Amorphous Polyethylene Terephthalate Market Share, Size, Trends, Industry Analysis Report

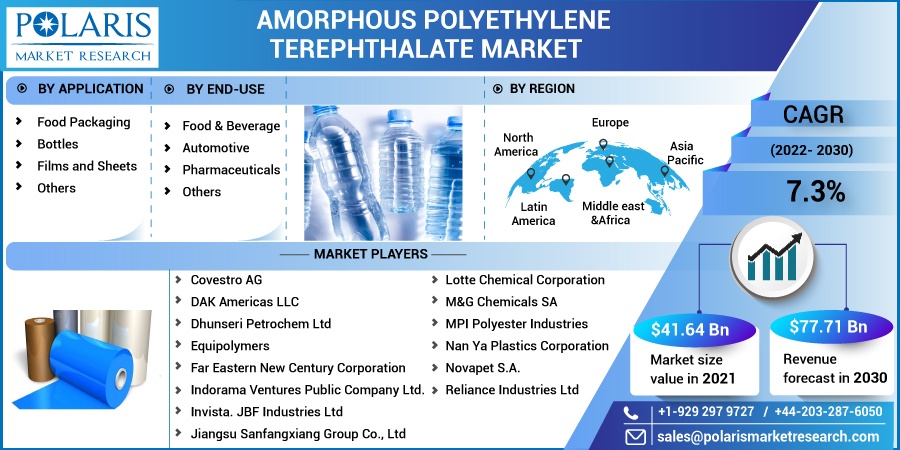

by Application (Food Packaging, Bottles, Films and Sheets, Others); by End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Sep-2022

- Pages: 114

- Format: PDF

- Report ID: PM2617

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

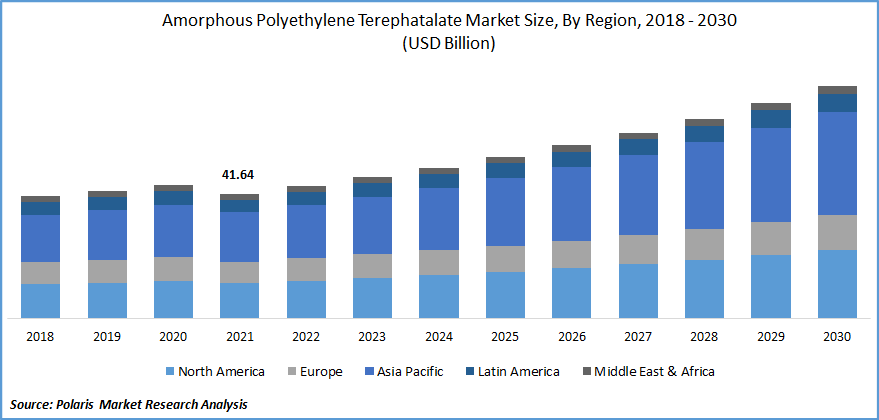

The global amorphous polyethylene terephthalate market was valued at USD 41.64 billion in 2021 and is expected to grow at a CAGR of 7.3% during the forecast period. Amorphous polyethylene terephthalate offers low weight, durability, recyclability, clarity, and high strength. The adoption of APET has also increased owing to its high impact resistance, barrier properties, and chemical & solvent resistance.

Know more about this report: Request for sample pages

Growth in environmental concerns coupled with increasing consumer consciousness regarding the use of sustainable solutions and recycling supports the growth of the amorphous polyethylene terephthalate industry. The greater need to decrease the environmental impact of packaging has accelerated the growth of the industry.

APET is increasingly being used in packaging solutions for improved performance, effective barrier properties, and greater resistance to puncture and temperature. Plastic products and solutions have wide applications in numerous industries, which has encouraged governments across the globe to regulate and reduce the use of plastics.

Organizations are also turning toward recycled and bio-based plastics to address environmental concerns. Greater initiatives for the adoption of sustainable solutions have been observed across several nations. For instance, India introduced a plastics pact for encouraging and motivating small and large businesses to support a circular system for plastics in September 2021.

Consumers are turning toward packaging solutions that are easy to use, lighter and durable, increasing the demand for APET. It offers high strength, low weight, flexibility, and affordability. Consumers are spending more time ‘on the go’, which has increased the demand for packaged food products owing to time constraints.

The rise in disposable income of consumers, changing lifestyles, and rising middle-class population in developing countries are factors contributing to the growth of the amorphous polyethylene terephthalate market.

The outbreak of COVID-19 influenced the growth of the industry through a disrupted supply chain, reduced workforce, and restrictions on import and export activities. Travel restrictions across the world affected the transportation of raw materials and finished products.

Negative impact on industries such as automotive and electronics resulted in decreased demand for APET. However, the market is expected to experience growth during the forecast period owing to growth in e-commerce platforms, supportive government regulations, and favorable environmental policies.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The increasing demand for amorphous polyethylene terephthalate from the food and beverage, automotive, and pharmaceutical sectors support the growth of the industry. The rise in population, industrialization, and urbanization has further contributed to the growth of the amorphous polyethylene terephthalate market.

APET is increasingly being used for the packaging of food products. The inclination toward the use of sustainable packaging solutions further boosts its adoption. Changes in consumer lifestyle, greater demand from emerging economies, and growth of e-commerce platforms would accelerate the adoption of APET during the forecast period.

The demand for amorphous polyethylene terephthalate is expected to increase for bottle manufacturing to be used as carbonated soft drink bottles, mineral water bottles, and others. An increase in applications, technological advancements, and growth in investments in R&D have further increased the demand for APET.

There has been a rise in environmental concerns associated with plastic use across the world. Several governments are introducing stringent regulations regarding the use of plastic & plastic packaging waste and employing new recycling techniques, thereby supporting the growth of the market. Public and private organizations are also taking initiatives to reduce their carbon footprint, accelerating the demand for APET.

Report Segmentation

The market is primarily segmented based on application, end-use, and region.

|

By Application |

By End-Use |

By Region |

|

|

|

Know more about this report: Request for sample pages

Bottles accounted for a significant share in 2021

The different applications of amorphous polyethylene terephthalate include food packaging, bottles, films and sheets, and others. The bottles segment accounted for a significant market share in 2021. Bottles are widely used in the packaging of water, carbonated drinks, medicines, and pharmaceuticals, among others.

Amorphous polyethylene terephthalate is also increasingly being used in food packaging. The demand for amorphous polyethylene terephthalate is expected to increase in the food packaging sector during the forecast period. Greater consumption of healthy snacks and quick breakfasts has increased the demand for packaged food products.

Companies in this industry are developing sustainable packaging solutions to cater to the growing consumer demand. Greater demand for packaging from developing nations, changes in consumer lifestyle, and a rise in popularity of e-commerce platforms are factors expected to increase the use of amorphous polyethylene terephthalate in the coming years.

Food & beverage industry accounts for a major share

On the basis of end-use, the amorphous polyethylene terephthalate market is segmented into food & beverage, automotive, pharmaceuticals, and others. The rise in demand for packaged food products worldwide has increased the demand for amorphous polyethylene terephthalate.

It is used in the food and beverage industry for containing, protecting, and preserving food products owing to its stiffness, strength, and clarity. An increase in disposable income of consumers, improved customer lifestyle, and enhanced standard of living have resulted in greater consumption of packaged food products.

The high use of e-commerce platforms and the strengthening retail industry have supported the growth of the market. Amorphous polyethylene terephthalate, when used in the packaging of food and beverages, offers product safety and durability. Greater focus on product presentation in the retail environment has increased the demand for amorphous polyethylene terephthalate.

Asia-Pacific dominated the global market in 2021

Asia Pacific dominated the global amorphous polyethylene terephthalate market in 2021. Growth in urbanization, industrialization and economic development in countries such as India, Japan, and China support the market growth in the region. Strengthening the FMCG industry and greater demand for food and beverages has increased the demand for amorphous polyethylene terephthalate in the region.

Rising automotive penetration and increasing demand from the pharmaceutical sector support the greater application of amorphous polyethylene terephthalate. Several global market players are expanding their presence in this region to leverage the availability of material and labor.

Competitive Insight

Some major players operating in the global market include Covestro AG, DAK Americas LLC, Dhunseri Petrochem Ltd, Equipolymers, Far Eastern New Century Corporation, Indorama Ventures Public Company Limited, Invista, JBF Industries Ltd, Jiangsu Sanfangxiang Group Co., Ltd, Lotte Chemical Corporation, M&G Chemicals SA, MPI Polyester Industries, Nan Ya Plastics Corporation, Novapet S.A., and Reliance Industries Limited.

The prominent market players in the region are developing advanced solutions to cater to the growing consumer demand. Partnerships and collaborations with other market players and public organizations offer opportunities to strengthen market presence.

Recent Developments

In April 2022, Indorama Ventures Public Company Limited acquired Ngoc Nghia Industry – Service – Trading Joint Stock Company (NN). The acquisition enabled the company to expand its portfolio of PET packaging solutions.

In February 2022, Alpek, S.A.B. de C.V. announced the acquisition of OCTAL Holding SAOC. The acquisition enhancing the company’s portfolio in PET sheet segment, while also strengthening geographic presence in Americas, Middle East, and Europe.

Amorphous Polyethylene Terephthalate Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 41.64 billion |

|

Revenue forecast in 2030 |

USD 77.71 billion |

|

CAGR |

7.3% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Covestro AG, DAK Americas LLC, Dhunseri Petrochem Ltd, Equipolymers, Far Eastern New Century Corporation, Indorama Ventures Public Company Limited, Invista. JBF Industries Ltd, Jiangsu Sanfangxiang Group Co., Ltd, Lotte Chemical Corporation, M&G Chemicals SA, MPI Polyester Industries, Nan Ya Plastics Corporation, Novapet S.A., Reliance Industries Limited |