Prostate Cancer Biomarker Market Size, Share, & Industry Analysis Report

: By Type (Genetic Biomarkers, Protein Biomarkers, Cell-Based Biomarkers, and Metabolomic Biomarkers), By Application, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5692

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

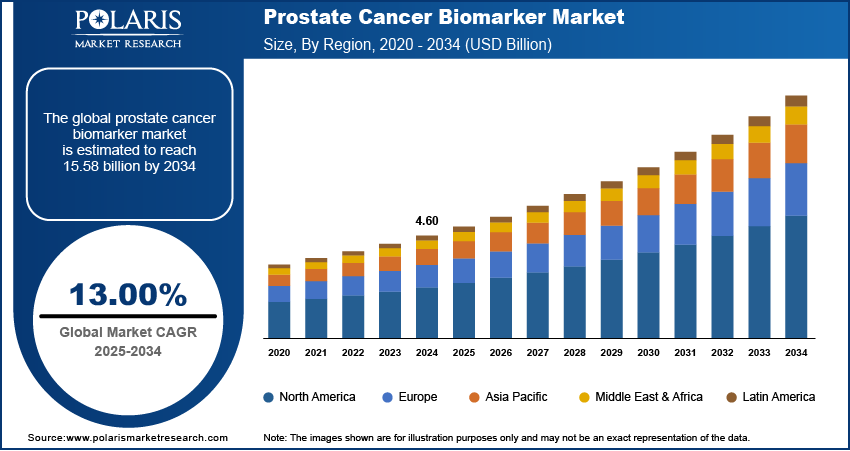

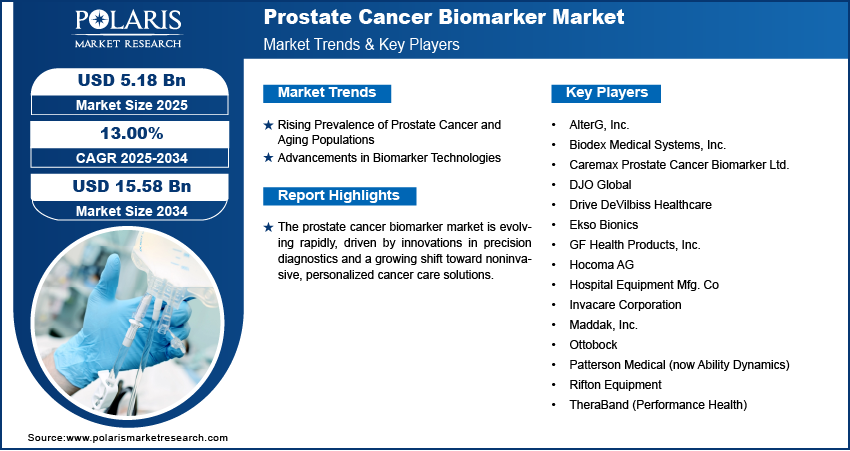

The global prostate cancer biomarker market was valued at USD 4.60 billion in 2024 and is expected to grow at a CAGR of 13.00% from 2025 to 2034. The prostate cancer biomarker market is driven by rising prostate cancer prevalence, growing demand for early and accurate diagnosis, advancements in biomarker technology, and increasing awareness about personalized treatment options.

The growing adoption of personalized medicine biomarkers has especially influenced prostate cancer diagnosis and treatment. Prostate cancer biomarkers are measurable biological indicators used to detect the presence, progression, or therapeutic response of prostate cancer. Personalized medicine relies on biomarker-based stratification to tailor therapies according to an individual’s genetic and molecular profile, thereby enhancing treatment efficacy and minimizing unnecessary interventions. The demand for precision diagnostics has led to the development of advanced biomarker panels that aid in identifying high-risk patients, monitoring disease recurrence, and guiding therapeutic decisions. For instance, a February 2024 PMC report revealed that personalized medicines accounted for over one-third of FDA drug approvals in 2023 for the fourth consecutive year, including 16 new rare disease treatments. In the year, 26 novel therapies were approved and 19 expanded indications for existing treatments. This targeted approach improves patient outcomes and also optimizes healthcare resource utilization.

The growing awareness of prostate cancer's early detection, supported by public health initiatives and educational campaigns, has boosted the focus on regular screening and early diagnosis, especially for high-risk populations. In February 2025, EDX Medical developed a prostate cancer test analyzing over 100 blood/urine biomarkers via AI to detect cancer stage, aggressiveness, and genetic risks. The patented algorithm provides comprehensive results, surpassing current tests limited to 20 biomarkers. Biomarkers play a crucial role in early detection by offering noninvasive, accurate, and timely identification of cancerous changes, often before symptoms manifest. This early intervention capability reduces the risk of disease progression and improves prognosis. The reliance on biomarker-based diagnostic services continues to strengthen as healthcare systems prioritize preventive care, positioning them as integral components of modern prostate cancer management.

Market Dynamics

Rising Prevalence of Prostate Cancer and Aging Populations

The rising prevalence of prostate cancer, particularly among aging populations, is driving the prostate cancer biomarker market growth. The increasing proportion of elderly individuals globally has led to a greater incidence of prostate cancer diagnoses, as age is a primary risk factor. According to a December 2024 CDC report, the US recorded 236,659 prostate cancer cases in 2021, with an incidence rate of 112 per 100,000 males. Approximately 70% of cases were diagnosed at the localized stage. This demographic shift necessitates improved screening, monitoring, and diagnostic approaches to manage the growing patient burden effectively. Prostate cancer biomarkers enable early detection and risk assessment, supporting timely intervention and personalized treatment strategies. The demand for reliable, accessible, and minimally invasive biomarker-based tools continues to escalate as healthcare systems respond to the needs of aging populations.

Advancements in Biomarker Technologies

Advancements in biomarker technologies are fueling the prostate cancer biomarker market expansion. In July 2024, Scipher Medicine launched PRoBeNet, an AI and network biology framework to accelerate biomarker discovery for complex diseases. The patent-pending approach analyzes therapy-targeted proteins and disease signatures to address data limitations in precision medicine. Progress in genomics, proteomics, and molecular infectious disease testing has led to the identification and validation of more specific and sensitive biomarkers. These innovations are enhancing the accuracy of prostate cancer detection, staging, and therapeutic monitoring, ultimately contributing to better clinical outcomes. Additionally, the integration of high-throughput technologies and bioinformatics tools allows for the development of multiplex biomarker panels and companion diagnostics. As the field evolves toward precision oncology, technological advancements are playing a pivotal role in expanding the clinical utility and adoption of biomarker-driven decision-making.

Segment Insights

Market Assessment by Type

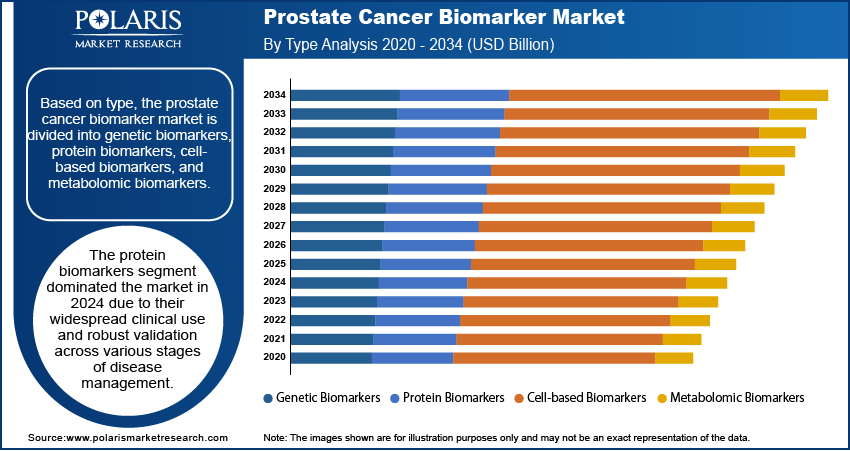

The global prostate cancer biomarker market segmentation, based on type, includes genetic biomarkers, protein biomarkers, cell-based biomarkers, and metabolomic biomarkers. The protein biomarkers dominated the market in 2024 due to their widespread clinical use and robust validation across various stages of disease management. These biomarkers, such as prostate-specific antigen (PSA), are well-established tools for detection, monitoring, and risk assessment in clinical practice. Their accessibility, cost-effectiveness, and ability to provide rapid results have supported their continued dominance in diagnostic workflows. Furthermore, ongoing improvements in immunoassay technologies and biomarker standardization have reinforced the reliability of protein-based tests, making them a preferred choice among healthcare professionals for routine prostate cancer evaluation.

Market Evaluation by Application

The global prostate cancer biomarker market segmentation, based on application, includes screening and early detection, diagnosis and risk stratification, prognosis and treatment monitoring, and companion diagnostics. The companion diagnostics segment is expected to witness the fastest growth during the forecast period, driven by the increasing adoption of personalized medicine and targeted therapies. These diagnostics are crucial for identifying patients who are most likely to benefit from specific therapeutic agents, thereby improving treatment efficacy and minimizing adverse effects. Companion diagnostics are being integrated into clinical pathways to guide individualized treatment strategies with advances in genomic profiling and biomarker discovery. The demand for companion diagnostics in prostate cancer management is expected to accelerate as pharmaceutical companies and diagnostic developers collaborate to co-develop targeted therapies and associated tests.

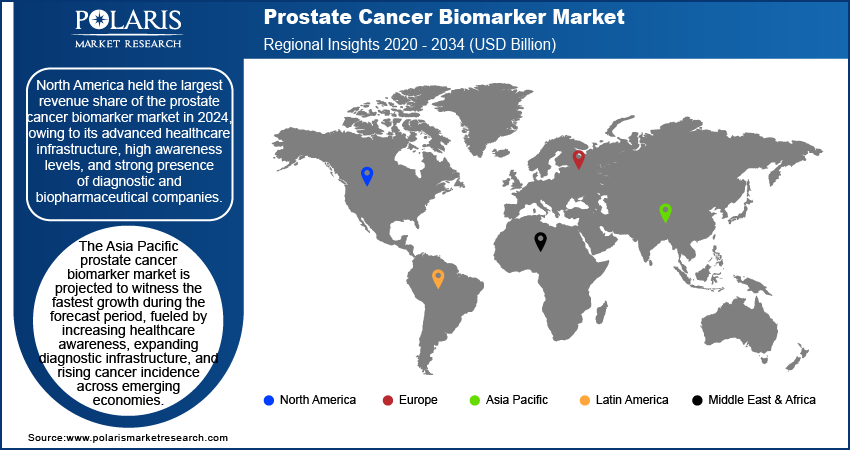

Regional Analysis

The report provides the market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America prostate cancer biomarker market held the largest revenue share in 2024, owing to its advanced healthcare infrastructure, high awareness levels, and strong presence of diagnostic and biopharmaceutical companies. The region benefits from widespread access to advanced technologies, a well-established regulatory framework, and significant investments in cancer research. For instance, in July 2024, the Parker Institute for Cancer Immunotherapy allocated USD 125 million to expand research and accelerate immunotherapy development, supporting collaborative studies and translation of scientific discoveries into potential cancer treatments. Additionally, routine screening programs and favorable reimbursement policies have supported the adoption of biomarker-based diagnostics. These factors, coupled with an aging population and high prostate cancer incidence, have solidified North America’s leadership position in the market.

The Asia Pacific prostate cancer biomarker market is projected to witness the fastest growth during the forecast period, fueled by increasing healthcare awareness, expanding diagnostic infrastructure, and rising cancer incidence across emerging economies. According to a February 2024 NCDIR report, India reported 1,461,427 new cancer cases in 2022, reflecting a crude rate of 100.4 cases per 100,000 population, out of which prostate cases were 76,898. Governments in the region are investing in early detection and precision medicine initiatives, which encourage the integration of biomarker testing into standard care. Moreover, growing healthcare expenditure, improving access to diagnostic technologies, and a larger aging male population are contributing to the market's expansion. Thus, as regional healthcare systems evolve, the demand for effective, noninvasive prostate cancer diagnostic solutions is expected to rise rapidly.

Key Players & Competitive Analysis Report

The prostate cancer biomarker sector is experiencing rapid transformation, fueled by three key drivers such as breakthrough technologies in liquid biopsies and AI-powered diagnostics, increasing demand for precision medicine, and expanding applications in clinical decision-making. In developed markets such as North America and Europe, adoption rates are surging as next-generation biomarkers demonstrate superior accuracy in early cancer detection and treatment monitoring. Competitive dynamics show industry leaders are making strategic investments in multi-omics and companion diagnostics, aiming to capitalize on unmet needs for personalized oncology solutions. Meanwhile, emerging markets, particularly in Asia Pacific, are gaining attention as rising prostate cancer incidence and healthcare modernization create new opportunities. However, companies must navigate complex economic conditions and evolving regulatory landscapes. Technological disruption is accelerating across the value chain, with machine learning algorithms now enhancing biomarker discovery and validation processes. This innovation rise is creating distinct competitive paths, and smaller firms are pioneering niche segments such as exosome-based biomarkers. A few of the key players in the market are Arquer Diagnostics; Beckman Coulter, Inc.; Bio-Techne; DiaCarta; Exact Sciences Corporation; ExoDx; Genomic Health; GenPath Oncology; MDxHealth; Myriad Genetics, Inc.; Nucleix; OPKO Health, Inc.; Proteomedix; and Veracyte, Inc.

MDxHealth is a molecular diagnostics company specializing in the development and commercialization of advanced biomarker tests for prostate cancer. The company’s flagship products, SelectMDx and ConfirmMDx, are designed to address challenges in prostate cancer diagnosis and management. SelectMDx is a noninvasive urine-based test that measures the expression of two mRNA cancer-related biomarkers, HOXC6 and DLX1, to help assess a patient’s risk for clinically significant prostate cancer. SelectMDx aids physicians in determining which patients may benefit from a prostate biopsy and which can safely avoid unnecessary procedures by combining biomarker results with clinical risk factors, thereby improving diagnostic efficiency and reducing overtreatment. ConfirmMDx, on the other hand, is a tissue-based assay that analyzes DNA methylation patterns in prostate biopsy samples. This test is particularly valuable for men who have had a previous negative biopsy but remain at risk for undetected prostate cancer, as it helps identify patients who may harbor hidden malignancies and guides decisions about repeat biopsies. Supporting their use as precision medicine tools for risk stratification and clinical decision-making in prostate cancer care, both tests have demonstrated high sensitivity and negative predictive value.

Beckman Coulter, Inc. specializes in biomedical testing and diagnostics, with a presence in the field of prostate cancer biomarkers. The company is best known for its Prostate Health Index (PHI), an advanced blood test designed to improve the detection and risk assessment of prostate cancer. The PHI test combines three key biomarkers such as total PSA, free PSA, and [-2] proPSA into a single score, offering clinicians a more accurate tool for distinguishing prostate cancer from benign prostatic conditions, particularly in men aged 50 years and above with PSA levels in the diagnostic “gray zone” between 4 and 10 ng/mL. This multivariate approach provides a better assessment of cancer probability than PSA testing alone, helping to reduce unnecessary biopsies and guide clinical decision-making. The PHI score is calculated using a proprietary formula, with higher scores indicating a greater likelihood of prostate cancer. Beckman Coulter’s PHI test is FDA-approved and has been validated in large clinical studies for its ability to improve specificity and sensitivity in prostate cancer detection. Beckman Coulter continues to play a vital role in advancing prostate cancer diagnostics and improving outcomes for patients worldwide by delivering actionable insights and supporting more personalized patient management.

List of Key Companies in Prostate Cancer Biomarker Market

- Arquer Diagnostics

- Beckman Coulter, Inc.

- Bio-Techne

- DiaCarta

- Exact Sciences Corporation

- ExoDx

- Genomic Health

- GenPath Oncology

- MDxHealth

- Myriad Genetics, Inc.

- Nucleix

- OPKO Health, Inc.

- Proteomedix

- Veracyte, Inc.

Prostate Cancer Biomarker Industry Developments

February 2025: Myriad Genetics collaborated with PATHOMIQ to exclusively license its AI platform (PATHOMIQ_PRAD) for prostate cancer in the US, enhancing Myriad’s oncology solutions with AI-powered diagnostics for treatment decision-making across different stages of prostate cancer management.

March 2025: BC Platforms joined the BRECISE initiative, a five-year Horizon Europe project (2025–2029) to advance precision oncology biomarkers for prostate/bladder cancers through multidisciplinary research co-funded by the Innovative Health Initiative.

October 2023: MeCo Diagnostics and Unravel Biosciences collaborated to develop AI-driven prostate cancer biomarkers and adjuvant therapies, combining MeCo's functional cell assays with Unravel's machine-learning drug discovery platform to improve treatment response prediction.

Prostate Cancer Biomarker Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Genetic Biomarkers

- Protein Biomarkers

- Cell-based Biomarkers

- Metabolomic Biomarkers

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Screening and Early Detection

- Diagnosis and Risk Stratification

- Prognosis and Treatment Monitoring

- Companion Diagnostics

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals & Diagnostic Laboratories

- Academic & Research Institutes

- Biopharmaceutical Companies

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Prostate Cancer Biomarker Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4.60 billion |

|

Market Size Value in 2025 |

USD 5.18 billion |

|

Revenue Forecast by 2034 |

USD 15.58 billion |

|

CAGR |

13.00% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.60 billion in 2024 and is projected to grow to USD 15.58 billion by 2034.

The global market is projected to register a CAGR of 13.00% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are AlterG, Inc.; Biodex Medical Systems, Inc.; Caremax Prostate Cancer Biomarker Ltd.; DJO Global; Drive DeVilbiss Healthcare; Ekso Bionics; GF Health Products, Inc.; Hocoma AG; Hospital Equipment Mfg. Co; Invacare Corporation; Maddak, Inc.; Ottobock; Patterson Medical (now Ability Dynamics); Rifton Equipment; and TheraBand (Performance Health).

The protein biomarkers dominated the market in 2024.

The companion diagnostics segment is expected to witness the fastest growth during the forecast period.