U.S. Polyethylene Terephthalate Catalyst Market Size, Share, Trends, Industry Analysis Report

By Product (Antimony-Based, Aluminum-Based, Titanium-Based, Germanium-Based, Other Catalysts), By Application – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 126

- Format: PDF

- Report ID: PM6442

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

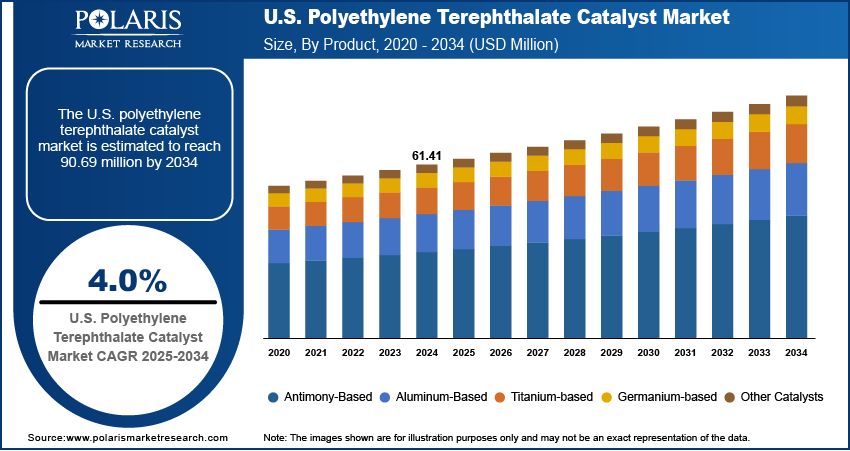

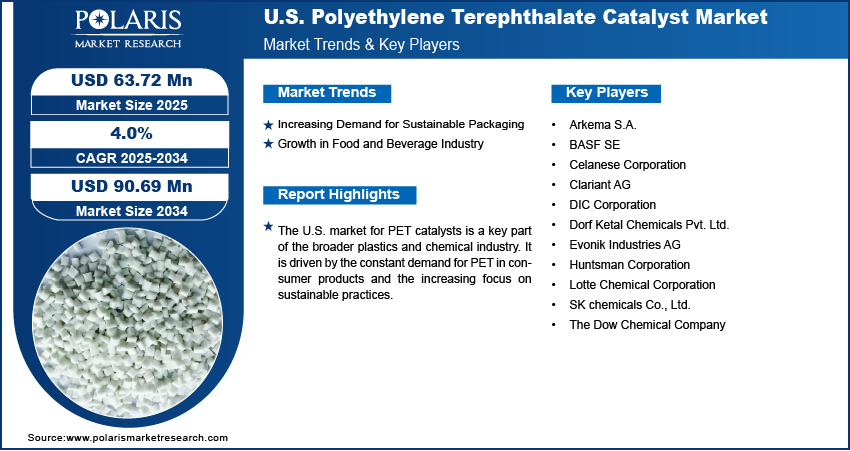

The U.S. polyethylene terephthalate (PET) catalyst market size was valued at USD 61.41 million in 2024 and is anticipated to register a CAGR of 4.0% from 2025 to 2034. The main drivers for the market growth are the strong demand for PET in bottle and food packaging production. This is driven by PET's beneficial properties, such as being lightweight, safe, and easily recyclable. The market also sees growth from the increasing use of recycled PET and bio-based PET, which is supported by new catalyst technologies that improve polymer quality.

Key Insights

- By product, the antimony-based catalyst segment held the largest share in 2024, driven by its established adoption and efficiency in large-scale PET resin manufacturing.

- By application, the packaging segment held the largest revenue share in 2024, supported by high consumption of bottled beverages and increasing demand for lightweight, recyclable packaging materials.

Industry Dynamics

- The growing preference for lightweight and shatterproof packaging materials, particularly in the beverage and food industries, is a key driver. This demand trend is fueled by consumers’ focus on convenience and safety, prompting manufacturers to increase production of PET-based containers. It increases the demand for catalysts required for PET production.

- A significant growth factor is the increasing adoption of sustainable and recycled packaging solutions across various sectors. With a stronger focus on environmental regulations and corporate social responsibility, companies are turning to recycled PET, which requires specific catalysts to ensure the quality and purity of the final product, boosting its demand.

- Technological developments in catalyst formulations are playing a big part in the growth. Innovations are leading to more efficient and cost-effective catalysts that improve the polymerization process. These new catalysts also enhance the quality of the end product, making PET more versatile for different applications, from bottles to fibers.

Market Statistics

- 2024 Market Size: USD 61.41 million

- 2034 Projected Market Size: USD 90.69 million

- CAGR (2025–2034): 4.0%

The U.S. polyethylene terephthalate catalyst market involves the production and use of chemical substances that help create polyethylene terephthalate, also known as PET. These catalysts are essential for speeding up the reaction of key raw materials to produce high-quality PET resin. The market is driven by the demand for these catalysts across various industries that rely on PET for their products, such as packaging and textiles.

One driver is the shift toward using alternative catalyst materials to replace traditional antimony-based ones. Another is the increasing push for cleaner production methods to reduce the overall environmental impact of PET manufacturing. These factors, while not as large as consumer demand, are important for shaping the future direction.

The push toward more environmentally friendly catalysts is a growing driver for the U.S. market. Rising concerns about the potential toxicity of traditional antimony-based catalysts propel the adoption of alternatives such as titanium and aluminum-based options. These substitutes are seen as more sustainable and can help companies meet new environmental standards. For example, the FDA's guidance on recycled plastics in food packaging, which considers the chemistry and safety of the process, encourages the use of materials that are less likely to cause harm. This focus on safer, greener production processes is prompting companies to seek new catalyst formulations that can enhance product quality and safety while reducing their environmental footprint.

Drivers and Trends

Increasing Demand for Sustainable Packaging: The growing focus on environmental responsibility and sustainability boosts the U.S. polyethylene terephthalate catalyst market. As consumers and corporations become more aware of the environmental impact of plastic waste, there's a strong push for a circular economy where materials are reused and recycled. This shift is leading to a higher demand for catalysts that are efficient and support the production of high-quality recycled PET (rPET), amorphous PET. This creates a direct link between the push for green initiatives and the need for advanced catalysts that can maintain the integrity and properties of PET through multiple recycling cycles, ensuring it remains a valuable and reusable material for packaging.

The U.S. has seen a significant increase in PET recycling, which highlights the industry's commitment to sustainability. According to a report by the National Association for PET Container Resources (NAPCOR) in its "2023 PET Recycling Report" published in December 2024, the U.S. PET bottle collection rate reached 33% in 2023. The report also found that the amount of rPET used in U.S. bottles reached an all-time high of 16.2% in 2023, up from 13.2% in the previous year. This rising demand for recycled materials directly drives the market for PET catalysts that are specifically designed for the recycling process.

Growth in Food and Beverage Industry: The expanding food & beverage industry remains a fundamental driver for the U.S. polyethylene terephthalate catalyst market. PET is widely used for bottles and containers because it is lightweight, transparent, and provides excellent barriers against moisture and gases, which are critical for preserving the quality and shelf life of products. The increasing demand for single-serve and ready-to-eat convenience foods and beverages has led to a consistent need for PET packaging. This trend is further supported by innovations in packaging technology that make PET even more versatile and suitable for a wider range of products.

Data from the U.S. Department of Agriculture (USDA) supports the ongoing growth in the food & beverage sector. The U.S. Census Bureau published the Advance Retail Trade data for “Food and Beverage Stores.” As of July 2025, monthly sales are roughly USD 85.01 billion (seasonally adjusted) for “food and beverage store” outlets. Such data denoted that there is an increased demand for packaged foods, which, in turn, drives the need for the catalysts used to produce the PET packaging.

Segmental Insights

Product Analysis

Based on product, the segmentation includes antimony-based, aluminum-based, titanium-based, germanium-based, and other catalysts. The antimony-based segment held the largest share in 2024. This dominance is attributed to their long history of use, proven performance, and cost-effectiveness in the production of PET resin. Antimony-based catalysts have been a standard in the landscape for decades, offering consistent reaction rates and excellent control over the polymerization process, which is essential for producing high-quality PET for various end uses. Their reliability and low cost have made them the preferred choice for a vast majority of PET manufacturers worldwide. Despite growing environmental concerns and regulatory pressures to limit heavy metals, the established infrastructure and performance advantages of these catalysts allow them to maintain a significant lead over other product types, shaping the overall dynamics. This long-standing preference for antimony-based catalysts ensures they continue to hold the largest share of the market, even as new alternatives emerge.

The titanium-based segment is anticipated to register the highest growth rate during the forecast period, due to the rising shift toward more sustainable and safer production methods. These catalysts offer a nontoxic alternative to antimony, aligning with increasingly strict global regulations and growing consumer demand for eco-friendly products. Advancements in technology have improved the performance of titanium-based catalysts, making them more competitive in terms of efficiency and product quality. While they are still a smaller part of the overall market, their rapid adoption in new production facilities and as replacements for older systems is a key trend. The superior environmental profile and improved properties of the final PET product, such as better clarity and thermal stability, are strong incentives for manufacturers to switch. This momentum in adopting new, cleaner alternatives is propelling the titanium-based segment growth.

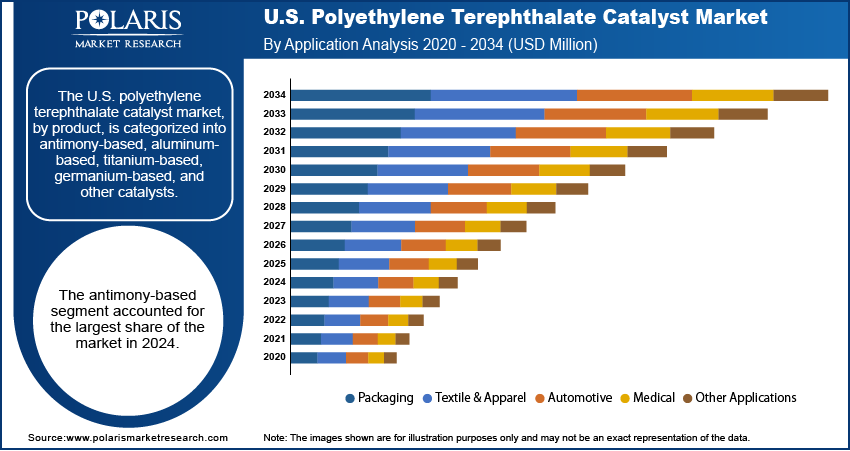

Application Analysis

Based on application, the segmentation includes packaging, textile & apparel, automotive, medical, and other applications. The packaging segment held the largest share in 2024. PET's desirable properties, such as its lightweight nature, transparency, durability, and excellent barrier against moisture and gases, have made it the material of choice for bottling beverages and food products. The rise of single-serve and ready-to-eat food and drink options has contributed to this segment's leading position. As consumer lifestyles have shifted toward convenience, the demand for PET in plastic bottles and films has grown consistently. The packaging sector's widespread infrastructure and consumer acceptance make it the single largest driver of the U.S. PET catalyst market, as producers must ensure a consistent supply of high-quality resin to meet the needs of the food, beverage, and personal care industries. This dominant application for bottles and other containers continues to boost the market.

The textile & apparel application is anticipated to register the highest growth rate during the forecast period. The demand for PET in this sector is fueled by the widespread use of polyester, a synthetic fiber known for its durability, affordability, and resistance to wrinkles and shrinking. Polyester is a key material in modern clothing, home furnishings, and industrial textiles. A major factor contributing to this growth is the increasing focus on sustainability, as many brands are now using recycled PET to create new fibers. The process of converting plastic bottles into fabric helps reduce waste and supports circular economy initiatives. This growing trend in sustainable fashion, coupled with a consistent demand for high-performance synthetic fabrics, is propelling the textile and apparel segment forward as a key area of future expansion.

Key Players and Competitive Insights

The competitive landscape of the U.S. polyethylene terephthalate catalyst market is moderately consolidated, with a few large chemical manufacturers holding significant shares. Key players such as SK Chemicals, Dorf Ketal, and Huntsman lead the market, leveraging their extensive production capacity and global reach. The competition is driven by innovation in catalyst technology, particularly the development of non-antimony-based alternatives to meet evolving environmental regulations and customer demand for sustainable products. Companies vie for market position by focusing on research and development to create more efficient and cost-effective catalysts, while also expanding their presence through strategic partnerships and global distribution networks. This dynamic environment is also influenced by vertical integration, as some major players also produce PET, giving them a distinct advantage in controlling the supply chain.

A few prominent companies in the U.S. polyethylene terephthalate catalyst market include SK chemicals Co., Ltd. (SK Group); Dorf Ketal Chemicals Pvt. Ltd.; The Dow Chemical Company; Huntsman Corporation; Celanese Corporation; Arkema S.A.; Clariant AG; Evonik Industries AG; Lotte Chemical Corporation; DIC Corporation; and BASF SE.

Key Players

- Arkema S.A.

- BASF SE

- Celanese Corporation

- Clariant AG

- DIC Corporation

- Dorf Ketal Chemicals Pvt. Ltd.

- Evonik Industries AG

- Huntsman Corporation

- Lotte Chemical Corporation

- SK chemicals Co., Ltd.

- The Dow Chemical Company

U.S. Polyethylene Terephthalate Catalyst Industry Developments

June 2025: Toyobo Co., Ltd. announced a collaborative R&D partnership with U.S.-headquartered DMC Biotechnologies to create and market eco-friendly chemical compounds. The compounds are intended for use as raw materials in general-purpose plastics. They will be produced through advanced biomanufacturing methods that incorporate synthetic biology and precision fermentation.

U.S. Polyethylene Terephthalate Catalyst Market Segmentation

By Product Outlook (Revenue – USD Million, 2020–2034)

- Antimony-Based

- Aluminum-Based

- Titanium-Based

- Germanium-Based

- Other Catalysts

By Application Outlook (Revenue – USD Million, 2020–2034)

- Packaging

- Textile & Apparel

- Automotive

- Medical

- Other Applications

U.S. Polyethylene Terephthalate Catalyst Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 61.41 million |

|

Market Size in 2025 |

USD 63.72 million |

|

Revenue Forecast by 2034 |

USD 90.69 million |

|

CAGR |

4.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 61.41 million in 2024 and is projected to grow to USD 90.69 million by 2034.

The market is projected to register a CAGR of 4.0% during the forecast period.

A few key players include SK chemicals Co., Ltd. (SK Group); Dorf Ketal Chemicals Pvt. Ltd.; The Dow Chemical Company; Huntsman Corporation; Celanese Corporation; Arkema S.A.; Clariant AG; Evonik Industries AG; Lotte Chemical Corporation; DIC Corporation; and BASF SE.

The antimony-based segment accounted for the largest share in 2024.

The textile and apparel segment is expected to witness the fastest growth during the forecast period.