanced proteomic workflows. The collaboration focuses on improving the quality and consistency of protein analysis, which includes developing better methods for antibody specificity testing.

Europe Antibody Specificity Testing Market Segmentation

By Product & Services Outlook (Revenue – USD Million, 2020–2034)

- Products

- Antibody Validation & Specificity Testing Services

By Technology Outlook (Revenue – USD Million, 2020–2034)

- Immunoassay-Based Technologies

- Genetic Validation-Based Technologies

- Microarray-Based Antibody Technologies

- Other Technologies

By Application Outlook (Revenue – USD Million, 2020–2034)

- Research & Development

- Clinical Diagnostics

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Diagnostic Laboratories

- Other End Use

By Country Outlook (Revenue – USD Million, 2020–2034)

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Antibody Specificity Testing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 214.94 million |

|

Market Size in 2025 |

USD 230.09 million |

|

Revenue Forecast by 2034 |

USD 433.81 million |

|

CAGR |

7.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 214.94 million in 2024 and is projected to grow to USD 433.81 million by 2034.

The market is projected to register a CAGR of 7.3% during the forecast period.

The UK dominated the market share in 2024.

A few key players in the market include Bio-Rad Laboratories, Inc.; Cell Signaling Technology, Inc.; Merck KGaA; PerkinElmer, Inc.; Thermo Fisher Scientific Inc.; F. Hoffmann-La Roche AG; Bio-Techne Corporation; and GenScript Biotech Corporation.

The products segment accounted for the largest share of the market in 2024.

The microarray-based antibody technologies segment is expected to witness the fastest growth during the forecast period.