Disposable Duodenoscope Market Size, Share, Trends, Industry Analysis Report

By Application (Diagnostics, Therapeutics/Treatment), By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 120

- Format: PDF

- Report ID: PM6445

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

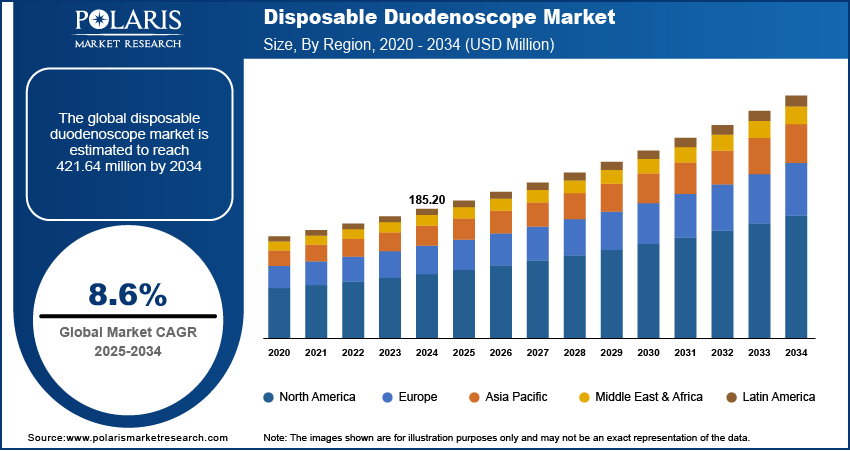

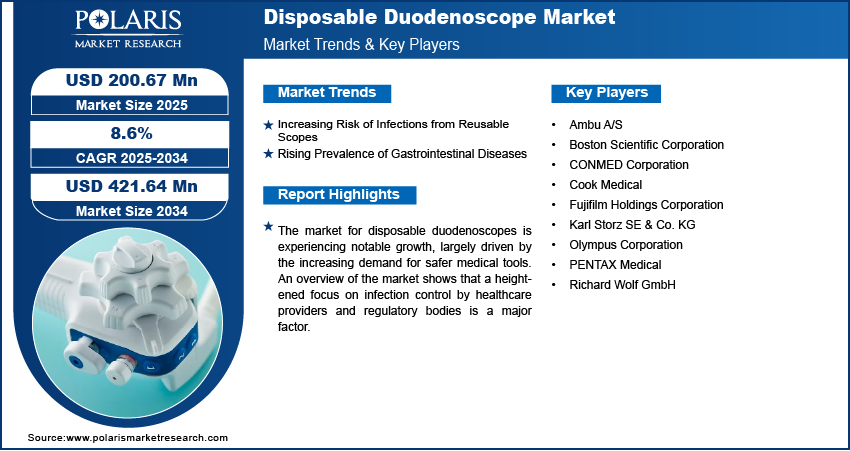

The global disposable duodenoscope market size was valued at USD 185.20 million in 2024 and is anticipated to register a CAGR of 8.6% from 2025 to 2034. The demand for disposable duodenoscopes is growing due to rising concerns about hospital-acquired infections (HAIs) caused by reusable scopes. The complex design of reusable duodenoscopes makes it difficult to clean and disinfect them properly. Also, the increasing prevalence of gastrointestinal diseases and the growing demand for minimally invasive procedures drive the growth.

Key Insights

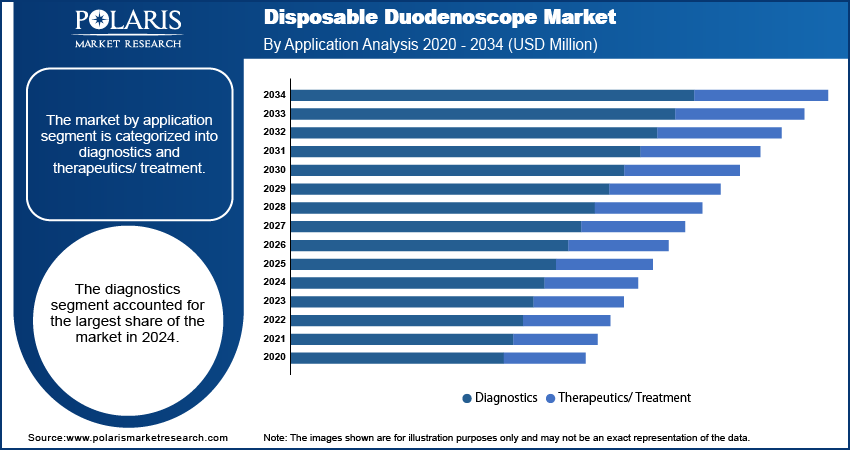

- By application, the diagnostics segment held the largest share in 2024. This is driven by the rising prevalence of gastrointestinal disorders requiring early and accurate detection.

- By end use, the hospitals segment dominated the market revenue in 2024, supported by higher patient inflow and the availability of advanced endoscopic infrastructure.

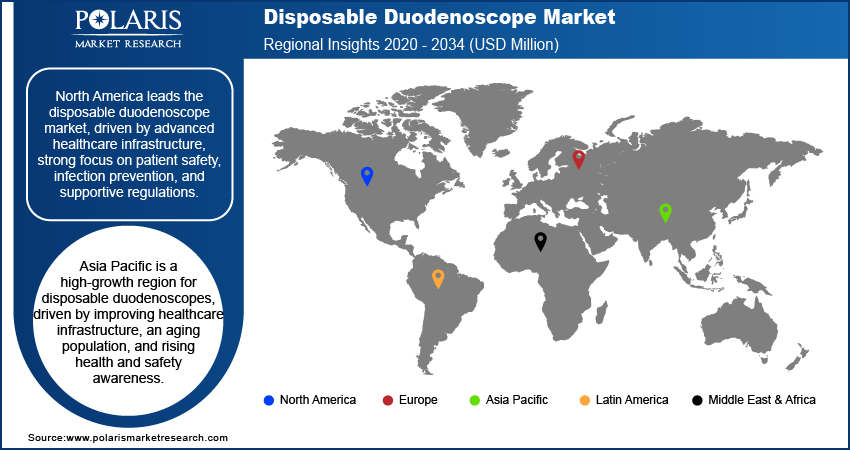

- North America held the largest share in 2024. This is propelled by strong regulatory support for infection prevention and rapid adoption of single-use endoscopy devices.

Industry Dynamics

- Growing number of hospital-acquired infections (HAIs) linked to improperly cleaned reusable scopes drives the adoption of disposable duodenoscopes. Concerns from regulatory bodies and healthcare providers about patient safety and infection control have increased the demand for single-use devices that eliminate this risk.

- The rising number of gastrointestinal and pancreatic diseases has increased the need for diagnostic and therapeutic procedures such as ERCP. As the global population ages, the frequency of these conditions is expected to rise, creating a greater need for effective and safe endoscopic tools.

- Technological advancements have led to the creation of disposable scopes with improved features such as better image quality and easier navigation. These innovations offer a sterile and convenient alternative to reusable devices, helping to speed up patient procedures and lower overall costs associated with reprocessing.

Market Statistics

- 2024 Market Size: USD 185.20 million

- 2034 Projected Market Size: USD 421.64 million

- CAGR (2025–2034): 8.6%

- North America: Largest market in 2024

AI Impact on Disposable Duodenoscope Market

- AI-enabled image recognition detects abnormalities in real time, which improves the accuracy of endoscopic procedures.

- AI algorithms trained on vast datasets assist healthcare experts in identifying polyps, lesions, or other signs of disease faster and more reliably.

- The technology helps optimize ERCP (endoscopic retrograde cholangiopancreatography) workflows by guiding scope navigation and predicting complications.

- AI-based smart analytics tools help reduce procedure time and improve patient outcomes. They are especially used in outpatient settings such as Ambulatory Surgery Centers (ASCs).

The disposable duodenoscope industry is centered on single-use, flexible endoscopes designed for procedures such as endoscopic retrograde cholangiopancreatography (ERCP). These devices are used once and then thrown away to prevent cross-contamination and the spread of infections between patients. This approach provides a sterile alternative to traditional reusable scopes, which require extensive cleaning and reprocessing after each use.

One of the drivers is the growing investments in product innovation and development by major companies. This includes specifications such as better image quality, improved navigation, and more user-friendly designs. The new features make the devices more appealing to doctors and hospitals. Additionally, new technology is making it easier to integrate these disposable endoscopes with existing hospital systems and equipment. This focus on research and development helps create more advanced and effective tools, which drives their adoption in hospitals and clinics.

The rising healthcare expenditure and supportive regulatory actions in different countries boost the industry expansion. As healthcare spending increases, more hospitals and surgical centers can afford to buy these single-use devices, even with their higher initial cost. Regulatory bodies, such as the U.S. Food and Drug Administration (FDA), encourage the use of innovative designs, including single-use devices, to improve patient safety. In 2020, the FDA cleared a sterile, single-use duodenoscope for use in ERCP procedures. It was a sign of support for this type of technology to reduce infection risks.

Drivers and Trends

Increasing Risk of Infections from Reusable Scopes: A major driver is the ongoing concern about healthcare-associated infections (HAIs) linked to reusable duodenoscopes. These complex medical devices have intricate channels and parts that are difficult to clean and disinfect completely. Even with proper cleaning procedures, bacteria can remain on the scopes and be passed from one patient to another. This has led to serious outbreaks of antibiotic-resistant bacteria, prompting hospitals and medical facilities to seek safer alternatives. The use of disposable duodenoscopes eliminates these risks, as a new, sterile scope is used for each procedure.

The Centers for Disease Control and Prevention (CDC) 2023 National and State Healthcare-Associated Infections Progress Report found that even with prevention efforts, certain infections were still a problem in some healthcare settings. This constant need to improve infection control measures is fueling the adoption of single-use devices, such as disposable duodenoscopes.

Rising Prevalence of Gastrointestinal Diseases: The growing number of gastrointestinal (GI) and pancreatic disease cases boosts the demand for disposable duodenoscopes. The diagnosis and treatment of conditions, such as bile duct stones, tumors, and various cancers, require procedures such as ERCP. The rising number of people with these issues, especially in an aging population, creates a higher demand for the procedures that use duodenoscopes. The need for faster and safer procedures also contributes to the adoption of single-use scopes.

According to a 2023 report from the World Health Organization (WHO), "Global status report on noncommunicable diseases," chronic diseases, including many that affect the GI system, are rising worldwide. The report noted that a significant portion of the global population is affected by these conditions, which often need endoscopic procedures. This rise in disease burden increases the need for disposable duodenoscopies.

Segmental Insights

Application Analysis

Based on application, the segmentation includes diagnostics and therapeutics/treatment. The diagnostics segment held the largest share in 2024. This is mainly attributed to the growing need for early and accurate detection of gastrointestinal diseases, such as bile duct blockages, pancreatic disorders, and various forms of cancer. Diagnostic procedures such as ERCP are frequently used to get a clear visual of the upper GI tract and to take tissue samples, or biopsies, to confirm a diagnosis. The single-use nature of these scopes makes them ideal for diagnostic purposes, as they eliminate the risk of cross-contamination between patients, which is a major concern in hospitals. The simplified workflow of a disposable device, with no need for a complex reprocessing cycle, allows healthcare providers to perform diagnostic procedures more efficiently. This focus on patient safety and operational ease helps the diagnostics segment to maintain its leading position.

The therapeutics/treatment segment is anticipated to register the highest growth rate during the forecast period. This is because of technological advancements that are improving the capabilities of disposable scopes for therapeutic use. Historically, reusable scopes were preferred for complex therapeutic procedures that require larger working channels for instruments such as stents and snares. However, newer disposable models are being developed with larger working channels and better maneuverability, making them more suitable for these interventions. As more doctors and hospitals gain confidence in these advanced single-use devices, they are increasingly being used for therapeutic procedures such as stone removal and stent placement. This shift is also driven by the desire to reduce the risk of infection, as therapeutic procedures often involve a higher risk of bacterial transmission. This growing demand to treat a wider range of treatments is fueling the rapid expansion of the therapeutics segment.

End Use Analysis

Based on end use, the segmentation includes hospitals and outpatient facilities. The hospitals segment held the largest share in 2024. Hospitals are the primary locations for complex and high-risk procedures such as ERCP, where duodenoscopes are most often used. They have the necessary infrastructure, including operating rooms, intensive care units, and a larger team of specialized medical staff, which makes them the most suitable environment for these types of procedures. Hospitals also treat a greater number of high-risk and critically ill patients who are more susceptible to infections, making the use of single-use, sterile devices a major priority for infection control. Furthermore, hospitals handle a high volume of endoscopic procedures on a daily basis, which drives the consistent demand for these disposable tools. The focus on patient safety and the ability to manage a wide range of cases, from routine to emergency, positions the hospital segment as the biggest consumer of disposable duodenoscopes.

The outpatient facilities segment is anticipated to register the highest growth rate during the forecast period. This is a result of a growing trend in healthcare to move certain procedures from traditional hospital settings to outpatient centers, such as ambulatory surgical centers (ASCs). These facilities offer several benefits, including lower costs for both patients and healthcare providers, shorter wait times, and a more convenient setting for patients. As disposable duodenoscopes become more advanced and easier to use, they are a great fit for the efficient and streamlined workflow of outpatient facilities. The elimination of the need for an expensive and time-consuming reprocessing department makes single-use scopes very appealing for these centers. As more procedures are deemed safe to be performed outside of a hospital, and as patients seek more convenient and cost-effective options, the adoption of disposable duodenoscopes in outpatient facilities is growing at a rapid pace.

Regional Analysis

The North America disposable duodenoscope market accounted for the largest share in 2024. A well-developed healthcare system, strong focus on patient safety and infection control, and favorable government regulations boost the regional industry growth. The region's healthcare providers are increasingly adopting single-use devices to reduce the risk of hospital-acquired infections (HAIs) that have been linked to improperly cleaned reusable scopes. Additionally, the presence of major medical device companies and a high number of advanced surgical and endoscopic procedures further supports the growth.

U.S. Disposable Duodenoscope Market Insights

The U.S. holds a significant share in North America, due to the high prevalence of gastrointestinal diseases and the large number of ERCP procedures performed. Strict guidelines from regulatory bodies, such as the US Food and Drug Administration (FDA), prompt hospitals and clinics to seek safer alternatives to reusable scopes. The country has a high level of health spending and an increasing trend toward minimally invasive procedures, which helps drive the demand for advanced and sterile medical devices.

Europe Disposable Duodenoscope Market Trends

The European market for disposable duodenoscopes is growing steadily, fueled by increasing awareness of the risks associated with reusable devices. Healthcare systems across Europe are putting a higher priority on patient safety and infection control. This is leading to a gradual shift from traditional reusable endoscopes to single-use options. Furthermore, the rising number of elderly people and the growing occurrence of pancreatic and biliary diseases are increasing the need for diagnostic and therapeutic procedures, which boosts the demand for duodenoscopes.

In Europe, the Germany disposable duodenoscope market witnesses rapid growth. The country has a very advanced and well-funded healthcare system. This allows for a quick adoption of new and innovative medical technologies. The country also has a high number of diagnostic and therapeutic endoscopy devices procedures being performed. German hospitals and clinics are investing in modern equipment to maintain high standards of patient care and safety, which is a major factor in the growing use of disposable duodenoscopes.

Asia Pacific Disposable Duodenoscope Market Overview

The Asia Pacific is seen as a high-growth market for disposable duodenoscopes. The growth is fueled by a combination of improving healthcare infrastructure, a large and aging population, and a rising awareness of health and safety issues. Many countries in this region are increasing their healthcare spending, which allows for better access to advanced medical devices. The high prevalence of chronic diseases leads to a greater demand for endoscopic procedures.

China Disposable Duodenoscope Market Overview

China is a major country in Asia Pacific. The country's vast population and the increasing prevalence of gastrointestinal disorders are creating a large demand for diagnostic and therapeutic procedures. The government's focus on improving healthcare and expanding access to modern medical technology is also helping. Chinese hospitals are adopting single-use duodenoscopes to improve patient safety and reduce the costs and time linked to cleaning and maintaining reusable devices.

Key Players and Competitive Insights

The disposable duodenoscope market is competitive with several major players such as Olympus Corporation, Boston Scientific Corporation, Ambu A/S, Pentax Medical (a part of HOYA Corporation), and Fujifilm Holdings Corporation. These companies are actively working to gain a bigger share of the market by offering new products and forming strategic partnerships. The competitive environment is focused on creating devices with better imaging quality, improved safety features, and easier use, all while aiming to reduce the risk of cross-contamination. Many companies that once focused only on reusable scopes are now putting more effort into developing single-use models to meet the growing demand for safer alternatives.

A few prominent companies in the industry include Boston Scientific Corporation, Ambu A/S, Fujifilm Holdings Corporation, Olympus Corporation, Pentax Medical, Karl Storz SE & Co. KG, Cook Medical, Richard Wolf GmbH, and CONMED Corporation.

Key Players

- Ambu A/S

- Boston Scientific Corporation

- CONMED Corporation

- Cook Medical

- Fujifilm Holdings Corporation

- Karl Storz SE & Co. KG

- Olympus Corporation

- PENTAX Medical

- Richard Wolf GmbH

Disposable Duodenoscope Industry Developments

May 2025: Olympus announced it had received FDA clearance for its most advanced imaging endoscopes. This approval helps solidify the company's position by offering healthcare providers a new set of tools with advanced imaging capabilities, supporting better clinical outcomes.

August 2024: Olympus Corporation announced a strategic relationship with Karl Storz SE & Co. KG to transform endoscopy. This collaboration aims to develop a new era of endoscopy, which will bring together both companies' hardware, software, and services to enhance clinical outcomes and operational efficiency.

Disposable Duodenoscope Market Segmentation

By Application Outlook (Revenue – USD Million, 2020–2034)

- Diagnostics

- Therapeutics/Treatment

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Hospitals

- Outpatient Facilities

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Disposable Duodenoscope Market Report Scope:

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 185.20 million |

|

Market Size in 2025 |

USD 200.67 million |

|

Revenue Forecast by 2034 |

USD 421.64 million |

|

CAGR |

8.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 185.20 million in 2024 and is projected to grow to USD 421.64 million by 2034.

The global market is projected to register a CAGR of 8.6% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include Boston Scientific Corporation, Ambu A/S, Fujifilm Holdings Corporation, Olympus Corporation, Pentax Medical, Karl Storz SE & Co. KG, Cook Medical, Richard Wolf GmbH, and CONMED Corporation.

The diagnostics segment accounted for the largest share of the market in 2024.

The outpatient facilities segment is expected to witness the fastest growth during the forecast period.