Duodenoscope Market Size, Share, Trends, Industry Analysis Report

By Product (Reusable, Disposable), By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 126

- Format: PDF

- Report ID: PM6444

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

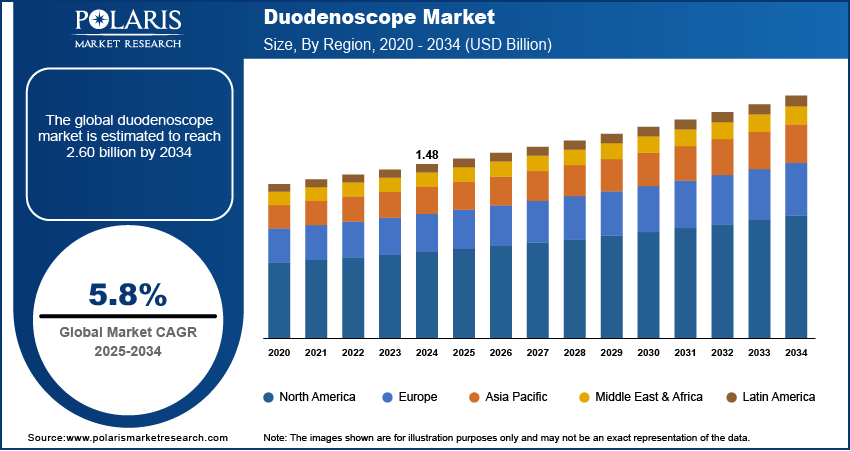

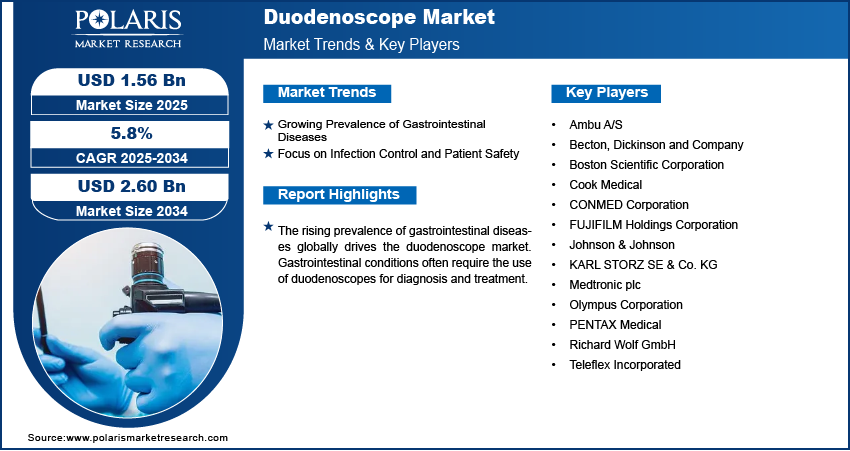

The global duodenoscope market size was valued at USD 1.48 billion in 2024 and is anticipated to register a CAGR of 5.8% from 2025 to 2034. The rising prevalence of gastrointestinal diseases and the growing demand for less invasive surgical procedures boost the requirement for duodenoscopes. A key factor is also the increased focus on patient safety, which has led to a push for single-use duodenoscopes to reduce the risk of cross-contamination. Technological advancements in imaging and design are also helping to improve these devices.

Key Insights

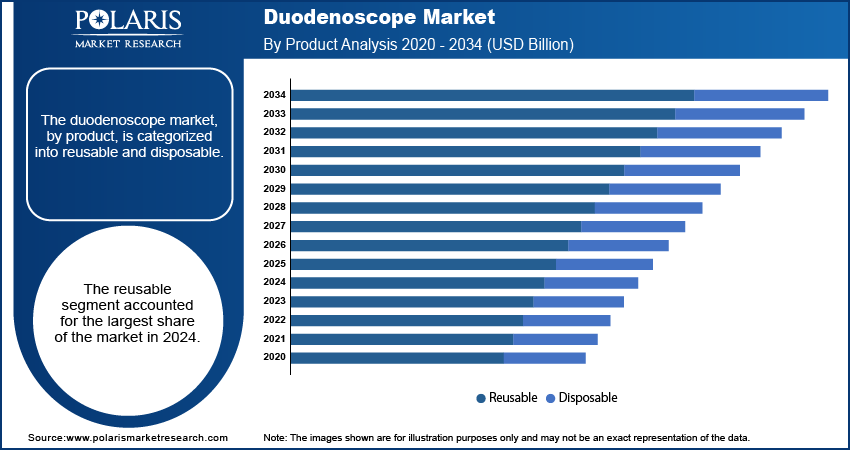

- By product, the reusable duodenoscopes segment held the largest share in 2024. This is driven by their cost-effectiveness and established use across high-volume clinical settings.

- By application, the therapeutics/treatment application segment dominated the revenue share in 2024. This is because of the growing number of ERCP procedures for biliary and pancreatic disorders.

- By end use, the hospitals segment held the largest share in 2024, owing to the availability of advanced endoscopy suites and higher number of patients for complex procedures.

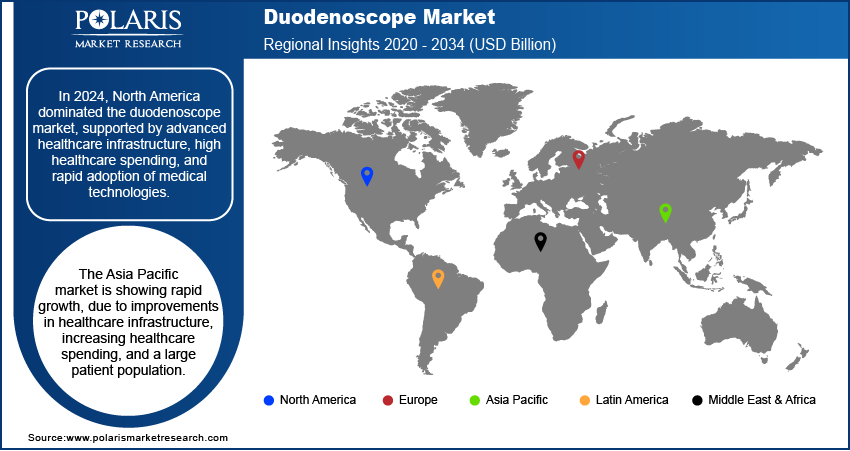

- By region, North America dominated the global duodenoscope market in 2024, fueled by advanced healthcare infrastructure and rapid adoption of innovative endoscopic technologies.

Industry Dynamics

- The growing prevalence of gastrointestinal disorders drives the market expansion. The cases of bile duct obstructions, gallstones, and other conditions are rising globally. The rising need for diagnosis and treatment of these conditions propels the demand for duodenoscopes.

- The increasing focus on patient safety and infection control is another key factor. Due to a history of infection outbreaks, there is a strong push for the use of single-use devices, such as disposable duodenoscopes.

- Technological advances are playing a big part. New features such as better imaging, including high-definition and AI-enhanced visuals, and designs that are easier to use are making procedures more effective. These innovations are improving patient results and encouraging wider use.

Market Statistics

- 2024 Market Size: USD 1.48 billion

- 2034 Projected Market Size: USD 2.60 billion

- CAGR (2025-2034): 5.8%

- North America: Largest market in 2024

AI Impact on Duodenoscope Market

- Artificial Intelligence (AI) is positively impacting the duodenoscopy market. The technology is enhancing procedural efficiency and diagnostic precision.

- The integration of AI is improving surgical outcomes. AI-assisted duodenoscopy offers various benefits such as shorter operation times, fewer complications, lower intraoperative blood loss, faster recovery of gastrointestinal function, and reduced hospital stays.

- AI reduces inter-operator variability, leading to more consistent and efficient procedures.

A duodenoscope, a type of flexible endoscope, is specially designed to examine and treat conditions in the upper part of the small intestine, known as the duodenum. It is a critical tool for procedures such as endoscopic retrograde cholangiopancreatography, or ERCP, which helps diagnose and treat problems in the bile ducts and pancreas.

The growing healthcare infrastructure in developing regions drives the duodenoscope sector. As countries improve their medical facilities and increase healthcare spending, there is a greater ability to perform more advanced diagnostic and therapeutic procedures. This leads to higher demand for specialized tools such as duodenoscopes. This trend is also supported by the increasing number of doctors being trained in these procedures.

Another notable driver is the increase in the elderly population globally. Older individuals are more likely to develop gastrointestinal diseases that require procedures using duodenoscopes. This demographic shift naturally increases the patient pool for these types of interventions. According to data from the Centers for Disease Control and Prevention (CDC), digestive diseases account for millions of hospitalizations and doctor visits each year, with a significant portion of this burden on older adults.

Drivers and Trends

Growing Prevalence of Gastrointestinal Diseases: The increasing number of people suffering from gastrointestinal and digestive disorders propels the demand for duodenoscopes. These devices are crucial for diagnosing and treating various conditions, including cancers, gallstones, and other issues in the pancreas and bile ducts. With more patients needing these procedures, there is rising need for specialized equipment such as duodenoscopes.

According to the 2023 WHO (World Health Organization) report on mortality, digestive diseases were a significant cause of death. Over 19,000 deaths in the 55–74 and 75+ age groups were reported globally in 2020. The growing number of gastrointestinal disease cases drives the need for effective diagnostic and treatment tools such as duodenoscopes.

Focus on Infection Control and Patient Safety: The increasing focus on patient safety and the prevention of infections linked to medical devices drives the industry growth. Due to past outbreaks of bacterial infections related to improperly cleaned reusable duodenoscopes, there is a strong push toward safer, more modern solutions. This has led to a major shift toward devices that are designed to be easier to clean or are disposable.

In the U.S., according to the Food and Drug Administration (FDA) "Infections Associated with Reprocessed Duodenoscopes" report, updated in April 2022, there have been documented cases of patient-to-patient transmission of infection even when facilities followed proper cleaning instructions. This has prompted the FDA to support the shift toward duodenoscopes with disposable components and fully disposable endoscope models. The shift encourages manufacturers and hospitals to adopt these new model to enhance patient safety.

Segmental Insights

Product Analysis

Based on product, the segmentation includes reusable and disposable. The reusable segment held the largest share in 2024. Reusable devices have been the standard for many years. Hospitals and clinics have already invested heavily in them. They are seen as a cost-effective choice for facilities that perform a high volume of procedures, as the initial cost of the device is spread out over thousands of uses. The well-established reprocessing protocols, along with the durability and quality of these devices, have helped them maintain their strong position. Many healthcare providers are also well-trained and comfortable with the current reusable models, which further contributes to their continued dominance.

The disposable segment is anticipated to register the highest growth rate during the forecast period. Increased concerns about patient safety and the risk of infection from improperly cleaned reusable devices boost the demand for disposable duodenoscopes. The use of single-use scopes eliminates the need for complex and time-consuming cleaning, which reduces the risk of cross-contamination between patients. As a result, healthcare facilities are increasingly adopting these disposable options to improve patient outcomes and to comply with new safety guidelines. The growing awareness among healthcare providers and patients about the risks tied to reusable scopes is also a strong factor. This trend is expected to continue the segment growth as more hospitals prioritize infection control and efficiency in their procedures.

Application Analysis

Based on application, the segmentation includes diagnostics and therapeutics/treatment. The therapeutics/treatment segment held the largest share in 2024. These devices are most often used for interventions in the bile ducts and pancreas to address serious conditions such as gallstones, tumors, and blockages. Procedures such as endoscopic retrograde cholangiopancreatography, or ERCP, are highly complex and are a main reason for the use of duodenoscopes. These procedures are performed more frequently than diagnostic exams, which propels the requirement for sophisticated tools such as duodenoscopes. The ongoing development of new accessories and tools that can be used with duodenoscopes for therapeutic purposes is also helping this segment maintain its dominance.

The diagnostics segment is anticipated to register the highest growth rate during the forecast period. While many procedures are diagnostic and therapeutic, there is a rising trend toward using duodenoscopes for earlier and more accurate diagnosis of gastrointestinal and pancreatic diseases. Advances in imaging technology, such as high-definition visuals and other enhanced features, are making it easier for doctors to identify small tumors, inflammation, and other abnormalities. This focus on early detection is a major driver of growth as it leads to better patient outcomes and more effective treatment plans. Additionally, the increasing use of minimally invasive diagnostic techniques is contributing to the high growth rate of this segment.

End Use Analysis

Based on end use, the segmentation includes hospitals and outpatient facilities. The hospitals segment held the largest share in 2024. Hospitals are the primary locations for complex and emergency medical procedures, including types that require duodenoscopes. They have the advanced infrastructure, specialized surgical units, and a large patient volume that make them the main end user for these devices. Additionally, hospitals have the necessary staff, such as gastroenterologists and surgeons, who are trained to perform procedures such as ERCP. They also deal with a wider variety of patient cases, including high-risk or severe conditions, making the duodenoscope a consistently needed tool in their medical arsenal. The high number of these procedures and the overall size of hospital facilities contribute to this segment’s leading position.

The outpatient facilities segment is anticipated to register the highest growth rate during the forecast period. This trend is a result of the ongoing shift in healthcare toward providing more procedures in less costly and more convenient settings. Many diagnostic and less complex therapeutic procedures that once required a hospital stay are now being performed in outpatient centers. The increasing demand for minimally invasive procedures and the desire for shorter recovery times are also driving patients to these facilities. As new, more portable, and single-use duodenoscopes become available, they are a great fit for the faster-paced, high-turnover environment of outpatient facilities. This move toward outpatient care is a key factor pushing the strong growth in this segment.

Regional Analysis

The North America duodenoscope market accounted for the largest share in 2024. The region's strong position is supported by its well-developed healthcare system, high healthcare spending, and a large population that is becoming more aware of various gastrointestinal health issues. There is also a quick adoption of new technologies and a rising preference for less invasive medical procedures. The presence of major medical device manufacturers and favorable government support for research and development also helps the regional market growth.

U.S. Duodenoscope Market Insights

In North America, the U.S. is the largest contributor to the regional industry. This is due to a high number of advanced endoscope procedures being performed each year. The country's strong focus on patient safety has also accelerated the shift toward single-use duodenoscopes and other disposable components. This is driven by regulatory oversight and a need to reduce infection risks. The high prevalence of chronic digestive diseases and a large aging population increase the demand for these devices.

Europe Duodenoscope Market Trends

Europe is a significant regional market for duodenoscope. The region focuses on advanced diagnostics and therapeutic applications. The landscape here is supported by a growing elderly population, which often requires gastrointestinal procedures, and strong healthcare systems across many countries. There is a rising trend toward using advanced medical technologies to improve patient care and procedural efficiency.

The Germany duodenoscope market holds a major share in Europe. It has a robust healthcare infrastructure and a high standard of medical care, which leads to a strong demand for advanced medical devices. The country is also a center for medical research and development. Also, healthcare providers in Germany are quick to adopt new, safer technologies, including single-use duodenoscopes.

Asia Pacific Duodenoscope Market Overview

The Asia Pacific market for duodenoscope is showing rapid growth. This is mainly due to improvements in healthcare infrastructure, increasing healthcare spending, and a large patient population. As countries in this region experience economic growth, there is a greater ability to invest in modern medical equipment. The increasing awareness of gastrointestinal diseases and the benefits of early diagnosis also play a big part in the expansion.

Japan Duodenoscope Market Outlook

Japan is a key contributor to the industry growth in Asia Pacific. The country has a highly advanced healthcare system and a large elderly population, both of which are strong drivers for. Japanese manufacturers are also known for their innovation in medical imaging and device technology. This drives the adoption of new and improved duodenoscopes across the country.

Key Players and Competitive Insights

The competitive landscape of the duodenoscope market includes key players such as Olympus Corporation, FUJIFILM Holdings Corporation, PENTAX Medical, KARL STORZ SE & Co. KG, and Ambu A/S. These companies are constantly innovating to meet the evolving needs of healthcare professionals and address the growing demand for safer, more efficient devices. The market is highly competitive, with a strong focus on research and development to introduce new products with advanced features, like single-use designs and improved imaging technology. Companies are also forming strategic partnerships to expand their global reach and strengthen their product offerings.

A few prominent companies in the industry include Olympus Corporation; FUJIFILM Holdings Corporation; PENTAX Medical; KARL STORZ SE & Co. KG; Ambu A/S; Boston Scientific Corporation; Cook Medical; CONMED Corporation; Medtronic plc; Johnson & Johnson; Richard Wolf GmbH; Becton, Dickinson and Company; and Teleflex Incorporated.

Key Players

- Ambu A/S

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Cook Medical

- CONMED Corporation

- FUJIFILM Holdings Corporation

- Johnson & Johnson

- KARL STORZ SE & Co. KG

- Medtronic plc

- Olympus Corporation

- PENTAX Medical

- Richard Wolf GmbH

- Teleflex Incorporated

Duodenoscope Industry Developments

October 2024: Olympus announced that it had received CE approval for three of its cloud-based artificial intelligence medical devices for endoscopy.

August 2024: PENTAX Medical received clearance from the FDA for its DEC Duodenoscope (ED34-i10T2s) to be compatible with the STERRAD 100NX Sterilizer.

Duodenoscope Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Reusable

- Disposable

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Diagnostics

- Therapeutics/Treatment

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Hospitals

- Outpatient Facilities

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Duodenoscope Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.48billion |

|

Market Size in 2025 |

USD 1.56 billion |

|

Revenue Forecast by 2034 |

USD 2.60 billion |

|

CAGR |

5.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.48 billion in 2024 and is projected to grow to USD 2.60 billion by 2034.

The global market is projected to register a CAGR of 5.8% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include Olympus Corporation; FUJIFILM Holdings Corporation; PENTAX Medical; KARL STORZ SE & Co. KG; Ambu A/S; Boston Scientific Corporation; Cook Medical; CONMED Corporation; Medtronic plc; Johnson & Johnson; Richard Wolf GmbH; Becton, Dickinson and Company; and Teleflex Incorporated.

The reusable segment accounted for the largest share of the market in 2024.

The diagnostics segment is expected to witness the fastest growth during the forecast period.