Oligonucleotide Synthesis Market Share, Size, Trends, Industry Analysis Report

By Product (Synthesized Oligonucleotide Products, Equipment, Reagents, Equipment, and Services); By Application; By Region; Segment Forecast, 2024- 2032

- Published Date:May-2024

- Pages: 116

- Format: PDF

- Report ID: PM4917

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

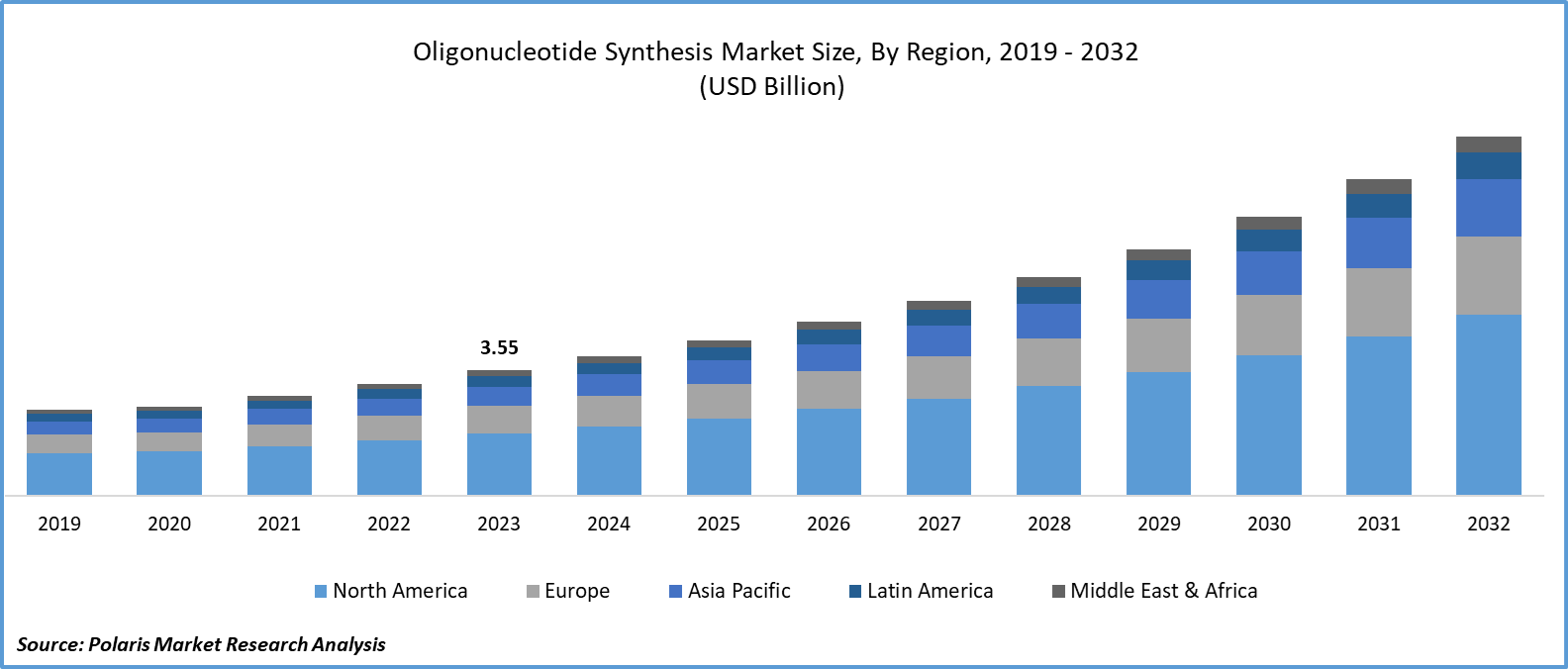

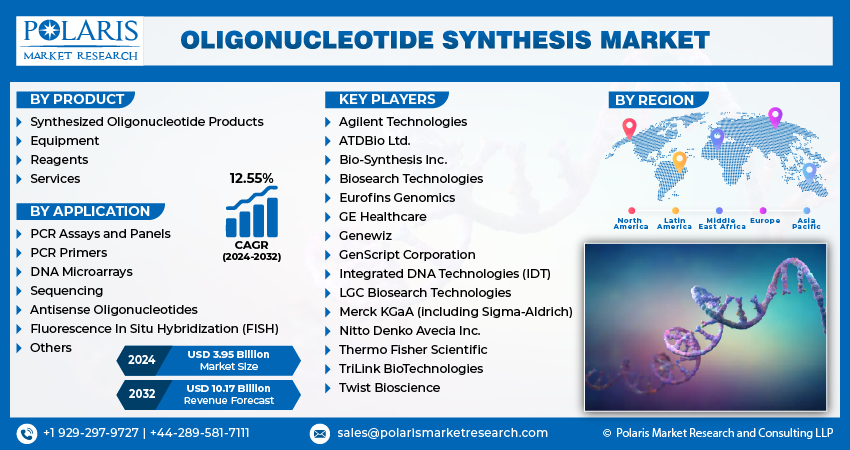

Oligonucleotide Synthesis Market size was valued at USD 3.55 billion in 2023. The market outlook is anticipated to grow from USD 3.95 billion in 2024 to USD 10.17 billion by 2032, exhibiting the CAGR of 12.55% during the forecast period.

Market Introduction

The burgeoning utilization of synthesized oligos in applications, including clinical and molecular diagnostics, coupled with the cumulative infusion of government investments. Governments across different regions are heavily investing in research and development in sectors including pharmaceutical and biotechnology, alongside the increasing reservoir of venture capital savings, which emerges as the primary driving force set to propel the oligonucleotide synthesis market's growth in the forecast period.

Despite these optimistic factors, challenges loom on the horizon. The erosion of costs associated with oligo synthesis and the absence of a unified set of guidelines for therapeutic oligos stand as potential impediments likely to restrain the expansion of the oligonucleotide synthesis market throughout the forecast period.

However, potential obstacles and emerging market scope in developing countries are expected to present lucrative opportunities, providing a positive market outlook for industry participants. However, substantial challenges linked to the large-scale synthesis of oligos and the precise distribution of oligonucleotide drugs to targeted locations present formidable obstacles that may impede the consistent growth of the oligonucleotide synthesis market in the future. Skillfully navigating these intricacies will be essential for stakeholders to guarantee the ongoing progress of oligonucleotide synthesis technologies within the dynamic realm of molecular diagnostics and clinical applications.

To Understand More About this Research: Request a Free Sample Report

For instance, in July 2023, Analytix introduced two novel instruments for organic synthesis. The first, wavePREP, was designed specifically for oligonucleotide synthesis. The second, Xelsius, serves as a multi-reaction synthesis workstation.

The oligonucleotide synthesis market is experiencing significant expansion driven by various factors, including heightened research and development endeavors by industry participants and the expansion of manufacturing facilities to cater to growing customer demands. Furthermore, based on market dynamics, several market players have garnered accreditation from regulatory authorities for their manufacturing facilities.

Industry Growth Drivers

Increasing Utilization of Synthesized Oligonucleotides in Molecular Diagnostics and Clinical Applications Is Projected to Spur Product Demand

The oligonucleotide synthesis market growth is greatly aided by an increasing utilization of synthesized oligonucleotides in molecular diagnostics and clinical applications plays a crucial role. The surge in market scope is attributable to their diverse applications, ranging from genetic testing to targeted therapeutics. The ever-expanding landscape of personalized medicine bolsters this market trend.

Increased Investment in Pharmaceutical and Biotechnology Companies is Expected to Drive Oligonucleotide Synthesis Market Growth

The oligonucleotide synthesis market is buoyed by the substantial investment pouring into pharmaceutical and biotechnology companies, primarily driven by government funds and research and development expenses. This financial backing not only fosters innovation and technological advancements but also facilitates the exploration of novel therapeutic avenues. However, industry analysis predicts challenges such as cost erosion and the absence of standardized therapeutic guidelines pose potential hindrances. Navigating these market dynamics will be essential for stakeholders to harness the full growth potential of the oligonucleotide synthesis market in the foreseeable future. For instance, Sierra BioSystems, Inc. is offering oligo synthesizer containing 12 amidite, 8 column, and 6 reagent positions to fulfill the specific laboratory requirements.

Industry Challenges

Erosion of Costs is Likely to Impede the Market Oligonucleotide Synthesis Growth Opportunities

Despite the optimistic growth factors, the oligonucleotide synthesis market faces restraining elements. The erosion of costs associated with synthesized oligos poses a challenge, impacting profit margins and market sustainability. Additionally, the absence of a unified set of guidelines for therapeutic oligos introduces uncertainty, potentially hindering the market's expansion. These limitations may impede the seamless progression of oligonucleotide synthesis technologies, underscoring the need for industry stakeholders to address and navigate these challenges effectively for sustained growth in the evolving landscape of molecular diagnostics and clinical applications.

Report Segmentation

The market report is primarily segmented based on product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Synthesized Oligonucleotide Products Segment is Expected to Witness the Highest Growth During the Forecast Period

The synthesized oligonucleotide products segment is projected to grow at a CAGR during the projected period in the oligonucleotide synthesis market. This surge is attributed to the increased prevalence of genomic studies, including gene expression analysis and genetic testing. Furthermore, the introduction of biochips (DNA chips) for the simultaneous analysis of multiple clinical samples is projected to contribute to overall market revenue significantly. The escalating utilization of antisense oligonucleotides in clinical trials addressing conditions such as cancer, cardiac disorders, and ocular dysfunctions is set to propel the segment into a phase of lucrative growth.

Moreover, the rising awareness and comprehension of genetic disorders are fueling the market demand for oligonucleotides in diagnostics and potential therapeutic interventions.

By Application Analysis

Pcr Primers Segment is Expected to Dominate the Oligonucleotide Synthesis Market During the Forecast Period

In 2023, the oligonucleotide synthesis market share was predominantly influenced by PCR primers, commanding a significant market share. PCR primers, being the most extensively employed oligonucleotide in Polymerase Chain Reaction (PCR), play a crucial role. The escalating adoption of primers in gene sequencing experiments is notable, driven by their utility in fluorescent detection and target amplification, leading to diverse primer designs featuring various probe- and primer-based detection chemistries. As PCR technology has advanced into RT-PCR, qPCR, and digital PCR, primers have adapted accordingly. Specifically designed PCR assays and panels for detecting and measuring gene expression underscore the pivotal role of primers in these advanced systems, anticipating sustained market growth. For instance, Thermo Fisher Scientific Inc. is offering services for custom DNA oligo synthesis for varied applications including cloning, sequencing, PCR, and gene detection.

Regional Insights

North America Region Dominated the Global Oligonucleotide Synthesis Market in 2023

North America dominated the global oligonucleotide synthesis market in 2023 and is expected to continue to do so. The region's prominent pharmaceutical and biotechnology sector, coupled with substantial research and development investments, has propelled the market trends. Additionally, a surge in genomic studies and gene therapy initiatives, such as those launched by leading institutions, contributes to the expanding demand for oligonucleotides. The well-established infrastructure, favorable regulatory environment, and a growing awareness of genetic disorders further accentuate North America's role in driving the significant growth observed in the oligonucleotide synthesis market.

In the meanwhile, the Asia-Pacific is expected to be the lucrative region in the oligonucleotide synthesis market. The surge in growth is a result of major players expressing heightened interest in maximizing profits within emerging markets. These industry leaders have strategically embraced acquisitions, collaborations, and distribution agreements to augment their market share, consequently boosting market revenue generation. Notably, countries such as Japan, China, and India are witnessing a flurry of business initiatives in the oligonucleotide synthesis market, playing a pivotal role in propelling the growth of the regional market.

Key Market Players & Competitive Insights

The market research identifies oligonucleotide synthesis market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These market manufacturers focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Agilent Technologies

- ATDBio Ltd.

- Bio-Synthesis Inc.

- Biosearch Technologies

- Eurofins Genomics

- GE Healthcare

- Genewiz

- GenScript Corporation

- Integrated DNA Technologies (IDT)

- LGC Biosearch Technologies

- Merck KGaA (including Sigma-Aldrich)

- Nitto Denko Avecia Inc.

- Thermo Fisher Scientific

- TriLink BioTechnologies

- Twist Bioscience

Recent Developments

- In May 2023, GenScript Biotech Corporation, a global leader in life-science research tools and services, extended its main manufacturing facility dedicated to oligonucleotide and peptide production in Zhenjiang, Jiangsu, China. This expansion reinforced GenScript's commitment to assisting scientists globally by delivering top-notch oligos and peptides, a legacy upheld for two decades.

- In February 2023, Fluor Corporation collaborated with Agilent Technologies, Inc. for the expansion of an oligonucleotide therapeutics manufacturing facility in Colorado. The facility is designed to provide purification, synthesis, and lyophilization of nucleic acids therapeutics.

Report Coverage

The oligonucleotide synthesis market research report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and market trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative market analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The market research report provides a detailed market analysis of the market while focusing on various key aspects such as competitive industry analysis, product, end-user, and their futuristic growth opportunities.

Oligonucleotide Synthesis Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.95 billion |

|

Revenue forecast in 2032 |

USD 10.17 billion |

|

CAGR |

12.55% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The Oligonucleotide Synthesis Market report covering key segments are product, application, and region.

Oligonucleotide Synthesis Market Size Worth $10.17 Billion By 2032

Oligonucleotide Synthesis Market exhibiting the CAGR of 12.55% during the forecast period.

North America is leading the global market

key driving factors in Oligonucleotide Synthesis Market are Increased investment in pharmaceutical and biotechnology companies