Industrial Nitrogen Generator Market Size, Share, Trends, Industry Analysis Report

By Design (Plug & Play, Cylinder-Based), By Size, By Technology Type, By End-Use Industry, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 126

- Format: PDF

- Report ID: PM6462

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

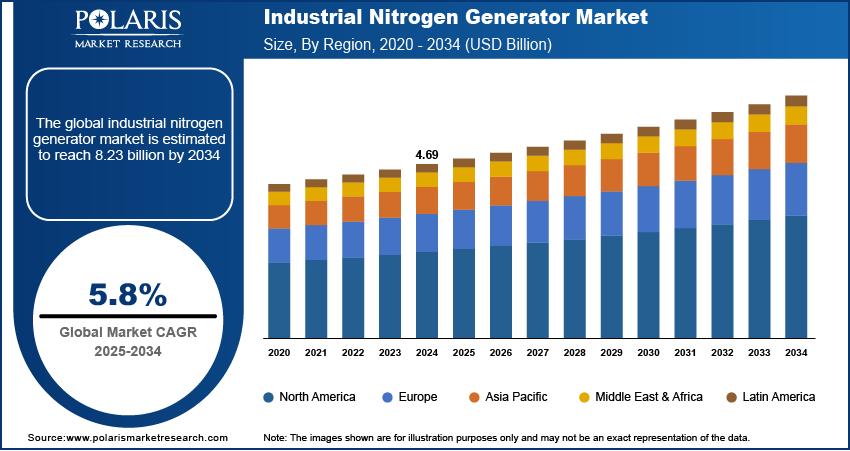

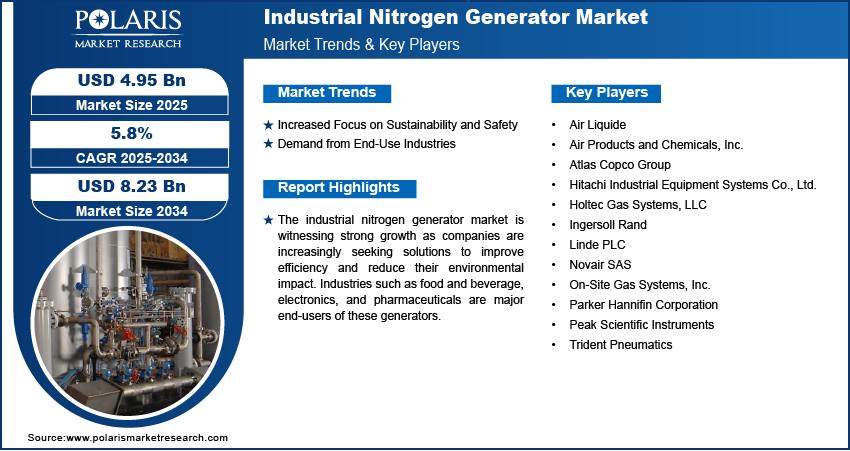

The global industrial nitrogen generator market size was valued at USD 4.69 billion in 2024 and is anticipated to register a CAGR of 5.8% from 2025 to 2034. The rising demand for on-site nitrogen gas production from food & beverage, electronics, pharmaceuticals, and other industries boosts the market expansion. Additionally, the need for cost-effective and energy-efficient solutions for nitrogen supply also helps boost the growth.

Key Insights

- By design, the plug-and-play segment held the largest share in 2024 due to its simple design and ease of use.

- By size, the stationary segment held the largest share in 2024 due to its high capacity and reliability.

- By technology type, the pressure swing adsorption (PSA) technology segment held the largest share in 2024. The technology is effective at producing high-purity nitrogen, which is a critical requirement for a wide range.

- By end-use industry, the food and beverage industry held the largest share in 2024, due to the widespread use of nitrogen for applications such as modified atmosphere packaging (MAP).

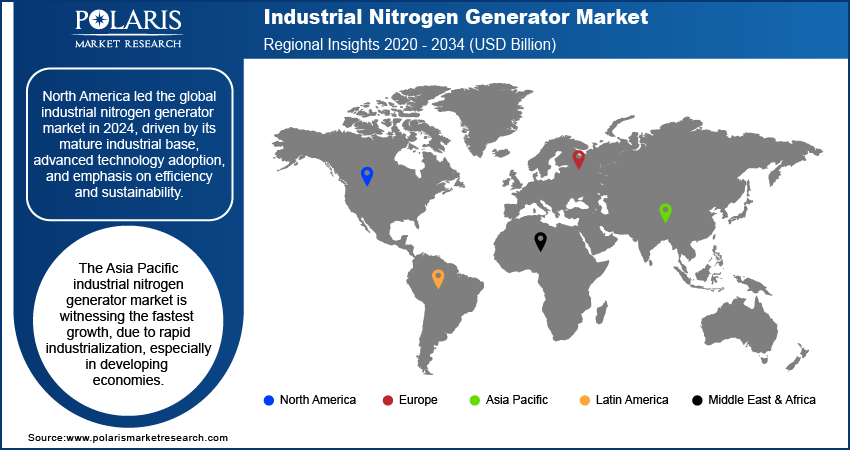

- By region, North America held the largest share in 2024 as it has a strong and mature industrial base and early adoption of advanced technologies.

Industry Dynamics

- Many industries, such as food and beverage, electronics, and pharmaceuticals, are increasingly using on-site nitrogen generators. This is because they provide a constant and pure supply of gas for various applications such as packaging and blanketing.

- The growing need for cost-effective and energy-efficient ways to derive nitrogen boosts the demand for industrial nitrogen generators. On-site generators help businesses reduce operational costs by eliminating the need for expensive third-party deliveries and storage tanks.

- The increasing shift toward more environmentally friendly practices propels the adoption of industrial nitrogen generators. The use of on-site generators helps reduce carbon emissions by removing the requirement for regular gas deliveries, which aligns with modern sustainability goals.

Market Statistics

- 2024 Market Size: USD 4.69 billion

- 2034 Projected Market Size: USD 8.23 billion

- CAGR (2025–2034): 5.8%

- North America: Largest market in 2024

AI Impact on Industrial Nitrogen Generator Market

- IoT sensors are used in AI-powered nitrogen generators to keep the track of flow rates, purity levels, and pressure continuously.

- AI algorithms can adjust compressor speed, pressure, and airflow as per the requirement, which optimizes energy use and reduces operational costs.

- AI tools help detect early signs of wear or failure in components, which allows for proactive maintenance. This prediction reduces downtime and extends equipment life.

- Due to the reduction in energy consumption and reliance on delivered nitrogen, AI-integrated systems lower carbon footprints and operational expenses

An industrial nitrogen generator is a machine that produces nitrogen gas from the surrounding air. It uses pressure swing adsorption, membrane separation, and other technologies to remove oxygen and other impurities, giving a steady supply of pure nitrogen for various industrial uses. This on-site production offers a reliable and cost-effective way to get nitrogen gas without needing traditional cylinders or deliveries

The growing focus on adopting advanced technology and innovation is expected to boost the industry expansion during 2025–2034. Companies are seeking to improve their systems, and this has led to more efficient and compact nitrogen generators. Newer models use less energy and are easier to maintain, which makes them more appealing to a wider range of businesses. These advances also allow for higher purity levels, which are important for specific, sensitive processes.

The growing need to comply with stringent safety and environmental regulations in various industries propels the adoption of industrial nitrogen generators. These rules encourage businesses to find safer and more sustainable ways to operate. On-site nitrogen generation greatly reduces the safety risks that come with handling high-pressure gas cylinders or cryogenic liquids, which are used in traditional delivery methods. For example, the CDC and other health organizations have documented the risks of handling compressed gases, including the dangers of asphyxiation in enclosed spaces if leaks occur. By generating nitrogen on-site at lower pressures, end-use companies can lower these risks.

Drivers and Trends

Increased Focus on Sustainability and Safety: Shifts in environmental awareness, as well as the need for safer industrial operations, are significantly driving the demand for industrial nitrogen generators. The supply of nitrogen through gas cylinders under pressure, cryogenic liquid, or liquid nitrogen tankers results in significant carbon emissions due to transportation and the energy required for liquefaction. The use of on-site generators helps companies lower these emissions by generating the gas where it is needed. It also eliminates the safety concerns associated with the transportation and handling of heavy pressurized cylinders.

According to a 2024 report by the U.S. Environmental Protection Agency (EPA), "Inventory of U.S. Greenhouse Gas Emissions and Sinks," industrial processes are a significant source of overall greenhouse gas (GHG) emissions. The report points out that a strong focus on reducing carbon emissions is a key goal for many industries. In a related finding, the International Council on Clean Transportation noted in their 2024 policy update on "U.S. EPA Phase 3 greenhouse gas emission standards for heavy-duty vehicles" that new regulations are aiming to cut emissions from transportation, which includes the delivery of industrial gases. This growing emphasis on environmental rules and safety is encouraging more companies to switch to on-site nitrogen generation.

Demand from End-Use Industries: There is an increasing and consistent need for nitrogen gas in the food & beverages industry, electronics, and pharmaceuticals. The food industry employs nitrogen in modified atmosphere packaging to enhance the preservation and shelf life of food substances. In electronics, it creates an inert atmosphere for soldering and also controls the oxidation of some sensitive components. The wide range of these applications creates a continuous demand for nitrogen supply.

Data from the U.S. Department of Agriculture’s Economic Research Service 2023 report stated that the value of U.S. agricultural exports has seen significant growth, which is linked to an increase in demand for packaged and processed foods. The Department of Energy (DOE) also noted in its "Energy Statistics India 2025" report that the industrial sector's energy consumption has seen a significant increase, reflecting broad industrial expansion. This ongoing growth in key industries boosts the need for on-site nitrogen generators.

Segmental Insights

Design Analysis

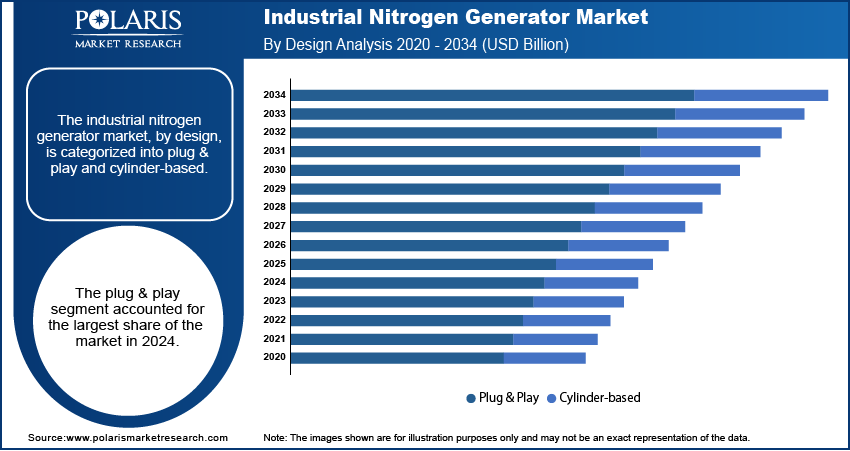

Based on design, the segmentation includes plug & play and cylinder-based. The plug & play segment held the largest share in 2024. Such systems are easy to install and do not require much effort to set up. They are custom-built, pre-packed, and do not require any technical prerequisites. Their simplistic design makes them easy to set up and use. Such modules are popular in various industries for on-site nitrogen supply systems. The plug and play systems are low cost. Small to mid-sized enterprises (SMEs) prefer deployment systems for low technical needs due to budget constraints. The growing demand for these systems can be attributed to their operational efficacy and ease of use, which is why these systems have the largest market share. Furthermore, the systems tend to occupy a smaller footprint, making them suitable for companies with limited floor space.

The use of traditional cylinders for delivering nitrogen still works today, but it is clear that more modern and sophisticated methods are needed. Business owners in this sector are seeking a more economical and compact solution for in-house gas supply management. Companies that need the flexibility of a cylinder system, but do not want to deal with the high costs and delivery issues of outsourcing, drive this expansion. These next-generation, cylinder-based systems offer more integration and automation than previous models, resulting in improved control over pressure and purity. This cylinder-based segment is experiencing a significant increase in demand as more industries seek to reduce their operational dependency on external suppliers.

Size Analysis

Based on size, the segmentation includes stationary and portable. The stationary segment held the largest share in 2024. These systems are designed for installation in locations that have significant and constant utilization of nitrogen gas. Chemical processing and production, larger food processing and beverage plants, and some specialized metal industry facilities depend on stationary generators for their reliable performance and high capacity. These systems are integrated into the building structure to provide a 24-hour supply, making them more economical and reliable compared to other options. A major factor for their significant market dominance is their ability to meet the requirements of processes at heavy industrial facilities reliably and consistently without drawing on external sources.

The portable segment is anticipated to register the highest growth rate during the forecast period. This is due to the increasing desire for greater flexibility and mobility within industrial activities. Portable generators are ideal for firms needing to be on-site at different locations, such as in construction, oil and gas exploration, or for a temporary construction site. Their small and convenient size and portability enable them to function in remote or inaccessible regions. The increasing demand for mobile and flexible business solutions is driving the growth of this segment. These units are gaining considerable attraction among small and medium-sized enterprises because of the lower upfront financing and versatility for different uses within a single plant.

Technology Type Analysis

Based on technology type, the segmentation includes pressure swing adsorption, membrane-based, and cryogenic-based. The pressure swing adsorption segment held the largest share in 2024. PSA technology is dependable and can produce nitrogen gas of extremely high purity. Thus, it is highly utilized in the electronics and pharmaceutical industries. These devices operate by isolating nitrogen from compressed air and a carbon molecular sieve. PSA nitrogen systems and separator units are efficient, easy to scale, and inexpensive to operate. Their versatile applications are the main reason for the dominance of the PSA segment.

The cryogenic-based segment is anticipated to register the highest growth rate during the forecast period. This is a result of the lowering of air temperatures to a level of at least –150 degrees centigrade, and then the fractionation of the air into its components such as nitrogen. While the initial costs of these systems were exorbitant, subsequent improvements in the technology have rendered these systems more cost-friendly. This is mainly evident in growing economies and niche markets whose industries have a sudden high demand for bulk nitrogen. Cryogenic generators can generate nitrogen in a nearly pure state to be used for other sensitive applications in medical research and in other bulk industrial uses.

End-Use Industry Analysis

Based on end-use industry, the segmentation includes food & beverage, medical & pharmaceutical, transportation, electrical & electronics, chemical & petrochemical, manufacturing, packaging, and others. The food & beverage (F&B) segment held the largest share in 2024. In the food industry, nitrogen is used for multiple applications to maintain the product quality and improve shelf life. Nitrogen gas is used in modified atmosphere packaging (MAP) to substitute oxygen in food packages to avoid food spoilage and maintain freshness. This is important for snacks, meat, packaged fruits, and other similar products. Nitrogen is also used in the beverage industry for sparging, which is used to remove excess dissolved gas, and in dispensing beverages such as beer and coffee. The high demand for packaged foods and processed foods, as well as the increasing consumption of nitrogenated beverages, has contributed to the dominance of the food & beverage segment.

The medical and pharmaceutical segment is anticipated to register the highest growth rate during the forecast period. This particular sector still has a great deal of fulfillment of the requirements for the safe and clinically effective high-purity and uniform gas supply. Inerting nitrogen is vital and has various advantageous processes such as the protection of sensitive active components of the drugs, the containment of the drug's active ingredients from the access of oxygen, and the closing of containers to avoid contamination. The construction in the healthcare sector, along with the growing strategic development of new vaccines and medicines, is propelling the demand for stable, on-site field nitrogen gas generators. These systems are providing a stable and budget-friendly alternative to gas delivery systems, which boosts their adoption across the segment.

Regional Analysis

The North America industrial nitrogen generator market accounted for the largest share in 2024. This is due to the region’s industrial structure and the support of numerous large-scale textile and technology businesses. There is a constant and high need for butane and nitrogen in the F&B, electronics, and oil & gas sectors. This region is interested in technological advancements and invests in technology for greater productivity and sustainability. In this region, the modern generator systems, which have the least operational costs and maximum output, are often the first that are spatial autoscaled.

U.S. Industrial Nitrogen Generator Market Insights

In North America, the U.S made the largest contribution in 2024. The U.S. is one of the most solvent countries in the world, and the chemical, pharmaceutical, and manufacturing industries are among the most productive sectors of the region's economy. Numerous companies are seeking to make arrangements in which they can utilize the on-site nitrogen generation systems. This aims to help companies improve their production processes while ensuring compliance with set environmental and safety standards and regulations. The consumption of high volumes of nitrogen is the one factor that confirms the strength of the market. Any industrial processes, such as food preservation and the creation of inert atmospheres in factories, boost the adoption of nitrogen generators.

Europe Industrial Nitrogen Generator Market Trends

Europe is another major region in the global market for industrial nitrogen generators and is relatively advanced in the field. There is a strong need for compliance with environmental regulations and energy efficiency, which prompts companies to adopt more sustainable on-site gas options. The automotive, pharmaceutical, and manufacturing industries are significant consumers of nitrogen. The trend toward increased automation and advanced systems is a significant growth factor for the region. The degree of industrial development and the ongoing demand for these generators significantly drive the adoption of cleaner production methods.

The Germany industrial nitrogen generators market held the major share in Europe in 2024. Germany is a manufacturing and engineering powerhouse, one of the largest automobile producers in the region. There is a strong demand for nitrogen for metal fabrication and heat treatment. The country's strong inclination toward green production and technologies has led to a high demand for advanced, energy-efficient nitrogen generators on the market.

Asia Pacific Industrial Nitrogen Generator Market Overview

The Asia Pacific market for industrial nitrogen generator is growing faster, due to the rapid industrial growth within emerging markets. Increasing industrial output, especially in the manufacturing sector, elevated infrastructure spending, and rising consumer demand are creating a surge of need for nitrogen generators for electronics, advanced food processing, and beverage dispensers. All these factors have led to a growth shift away from traditional central gas supply systems to on-site generators, which is a faster way for companies in the region to save on operational costs.

China Industrial Nitrogen Generator Market Assessment

The industry in China is witnessing the highest growth in Asia Pacific. The increasing need for high-purity nitrogen within the massive manufacturing and electronics sectors is driving demand for industrial nitrogen generators. The government's commitment to standardized industrial policies, growing investments in industrial nitrogen generation units, and the positive feedback from these generators propel the demand for industrial nitrogen generators.

Key Players and Competitive Insights

The industrial nitrogen generator industry comprises various key players, including Air Products and Chemicals, Parker Hannifin, Atlas Copco, Ingersoll Rand, and Linde PLC, which dominate the vertical. In addition to trying to develop specific end-use industrials targeted high-purity nitrogen for the pharmaceutical industry and portable units for oil and gas, these players are actively trying to solve these problems. There has been an increase in niche firms focusing on specific technologies and customer segments, which adds to the competitive pressure.

A few prominent companies in the industry include Air Products and Chemicals, Parker Hannifin, Atlas Copco, Linde PLC, Air Liquide, Inmatec GmbH, On Site Gas Systems, Peak Scientific Instruments, and Novair SAS.

Key Players

- Air Liquide

- Air Products and Chemicals, Inc.

- Atlas Copco Group

- Hitachi Industrial Equipment Systems Co., Ltd.

- Holtec Gas Systems, LLC

- Ingersoll Rand

- Linde PLC

- Novair SAS

- On Site Gas Systems, Inc.

- Parker Hannifin Corporation

- Peak Scientific Instruments

- Trident Pneumatics

Industrial Nitrogen Generator Industry Developments

September 2025: Air Products and Chemicals announced that its new air separation facility and liquefier in Cleveland, Ohio, is operational. This facility is supplying on-site and regional customers with essential industrial gases, including nitrogen.

October 2024: Linde Engineering signed an agreement with NEXTCHEM to provide its new carbon capture technology to ADNOC's Hail and Ghasha project in the UAE.

Industrial Nitrogen Generator Market Segmentation

By Design Outlook (Revenue – USD Billion, 2020–2034)

- Plug & Play

- Cylinder-based

By Size Outlook (Revenue – USD Billion, 2020–2034)

- Stationary

- Portable

By Technology Type Outlook (Revenue – USD Billion, 2020–2034)

- Pressure Swing Adsorption

- Membrane-Based

- Cryogenic-Based

By End-Use Industry Outlook (Revenue – USD Billion, 2020–2034)

- Food & Beverage

- Medical & Pharmaceutical

- Transportation

- Electrical & Electronics

- Chemical & Petrochemical

- Manufacturing

- Packaging

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Industrial Nitrogen Generator Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.69 billion |

|

Market Size in 2025 |

USD 4.95 billion |

|

Revenue Forecast by 2034 |

USD 8.23 billion |

|

CAGR |

5.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.69 billion in 2024 and is projected to grow to USD 8.23 billion by 2034.

The global market is projected to register a CAGR of 5.8% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include Air Products and Chemicals, Parker Hannifin, Atlas Copco, Linde PLC, Air Liquide, Inmatec GmbH, On Site Gas Systems, Peak Scientific Instruments, and Novair SAS.

The plug & play segment accounted for the largest share of the market in 2024.

The portable segment is expected to witness the fastest growth during the forecast period.