Europe Polyethylene Terephthalate Catalyst Market Size, Share, Trends, Industry Analysis Report

By Product (Antimony-Based, Aluminum-Based, Titanium-Based, Germanium-Based, Other Catalysts), By Application, By Country – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM6443

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

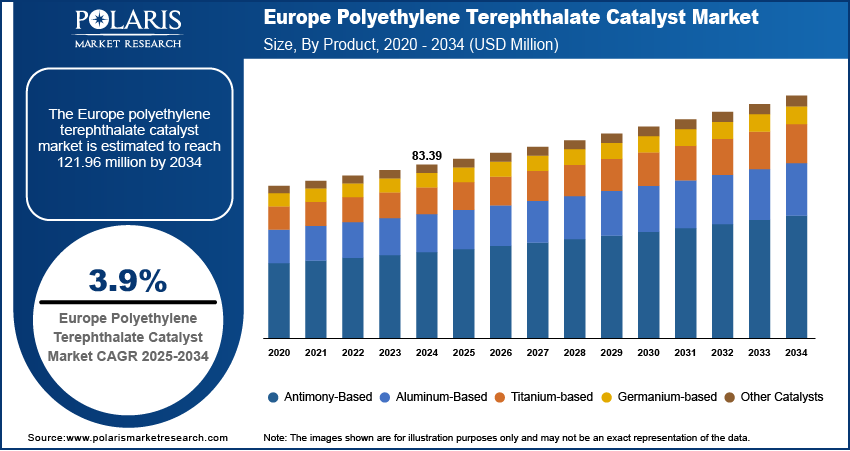

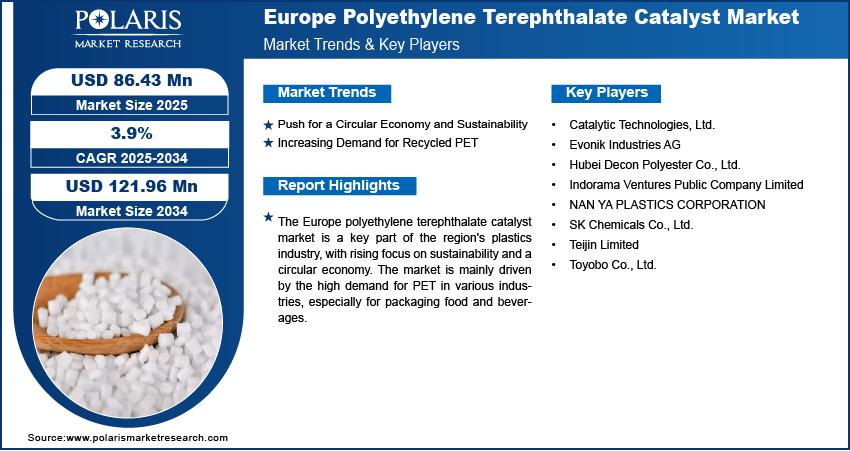

The Europe polyethylene terephthalate (PET) catalyst market size was valued at USD 83.39 million in 2024 and is anticipated to register a CAGR of 3.9% from 2025 to 2034. The market is driven by the growing demand for sustainable packaging solutions. Strict government regulations and policies that promote a circular economy also boost the use of PET catalysts. Additionally, the increasing use of recycled polyethylene terephthalate, or rPET, is a key growth factor.

Key Insights

- By product, the antimony-based catalyst segment held the largest share in 2024, driven by its high efficiency and cost-effectiveness in PET resin production.

- By application, the packaging segment accounted for the largest share in 2024, supported by strong demand for PET bottles and containers in the food and beverage industry.

- By country, Germany held the largest share in 2024 due to its strong manufacturing and industrial base and focus on sustainable production.

Industry Dynamics

- The increasing use of polyethylene terephthalate, or PET, in various industries such as food packaging and textiles is a major driver. PET is a lightweight, clear, and strong material. It is a preferred material for bottles and containers, which boosts demand for the catalysts needed to make it.

- Strict government regulations and a focus on creating a circular economy are also key factors. Policies that encourage the use of recycled PET, or RPET, and promote higher recycling rates directly increase the need for catalysts that can be used in both new and recycled plastic production.

- A growing consumer awareness of environmental issues is also influencing the demand for more sustainable products. This has led to a shift toward recycled and bio-based plastics, which require new and improved catalysts to ensure the final products meet quality and performance standards.

Market Statistics

- 2024 Market Size: USD 83.39 million

- 2034 Projected Market Size: USD 121.96 million

- CAGR (2025–2034): 3.9%

- Germany: Largest Market in 2024

Polyethylene terephthalate, or PET, catalysts are chemical substances that speed up the process of making PET without being used up in the reaction. These catalysts are essential for producing high-quality PET resins, which are widely used to make plastic bottles, packaging, and textile fibers.

One of the drivers is the development of new, more efficient catalysts. These new catalysts, such as some aluminum-based ones, are gaining popularity as they are a more affordable and eco-friendly choice. They help make PET production more sustainable by lowering its environmental impact compared to older, traditional catalysts. The ongoing development in catalyst technology is helping to meet the need for better materials and production processes.

Another factor is the increasing use of PET in the automotive and electronics industries. While packaging and textiles are the main uses, PET is also being used more for making lightweight car parts and electrical components. The demand for durable, yet lightweight, materials in these industries is encouraging the use of PET and, in turn, the need for its catalysts. This trend is driven by the shift toward electric vehicles and the need for new materials in electronic devices.

Drivers and Trends

Push for a Circular Economy and Sustainability: The landscape is largely shaped by the region's strong focus on sustainability and moving toward a circular economy. Growing environmental concerns and consumer demand for eco-friendly products boost the demand for recycled and sustainable materials. As a result, there is a greater need for PET catalysts and amorphous PET that work well with both new and recycled materials to help create high-quality, sustainable products such as bottles and food containers.

The new Packaging and Packaging Waste Regulation (PPWR), which went into effect in February 2025, sets clear goals for increasing the amount of recycled content in plastic packaging. According to a report on plastics and packaging laws in the European Union, the regulation requires PET beverage bottles to contain at least 25% recycled plastic by 2025 and 30% by 2030. These requirements create a direct demand for catalysts that can handle recycled PET, which, in turn, drives the market forward.

Increasing Demand for Recycled PET: The growing sector for recycled PET, known as rPET, is another major driver for the PET catalyst market. Consumers and companies are increasingly choosing products made from recycled materials to lower their carbon footprint. This has led to a rise in recycling efforts and a need for new technologies that can efficiently turn plastic waste into valuable raw materials. Catalysts play a key role in this process by making sure the recycled PET is of high enough quality to be used in new products.

According to a report from Plastics Recyclers Europe, the total installed capacity for recycling PET in the EU and surrounding countries increased to almost 3.2 million tons in 2023. This is a clear sign of the growing infrastructure for recycling PET, which directly boosts the demand for catalysts used in the recycling and production of new materials from recycled sources. The ongoing growth in this sector is a major reason for the market's positive outlook.

Segmental Insights

Product Analysis

Based on product, the segmentation includes antimony-based, aluminum-based, titanium-based, germanium-based, and other catalysts. The antimony-based segment held the largest share in 2024. Antimony-based catalysts have been the traditional and most widely used option for a long time due to their effectiveness and reliability in PET production. They are known for their ability to achieve a fast reaction rate and produce a high-quality polymer with consistent properties such as clarity and strength. This makes them a preferred choice for manufacturers, particularly in the packaging industry, which has strict requirements for product quality. The strong position of this segment is also a result of existing manufacturing processes being set up to use these catalysts, making it easier for producers to stick with what they know. The widespread and continued use of these catalysts in both new and recycled PET production solidifies their leading position.

The titanium-based segment is anticipated to register the highest growth rate during the forecast period. This growth is driven by a shift in the industry toward more sustainable and environmentally friendly options. As regulations on heavy metals become stricter and companies seek greener ways to produce plastics, titanium-based catalysts are becoming a more popular alternative. They are less toxic than their antimony counterparts and are considered to be a more modern solution for PET production. This segment is also benefiting from ongoing advancements in technology, which have improved the performance of these catalysts, making them more competitive. The increasing demand for recycled materials also plays a role, as new catalyst technologies are being developed to work more effectively with recycled plastics. This strong focus on sustainability and innovation is a key reason for the segment's rapid growth.

Application Analysis

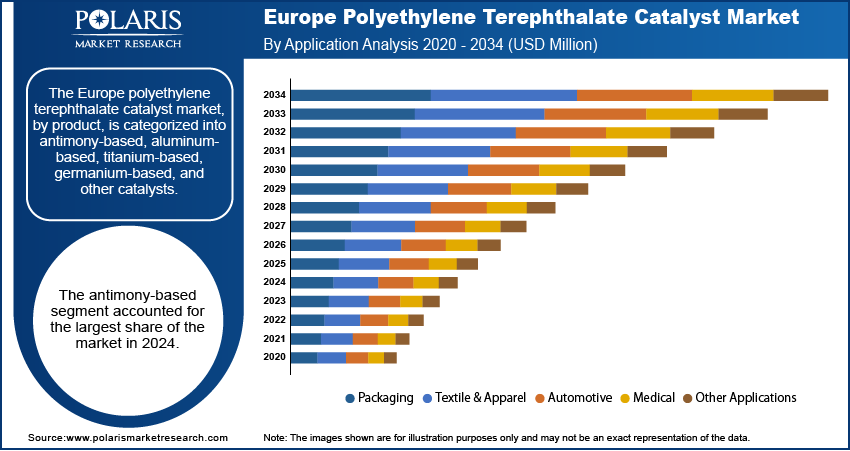

Based on application, the segmentation includes packaging, textile & apparel, automotive, medical, and other applications. The packaging segment held the largest share in 2024. PET is a highly preferred material for making bottles, films, and containers due to its lightweight, durability, and ability to keep products fresh. The rising demand for consumer goods such as beverages and food is a major reason for the leading position of this segment. As consumers in Europe continue to choose bottled drinks and packaged foods, the need for PET catalysts to produce these materials remains consistently high. The packaging segment also benefits from the ongoing trend toward using recycled PET, as catalysts are essential for making sure the recycled material meets quality standards for new packaging.

The medical segment is anticipated to register the highest growth rate during the forecast period. PET is a very useful material in the medical field due to its strength, biocompatibility, and sterilization capabilities. It is used in a variety of medical applications, from making surgical implants such as artificial ligaments and sutures to creating medical trays and blister packs for medicines. The increasing focus on patient safety and the growing need for advanced medical devices are driving the demand for high-quality PET. New innovations in the medical field, along with a rising number of surgical procedures, are boosting the need for specialized PET materials. This growth is also supported by the fact that PET is a reliable and safe material for single-use medical products, which are becoming more common in healthcare settings.

Country Analysis

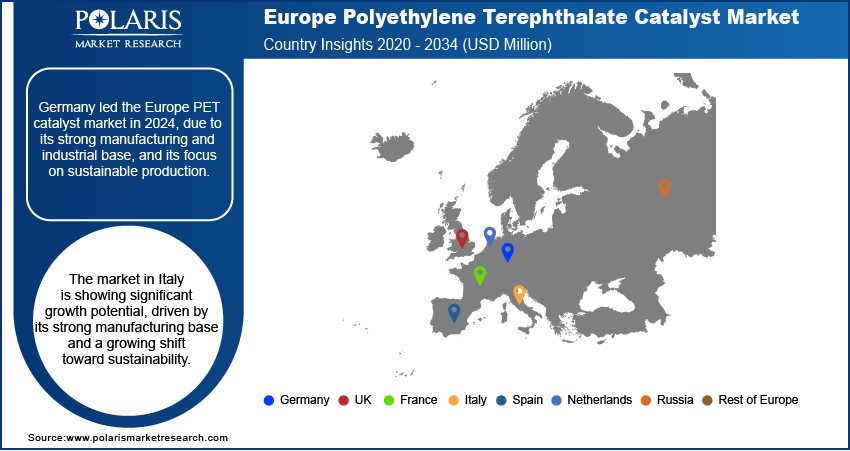

The Germany polyethylene terephthalate catalyst market stands as a major country in Europe. This is mainly due to its strong position as an industrial and manufacturing hub within the region. The country has a large and well-established chemical industry, which is a major consumer of PET catalysts. The strong automotive and packaging sectors in Germany also contribute to the high demand for PET. The country’s focus on sustainable manufacturing and its push for a circular economy encourage the use of advanced and eco-friendly catalysts. This is a key reason for Germany’s leading role in the market, as it has the infrastructure and industry to support a growing demand for PET products.

Italy Polyethylene Terephthalate Catalyst Market Overview

Italy is a key country in the Europe polyethylene terephthalate catalyst market, showing significant growth potential. The country's strong manufacturing base, especially in consumer goods, food and beverages, and textiles, drives a consistent demand for PET. The Italian market is also influenced by a shift toward more sustainable materials and the need for new solutions to meet European environmental goals. The local industries are actively investing in modernizing their production processes to use recycled PET and more efficient catalysts, which helps to boost the market. This focus on innovation and sustainability makes Italy a growing country in the market.

UK Polyethylene Terephthalate Catalyst Market Trends

The UK holds an important position in the market. The country has a strong and growing demand for PET, particularly in the packaging and electrical and electronics sectors. The UK's market is shaped by its own set of policies and a strong consumer preference for recycled and sustainable products. This has led to a focus on new technologies and processes that can handle recycled materials more effectively. The push for a circular economy and the need for new materials in high-growth industries such as electronics and automotive are key reasons for the UK's steady demand for PET catalysts.

Key Players and Competitive Insights

The Europe polyethylene terephthalate catalyst market has a competitive landscape that is quite active, with several key players competing to offer a range of products. The landscape includes both large, global chemical companies and smaller, specialized manufacturers. These companies compete based on factors such as product innovation, cost, and the ability to meet the growing demand for more eco-friendly and high-performance catalysts. Many of the major players are focused on developing new catalyst technologies, especially those that can support the circular economy and work with recycled materials. The market also sees competition from different types of catalysts, such as the older, traditional antimony-based options and the newer, more advanced titanium-based ones. This constant push for innovation is what shapes the market and drives its overall development.

A few prominent companies in the industry include Toyobo Co., Ltd.; Evonik Industries AG; Teijin Limited; Indorama Ventures Public Company Limited; SK Chemicals Co., Ltd.; Catalytic Technologies, Ltd.; Hubei Decon Polyester Co., Ltd.; and NAN YA PLASTICS CORPORATION.

Key Players

- Catalytic Technologies, Ltd.

- Evonik Industries AG

- Hubei Decon Polyester Co., Ltd.

- Indorama Ventures Public Company Limited

- NAN YA PLASTICS CORPORATION

- SK Chemicals Co., Ltd.

- Teijin Limited

- Toyobo Co., Ltd.

Europe Polyethylene Terephthalate Catalyst Market Segmentation

By Product Outlook (Revenue – USD Million, 2020–2034)

- Antimony-Based

- Aluminum-Based

- Titanium-Based

- Germanium-Based

- Other Catalysts

By Application Outlook (Revenue – USD Million, 2020–2034)

- Packaging

- Textile & Apparel

- Automotive

- Medical

- Other Applications

By Country Outlook (Revenue – USD Million, 2020–2034)

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Polyethylene Terephthalate Catalyst Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 83.39 million |

|

Market Size in 2025 |

USD 86.43 million |

|

Revenue Forecast by 2034 |

USD 121.96 million |

|

CAGR |

3.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 83.39 million in 2024 and is projected to grow to USD 121.96 million by 2034.

The market is projected to register a CAGR of 3.9% during the forecast period.

Germany held the largest share.

A few key players in the market include Toyobo Co., Ltd.; Evonik Industries AG; Teijin Limited; Indorama Ventures Public Company Limited; SK Chemicals Co., Ltd.; Catalytic Technologies, Ltd.; Hubei Decon Polyester Co., Ltd.; and NAN YA PLASTICS CORPORATION.

The antimony-based segment accounted for the largest share of the market in 2024.

The medical segment is expected to witness the fastest growth during the forecast period.