Flexible Endoscopes Market Size, Share, & Trends Analysis Report

: By Product (Bronchoscopes, Laparoscopes, Laryngoscopes, Otoscopes, Ureteroscopes, Cystoscopes, Nasopharyngoscopes), By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5731

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

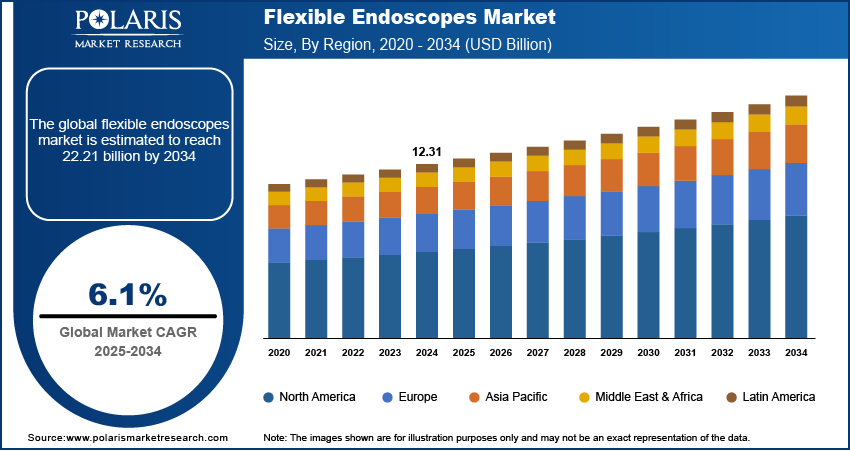

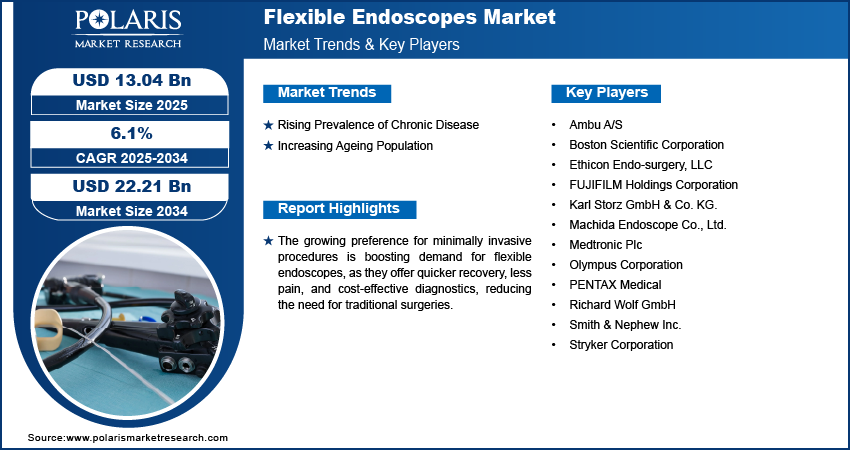

The global flexible endoscopes market size was valued at USD 12.31 billion in 2024, growing at a CAGR of 6.1% during 2025–2034. The growth is driven by the rising prevalence of chronic disease, increasing aging population, and shift toward minimally invasive surgeries.

Flexible endoscopes are thin, bendable medical instruments equipped with a light and camera, used to visually examine the inside of the body’s hollow organs and cavities. They allow doctors to diagnose and sometimes treat conditions without making large incisions.

Patients and healthcare providers are increasingly preferring minimally invasive procedures due to quicker recovery times, less pain, and lower complication risks. Flexible endoscopes enable these less invasive examinations and treatments by allowing access to internal organs through natural body openings. This reduces the need for traditional surgeries, encouraging hospitals to invest in flexible endoscopy equipment. The demand for flexible endoscopes is growing as the healthcare industry shifts toward patient-friendly, cost-effective solutions.

To Understand More About this Research: Request a Free Sample Report

Technological improvements have made flexible endoscopes smaller, more flexible, and equipped with better imaging capabilities such as high-definition and 3D visuals. These advances make procedures more accurate and safer, encouraging more doctors to use flexible endoscopes. Innovations such as better sterilization methods and disposable endoscopes further reduce infection risks, making these devices more appealing to hospitals. The demand for flexible endoscopes is growing as technology continues to evolve, thereby driving the industry growth.

Industry Dynamics

Rising Prevalence of Chronic Disease

Chronic diseases such as gastrointestinal disorders, respiratory illnesses, and urological conditions are becoming more common worldwide. According to the National Institute of Diabetes, Digestive and Kidney Disease, 60 to 70 million people are affected by all kinds of digestive diseases annually. Flexible endoscopes are used in diagnosing and monitoring these conditions by allowing doctors to observe internal parts of the body without surgery. Hospitals and clinics perform more endoscopy procedures as more people suffer from these illnesses, driving demand for flexible endoscopes.

Increasing Aging Population

The global population is aging, and older adults are more likely to suffer from diseases that require endoscopic examination, such as colon cancer and chronic digestive issues. According to Eurostat, as of 2024, 21.6% of Europe's population is aged 65 years and above. The growing elderly population increases the need for regular screening and minimally invasive diagnostic procedures. Flexible endoscopes offer a safer, less painful option for these patients compared to traditional surgery. Therefore, the demand for flexible endoscopes rises as healthcare systems prepare to meet the needs of aging populations and improve their quality of life.

Segmental Insights

By Product Analysis

The gastrointestinal endoscopes segment holds the largest share in 2024, as they are widely used to diagnose and treat digestive tract conditions such as ulcers, polyps, and cancers. These endoscopes allow doctors to observe esophagus, stomach, and intestines with ease, helping in early detection and minimally invasive treatment. The high prevalence of gastrointestinal diseases globally and growing awareness about routine screening procedures boost the gastrointestinal endoscopes segment growth.

The ureteroscopes segment is expected to witness significant growth during the forecast period, due to increasing cases of urinary tract disorders, especially kidney stones and strictures. These flexible endoscopes are designed specifically to navigate the urinary tract, allowing doctors to diagnose and treat problems with minimal discomfort. The rising incidence of kidney stones and other urological conditions, along with advances in ureteroscopy technology, has boosted their adoption. Additionally, the growing focus on minimally invasive urological procedures is driving the segment growth.

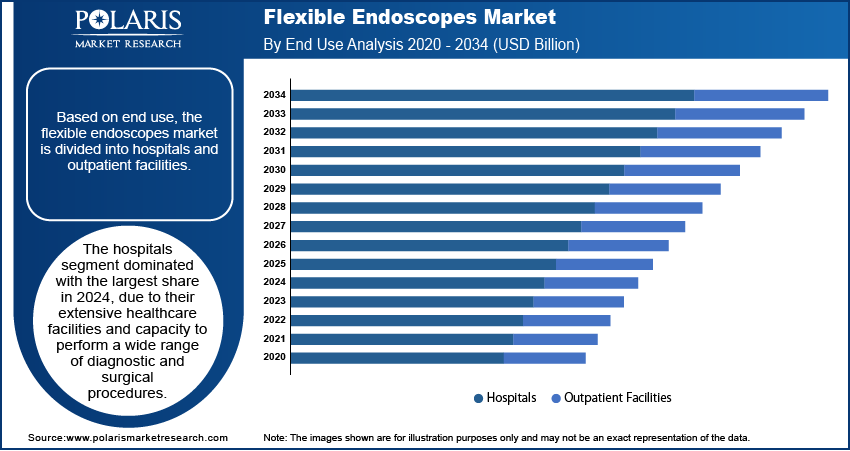

By End Use Analysis

The hospitals segment dominated with the largest share in 2024 due to their extensive healthcare facilities and capacity to perform a wide range of diagnostic and surgical procedures. They handle the highest patient volumes and have specialized departments for gastroenterology, pulmonology, and urology that extensively use flexible endoscopes. Hospitals invest heavily in advanced medical technologies to provide comprehensive care, which keeps the demand for flexible endoscopes consistently high. Their capability to offer emergency and complex procedures is further driving the segmental growth.

The outpatient facilities segment is expected to witness significant growth as more endoscopic procedures shift to these settings for cost-efficiency and convenience. These centers offer diagnostic and minor treatment services without requiring overnight hospital stays, appealing to patients and providers alike. Improvements in flexible endoscope technology allow safe and effective procedures in outpatient clinics, encouraging their increased use. The rising trend of ambulatory care services and preference for less invasive, quicker procedures outside hospitals are driving the growing adoption of flexible endoscopes in outpatient facilities.

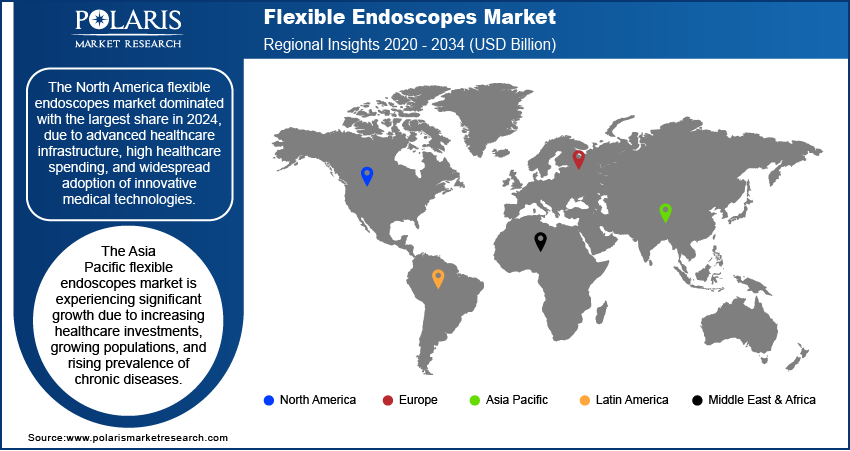

Regional Analysis

The North America flexible endoscopes market dominated with the largest share due to advanced healthcare infrastructure, high healthcare spending, and widespread adoption of innovative medical technologies. The region has a large patient base with chronic diseases such as cancer and gastrointestinal disorders that require endoscopic procedures. Strong government support for healthcare and growing awareness about preventive screenings drive demand. Additionally, the presence of key players and ongoing research and development activities contribute to the market growth. North America’s well-established healthcare system and preference for minimally invasive procedures further drive the industry growth in the region.

The Asia Pacific flexible endoscopes market is expected to witness significant growth during the forecast period, due to increasing healthcare investments, growing populations, and rising prevalence of chronic diseases. Improving healthcare infrastructure in countries such as China, Japan, and South Korea is boosting access to advanced medical devices. Additionally, rising health awareness and expanding health insurance coverage encourage more people to undergo diagnostic procedures. The region further benefits from a large patient pool requiring gastrointestinal and urological examinations, thereby driving the market growth.

The India flexible endoscopes market is growing due to expanding healthcare infrastructure and increasing government initiatives to improve medical services. The rising prevalence of lifestyle-related diseases such as diabetes and gastrointestinal disorders is driving demand for diagnostic tools such as flexible endoscopes. Growing awareness among patients and doctors about early disease detection and minimally invasive procedures supports growth in demand. Additionally, private hospitals and outpatient clinics are increasingly investing in advanced endoscopy equipment. India’s large population and improving access to healthcare facilities are further boosting the market growth.

The Europe flexible endoscopes market is expected to grow significantly during the forecast period due to well-developed healthcare systems and high adoption of advanced medical technologies. Countries such as Germany, France, and the UK are investing significantly in healthcare, supporting widespread use of endoscopic procedures for diagnosis and treatment. The aging population in Europe is driving the demand for routine screenings and minimally invasive interventions. Strict regulatory standards ensure high-quality medical devices, fostering innovation in the region. Europe’s focus on improving patient outcomes and increasing healthcare awareness is further fueling the growth of the industry.

Key Players and Competitive Analysis

The flexible endoscope market is highly competitive, dominated by established medical technology leaders such as Olympus Corporation, Karl Storz GmbH & Co. KG, and FUJIFILM Holdings Corporation, known for their innovative imaging technologies and broad product portfolios. Key players such as Medtronic Plc, Boston Scientific Corporation, and Smith & Nephew Inc. compete by expanding endoscopic capabilities and improving ergonomics. Emerging firms such as Machida Endoscope Co., Ltd. and Ambu A/S focus on single-use and disposable endoscopes to address infection control concerns. Companies such as PENTAX Medical; Ethicon Endo-surgery, LLC; Richard Wolf GmbH; and Stryker Corporation further intensify competition through advanced features, clinical support, and strategic partnerships to capture market share globally.

Key Players

- Ambu A/S

- Boston Scientific Corporation

- Ethicon Endo-surgery, LLC

- FUJIFILM Holdings Corporation

- Karl Storz GmbH & Co. KG.

- Machida Endoscope Co., Ltd.

- Medtronic Plc

- Olympus Corporation

- PENTAX Medical

- Richard Wolf GmbH

- Smith & Nephew Inc.

- Stryker Corporation

Industry Developments

In September 2024, Olympus Latin America launched its latest EVIS X1 endoscopy system in Brazil to enhance colorectal cancer detection. In September 2024, Lumicell secured a Phase I NIH SBIR contract to develop a novel flexible endoscope using LUMISIGHT for early esophageal cancer detection in Barrett’s esophagus patients.

Flexible Endoscopes Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Bronchoscopes

- Laparoscopes

- Laryngoscopes

- Otoscopes

- Ureteroscopes

- Cystoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Arthroscopes

- Neuroendoscopes

- Hysteroscopes

- Gynecology Endoscopes

- Gastrointestinal Endoscopes

- Colonoscope

- Gastroscope (Upper GI Endoscope)

- Duodenoscope

- Enteroscope

- Sigmoidoscope

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Outpatient Facilities

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Flexible Endoscopes Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 12.31 Billion |

|

Market Size Value in 2025 |

USD 13.04 Billion |

|

Revenue Forecast by 2034 |

USD 22.21 Billion |

|

CAGR |

6.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 12.31 billion in 2024 and is projected to grow to USD 22.21 billion by 2034.

The global market is projected to register a CAGR of 6.1% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Ambu A/S; Boston Scientific Corporation; Ethicon Endo-surgery, LLC; FUJIFILM Holdings Corporation; Karl Storz GmbH & Co. KG.; Machida Endoscope Co., Ltd.; Medtronic Plc; Olympus Corporation; PENTAX Medical; Richard Wolf GmbH; Smith & Nephew Inc.; and Stryker Corporation.

The gastrointestinal endoscope segment dominated the market share in 2024.

The outpatient facilities segment is expected to witness the significant growth during the forecast period.