Catalyst Market Size, Share, Trends, Industry Analysis Report

By Product (Heterogeneous Catalyst, Homogeneous Catalyst), By Raw Material, By Process, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 129

- Format: PDF

- Report ID: PM4502

- Base Year: 2023

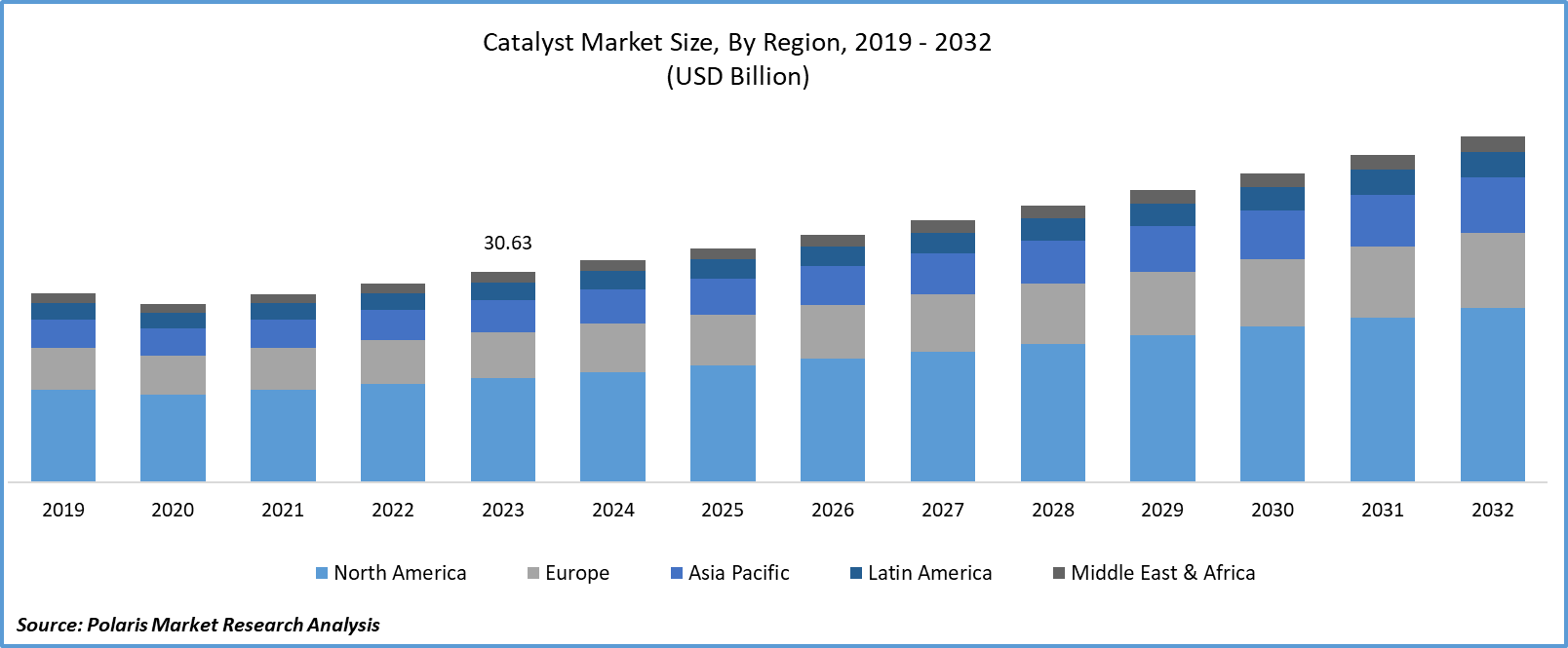

- Historical Data: 2019 – 2022

Market Overview

The catalyst market size was valued at USD 32.34 billion in 2024 and is expected to register a CAGR of 4.5% from 2025 to 2034. Rapid industrialization across the world drives the demand for catalysts. The rising requirement for high-performance catalysts is expected to continue to grow as global fuel consumption rises.

Key Insights

- The heterogeneous catalyst segment dominated the global catalyst market share in 2024 due to its broad industrial applicability, operational efficiency, and ease of separation from reaction mixtures.

- The recycling segment accounted for a major market share in 2024 due to its cost-effectiveness, regulatory compliance, and the growing emphasis on sustainable industrial practices.

- Asia Pacific accounted for a major market share in 2024 due to rapid industrialization, expanding petrochemical capacity, and increasing demand from the automotive and refining sectors.

- The catalysis industry in North America is expected to expand at a robust pace in the coming years, owing to the rigorous environmental regulations and the strong automotive and industrial base.

Industry Dynamics

- Automobile manufacturers integrate catalytic converters into vehicle exhaust systems to comply with stringent environmental regulations. Hence, the rising production of automobiles boosts the expansion of the catalyst market.

- Urbanization prompts governments and industries to expand infrastructure such as power plants, refineries, chemical manufacturing, and public transportation systems. These infrastructures rely heavily on catalytic processes to minimize environmental impact and meet regulatory standards. Therefore, rapid urbanization worldwide propels industry expansion.

- It is complex and costly to remove catalyst from the reaction mixture, which hinders the market growth.

- The rising development of environmentally friendly catalysts, due to the imposition of stringent laws, is expected to offer lucrative opportunities during the forecast period.

Market Statistics

2024 Market Size: USD 32.34 Billion

2034 Projected Market Size: USD 50.02 Billion

CAGR (2025–2034): 4.5%

Asia Pacific: Largest market in 2024

AI Impact on Catalyst Market

- Artificial intelligence (AI) tools are used to analyze vast experimental datasets to predict optimal catalyst structures and compositions.

- AI systems track catalyst health during operations, which detects signs of contamination and deactivation.

- Predictive analysis enables timely adjustments, reducing downtime and extending catalyst life.

- Robotics and AI combine to test thousands of catalyst candidates.

- HTS platforms are automating characterization, synthesis, and performance testing, which is dramatically speeding up development cycles.

To Understand More About this Research: Request a Free Sample Report

A catalyst is a substance that increases or decreases the rate of a chemical reaction by providing an alternative reaction pathway with lower activation energy, without itself being consumed or permanently altered in the process. Catalysts work by breaking and reforming chemical bonds more efficiently, making it easier for reactant molecules to convert into products. There are two main types of catalysts: heterogeneous catalysts, which are in a different phase than the reactants, and homogeneous catalysts, which share the same phase as the reactants, typically dissolved in the same solvent. The usage of catalysts is widespread and vital in industries. Catalysts are essential for the efficient production of chemicals, fuels, plastics, pharmaceuticals, and fertilizers. They also enable the production of cleaner fuels, biodegradable plastics, and more effective medicines.

The rising industrialization globally is propelling the catalyst market growth. Industries seek more advanced catalysts to meet stricter environmental regulations and achieve sustainable production with expanding industrialization. Industries such as petroleum refining, pharmaceuticals, and chemical manufacturing use catalysts to enhance output, reduce energy consumption, and lower operational costs. Moreover, emerging economies are investing in large-scale industrial projects that require catalysts to optimize processes and maintain competitive production rates. Therefore, the rising industrialization globally is propelling the catalyst industry expansion.

The catalyst market demand is driven by the rising fuel consumption globally. Catalysts help break down heavy hydrocarbons into lighter, more valuable fuels, allowing refineries to meet growing fuel needs. Additionally, stricter environmental regulations push fuel producers to use advanced catalysts that reduce sulfur and other harmful emissions, ensuring cleaner-burning fuels. Thus, the need for high-performance catalysts is estimated to continue to grow as global fuel demand rises.

Market Dynamics

Rising Production of Automobiles

Automobile manufacturers increasingly integrate catalytic converters into vehicle exhaust systems to comply with stringent environmental regulations. These converters use catalysts, typically made from platinum, palladium, and rhodium, to convert toxic gases into less harmful substances. Advancements in automotive technology and the push for cleaner, more efficient engines further amplify the requirement for high-performance catalysts. Additionally, the shift toward hybrid vehicles, which still rely partially on combustion engines, drives the need for efficient catalysts. Therefore, the need for catalysts made from precious metals is increasing as more vehicles are produced globally. The European Automobile Manufacturers' Association stated the production of 85.4 million motor vehicles around the world in 2022, an increase of 5.7% compared to 2021. Hence, the rising production of automobiles boosts the catalyst market expansion.

Growing Urbanization Worldwide

Urbanization propels governments and industries to expand infrastructure, including power plants, refineries, chemical manufacturing, and public transportation systems. These infrastructures rely heavily on catalytic processes to minimize environmental impact and meet regulatory standards. Urban centers also generate higher volumes of waste and emissions, prompting the need for advanced pollution control technologies. To manage these concerns, municipalities invest in cleaner energy production and stricter emission controls, both of which depend on effective catalytic systems. Additionally, increased vehicle ownership and construction in urban areas drive up the demand for catalysts used in exhaust treatment and the production of cleaner fuels and materials. United Nations Development Programme in 2024 stated that cities host more than half of the global population and are projected to double by 2050. This rapid urban growth is creating a sustained need for catalytic solutions that support sustainable development while maintaining industrial efficiency.

Segment Insights

Market Evaluation by Product

Based on product, the market is divided into heterogeneous catalysts and homogeneous catalysts. The heterogeneous catalyst segment dominated the global catalyst market share in 2024 due to its broad industrial applicability, operational efficiency, and ease of separation from reaction mixtures. Industries such as petroleum refining, chemical manufacturing, and environmental protection rely heavily on heterogeneous catalysts owing to their stability under harsh conditions and cost-effective regeneration capabilities. Fluid catalytic cracking and hydrotreating processes, which are integral to fuel production and emission control, predominantly utilize these catalysts. Additionally, the rise in global energy demand, coupled with increasingly stringent environmental regulations, pushed refiners to adopt more efficient and environmentally friendly catalytic systems, further boosting the demand for heterogeneous variants.

The homogeneous catalysts segment is expected to grow at a robust pace in the coming years, owing to its superior selectivity and efficiency in fine chemical and pharmaceutical synthesis. Unlike heterogeneous alternatives, these catalysts operate in the same phase as reactants, enabling precise molecular-level interaction and higher yields in complex reactions. The pharmaceutical industry, in particular, continues to invest heavily in high-performance catalytic systems to meet the increasing demand for enantiomerically pure compounds and active pharmaceutical ingredients. Innovations in ligand design and metal complex stability also contribute to the broader adoption of homogeneous catalysts, positioning them as a critical compound for next-generation chemical processes.

Market Insight by Process

In terms of process, the market is segregated into recycling, regeneration, and rejuvenation. The recycling segment accounted for a major market share in 2024 due to its cost-effectiveness, regulatory compliance, and the growing emphasis on sustainable industrial practices. Industries, particularly in oil refining and chemical manufacturing, increasingly adopted recycling methods to recover valuable metals such as platinum, palladium, and rhodium. These metals, essential for catalytic activity, witnessed significant price volatility and supply chain concerns, prompting manufacturers to invest in closed-loop recycling systems. Additionally, stringent environmental regulations across North America and Europe pushed companies to minimize waste and emissions, further reinforcing the appeal of recycling.

Regional Outlook

By region, the catalyst market report provides insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific accounted for a major market share in 2024 due to rapid industrialization, expanding petrochemical capacity, and increasing demand from the automotive and refining sectors. China dominated the regional market and contributed the most significant revenue share, fueled by its large-scale manufacturing base, government-backed environmental policies, and ongoing investments in renewable energy and emission reduction technologies. The country’s emphasis on upgrading refining capabilities and adopting stringent fuel standards further boosted demand for advanced catalytic processes. Additionally, India and Southeast Asian nations, including Vietnam and Indonesia, experienced strong market growth due to rising energy consumption, urbanization, and infrastructure development. For instance, the World Bank in its report stated that India is urbanizing rapidly, by 2036, its towns and cities will be home to 600 million people, or 40% of the population, up from 31% in 2011.

The availability of low-cost labor, expanding chemical production, and supportive regulatory frameworks further contributed to Asia Pacific's dominance in both the consumption and production of catalysts.

The catalysis industry in North America is expected to expand at a robust pace in the coming years, owing to the rigorous environmental regulations and the strong automotive and industrial base. The US is projected to lead the regional industry during the forecast period, due to its aggressive implementation of air quality standards under frameworks such as the Clean Air Act. These regulations continue to push industries to adopt emission-reducing technologies, especially in sectors such as transportation, power generation, and refining. Furthermore, rising investments in electric vehicles and sustainable fuels have accelerated research and development efforts to enhance catalytic efficiency and durability. Canada is also expected to contribute to regional growth, supported by clean energy initiatives and its commitment to reducing greenhouse gas emissions.

Key Players and Competitive Analysis

The catalyst industry is fragmented and is anticipated to witness competition from several players. The demand for catalysts in petrol refining and pharmaceutical companies is expected to grow even more as a result of major players in the industry making significant R&D investments to extend their product lines. Important market developments include the introduction of new products, larger-scale mergers and acquisitions, contractual agreements, and cooperation with other companies.

The market is fragmented, with the presence of numerous global and regional market players. Major players in the market are Albemarle Corporation, Arkema, Axens, BASF SE, Clariant, Evonik Industries AG, Exxon Mobil Corporation, Haldor Topsoe A/S, Johnson Matthey, LyondellBasell Industries Holdings B.V., The Dow Chemical Company, Umicore, W. R. Grace & Co.-Conn., and Zeolyst International.

Arkema is a global company in specialty materials, renowned for its innovation-driven approach and commitment to sustainable development. Headquartered in Colombes, France, the company operates in 55 countries and employs over 21,000 people. Arkema’s business is structured around three main segments: Adhesive Solutions, Advanced Materials, and Coating Solutions, which together account for 92% of its sales, complemented by an Intermediates segment. The company’s materials are integral to a wide range of industries, including automotive, construction, electronics, packaging, and energy, reflecting its global reach and diversified portfolio.

Evonik Industries AG is a global company in specialty chemicals, with a strong reputation for innovation and sustainability across diverse markets. Headquartered in Germany, Evonik operates worldwide and is particularly prominent in the field of catalysts, where it has been at the forefront for over 75 years. Evonik’s catalyst portfolio is extensive and tailored to meet the needs of industries ranging from pharmaceuticals and agrochemicals to petrochemicals and plastics recycling. The company produces a wide array of catalysts, including precious metal powder catalysts under the Noblyst P brand, activated metal catalysts such as KALCAT and Metalyst, and specialized catalysts for hydrogenation, oxidation, and polymer production.

List of Key Companies in Catalyst Market

- Albemarle Corporation

- Arkema

- Axens

- BASF

- Clariant

- Evonik Industries AG

- Exxon Mobil Corporation

- Haldor Topsoe A/S

- Johnson Matthey

- LyondellBasell Industries Holdings B.V.

- The Dow Chemical Company

- Umicore

- W. R. Grace & Co.-Conn.

- Zeolyst International

Catalyst Industry Developments

January 2023: Albemarle Corporation, a leader in the global specialty chemicals industry, announced the official brand launch of Ketjen to provide advanced catalyst solutions for the petrochemical, refining, and specialty chemicals industries.

September 2022: BASF introduced the novel X3DTM technology, a new additive manufacturing technology for catalysts based on 3D printing.

Catalyst Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Heterogeneous Catalyst

- Homogeneous Catalyst

By Raw Material Outlook (Revenue, USD Billion, 2020–2034)

- Chemical Compounds

- Peroxides

- Acids

- Amines & Others

- Metals

- Precious Metals

- Base Metals

- Zeolites

- Others

By Process Outlook (Revenue, USD Billion, 2020–2034)

- Recycling

- Regeneration

- Rejuvenation

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Petroleum Refining

- Fluid Catalytic Cracking (FCC)

- Alkylation Catalysts

- Hydro Processing Catalysts

- Catalytic Reforming

- Others

- Chemical Synthesis

- Polyolefins

- Catalytic Oxidation

- Hydrogenation Catalysts

- Others

- Polymer Catalysis

- Ziegler Natta

- Reaction Initiator

- Single Site

- Others

- Environmental

- Light Duty Vehicles

- Heavy Duty Vehicles

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Catalyst Market Report Scope

|

Report Attributes |

Details |

|

Market Value in 2024 |

USD 32.34 Billion |

|

Market Forecast in 2025 |

USD 33.72 Billion |

|

Revenue Forecast in 2034 |

USD 50.02 Billion |

|

CAGR |

4.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 32.34 billion in 2024 and is projected to grow to USD 50.02 billion by 2034.

The global market is projected to register a CAGR of 4.5% during the forecast period.

Asia Pacific had the largest share of the global market in 2024.

A few of the key players in the market are Albemarle Corporation, Arkema, Axens, BASF SE, Clariant, Evonik Industries AG, Exxon Mobil Corporation, Haldor Topsoe A/S, Johnson Matthey, LyondellBasell Industries Holdings B.V., The Dow Chemical Company, Umicore, W. R. Grace & Co.-Conn., and Zeolyst International.

The recycling segment dominated the market revenue in 2024.

The homogeneous catalyst segment is expected to grow at the fastest pace in the coming years.