Stem Cell Market Share, Size, Trends, Industry Analysis Report

By Type; By Application (Drug Discovery and Development, Regenerative Medicine); By Technology; By Therapy; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 117

- Format: PDF

- Report ID: PM2725

- Base Year: 2024

- Historical Data: 2020-2023

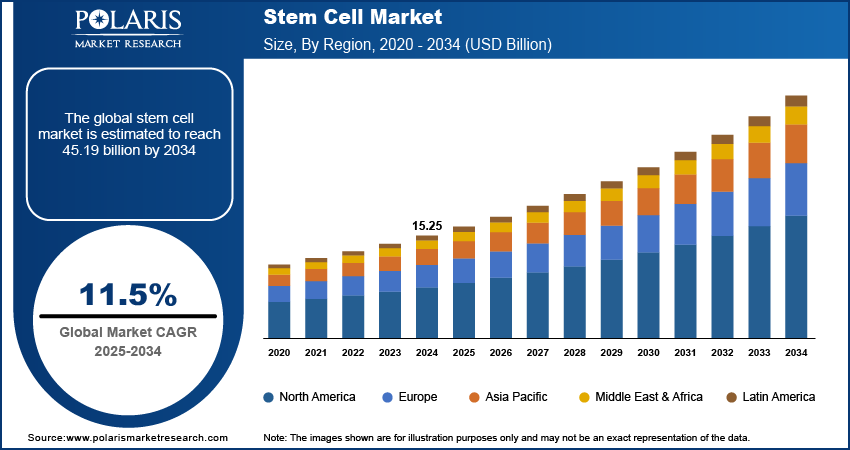

The stem cell market was valued at USD 15.25 billion in 2024 and is expected to grow at a CAGR of 11.5% during the forecast period. The rise in cell therapy production facilities, the growing number of precision medicine, and the rising number of clinical trials are some prominent factors responsible for market growth.

Key Insights

- By type, adult stem cells held the largest share in 2024, driven by their established clinical use (e.g., hematopoietic and mesenchymal stem cell therapies) and more mature regulatory/clinical pathways compared with embryonic or newer iPSC technologies.

- By application, regenerative medicine held the largest share in 2024, accounting for the vast majority of revenue as stem cells are widely used for tissue repair, grafting, and cell-replacement therapies across many specialtie.

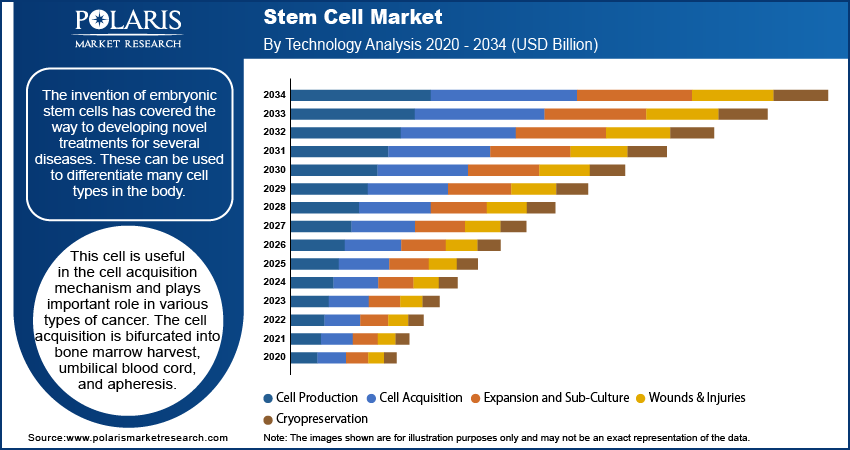

- By technology, cell acquisition held the largest share in 2024 because it is a required, recurring step for virtually all downstream workflows.

- By therapeutic therapy, allogeneic stem cell therapies held the largest share in 2024 due to easier scalability, off-the-shelf manufacturing, and the ability to serve many patients from a single donor product.

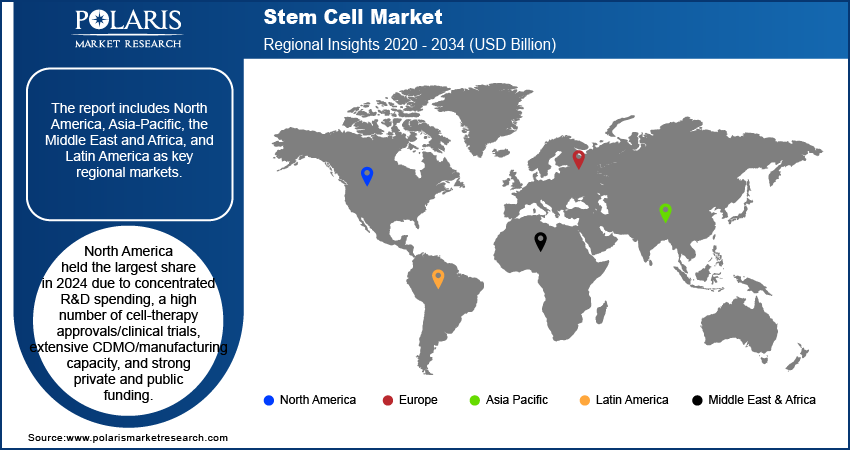

- By region, North America held the largest share in 2024 due to concentrated R&D spending, a high number of cell-therapy approvals/clinical trials, extensive CDMO/manufacturing capacity, and strong private and public funding.

Industry Dynamics

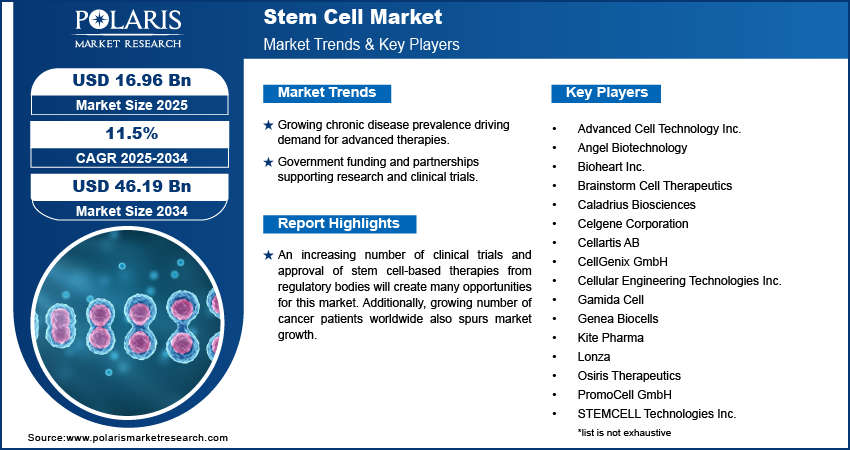

- The increasing prevalence of chronic diseases such as cancer, cardiovascular disorders, and neurodegenerative conditions is fueling demand for advanced therapies.

- Rising government funding, public–private partnerships, and favorable regulatory initiatives are supporting research programs, clinical trials, and infrastructure development.

- Technological advancements in cell harvesting, cryopreservation, expansion, and culture techniques are enhancing yield, viability, and scalability.

Market Statistics

- 2024 Market Size: USD 15.25 billion

- 2034 Projected Market Size: USD 45.19 billion

- CAGR (2025-2034): 11.5%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

AI Impact on the Market

- Integration of AI in cell research is streamlining drug discovery and therapeutic development by enabling predictive modeling of cell behavior.

- AI-driven image analysis tools are improving accuracy in cell identification, classification, and quality control.

- By combining AI with bioinformatics, researchers can better understand gene expression patterns and cellular differentiation pathways.

An increasing number of clinical trials and approval of stem cell-based therapies from regulatory bodies will create many opportunities for this market. Additionally, growing number of cancer patients worldwide also spurs market growth.

Financial assistance from governments, private vendors, and NGOs drives the market's growth. For instance, National Stem Cell Foundation, a nonprofit, provides funds for research and clinical trials for adult stem cell therapies, education initiatives, and patient advocacy.

Covid-19 has positively influenced the market, as lung dysfunction was the primary cause of death during the pandemic. For instance, in January 2020, University of Miami researchers administered two infusions of stem cells to COVID-19 patients with lung injury. The results showed no noticeable side effects, and the therapy was effective.

Also, according to the article published by BioMed Central Ltd. (BMC), stem cells are safe and effective in treating severe COVID-19 disease, indicating significant potential.

However, limited awareness regarding appropriate treatment and ethical concerns for embryonic stem cells are some factors hampering the market growth. Also, decreased adoption due to high costs for the therapies can hinder the market's growth.

Industry Dynamics

Growth Drivers

Increasing technological advancement in stem cell therapeutics, rising demand for stem cell banking, and a growing focus on developing personalized medicines are the primary factors driving the market’s growth.

Increased product launches by key market players are expected to drive the market over the forecast period. For instance, LifeCell, a healthcare service provider, introduced an advanced umbilical cord-stem cell collection kit on August 2017 that protects neonatal stem cells from environmental damage and temperature fluctuations.

Rising chronic disorders are also supposed to accelerate the market's growth. Chronic diseases are common health problems all over the world. One in every three adults worldwide suffers from a chronic condition. Chronic diseases, such as cancer, musculoskeletal and neurologic disorders, chronic injuries, and cardiovascular and gastrointestinal, can result in hospital treatment, long-term disability, decreased quality of life, and death.

Report Segmentation

The market is primarily segmented based on type, application, technology, therapy, and region.

|

By Type |

By Application |

By Technology |

By Therapy |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Adult Stem Cell Type Accounted the Largest Market Share in 2024

Adult stem cell offers benefits such as a capacity for autologous transformation, low risk of tumor formation, and availability of established treatment options. These collectively enhance the adult stem cell demand. These cells do not involve the destruction of embryos, which is the case in embryonic stem cells. Furthermore, there is no risk of graft rejection in the case of adult stem cells.

Therefore, the development of cell banking services and advances in bio preservation and cryopreservation are expected to increase the demand for adult stem cells further.

Cost-effectiveness and the expansion of stem cell banking have all contributed to the growth of this segment.

Regenerative Medicine Segment Acquires the Largest Market Share During the Forecast Period

Stem cells have played an important role in orthopedic regenerative medicine, particularly in healing the body without invasive surgery. Although orthopedic treatment applications in stem cell therapies are still evolving, recent research has shown promising outcomes expected to drive future market growth.

Additionally, the developed regenerative is useful for treating various blood disorders, heart diseases, diabetes, and vision loss. It has influenced the segment’s growth.

The increasing approvals for clinical trials of stem cell therapies for various diseases gain traction in the segment over the forecast period.

Cell Acquisition Segment is Expected to Hold the Significant Revenue Share Over the Anticipated Years

The invention of embryonic stem cells has covered the way to developing novel treatments for several diseases. These can be used to differentiate many cell types in the body. This cell is useful in the cell acquisition mechanism and plays important role in various types of cancer. The cell acquisition is bifurcated into bone marrow harvest, umbilical blood cord, and apheresis.

Thus, factors such as increasing prevalence of blood cancer and easy access to bone marrow transplantation therapy boost the segment’s growth during forecast period.

Allogenic Therapy Segment is Expected to Hold the Largest Revenue Share In Upcoming Years

The allogenic type creates a new immune system for the patients when the donor cells engraft in the recipient. Many malignant and non-cancerous disorders, such as acute leukemia, chronic leukemia, Hodgkin's lymphoma, Bone marrow failure syndromes, and others, can be treated by allogeneic stem cell transplants.

High pricing and development in stem cell banking have contributed to the growth of this segment. Furthermore, many cell therapy companies are refocusing on developing allogeneic cell therapy products. This, in turn, is expected to result in significant growth in this segment. For Instance, in June 2022, Immatics and Bristol Myers Squibb expanded their strategic alliance to develop gamma delta allogeneic cell therapy programs.

North America is Projected For the Highest Growth Over the Forecast Period

North America is expected to witness the highest growth over the forecast period owing to the strong biotechnology industry, the dominance of major key players, extensive R&D activities, and the promotion of personalized medicines.

Furthermore, growth can be attributed to a growing government initiative to promote stem cell therapies. For instance, the Canadian government invested approximately USD 7 million in regenerative medicine and stem cell research in March 2020. It will finance nine transnational projects and four clinical trials in the country to help the country's growth in the regenerative medicine sector.

Competitive Insight

Some of the major players operating in the global market include Advanced Cell Technology Inc., Angel Biotechnology, Bioheart Inc., Brainstorm Cell Therapeutics, Caladrius Biosciences, Celgene Corporation, Cellartis AB, CellGenix GmbH, Cellular Engineering Technologies Inc., Gamida Cell, Genea Biocells, Kite Pharma, Lonza, Osiris Therapeutics, PromoCell GmbH, STEMCELL Technologies Inc., Tigenix, and Waisman Biomanufacturing.

Recent Developments

In January 2024, STEMCELL Technologies, Inc. acquired Propagenix Inc., gaining access to its EpiX technology to advance product development in regenerative medicine.

In February 2021, American CryoStem collaborated with BioTherapeutic Labs Corp for the research and development of stem cells. The main purpose of this collaboration was to develop and improve protocols utilizing CRYO’s ATCell and BTL’s human umbilical cord-based product lines.

Stem Cell Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 15.25 billion |

| Market size value in 2025 | USD 16.96 billion |

|

Revenue forecast in 2034 |

USD 46.19 billion |

|

CAGR |

11.5% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Type, By Application, By Technology, By Therapy, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Advanced Cell Technology Inc., Angel Biotechnology, Bioheart Inc., Brainstorm Cell Therapeutics, Caladrius Biosciences, Celgene Corporation, Cellartis AB, CellGenix GmbH, Cellular Engineering Technologies Inc., Gamida Cell, Genea Biocells, Kite Pharma, Lonza, Osiris Therapeutics, PromoCell GmbH, STEMCELL Technologies Inc., Tigenix, Waisman Biomanufacturing. |

FAQ's

? The global market size was valued at USD 15.25 billion in 2024 and is projected to grow to USD 45.19 billion by 2034.

? The global market is projected to register a CAGR of 11.5% during the forecast period.

? North America dominated the market share in 2024.

? The adult stem cells segment accounted for the largest share of the market in 2024.