Polyethylene Terephthalate Catalyst Market Size, Share, Trends, Industry Analysis Report

By Product (Antimony-Based, Aluminum-Based, Titanium-Based, Germanium-Based, Other Catalysts), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 123

- Format: PDF

- Report ID: PM6441

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

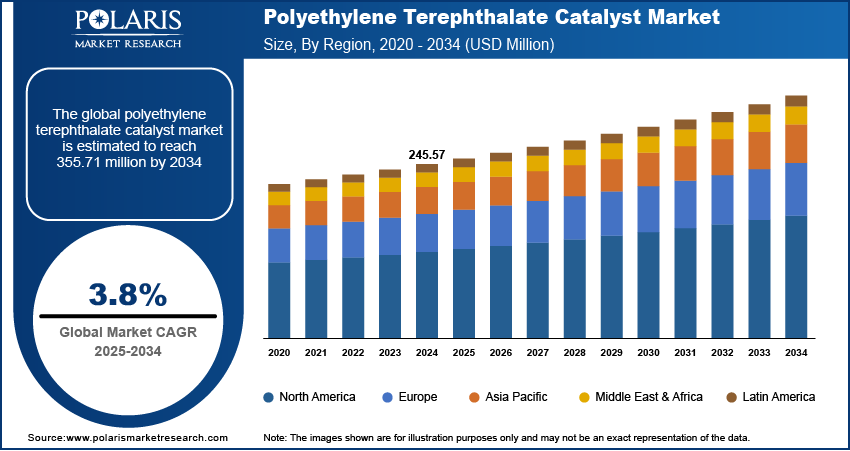

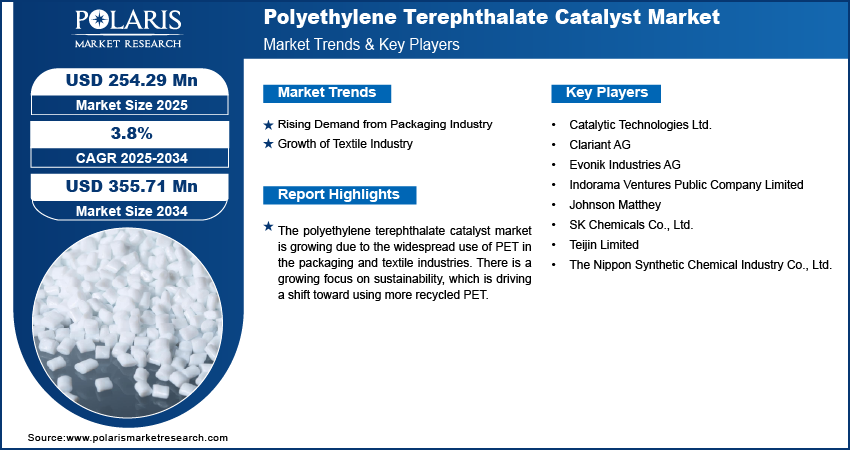

The global polyethylene terephthalate (PET) catalyst market size was valued at USD 245.57 million in 2024 and is anticipated to register a CAGR of 3.8% from 2025 to 2034. The increasing demand for PET from the packaging industry, due to a growing preference for lightweight and recyclable materials, drives industry growth. The shift toward sustainable products and eco-friendly manufacturing also boosts the need for advanced catalysts.

Key Insights

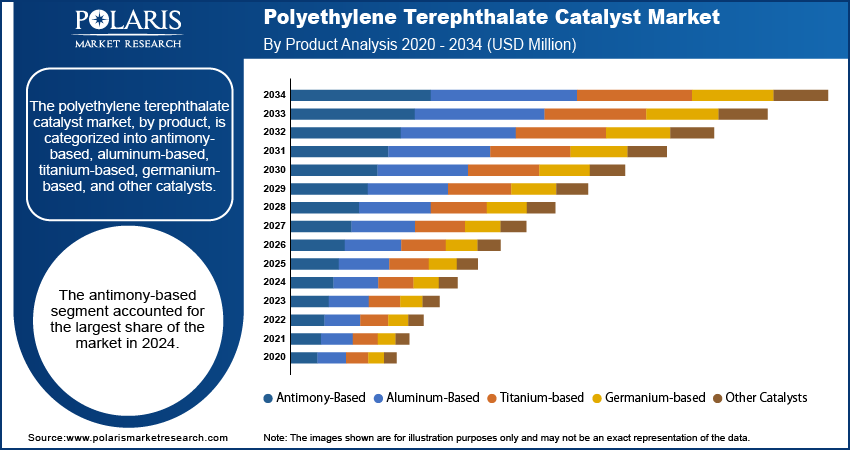

- By product, the antimony-based catalyst segment held the largest share in 2024, driven by its proven efficiency and cost-effectiveness in large-scale PET resin production.

- Based on application, the packaging segment dominated the market in 2024, supported by rising demand for PET bottles and containers in the food, beverage, and pharmaceutical industries.

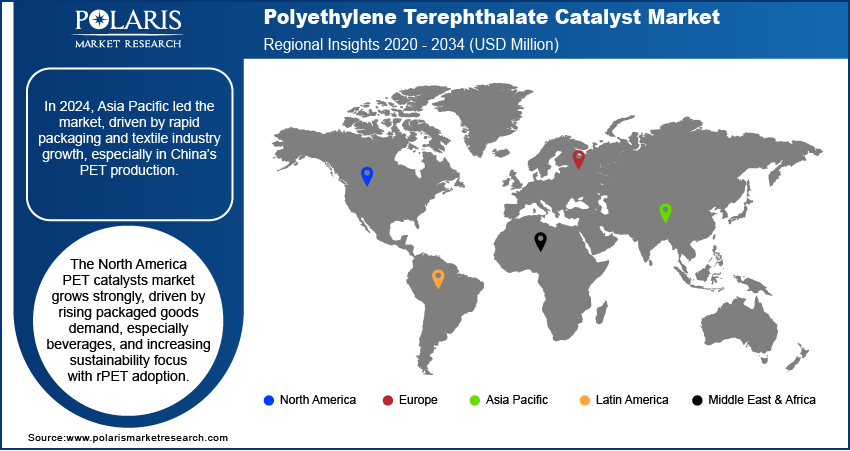

- By region, Asia Pacific held the largest share in 2024. The growth is fueled by rapid industrialization, strong PET packaging demand from expanding FMCG and beverage sectors, and growing PET resin production capacities.

Industry Dynamics

- The growing demand for high-performance and sustainable packaging is a key driver. This is fueled by increasing consumer preference for lightweight, durable, and recyclable materials in the food, beverage, and consumer goods industries, which increases the demand for PET.

- The shift toward using recycled PET (rPET) and bio-based PET is also driving the demand for catalysts. New catalyst technologies are being developed to improve the quality and production efficiency of these recycled and bio-based materials, which supports a more circular economy.

- Another major growth factor is the increasing use of PET in the textile and apparel sector, especially for making polyester fibers. The need for cost-effective, durable, and versatile synthetic fibers is boosting demand for these catalysts.

Market Statistics

- 2024 Market Size: USD 245.57 million

- 2034 Projected Market Size: USD 355.71 million

- CAGR (2025–2034): 3.8%

- Asia Pacific: Largest market in 2024

Polyethylene terephthalate (PET) catalysts include chemical substances that help in the PET production. These catalysts improve the reaction process and the quality of the final product. They are essential for making PET resins used in various products.

One driver is the growing demand for PET in the electronics industry. The material's lightweight, durable, and insulating properties make it useful for components such as protective films and substrates for flexible displays. As the use of wearable technology and smart devices grows, the demand for materials such as PET rises.

The rise of the textile industry, especially in developing economies, fuels the demand for polyethylene terephthalate catalysts. As disposable incomes increase in regions such as Asia Pacific, there is a greater demand for clothing and home furnishings. PET is a cost-effective material used to make polyester fibers for fabrics, which boosts the industry growth.

Drivers and Trends

Rising Demand from Packaging Industry: The increasing use of polyethylene terephthalate (PET) in the packaging sector drives the PET catalyst market growth. PET is widely favored for packaging food, beverages, and other consumer products due to its benefits such as lightweight, shatterproof, and recyclability. The growing trend of consumers choosing healthier drinks has led to a major increase in the demand for bottles, which directly boosts the need for PET catalysts used in bottle production. This shift is especially noticeable in urban areas and developing economies.

According to a 2024 report from the International Bottled Water Association, bottled water has been the top-selling packaged drink in the U.S. for nine straight years. The report notes that Americans drank 16.2 billion gallons of bottled water in 2024, a 2% increase from 2023. This growing preference for bottled water over other packaged beverages is pushing the need for more amorphous PET, which, in turn, drives the growth.

Growth of Textile Industry: The expansion of the textile and apparel industry boosts the demand for PET catalysts. PET is the main material used to make polyester fibers, which are used to produce a wide range of fabrics for clothing, home furnishings, and industrial applications. The demand for these fibers is rising due to their low cost, durability, and resistance to shrinking and stretching. As global textile production continues to grow, so does the need for the catalysts used to make PET.

Based on the "Annual Report 2023-2024" by the Ministry of Textiles, India is the sixth-largest exporter of textiles and apparel in the world. The report shows that in 2023-24, this sector accounted for 8.21% of India's total exports. This strong growth in textile production and exports in a major manufacturing country highlights the increasing worldwide demand for polyester fibers. This trend directly drives the need for PET and its catalysts.

Segmental Insights

Product Analysis

Based on product, the segmentation includes antimony-based, aluminum-based, titanium-based, germanium-based, and other catalysts. The antimony-based segment held the largest share in 2024. This is largely because antimony-based catalysts have been the traditional and most widely used option for a long time. Their use is well-established in the industry, and they are known for their efficiency and reliability in producing PET with consistent quality. The cost-effectiveness of these catalysts compared to other alternatives also plays a major role in their widespread adoption. Antimony-based catalysts are especially important in the production of PET resin for bottles, films, and fibers. Owing to their proven performance and economic benefits, many manufacturers continue to rely on these catalysts. This dominant position is a direct result of their long history of use and dependable performance in large-scale production.

The titanium-based segment is anticipated to register the highest growth rate during the forecast period. This growth is driven by a shift in the industry toward more sustainable and eco-friendly practices. Titanium-based catalysts are seen as a modern alternative to the traditional options, as they do not contain heavy metals. This makes the final PET product more suitable for sensitive applications such as food and beverage packaging, especially as regulations become stricter. The use of these catalysts also results in PET with better properties, such as improved clarity and thermal stability. These qualities are highly valued for making high-quality bottles and films. As consumer awareness about product safety and environmental impact increases, and as companies seek ways to meet new regulations, the adoption of titanium-based catalysts is expected to keep growing at a fast pace.

Application Analysis

Based on application, the segmentation includes packaging, textile & apparel, automotive, medical, and other applications. The packaging segment held the largest share in 2024. The high demand is driven by the use of PET for bottles, films, and containers for food, beverages, and consumer goods. PET is a very popular choice due to its properties, which include being lightweight, shatterproof, and highly recyclable. The increasing demand for packaged water, soft drinks, and ready-to-eat foods, especially in urban areas and fast-growing economies, is a major factor. As more people prefer the convenience of packaged products, the need for PET catalysts to make the materials used in this segment continues to grow..

The textile & apparel segment is anticipated to register the highest growth rate during the forecast period. PET is a primary material for making polyester fibers, which are used in everything from everyday clothing to industrial fabrics. The growth is fueled by a global increase in textile production, especially in countries with large manufacturing sectors. The affordability, strength, and versatility of polyester make it a preferred material for many types of apparel. Furthermore, a growing focus on sustainability is boosting the demand for recycled PET in textiles. This trend is driving innovation and growth in the catalyst as manufacturers develop new processes to create high-quality fibers from recycled plastic bottles, which supports the move toward a more circular and sustainable fashion industry.

Regional Analysis

The Asia Pacific polyethylene terephthalate catalyst market accounted for the largest share in 2024. This is due to rapid industrialization, growing populations, and rising incomes, which lead to a massive increase in the demand for packaged goods and textiles. The region is a major manufacturing hub for both these industries. Countries here are expanding their production capacities to meet both local and global needs. This scale of production requires a huge supply of catalysts.

China Polyethylene Terephthalate Catalyst Market Insights

China dominated the Asia Pacific industry. The country is the world's largest producer of both PET resin and polyester fibers, which makes it a major consumer of PET catalysts. Its massive manufacturing output for textiles and consumer electronics drives a significant portion of the global demand. As the Chinese middle class grows, there is also a higher demand for consumer products, which further fuels the need for PET and, by extension, its catalysts.

North America Polyethylene Terephthalate Catalyst Market Trends

The North America market for PET catalysts is seeing strong growth due to the high demand for packaged goods, especially beverages. There is a growing focus on sustainability and material recycling in the region, which is leading to an increased use of recycled PET (rPET). This creates a need for new and better catalysts to help produce high-quality materials from recycled sources. The move toward lighter, more efficient materials in packaging also drives the demand for innovative catalysts.

U.S. Polyethylene Terephthalate Catalyst Market Overview

In the U.S., the landscape is heavily influenced by the large-scale production of PET for beverage bottles. The country's strong economy and high consumer spending on packaged drinks and food items keep the demand steady. Additionally, there is a push from government regulations and consumer groups to increase recycling rates and use more recycled content. This is a major factor shaping the landscape and encouraging a shift toward catalyst technologies that are suitable for recycling processes.

Europe Polyethylene Terephthalate Catalyst Market Analysis

Europe is known for its strong emphasis on sustainability and a circular economy. Strict regulations and environmental goals set by the European Union are a major force in this region. This has pushed growth toward developing and using catalysts that are more eco-friendly and support the use of recycled PET. Companies are investing in new technology to meet these rules and consumer demand for green products. The focus on reducing single-use plastics also influences the growth, as manufacturers seek efficient ways to use recycled materials in new products.

The Germany polyethylene terephthalate catalyst market is driven by the country's strong manufacturing base, especially in the automotive and packaging industries. Germany is a key hub for innovation and has a high recycling rate, which makes it a leader in adopting new, sustainable technologies. The country's focus on advanced manufacturing and high-quality products means there is a constant need for specialized catalysts that deliver superior performance and help meet strict environmental standards.

Key Players and Competitive Insights

The PET catalyst market has a competitive landscape with several key players. Companies such as SK Chemicals, Indorama Ventures, and Johnson Matthey are active in this space. The market is competitive and includes a mix of large international chemical companies and specialized regional producers. The main focus for these companies is on developing better catalysts that improve product quality and make production more efficient. They also compete by offering a range of catalysts for different types of PET production, including those for recycled and bio-based materials.

A few prominent companies in the industry include SK Chemicals Co., Ltd.; Indorama Ventures Public Company Limited; Johnson Matthey; Catalytic Technologies Ltd.; Evonik Industries AG; Teijin Limited; The Nippon Synthetic Chemical Industry Co., Ltd.; and Clariant AG.

Key Players

- Catalytic Technologies Ltd.

- Clariant AG

- Evonik Industries AG

- Indorama Ventures Public Company Limited

- Johnson Matthey

- SK Chemicals Co., Ltd.

- Teijin Limited

- The Nippon Synthetic Chemical Industry Co., Ltd.

Polyethylene Terephthalate Catalyst Industry Developments

June 2025: SK Chemicals announced an exclusive partnership agreement with Durmont and Paarang to supply its recycled PET material, SKYPET CR, for use in automotive carpets.

May 2024: Toyobo Co., Ltd. announced that its newly developed PET shrink label film, ReCrysta, was recognized under the Association of Plastic Recyclers (APR) Design for Recyclability guidelines.

Polyethylene Terephthalate Catalyst Market Segmentation

By Product Outlook (Revenue – USD Million, 2020–2034)

- Antimony-Based

- Aluminum-Based

- Titanium-based

- Germanium-based

- Other Catalysts

By Application Outlook (Revenue – USD Million, 2020–2034)

- Packaging

- Textile & Apparel

- Automotive

- Medical

- Other Applications

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Polyethylene Terephthalate Catalyst Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 245.57 million |

|

Market Size in 2025 |

USD 254.29 million |

|

Revenue Forecast by 2034 |

USD 355.71 million |

|

CAGR |

3.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 245.57 million in 2024 and is projected to grow to USD 355.71 million by 2034.

The global market is projected to register a CAGR of 3.8% during the forecast period.

Asia Pacific dominated the share in 2024.

A few key players include SK Chemicals Co., Ltd.; Indorama Ventures Public Company Limited; Johnson Matthey; Catalytic Technologies Ltd.; Evonik Industries AG; Teijin Limited; The Nippon Synthetic Chemical Industry Co., Ltd.; and Clariant AG.

The antimony-based segment accounted for the largest share of the market in 2024.

The textile and apparel segment is expected to witness the fastest growth during the forecast period.