COVID-19 Diagnostics Market Size, Share, Trends, Industry Analysis Report

: By Product Type (Reagents & Kits, Instruments, and Others), Sample Type, Test Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 117

- Format: PDF

- Report ID: PM1752

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

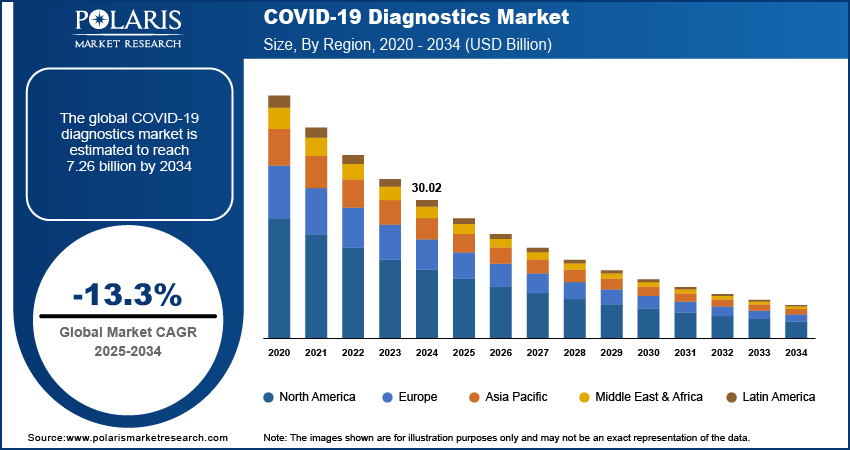

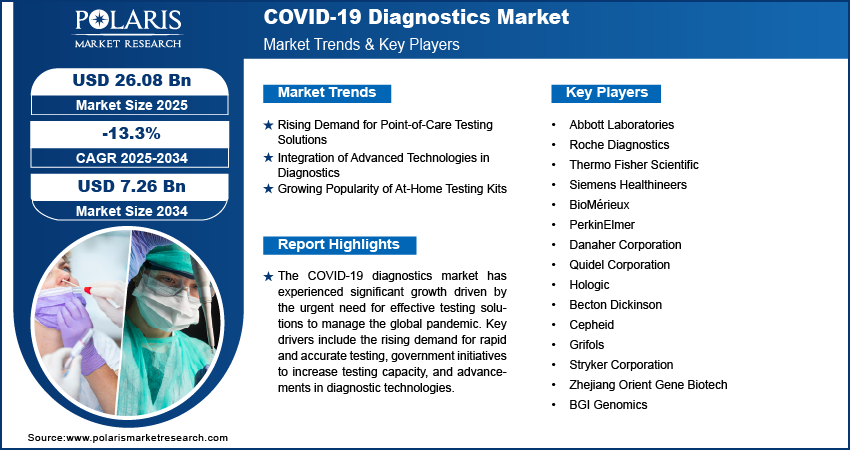

The global COVID-19 diagnostics market size was valued at USD 30.02 billion in 2024, growing at a CAGR of -13.3% during 2025–2034. The market is primarily driven by the increased need for surveillance and disease management, as well as technological advancements in diagnostic tools.

Key Insights

- The reagents and kits segment accounts for the largest market share, owing to their crucial role in testing procedures such as rapid antigen and PCR tests.

- The blood sample segment is witnessing the highest growth rate. The segment’s growth is driven by the growing adoption of serology and antibody tests for assessing immune response and post-infection surveillance.

- North America dominates the market. The regional market dominance is attributed to its widespread testing initiatives and the presence of a robust healthcare infrastructure.

- Asia Pacific is registering rapid growth, owing to high testing demands in densely populated countries like China and India.

Industry Dynamics

- The growing demand for point-of-care (POC) testing solutions, fueled by the increased need for rapid and decentralized testing options, is driving market expansion.

- The rising integration of advanced technologies in diagnostics, including artificial intelligence (AI) and cloud-based platforms, contributes to market development.

- The increasing preference for at-home testing kits for accessibility and convenience is expected to boost market growth in the coming years.

- An insufficient number of trained personnel may present market challenges.

Market Statistics

2024 Market Size: USD 30.02 billion

2034 Projected Market Size: USD 7.26 billion

CAGR (2025-2034): -13.3%

North America: Largest Market in 2024

AI Impact on COVID-19 Diagnostics Market

- AI accelerates diagnostic processes by analyzing imaging scans, test results, and patient data in real time.

- Machine learning models detect COVID-19 patterns with high accuracy, even in asymptomatic or early-stage cases.

- AI-powered platforms streamline testing workflows, reducing turnaround time and improving lab efficiency.

- Continuous AI learning enhances diagnostic tools to adapt to virus mutations and evolving testing requirements.

To Understand More About this Research: Request a Free Sample Report

The global COVID-19 diagnostics market focuses on the development, production, and distribution of testing solutions for detecting SARS-CoV-2 infection. This market encompasses diagnostic methods such as polymerase chain reaction (PCR), rapid antigen tests, and serology tests. Key drivers of market growth include the need for surveillance and disease management, government initiatives to enhance testing infrastructure, and technological advancements in diagnostic tools. Notable COVID-19 diagnostics market trends include the increasing adoption of point-of-care testing, the integration of artificial intelligence (AI) in diagnostic platforms, and the demand for at-home testing kits for convenience and accessibility.

Market Dynamics

Rising Demand for Point-of-Care Testing Solutions

Point-of-care (POC) testing has seen significant growth in the COVID-19 diagnostics market, driven by the demand for rapid and decentralized testing options. POC tests, particularly rapid antigen kits, gained popularity for their ability to provide results within minutes without complex laboratory equipment. This trend aligns with the increasing need for accessible diagnostics in remote areas and during emergency scenarios. According to a report by the World Health Organization (WHO), more than 60% of COVID-19 diagnostic tests distributed globally by mid-2021 were rapid antigen tests, emphasizing their widespread adoption. Thus, the rising adoption of POC testing solutions drives the COVID-19 diagnostics market demand.

Integration of Advanced Technologies in Diagnostics

The use of digital technologies, including AI and cloud-based platforms, has transformed the COVID-19 diagnostics landscape. AI-powered tools analyze test results more accurately and efficiently, reducing the potential for human error. Additionally, digital platforms have facilitated remote result sharing, contact tracing, and data collection for epidemiological studies. A study published in Nature highlighted the success of AI in detecting COVID-19 infection from chest X-rays with an accuracy exceeding 90%, demonstrating its utility in diagnostics. Therefore, the rising integration of advanced technologies in diagnostics propels the COVID-19 diagnostics market development.

Growing Popularity of At-Home Testing Kits

The demand for at-home COVID-19 testing kits surged as individuals sought convenient and safe testing options during the pandemic. These kits, including rapid antigen and molecular tests, allow users to test themselves without visiting healthcare facilities, thereby reducing exposure risks. Data from the US Food and Drug Administration (FDA) shows that over 20 at-home diagnostic test kits were approved for emergency use by mid-2022. This trend underscores the shift toward empowering individuals with accessible and user-friendly testing solutions. Hence, the growing popularity of at-home testing kits is expected to fuel the COVID-19 diagnostics market growth during the forecast period.

Market Segment Insights

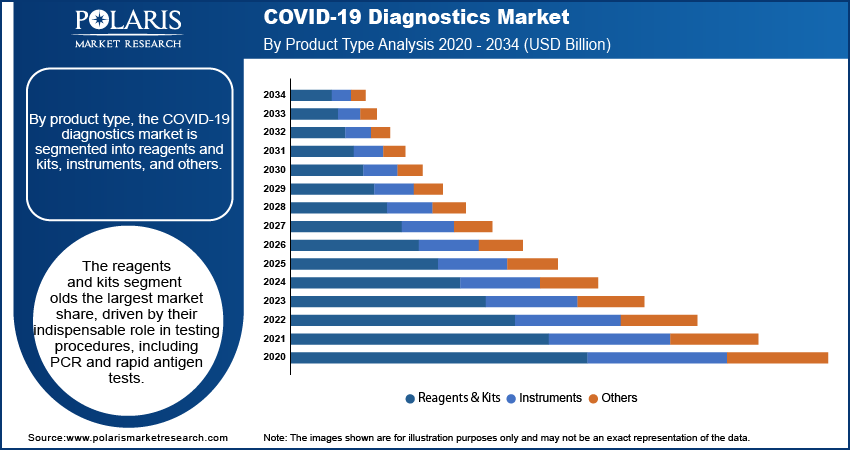

Market Outlook – Product Type-Based Insights

The COVID-19 diagnostics market, by product type, is segmented into reagents and kits, instruments, and others. The reagents and kits segment holds the largest market share, driven by their indispensable role in testing procedures, including PCR and rapid antigen tests. These products are essential for centralized and decentralized diagnostic workflows, making them critical for large-scale testing initiatives. The high consumption rate of reagents and kits, coupled with their recurring demand for testing purposes, has cemented this segment's dominance in the market.

The instruments segment witnesses the fastest growth, fueled by advancements in diagnostic technologies and increasing investments in laboratory infrastructure worldwide. Automated diagnostic instruments have gained traction due to their ability to enhance testing accuracy, reduce turnaround times, and handle high volumes of samples efficiently. Real-time PCR instruments have seen widespread adoption, particularly in high-capacity testing centers. Additionally, continuous product innovation and government funding for laboratory equipment have contributed to the robust growth trajectory of this segment.

Market Assessment – Sample Type-Based Insights

The COVID-19 diagnostics market segmentation, by sample type, includes swabs, blood, and others. The swabs segment holds the largest market share due to their widespread use in molecular and antigen-based testing methods such as nasopharyngeal and oropharyngeal swabs. These samples are considered the gold standard for detecting active SARS-CoV-2 infections, owing to their high sensitivity and reliability in capturing viral RNA. During the COVID-19 outbreak, their high demand was supported by the extensive use of swabs in mass testing campaigns and healthcare settings worldwide.

The blood sample segment is experiencing the highest growth, driven by the rising adoption of serology and antibody tests to assess immune response and post-infection surveillance. Blood-based testing has gained importance in understanding population-level immunity and monitoring vaccine effectiveness. Innovations in minimally invasive blood collection techniques, such as finger-prick samples, have also contributed to the growth of this segment by improving patient convenience and reducing procedural barriers.

Market Evaluation – Test Type Insights

The COVID-19 diagnostics market, by test type, is segmented into molecular (RT-PCR) testing, antigen-based testing, antibody (serology) testing, and others. The molecular (RT-PCR) testing segment holds the largest market share. The test is recognized as the gold standard for detecting active SARS-CoV-2 infections due to its high accuracy and sensitivity. Its extensive use in diagnostic laboratories, hospitals, and public health programs has solidified its position as the preferred testing method. The widespread deployment of RT-PCR testing during the pandemic, coupled with advancements in automation and high-throughput capabilities, has significantly contributed to the segment's dominance.

The antigen-based testing segment is registering the highest growth rate, driven by its rapid turnaround time and ease of use in point-of-care and at-home settings. These tests have been instrumental in large-scale screening efforts, particularly in resource-constrained regions where access to sophisticated laboratory infrastructure is limited. The increasing availability of cost-effective antigen kits and their emergency use authorization in multiple countries have further accelerated adoption. This growth is underpinned by ongoing innovations that enhance test sensitivity and specificity, making antigen-based testing a critical tool in managing the outbreak.

Regional Insights

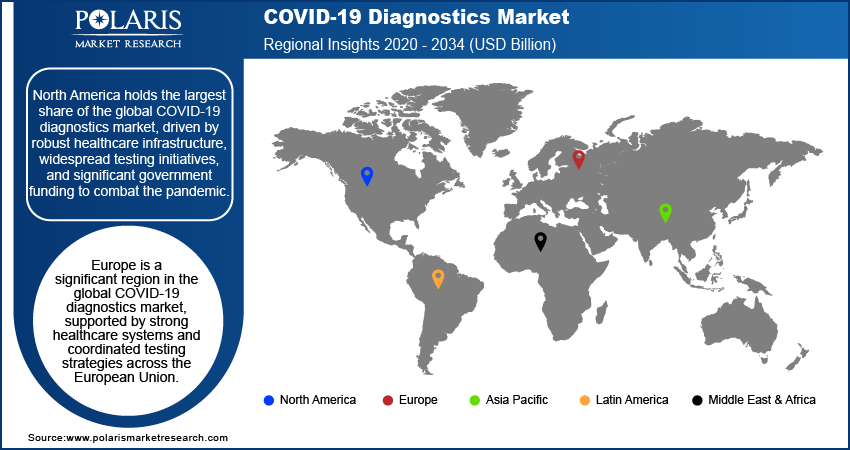

By region, the study provides COVID-19 diagnostics market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Considering the region-wise market size, North America holds the largest market share, driven by robust healthcare infrastructure, widespread testing initiatives, and significant government funding to combat the pandemic. The US, in particular, has led in adopting advanced diagnostic technologies, including molecular and rapid testing solutions, supported by extensive manufacturing and distribution networks. Additionally, the presence of key market players and the rapid approval of diagnostic tools by regulatory bodies such as the FDA have driven the region's dominance. High testing rates, coupled with proactive measures in public health management, have further contributed to North America's leading position in the global market.

Europe is a significant region in the COVID-19 diagnostics market, supported by strong healthcare systems and coordinated testing strategies across the European Union. Countries such as Germany, the UK, and France have been at the forefront, implementing widespread diagnostic programs to manage outbreaks. Favorable government policies and funding initiatives boost the adoption of advanced molecular and rapid testing solutions. Additionally, collaborations between public health authorities and private players have accelerated the availability of innovative diagnostic tools across the region.

The Asia Pacific COVID-19 diagnostics market is witnessing rapid growth, driven by high testing demands in densely populated countries such as India and China. Government initiatives aimed at enhancing testing capacity and accessibility, coupled with increasing investments in healthcare infrastructure, have propelled market growth. The region also benefits from a strong manufacturing base for diagnostic kits and reagents, enabling cost-effective production and distribution. Furthermore, the rising popularity of point-of-care testing and at-home diagnostic solutions is contributing to the market's expansion in this region.

Key Players and Competitive Insights

Abbott Laboratories, Roche Diagnostics, Thermo Fisher Scientific, Siemens Healthineers, BioMerieux, PerkinElmer, Danaher Corporation, Quidel Corporation, Hologic, Becton Dickinson, Cepheid, Grifols, Abbott, Stryker Corporation, and Zhejiang Orient Gene Biotech are a few key players in the COVID-19 diagnostics market. These companies have been instrumental in developing a wide range of diagnostic solutions, from molecular tests (such as PCR) to antigen and antibody kits, addressing laboratory and point-of-care testing needs. A few companies, such as Roche and Thermo Fisher Scientific, have also expanded their portfolios to include automated diagnostic systems, whereas other players, such as Quidel and Abbott, have focused on rapid antigen and at-home testing solutions. These companies are continuing to innovate and adapt their product offerings to meet the evolving demands of COVID-19 testing worldwide.

In terms of competition, companies in the COVID-19 diagnostics market are focusing on enhancing test accuracy, reducing testing time, and increasing the availability of their products globally. Key strategies include expanding manufacturing capacities, forging partnerships with healthcare providers, and securing regulatory approvals for new testing solutions. Many players are also focusing on fulfilling the growing demand for self-testing kits and point-of-care diagnostics. For instance, companies such as Abbott and Quidel have expanded their product lines to include easy-to-use rapid tests suitable for home use in response to a shift toward more accessible and convenient testing methods.

The competitive landscape has led to continuous innovation, especially in the rapid testing and point-of-care diagnostics segments, as companies strive to differentiate their products based on sensitivity, speed, and cost-effectiveness. Companies such as Cepheid and Hologic, known for their molecular diagnostic platforms, continue to focus on developing systems that can handle large volumes of tests with reduced turnaround times. At the same time, regional players, particularly in Asia Pacific, are expanding their market presence by offering cost-competitive diagnostic solutions, providing an additional layer of competition in the global market.

Abbott Laboratories is a global player in the COVID-19 diagnostics market, known for developing a range of diagnostic tests, including PCR and rapid antigen tests. The company has been actively involved in providing testing solutions globally, partnering with healthcare providers and governments to enhance testing capacity.

Roche Diagnostics is another major player, offering a variety of diagnostic products used for detecting COVID-19, such as PCR tests and antigen tests. Roche has played a critical role in the global response to the pandemic, helping to scale up testing efforts in various countries.

Key Companies

- Abbott Laboratories

- Roche Diagnostics

- Thermo Fisher Scientific

- Siemens Healthineers

- BioMérieux

- PerkinElmer

- Danaher Corporation

- Quidel Corporation

- Hologic

- Becton Dickinson

- Cepheid

- Grifols

- Stryker Corporation

- Zhejiang Orient Gene Biotech

- BGI Genomics

COVID-19 Diagnostics Industry Developments

- September 2025: QuidelOrtho announced the expansion of its QUICKVUE portfolio. The company added the QUICKVUE Influenza + SARS Test to its portfolio. It stated that the test will help clinicians differentiate between COVID-19 and seasonal flu infections.

- In March 2024, Abbott announced a new partnership with several European countries to expand its rapid COVID-19 testing infrastructure, providing more accessible solutions for both healthcare professionals and the common population.

- In February 2024, Roche received approval for its next-generation COVID-19 testing system, which promises to improve accuracy and testing efficiency, further solidifying its presence in the diagnostics market.

Market Segmentation

By Product Type Outlook

- Reagents & Kits

- Instruments

- Others

By Sample Type Outlook

- Swabs

- Blood

- Others

By Test Type Outlook

- Molecular (RT-PCR) Testing

- Antigen-Based Testing

- Antibody (Serology)

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

COVID-19 Diagnostics Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 30.02 billion |

|

Market Size Value in 2025 |

USD 26.08 billion |

|

Revenue Forecast by 2034 |

USD 7.26 billion |

|

CAGR |

-13.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The COVID-19 diagnostics market has been broadly segmented on the basis of product type, sample type, and test type. Moreover, the study provides the reader with a detailed understanding of the different segments at the global and regional levels.

Growth/Marketing Strategy

The COVID-19 diagnostics market growth and marketing strategies have focused on expanding product accessibility, improving test accuracy, and reducing turnaround times. Companies are enhancing their manufacturing capabilities to meet high global demand, while also forming partnerships with governments, healthcare organizations, and distributors to ensure widespread availability. In addition, market players are investing in research and development to introduce more advanced, user-friendly diagnostic solutions, including at-home and point-of-care tests. Companies are also leveraging digital platforms to support real-time data sharing and remote testing services, catering to the growing demand for convenience and efficiency in testing.

FAQ's

The global COVID-19 diagnostics market size was valued at USD 30.02 billion in 2024 and is projected to grow to USD 7.26 billion by 2034.

The global market is projected to register a CAGR of -13.3% during 2025–2034.

North America had the largest share of the global market in 2024.

A few key players in the COVID-19 diagnostics market are Abbott Laboratories, Roche Diagnostics, Thermo Fisher Scientific, Siemens Healthineers, BioMerieux, PerkinElmer, Danaher Corporation, Quidel Corporation, Hologic, Becton Dickinson, Cepheid, Grifols, Abbott, Stryker Corporation, and Zhejiang Orient Gene Biotech.

The reagents & kits segment accounted for the largest share of the global market in 2024.

The swab segment accounted for the largest share of the global market in 2024.

COVID-19 diagnostics refers to the methods and tools used to detect the presence of the SARS-CoV-2 virus, which causes COVID-19 in individuals. These diagnostic tests are essential for identifying infected individuals, helping to manage outbreaks, and controlling the spread of the virus. Common types of COVID-19 diagnostic tests include molecular tests, such as PCR (Polymerase Chain Reaction) tests, which detect the virus's genetic material, and antigen tests, which identify proteins on the surface of the virus. Additionally, antibody or serology tests are used to determine if a person has been previously infected by detecting antibodies in the blood. These diagnostic tools are used in various settings, including hospitals, laboratories, and point-of-care locations, as well as for at-home testing.

A few key trends in the COVID-19 diagnostics market are described below: Rising Preference for Point-of-Care Testing: Growing demand for rapid and decentralized testing solutions, especially in remote and underserved areas. Integration of Advanced Technologies: Use of AI, machine learning, and cloud platforms for more accurate diagnostics, faster result processing, and enhanced data collection. Expansion of At-Home Testing: Increased availability of user-friendly self-testing kits for convenience and greater accessibility. Shift to Multiplex Testing: Development of tests that can simultaneously detect multiple viruses or infections, reducing the need for separate tests.

A new company entering the COVID-19 diagnostics market must focus on developing rapid, cost-effective, and accurate testing solutions that cater to the increasing demand for point-of-care and at-home tests. Innovation in multiplex testing, which detects multiple pathogens simultaneously, could set the company apart. Additionally, leveraging digital platforms for real-time data sharing and integrating AI for faster and more precise results would appeal to healthcare providers and governments. Partnering with healthcare organizations for large-scale testing initiatives and ensuring quick regulatory approvals would help build trust and visibility in a competitive market. Offering flexible, scalable solutions for varying testing needs could be a key differentiator.

Companies manufacturing, distributing, or purchasing COVID-19 diagnostics and related products and other consulting firms must buy the report.