Digital Payment Market Share, Size, Trends, Industry Analysis Report

By End-Use (BFSI, Healthcare, IT & Telecom, Media & Entertainment, Retail & E-commerce, Transportation, Others); By Solution; By Mode of Payment; By Deployment; By Enterprise Size; By Region; Segment Forecast, 2022 - 2030

- Published Date:Sep-2025

- Pages: 114

- Format: PDF

- Report ID: PM2347

- Base Year: 2024

- Historical Data: 2020 - 2023

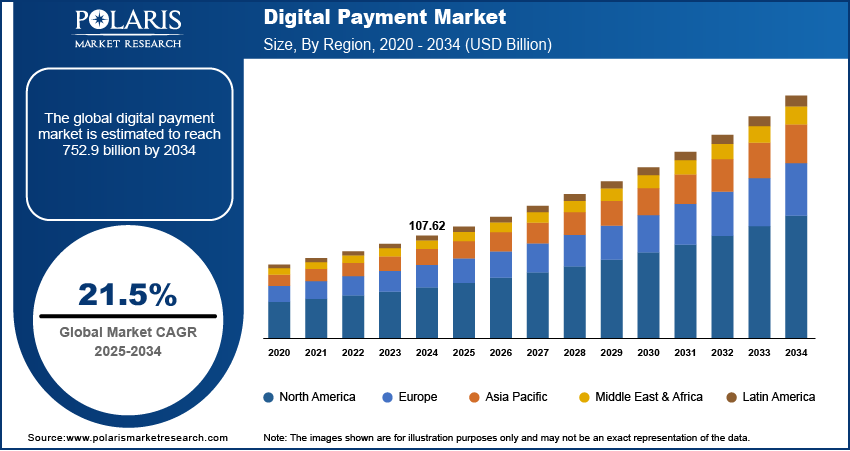

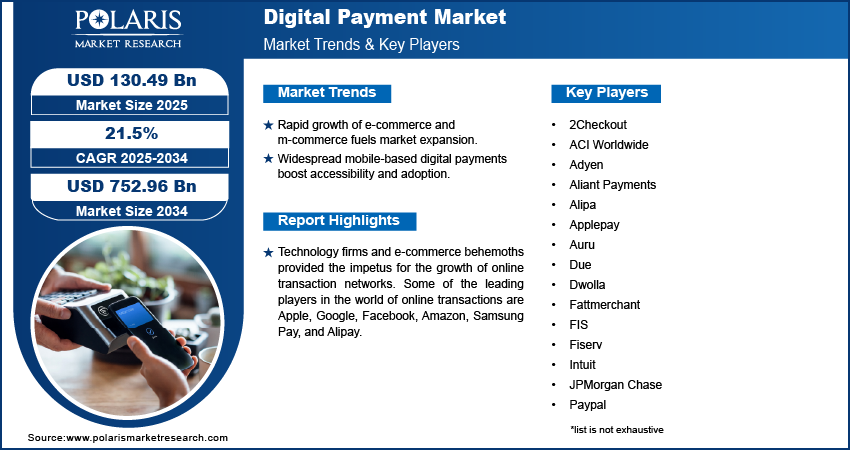

The global digital payment market was valued at USD 107.62 billion in 2024 and is expected to grow at a CAGR of 21.5% during the forecast period. Over the projected period, it is anticipated that the prevalence of cashless transactions will increase, and increasing government initiatives and funding will be provided to address the need for liquidity and the cash crisis.

Key Insights

- By solution, the payment processing subsegment held the largest share in 2024. Rapid adoption of electronic commerce is fueling this segment because secure and rapid online transactions are increasingly in demand.

- By mode of payment, the contactless transactions held the largest share in 2024. The adoption of smartphones and the increase in touchless payment technology are primary factors.

- By deployment, the on-premises held the largest share in 2024. This is because on-premises solutions give organizations complete control over their systems and data, which is critical for security and compliance.

- By enterprise size, the large enterprises segment held the largest share in 2024. These companies allocate more of their budgets for payment technologies and process complex payment transactions.

- By end-use, the Banking, Financial Services, and Insurance (BFSI) held the largest share in 2024. The increasing need for domestic and international digital transactions is the core driving force for this segment’s expansion.

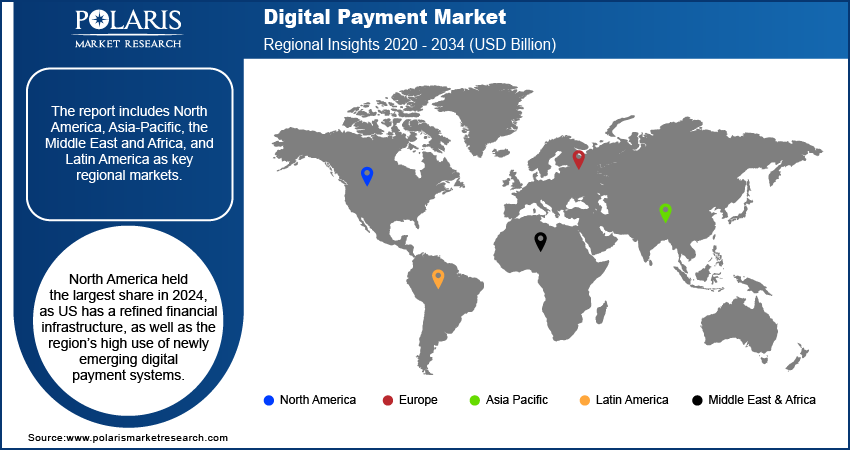

- By region, the North America held the largest share in 2024, as US has a refined financial infrastructure, as well as the region’s high use of newly emerging digital payment systems.

Industry Dynamics

- Online shopping or e-commerce and mobile commerce or m-commerce have increased tremendously and are a leading factor contributing to this.

- The current digital payment system is mostly reliant on mobile phones and the internet available to most people due to the rapid developments in the tech and telecommunication industries, even in the most remote parts of developing countries.

- Many governments have an economic agenda to achieve a cashless society, which is said to easily boost the economy, while also increasing financial transparency and inhibiting corruption.

Market Statistics

- 2024 Market Size: USD 107.62 billion

- 2034 Projected Market Size: USD 752.96 billion

- CAGR (2025-2034): 21.5%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

AI Impact on the Market

- The decreased margins of error and oversights in the entire digital payment processing system, along with increased efficiency and speed, are attributed to the incorporation of AI systems coupled with machine learning features.

- AI personalizes and eases payment activities for the users. AI can also power chatbots and virtual assistants and offer customer service concerning billing.

- AI also enhances the precision and the promptness of payments by mechanizing the hitherto hand-operated processes.

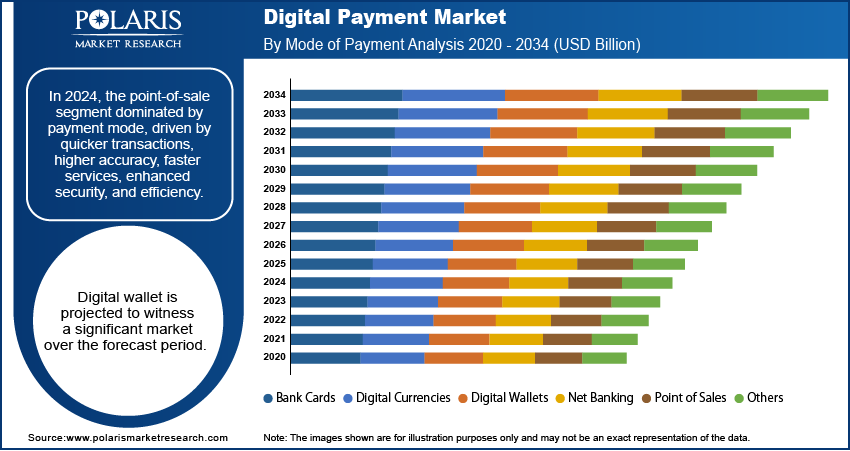

Over the projection period, it is anticipated that demand for digital transactions would rise due to the expanding usage of credit cards, debit cards, digital currencies, mobile wallets, net banking, point of sale, and the rising popularity of mobile apps. These mobile apps offer several promotional schemes for virtual transactions such as online shopping vouchers, cashback, discounts, in-shop offers, and others to attract customers and increase the use of such cards and apps for online transactions.

Technology firms and e-commerce behemoths provided the impetus for the growth of online transaction networks. Some of the leading players in the world of online transactions are Apple, Google, Facebook, Amazon, Samsung Pay, and Alipay. To make it simple for consumers and sellers to deal online, Alipay, one of the largest Chinese online transaction platforms, has 900 million domestic users.

In addition, the rising trend for online e-commerce also led to a greater demand for the digital payment market. Worldwide lockdown changed the shopping behavior of the people and had compelled the masses to embrace the online shopping system and buy groceries, medicines, personal care products, and other basic essential commodities online, which led to the increased usage of bank cards and mobile apps which also offers customers some great benefits.

Industry Dynamics

Growth Drivers

Real-time transaction systems are becoming increasingly in demand, and this need is fueled by the usage of smartphones, improved internet access, and non-physical interfaces. This demand is likely to drive growth in the digital compensation industry. Customers now expect a more streamlined and straightforward experience when using digital transactions. The increased global demand for the sector is fueled by a superior, smoother user experience and enhanced customization.

Mobile wallet proliferation is one of the most significant contributors to the growth of the virtual transaction system industry. The popularity of e-wallets has grown over the years owing to easy convenience and several offers provided by online transaction apps. According to the Global Payments Report 2021, the number of consumers that adopted mobile wallets to make transactions online increased from over 900 million to 1.48 billion in fiscal 2020 during the pandemic. Also, 25.7% of all POS (Point of Sale) transactions were made using mobile wallets.

Report Segmentation

The market is primarily segmented based on solution, mode of payment, deployment, enterprise size, end-use, and region.

|

By Solution |

By Mode of Payment |

By Deployment |

By Enterprise Size |

By End-Use |

By Region |

|

|

|

|

· |

|

Know more about this report: Request for sample pages

Insight by Mode of Payment

Based on mode of payment, the point-of-sale segment dominated the industry in 2024 due to its several benefits, such as quicker transactions, greater accuracy, expanded disbursement capabilities, faster services, better security, and many others.

Digital wallet is projected to witness a significant market over the forecast period. The increased usage of mobile phones, along with the ease of use and convenience, has led to the more considerable popularity of digital wallets among people, especially millennials, which is likely to boost the demand for the industry.

Insight by End-Use

Based on end-use, the market is further segmented into BFSI, healthcare, IT & telecom, media & entertainment, retail & e-commerce, transportation, and others. The Banking, Financial Services, and Insurance (BFSI) segment dominated the global digital transaction system market in 2024 and accounted for the largest revenue share.

With the introduction of digitization, banks have adopted the virtual transaction system owing to the several advantages it offers, such as increased efficiency of the delivery of products and services, wider reach of customers, improved quality of services, and reduced operational and transactional costs, increased financial inclusion, etc.

Media & entertainment will likely witness lucrative growth in the global market over the forecast period. The emergence and expansion of the OTT (Over the Top) platform among masses across the globe are driving the market demand primarily due to the convenience of use. OTT platforms have witnessed huge traffic over the past few years, wherein the Covid pandemic has played a crucial role in the rapid surge of online users.

Geographic Overview

North America dominated the global digital payment market in 2024 and witnessed the largest revenue share. The demand for the market in the area is anticipated to be driven by the proliferation of swift technology developments and investments in virtual transaction services and capabilities.

The region's fast emergence of digitization over the years has increased market demand. One of the biggest digital streaming platforms, Netflix is a production business and subscription streaming service based in the United States that gives clients worldwide a vast selection of movies and TV shows as well as tempting membership deals.

Competitive Insight

Some of the major market players operating in the global digital payment market include 2Checkout, ACI Worldwide, Adyen, Aliant Payments, Alipa, Applepay, Auru, Due, Dwolla, Fattmerchant, FIS, Fiserv, Global Payments, Intuit, JPMorgan Chase, Paypal, Paysafe, Paytrace, Payu, Spreedly, Square, Stripe, Visa, Wex, and Worldline.

Industry Dynamics

September 2024, PayPal Holdings Inc. introduced its PayPal Complete Payments (PPCP) platform in Hong Kong, offering businesses a flexible and powerful payment solution to strengthen global e-commerce operations.

Digital Payment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 107.62 billion |

| Market size value in 2025 | USD 130.49 billion |

|

Revenue forecast in 2034 |

USD 752.96 billion |

|

CAGR |

21.5% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Solution, By Mode Of Payment, By Deployment, By Enterprise Size, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

2Checkout, ACI Worldwide, Adyen, Aliant Payments, Alipa, Applepay, Auru, Due, Dwolla, Fattmerchant, FIS, Fiserv, Intuit, JPMorgan Chase, Paypal, Paysafe, Paytrace, Payu, Spreedly, Square, Stripe, Visa, Wex, and Worldline. |

FAQ's

? The global market size was valued at USD 107.62 million in 2024 and is projected to grow to USD 752.96 million by 2034.

? The global market is projected to register a CAGR of 21.5% during the forecast period.

? North America dominated the market share in 2024.

? The payment processing segment accounted for the largest share of the market in 2024.