Tissue Engineering Market Share, Size, Trends, Industry Analysis Report

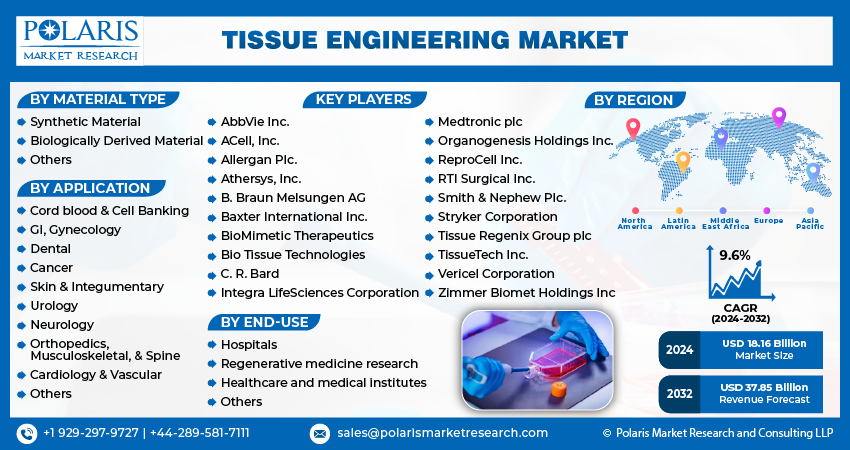

By Material Type (Synthetic Material, Biologically Derived Material, Others); By Application; By End-Use; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM4061

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

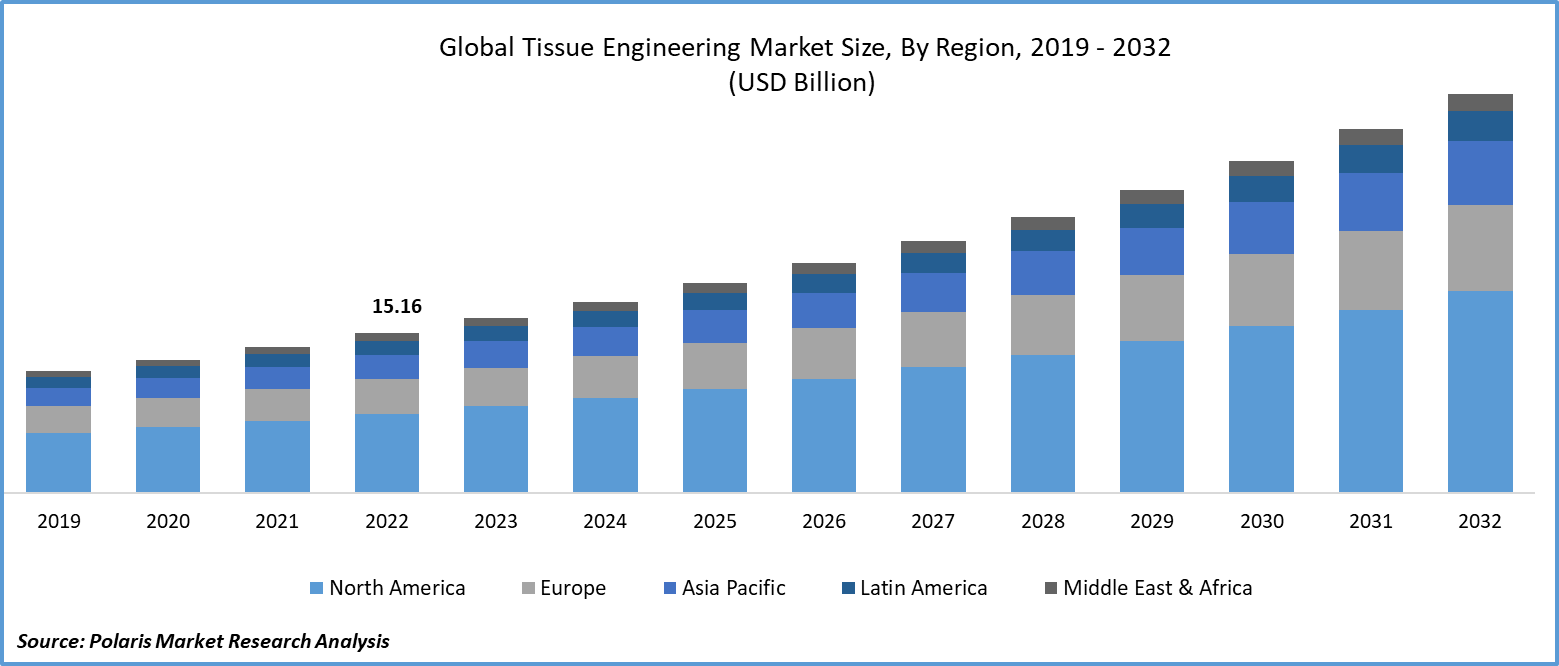

The global tissue engineering market was valued at USD 16.59 billion in 2023 and is expected to grow at a CAGR of 9.6% during the forecast period.

Tissue engineering offers several advantages over traditional treatments. It provides a personalized and regenerative approach, eliminating the need for lifelong immunosuppressive drugs and reducing the risk of rejection. It also addresses the shortage of organ donors by creating functional tissues and organs in the laboratory. Additionally, the market is a rapidly growing field within the healthcare industry that focuses on developing functional replacement tissues and organs to restore or improve the function of damaged or diseased tissues. It combines biology, engineering, and medicine principles to create biological substitutes that integrate with the patient's tissues.

To Understand More About this Research: Request a Free Sample Report

- For instance, In June 2023, The Central Drugs Standard Control Organisation (CDSCO) approved Cholederm, an animal-derived tissue engineering scaffold developed by Sree Chitra Tirunal Institute for Medical Sciences and Technology (SCTIMST). Cholederm, derived from the extracellular matrix of a pig's gall bladder, is a Class D medical device that serves as an advanced wound care product for healing skin wounds.

Moreover, the global market has been experiencing significant growth in recent years and is projected to continue expanding in the coming years. This growth is primarily driven by the increasing prevalence of chronic diseases and organ failure, advancements in stem cell research and regenerative medicine, and the rising demand for organ transplantation.

However, Government funding for medical and academic research activities is also a key factor in boosting the growth of tissue engineering. Increased financial support facilitates research and development efforts, leading to the development of novel techniques and therapies. This, in turn, propels the expansion of the market throughout the forecast period.

The COVID-19 pandemic has had a significant impact on the market. While the healthcare industry's immediate focus has been combating the virus and developing vaccines, the long-term implications of the pandemic have highlighted the importance of tissue engineering and regenerative medicine. The pandemic has underscored the need for advanced therapies that can address the lasting effects of the virus, such as organ damage and respiratory complications.

Growth Drivers

- Rising awareness of adverse effects on environment is projected to spur the product demand.

Technological advances have revolutionized tissue engineering and regenerative medicine, enabling the development of innovative platforms and tools. For instance, 3D bioprinting has emerged as a game-changing technology, allowing the precise fabrication of complex tissue structures.

Additionally, integrating stem cell research, biomaterials, and bioengineering has opened new avenues for creating functional tissues and organs. These novel platforms and technologies have improved the efficacy and safety of tissue engineering therapies and accelerated the research and development process, fueling market growth.

Moreover, there has been a significant increase in clinical studies focusing on regenerative medicine and tissue engineering. This growth is driven by the growing recognition of the potential of these therapies to address unmet medical needs. Clinical studies provide crucial evidence regarding the safety and efficacy of tissue engineering interventions, paving the way for their commercialization and widespread adoption. As more clinical trials are conducted and positive outcomes are reported, it generates confidence among healthcare providers, regulatory bodies, and patients, increasing market demand for tissue engineering products and treatments.

Report Segmentation

The market is primarily segmented based on material type, application, end-use, and region.

|

By Material Type |

By Application |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Material Type

- Synthetic material segment is anticipated to grow fastest over the forecast period

The synthetic material segment is a vital component of the market, encompassing polymers, ceramics, and composites. These artificially created materials offer customizable properties, biocompatibility, and degradation rates, making them suitable for various tissue engineering applications. Synthetic materials, such as polymeric scaffolds and ceramic implants, provide templates for cell growth and tissue regeneration, promoting the formation of functional tissues.

Advancements in material science have led to the development of innovative synthetic materials that enhance cell adhesion, proliferation, and differentiation. Synthetic materials' scalability and reproducibility are crucial in advancing tissue engineering and regenerative medicine.

By Application

- orthopedics, musculoskeletal and spine segment anticipated to hold significant revenue shares of the market over the forecast period

The orthopedics, musculoskeletal and spine segment is anticipated to hold significant revenue shares of the market. The orthopedics, musculoskeletal, and spine segment is a key area in tissue engineering, focusing on regenerative solutions for bone, joint, muscle, and spinal disorders. It aims to provide innovative therapies that promote tissue repair, restore normal function, and improve patient outcomes. By developing biomaterials, scaffolds, and cell-based approaches, this segment offers alternatives to traditional treatments, such as joint replacements, while addressing conditions like osteoarthritis, musculoskeletal injuries, and spinal disorders. Through advancements in tissue engineering, this segment strives to enhance mobility, reduce pain, and revolutionize orthopedic and spine care.

Regional Insights

- North America region dominated the global market in 2022

North America held the largest revenue share in the market. This can be attributed to increased awareness of stem cell therapy, a growing geriatric population, advanced diagnostic and treatment technologies for chronic diseases, private and government funding availability, and high healthcare expenditure. These factors collectively contribute to the region's dominant position in the market.

However, the Asia Pacific region is expected to witness the highest growth rate, driven by increasing investments in healthcare infrastructure, rising awareness about advanced treatment options, and a large patient pool.

Key Market Players & Competitive Insights

The tissue engineering market is highly competitive, with several players striving to gain a significant market share. The competition is driven by the continuous pursuit of innovative tissue engineering solutions, technological advancements, and the ability to meet the evolving needs of patients and healthcare providers.

Some of the major players operating in the global market include:

- AbbVie Inc.

- ACell, Inc.

- Allergan Plc.

- Athersys, Inc.

- B. Braun Melsungen AG

- Baxter International Inc.

- BioMimetic Therapeutics

- Bio Tissue Technologies

- C. R. Bard (now part of Becton, Dickinson and Company)

- Integra LifeSciences Corporation

- Medtronic plc

- Organogenesis Holdings Inc.

- ReproCell Inc.

- RTI Surgical Inc.

- Smith & Nephew Plc.

- Stryker Corporation

- Tissue Regenix Group plc

- TissueTech Inc.

- Vericel Corporation

- Zimmer Biomet Holdings Inc.

Recent Developments

- In June 2023, 3D BioFibR launched two new collagen fiber products, {μCollaFibR and {CollaFibR 3D scaffold. These products, made using the company's proprietary dry-spinning technology, offer substantial benefits for tissue engineering and culture applications.

- In January 2023, BioMed X extended its collaboration with AbbVie and launched its first institute in the US in New Haven, Connecticut. The partnership, which follows an initial joint project on Alzheimer's disease, will now focus on immunology and tissue engineering.

Tissue Engineering Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 18.16 billion |

|

Revenue forecast in 2032 |

USD 37.85 billion |

|

CAGR |

9.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Material Type, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |