Antibody Specificity Testing Market Size, Share, Trends, Industry Analysis Report

By Product & Services (Products, Antibody Validation & Specificity Testing Services), By Technology, By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 122

- Format: PDF

- Report ID: PM6458

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

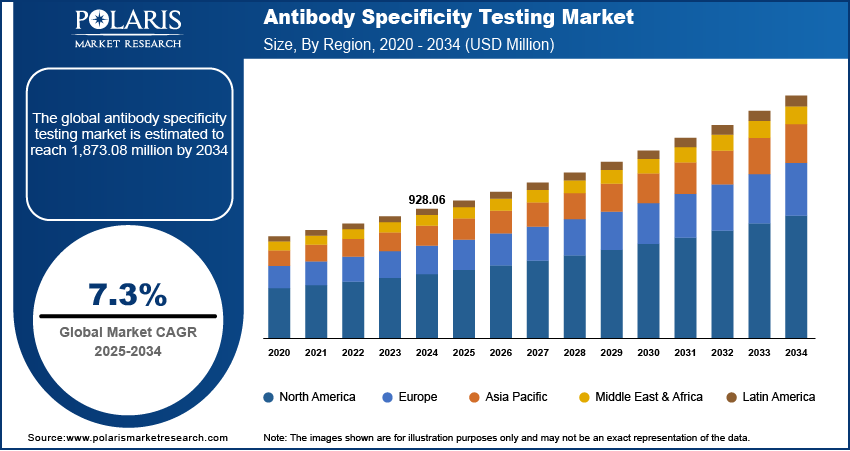

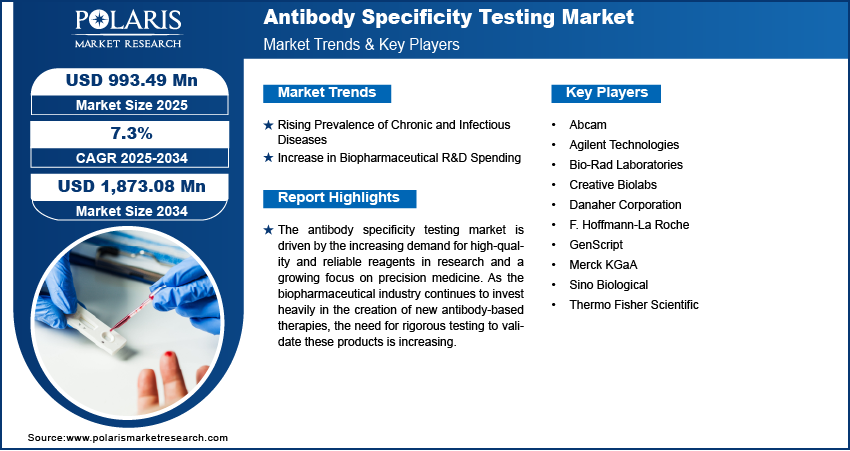

The global antibody specificity testing market size was valued at USD 928.06 million in 2024 and is anticipated to register a CAGR of 7.3% from 2025 to 2034. The growing prevalence of chronic and infectious diseases drives the demand for antibody specificity testing, as it increases the need for accurate diagnostic tools. Also, rising investments in research and development (R&D), especially in the life sciences and biopharmaceutical sectors, fuel the growth.

Key Insights

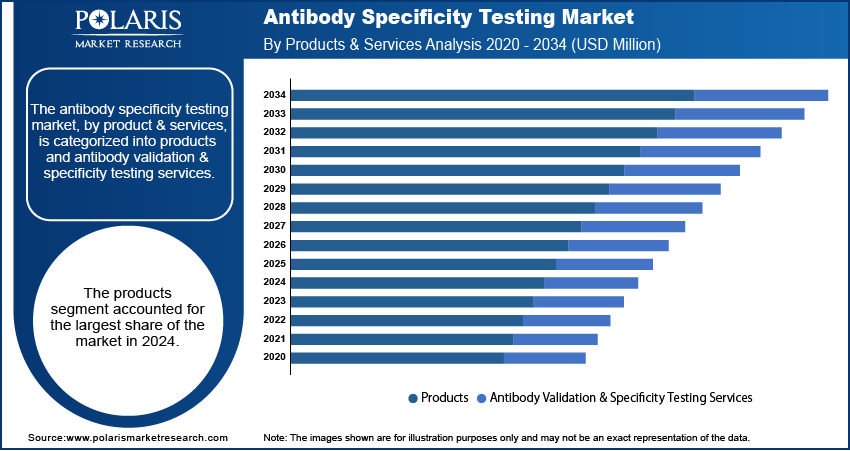

- By product & services, the products segment held the largest share in 2024 due to the widespread and constant demand for reagents, kits, and instruments used.

- By technology, the immunoassay-based technologies segment dominated in 2024 as they are well-established, reliable, and cost-effective.

- By application, the research and development segment led in 2024, as antibody specificity testing is a crucial, early step in drug discovery and development.

- By end use, the pharmaceutical and biotechnology companies segment held the dominant share in 2024, as they invest heavily in developing new antibody-based drugs.

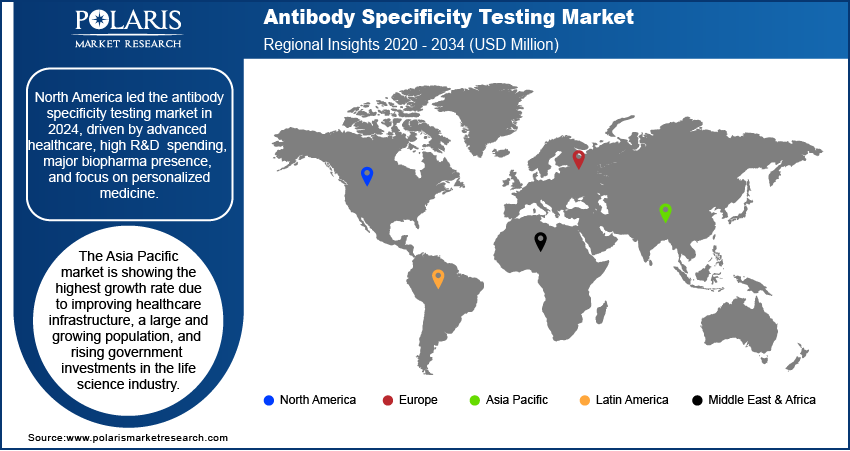

- By region, North America held the largest share in 2024 due to its advanced healthcare infrastructure and significant R&D spending.

Industry Dynamics

- The increasing prevalence of chronic and infectious diseases worldwide, such as cancer and autoimmune disorders, propels the industry expansion. This growth is directly linked to the rising demand for therapeutic and diagnostic products that depend on highly specific antibodies for effective treatment and detection.

- Growing research and development activities in the life sciences sector, especially in drug discovery services and development, are fueling the demand. These projects heavily rely on antibody testing to ensure the quality and reliability of research antibodies, which are essential to produce new drugs and vaccines.

- The growing use of personalized medicine and targeted therapies is also a significant growth factor. These medical approaches require antibodies with high precision to specifically target disease-causing cells, making thorough specificity testing a necessary step to ensure safety and effectiveness.

Market Statistics

- 2024 Market Size: USD 928.06 million

- 2034 Projected Market Size: USD 1,873.08 million

- CAGR (2025–2034): 7.3%

- North America: Largest market in 2024

AI Impact on Antibody Specificity Testing Market

- AI-based systems predict antibody-antigen interactions with high precision.

- Traditional antibody specificity testing methods rely on libraries and labor-intensive screening. However, AI technology reduces these tasks by analyzing sequence and structural data to prioritize high-potential candidates. This benefit enables quicker identification of antibodies with optimal specificity and affinity.

- Various companies operating in the diagnostics, drug development, and personalized medicine industry invest in AI platforms to stay competitive and expand their business.

Antibody specificity testing involves the test for the specificity of an antibody to understand if the antibody attaches to and binds only to the target protein of interest without associating with other non-targeted proteins. This is a crucial step when generating and employing antibodies for different purposes, which include research, diagnostics, and therapeutics. In laboratory and clinical contexts, the results obtained must be safe, accurate, and dependable. This requires an antibody to be specific for the target protein.

Growing concerns with the reproducibility crisis in research drive the industry expansion. Many scientific studies have been compromised due to the use of non-validated antibodies, resulting in false conclusions. This has led to a greater focus on improving methodologies for testing antibodies to provide high-quality and high-performance results.

Rising focus on single-cell technologies and proteomics research propels the market demand. These fields are generating enormous quantities of data that require highly specific and reliable antibodies for comprehensive analysis. There is a greater emphasis on the quality of research instruments, which is favorably correlated with the need for antibody testing.

Drivers and Trends

Rising Prevalence of Chronic and Infectious Diseases: Various chronic and infectious illnesses, such as cancer and autoimmune conditions, need precise diagnostic and treatment modalities. Antibodies are central to the diagnosis of these illnesses, and they need to be effective. There is an increased need for the development of novel antibodies and stringent testing to be done to determine their efficacy and safety, and their associated materials.

The burden of these diseases is substantial and growing. According to a WHO report from February 2024 on the global cancer burden, there were an estimated 20 million new cancer cases and 9.7 million deaths from cancer in 2022. This rising health burden increases the demand for precise diagnostic tests and targeted therapies that depend on highly specific antibodies. Thus, the rising prevalence of chronic and infectious diseases boosts the demand for antibody specificity testing.

Increase in Biopharmaceutical R&D Spending: Biopharmaceutical entities spend a significant amount of money on the development of novel drugs and therapies, a good number of which are antibody-based. There is an increase in the demand to test antibodies, which are at the center of these R&D operations. The reliability of these tests is fundamental to the success of the clinical trials and the safety of the end products.

A 2023 report from the National Science Foundation highlights that U.S. R&D spending totaled $892 billion in 2022, with a 2023 estimate indicating an increase to $940 billion. The report shows that U.S. research and experimental development spending was estimated to increase to $940 billion in 2023. This significant investments in R&D, especially within the life sciences, directly fuel the need for thorough antibody specificity testing, which is a key part of the drug development process.

Segmental Insights

Product & Service Analysis

Based on product & services, the segmentation includes products and antibody validation & specificity testing services. The products segment held the largest share in 2024. This is primarily attributed to the persistent and extensive need for diverse testing products, including reagents, kits, and instruments. These products are important for research laboratories, biopharma corporations, and antibody diagnostic centers. This is due to the rise in R&D activities aimed at developing new drugs and diagnostic tools. Also, the increasing adoption of emerging technologies such as ELISA and Western Blotting in laboratories amplifies the demand for diverse testing products. The continuous need to restock these undersupplied consumable products, as well as the constant evolution of improved diagnostic testing kits, ensures that this segment continues to thrive.

The services segment is anticipated to register the highest growth rate during the forecast period. This growth is attributed to the increasing trend of outsourcing focused testing services. Many small to mid-sized businesses and academic institutions are resorting to third-party complex antibody validation and testing services because such services require specialized facilities and skills that are economically not feasible to perform in-house. In addition, the surge in dependable antibodies for clinical use and drug development is motivating more businesses to collaborate with service providers to guarantee their results.

Technology Analysis

Based on technology, the segmentation includes immunoassay-based technologies, genetic validation-based technologies, microarray-based antibody technologies, and other technologies. The immunoassay-based technologies segment held the largest share in 2024. This is attributed to the fact that these technologies, which include ELISA and Western Blotting, are well-established and broadly utilized within diagnostic and research laboratories globally. They are sensitive, reliable, and cost-effective, which makes them a preferred option for wide applications, ranging from routine diagnostics to complex research. The dominance of these methods for validating antibodies within the academic and commercial sectors is increased. In addition, the automated and high-throughput capabilities of immunoassay platforms increased the demand for large-scale testing over the years, which has reinforced their leading position within the market.

The genetic validation-based segment is anticipated to register the highest growth rate during the forecast period. Increased need for greater certainty and reproducibility in scientific research boosts the segment growth. For traditional immunoassay methods, some issues with antibody specificity have raised concerns about the accuracy of the research. Genetic validation, where methods such as CRISPR-Cas9 are employed to prove that an antibody binds to a target, is the major standard for antibody specificity testing on a genetic level. It provides an exceptionally high level of confidence in the results as validation. This field is experiencing a surge in adoption as the scientific community shifts its focus toward developing thorough and reproducible research.

Application Analysis

Based on application, the segmentation includes research & development and clinical diagnostics. The research & development segment held the largest share in 2024. This is attributed to the fact that testing the specificity of antibodies is elementary and critical for the successful drug and antibody discovery and development. In research labs, academic and biopharmaceutical institutions, these tests are performed extensively for the discovery and validation of new antibodies. The constant need to guarantee the reliability and quality of antibodies applied in drug pipelines and for preclinical studies is one of the driving factors.

The clinical diagnostics segment is anticipated to register the highest growth rate during the forecast period. This enhanced growth is a result of the increasing need associated with the fast and accurate diagnosis of diseases, as well as the increasing popularity of personalized medicine. At the same time, the use of specific antibodies in a clinical setting is important in terms of the reliability of diagnostic tests for infectious diseases, cancer, and even autoimmune diseases. There is an increasing demand for reliable and validated antibodies because biomarkers are used in the early identification of diseases, accompanied by tailored treatment approaches. There is an increasing demand in a clinical setting for precision diagnosis for automated systems.

End Use Analysis

Based on end use, the segmentation includes pharmaceutical & biotechnology companies, academic & research institutes, diagnostic laboratories, and other end uses. The pharmaceutical & biotechnology companies segment held the largest share in 2024 as companies are at the frontline of developing new biotherapeutics and antibody-based therapies. In research and development, they invest in discovering and producing new therapeutic antibodies, drug conjugates, and even biosimilars. In the biopharmaceutical industry, the testing of antibodies for clinical applications is vital and increases the value of antibody testing. In clinical settings, the biopharmaceutical industry mandates the testing of antibodies to guarantee the products are safe and effective. The biopharmaceutical industry and consistent new drug pipeline in these industries contribute to a constant need for testing.

The research and academic institutions segment is anticipated to register the highest growth rate during the forecast period. The reason is the increased funding in life sciences and the rising focus of funding on understanding biology at the cellular level. These institutions are notable consumers of antibodies in protein analysis, cell signaling, and disease model studies. Research aimed at increasing accuracy and reproducibility is also reliant on high-quality, specific antibodies. There has been an increase in the use of antibody testing services and research due to the increase in funding of various academic and research institutes, both governmental and private.

Regional Analysis

The North America antibody specificity testing market accounted for the largest share in 2024, owing to the availability of sophisticated healthcare systems and the immense research and development spending. The presence of the top biopharmaceutical companies in the region also strengthens its position. The region's supply of innovative drugs and the personalized medicine approaches have created immense needs for accurate and reliable antibody specificity testing. The use of advanced technologies, government sponsorship, and the region's academic and research institutions offer a ready market for testing products and services that are research-centric. These factors help maintain the region's dominance.

U.S. Antibody Specificity Testing Market Insights

The U.S. plays a major role within North America due to its highly developed life science industry and substantial state investments in research and development for healthcare solutions. The biopharmaceutical industry, research institutions, and advanced clinical laboratories drive the increasing antibody-related research along with clinical antibody testing. The U.S. also has a strong research ecosystem, an increasing burden of chronic diseases, and robust clinical drug development processes.

Europe Antibody Specificity Testing Market Trends

In terms of the biopharmaceutical industry, Europe is highly concentrated and invests heavily in ongoing research. The rise in prevalence of chronic illnesses and a transition into a more personalized approach to health care are contributing to the biopharmaceutical industry’s demand. Europe’s active research and development team, coupled with antibody testing for diagnostics, provide a robust base of supporting academic institutions. The strong regulation, with high emphasis placed on quality and safety, results in a requirement for every new product.

The Germany antibody specificity testing market contributed to a substantial position in Europe. This is because of Germany’s high economic growth, coupled with a strong biopharmaceutical sector. Tradition in the field of medical innovation has been a big contributor to advanced medical tech in Germany and continues to drive the demand for precision testing. An interdisciplinary approach to medical research and innovation puts Germany among the leading countries.

Asia Pacific Antibody Specificity Testing Market Overview

The Asia Pacific market is anticipated to register the highest growth rate during 2025–2034, due to improving healthcare, rapid population growth, and increasing government funding in life sciences. As chronic and complex disease burden increases in the region, along with advanced medical care requirements, the demand for therapeutics and diagnostics is increasing. As the region becomes an important contract research and manufacturing hub, the demand for antibody validation and specificity testing services increases.

India Antibody Specificity Testing Market Analysis

In India, the industry growth is attributed to the expansion of the biopharmaceutical industry, a large pool of skilled researchers, and increasing government support for healthcare and research. The growing network of clinical research organizations provides affordable medical solutions, which drives the demand for antibody testing to support the manufacture of domestically developed medical products.

Key Players and Competitive Insights

The antibody specificity testing market is particularly concentrated, with dominant competitors being Thermo Fisher Scientific, Bio-Rad Laboratories, Merck KGaA, and Abcam. These companies have established their foothold in the market through a diverse portfolio containing reagents, kits, and various validation services. The companies have focused their strategies competitively within biopharma and research institutes on product diversity, cost, and innovative problem-solving, considering varying degrees of complexity. There is a presence of smaller businesses that have maintained their strategic focus on a single technology or application, often offering tailored services.

A few prominent companies in the industry include Thermo Fisher Scientific, Bio-Rad Laboratories, Merck KGaA, Abcam, F. Hoffmann-La Roche, Danaher Corporation, Agilent Technologies, Sino Biological, GenScript, and Creative Biolabs.

Key Players

- Abcam

- Agilent Technologies

- Bio-Rad Laboratories

- Creative Biolabs

- Danaher Corporation

- F. Hoffmann-La Roche

- GenScript

- Merck KGaA

- Sino Biological

- Thermo Fisher Scientific

Antibody Specificity Testing Industry Developments

June 2025: Bio-Rad Laboratories broadened its recombinant monoclonal anti-idiotypic antibody portfolio with the addition of antibodies targeting Perjeta, Tremfya, Ilaris, Benlysta, and Hemlibra, along with the introduction of a Human IgM-FcSpyCatcher reagent.

April 2025: Creative Diagnostics introduced Monkeypox Virus Neutralizing Antibody Testing services based on PRNT technology to aid vaccine development, therapeutic research, and evaluation of immune responses to monkeypox.

Antibody Specificity Testing Market Segmentation

By Product & Services Outlook (Revenue – USD Million, 2020–2034)

- Products

- Antibody Validation & Specificity Testing Services

By Technology Outlook (Revenue – USD Million, 2020–2034)

- Immunoassay-Based Technologies

- Genetic Validation-Based Technologies

- Microarray-Based Antibody Technologies

- Other Technologies

By Application Outlook (Revenue – USD Million, 2020–2034)

- Research & Development

- Clinical Diagnostics

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Diagnostic Laboratories

- Other End Use

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Antibody Specificity Testing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 928.06 million |

|

Market Size in 2025 |

USD 993.49 million |

|

Revenue Forecast by 2034 |

USD 1,873.08 million |

|

CAGR |

7.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 928.06 million in 2024 and is projected to grow to USD 1,873.08 million by 2034.

The global market is projected to register a CAGR of 7.3% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include Thermo Fisher Scientific, Bio-Rad Laboratories, Merck KGaA, Abcam, F. Hoffmann-La Roche, Danaher Corporation, Agilent Technologies, Sino Biological, GenScript, and Creative Biolabs.

The products segment accounted for the largest share of the market in 2024.

The genetic validation-based technologies segment is expected to witness the fastest growth during the forecast period.