US 3D Secure Payment Authentication Market Size, Share, Trend & Industry Analysis Report

: By Component (Access Control Server, Merchant Plug-in, and Others), and By Application– Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5856

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

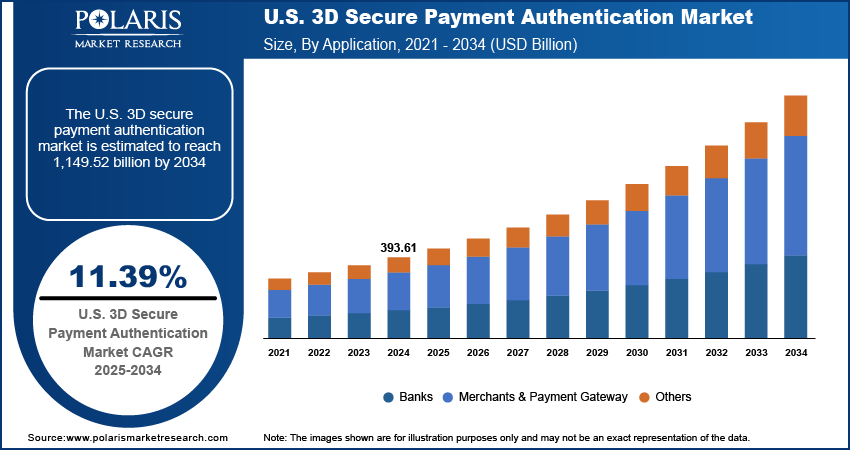

The U.S. 3D secure payment authentication market size was valued at USD 393.61 million in 2024 and is projected to grow at a CAGR of 11.39% during 2025–2034. Growing consumer preference for online and mobile shopping is increasing the volume of card-not-present transactions. Merchants and issuers are adopting 3D Secure to mitigate fraud while maintaining a seamless checkout experience across apps, websites, and mobile wallets.

The market refers to a segment of the digital payments ecosystem focused on enhancing online transaction security through an additional layer of user authentication. This protocol commonly recognized in versions like 3D secure 2.0 enables real-time verification during ecommerce payments, reducing the risk of unauthorized use while complying with evolving regulatory standards. It is used by banks, merchants, and payment gateways to ensure that the person initiating a card-not-present transaction is the legitimate cardholder. Rising regulatory focus on data protection and payment security is pushing financial institutions to deploy advanced authentication mechanisms. Compliance with evolving U.S. federal and state-level cybersecurity mandates is accelerating the adoption of 3D Secure frameworks. For instance, in March 2024, Visa expanded its global value-added services business by introducing three new AI-powered risk and fraud protection products. The new tools, which are part of Visa Protect's end-to-end suite, are intended to prevent fraud in instant account-to-account and card-not-present (CNP) payments, as well as transactions on and off Visa's network.

Increasing complexity of payment fraud, particularly in remote transactions, is forcing banks and payment gateways to implement layered authentication. For instance, according to the Association for Financial Professionals Payments Fraud and Control Survey, in 2024, 79% of U.S. organizations faced payments fraud, with a significant number involving cyberattacks. 3D Secure offers real-time identity verification, reducing fraud-related chargebacks and improving transaction trust.

Market Dynamics

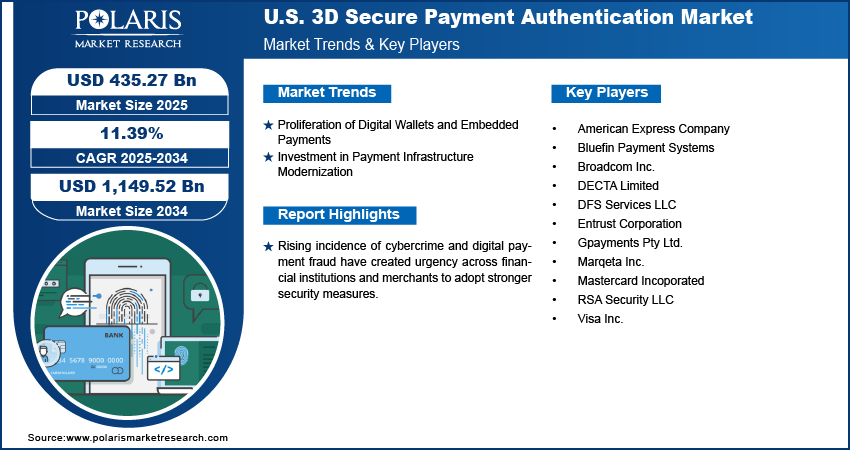

Proliferation of Digital Wallets and Embedded Payments

The growing popularity of digital wallets like Apple Pay, Google Pay, and other app-based payment methods is reshaping how consumers’ complete transactions. These platforms emphasize convenience, speed, and security, prompting payment processors to integrate advanced 3D Secure protocols. Tokenization and end-to-end encryption play a critical role in protecting sensitive data during online and in-app transactions. To support this shift, 3D Secure authentication enables seamless verification without disrupting the user experience, ensuring that the cardholder is properly validated while maintaining a frictionless payment flow. As embedded payment features continue to expand across retail, travel, and service apps, demand for intelligent, adaptable authentication systems is expected to rise steadily among issuers and merchants.

Investment in Payment Infrastructure Modernization

Banks and acquiring institutions across the U.S. are making substantial investments in modernizing their core payment infrastructure. The focus is on building scalable, real-time processing systems that support advanced fraud detection tools powered by AI and machine learning platform. This digital transformation aligns closely with 3D Secure adoption, as stronger authentication mechanisms are needed to meet regulatory expectations and evolving fraud threats. Modern systems allow for quicker deployment of EMV 3D Secure 2.0 protocols and better integration with digital banking channels. These upgrades improve transaction accuracy and security and also reduce false declines, enhance consumer trust, and prepare institutions for future innovations in the digital payments ecosystem.

Segment Insights

Market Assessment by Component

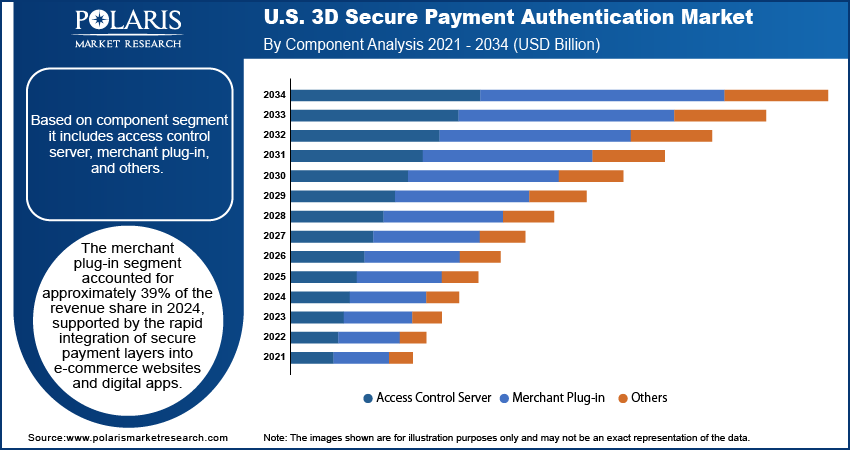

Based on component segment it includes access control server, merchant plug-in, and others. In 2024, the access control server segment in the U.S. 3D secure payment authentication market was valued at approximately USD 128 million, driven by growing demand from issuing banks and financial institutions aiming to secure digital transactions. This component serves as the core verification layer that manages communication between the card issuer and payment networks during authentication. Strong emphasis on minimizing fraud in card-not-present transactions has accelerated the deployment of advanced access control servers capable of real-time decision-making. Issuers are also focusing on compliance with protocols like EMV 3D Secure 2.0, which require enhanced infrastructure to support biometric validation and risk-based authentication. The increasing need to reduce false positives and ensure customer trust in mobile and online banking is supporting the value of scalable, low-latency servers.

The merchant plug-in segment accounted for approximately 39% of the revenue share in 2024, supported by the rapid integration of secure payment layers into e-commerce websites and digital apps. Retailers, subscription platforms, and service providers are embedding plug-ins that enable seamless communication between merchant servers and issuing banks during the transaction authentication process. High transaction volumes, increased fraud exposure, and consumer demand for low-friction checkout experiences have made real-time plug-in solutions essential. EMV 3D Secure 2.0 capabilities allow merchants to capture device data and apply adaptive authentication rules without disrupting user experience. These plug-ins also help merchants meet compliance standards and reduce liability by shifting fraud responsibility to the issuer. Continuous innovation in API-based plug-in architecture and compatibility across devices ensures this segment remains central to merchant-driven payment security strategies.

Market Assessment by Application

Based on application segment it includes banks, merchants & payment gateway, and others. In 2024, the merchants and payment gateway segment was valued at approximately USD 187 million, driven by the need for enhanced protection in high-volume online payment environments. Payment gateways are integrating 3D Secure authentication into their systems to provide merchants with secure, scalable solutions that verify cardholder identity during checkout. Rising concerns about fraud, chargebacks, and regulatory compliance have made authentication a critical priority for merchants operating across retail, travel, food delivery, and digital services. Payment service providers are adopting EMV 3D Secure 2.0 to offer contextual and frictionless verification, using data like geolocation, device ID, and behavioral patterns. This dynamic authentication flow helps retain customers by reducing false declines while preventing fraudulent access. As digital commerce expands and embedded payments become standard, merchant and gateway platforms continue to lead demand for robust authentication infrastructure that protects both customer trust and transactional revenue.

The banks segment is projected to register the fastest CAGR of 11.26% over the forecast period due to rising investment in digital transformation and fraud prevention technologies. For instnace, according to the U.S. Department of the Treasury, the U.S. Treasury prevented and recovered over USD 4 billion in fraud and improper payments in fiscal year 2024, up from USD 652.7 million in FY23. This growth shows improved efforts by the Office of Payment Integrity to use better technology and data to stop fraud and protect government funds. Financial institutions are moving toward cloud-native, scalable systems that support real-time transaction monitoring and dynamic authentication models. The need to align with data security standards, mitigate risk from phishing and credential theft, and ensure compliance with regulations like GLBA and FFIEC guidelines is accelerating adoption of 3D Secure protocols. Banks are also responding to growing customer expectations for secure mobile and online banking experiences. Advanced access control servers integrated with machine learning and biometric validation are being deployed to improve approval rates without compromising security. This focus on modernizing core systems and protecting cardholder data in an increasingly digital environment is positioning the banking segment for sustained growth in the 3D Secure payment authentication market.

Key Players & Competitive Analysis Report

The competitive landscape of the U.S. 3D secure payment authentication market is defined by a strong push toward innovation, regulatory alignment, and infrastructure modernization. Industry analysis indicates that vendors are accelerating market expansion strategies through joint ventures and strategic alliances with banks, fintech platforms, and payment gateway providers to deliver integrated authentication solutions. Mergers and acquisitions are being leveraged to consolidate capabilities in AI-based fraud detection, behavioral biometrics, and real-time risk analytics. Post-merger integration efforts focus on enhancing interoperability between legacy systems and EMV 3D Secure 2.0 protocols to improve fraud prevention and reduce cart abandonment. Technology advancements such as tokenization, biometric verification, and API-driven plug-ins are becoming standard as issuers and merchants prioritize low-friction user experiences. The shift toward mobile-first payment channels and embedded finance is driving the development of modular, cloud-native authentication systems that support dynamic data collection and seamless authorization. Regulatory compliance with standards such as PSD2 and PCI DSS continues to influence vendor positioning. Competition is intensifying across platforms offering adaptive authentication, real-time decisioning, and multi-factor solutions optimized for high transaction environments.

List of Key Companies

- American Express Company

- Bluefin Payment Systems

- Broadcom Inc.

- DECTA Limited

- DFS Services LLC

- Entrust Corporation

- Gpayments Pty Ltd.

- Marqeta Inc.

- Mastercard Incoporated

- RSA Security LLC

- Visa Inc.

3D Secure Payment Authentication Industry Developments

In June 2025, Worldpay enhanced its collaboration with Visa to optimize the 3D Secure (3DS) solution, helping U.S. merchants reduce fraud, minimize consumer friction, and increase authorization rates. 3DS Flex merchants transmit authentication data to the issuer, improving payment security and the shopping experience.

In March 2024, Visa expanded its U.S. value-added services business by introducing three new AI-powered risk and fraud protection products. The new tools, which are part of Visa Protect's end-to-end suite, are intended to prevent fraud in instant account-to-account and card-not-present (CNP) payments, as well as transactions on and off Visa's network.

U.S. 3D Secure Payment Authentication Market Segmentation

By Component Outlook (Revenue USD Million, 2020–2034)

- Access Control Server

- Merchant Plug-in

- Others

By Application Outlook (Revenue USD Million, 2020–2034)

- Banks

- Merchants & Payment Gateway

- Others

U.S. 3D Secure Payment Authentication Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 393.61 million |

|

Market Size Value in 2025 |

USD 435.27 million |

|

Revenue Forecast by 2034 |

USD 1,149.52 million |

|

CAGR |

11.39% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 393.61 million in 2024 and is projected to grow to USD 1,149.52 million by 2034.

The U.S. market is projected to register a CAGR of 11.39% during the forecast period.

A few of the key players includes are American Express Company; Bluefin Payment Systems; Broadcom Inc.; DECTA Limited; DFS Services LLC; Entrust Corporation; Gpayments Pty Ltd.; Marqeta Inc.; Mastercard Incoporated; RSA Security LLC; Visa Inc.

The merchant plug-in segment accounted for approximately 39% of the revenue share in 2024, supported by the rapid integration of secure payment layers into e-commerce websites and digital apps.

In 2024, the merchants and payment gateway segment was valued at approximately USD 187 million, driven by the need for enhanced protection in high-volume online payment environments.