Energy Efficient Motor Market Size, Share, Trends, Industry Analysis Report

By Efficiency Level, By Product Type (AC Motor and DC Motor), By Application, By End-User, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6285

- Base Year: 2024

- Historical Data: 2020-2023

Overview

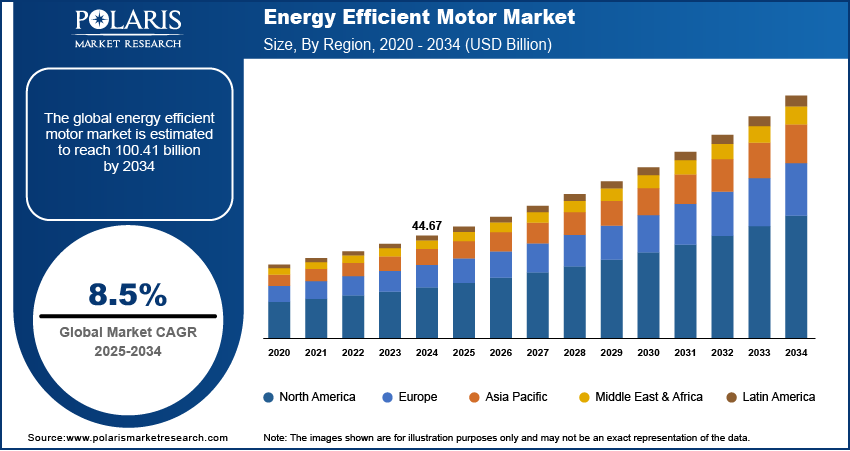

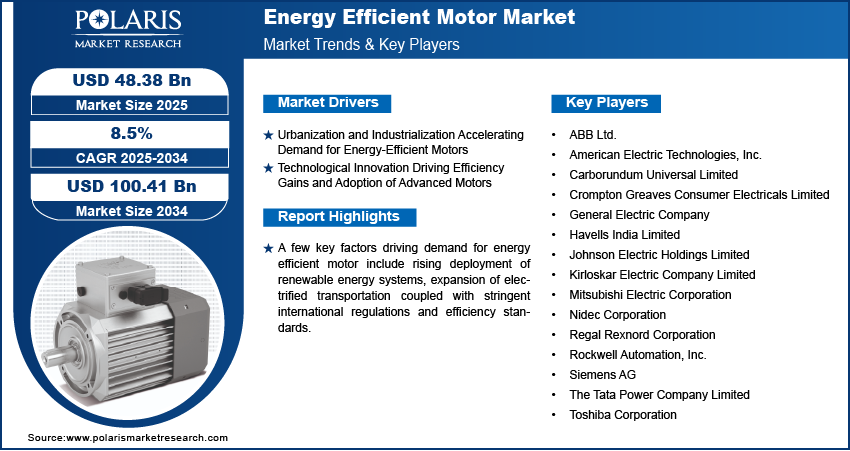

The global energy efficient motor market size was valued at USD 44.67 billion in 2024, growing at a CAGR of 8.5% from 2025 to 2034. Key factors driving demand for energy efficient motor include increasing urbanization and industrialization along with technological advancement propelling efficiency improvements and uptake of new generation motors.

Key Insights

- The IE3 segment dominated the market share in 2024.

- The compressors segment is projected to grow at a rapid pace in the coming years, increasing demand from chemical process, food and beverages, and oil and gas industries.

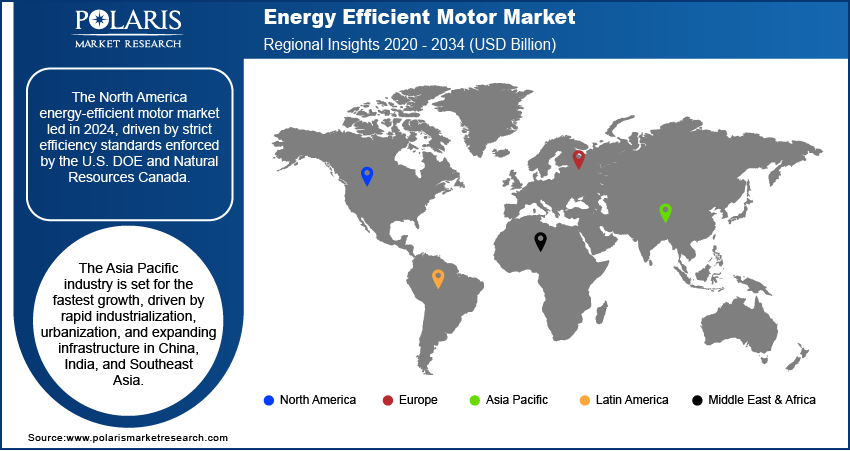

- North America dominated the global energy efficient motor market share in 2024.

- The U.S. energy efficient motor market is growing, due to high-speed industrial automation and robotics uptake among automotive, manufacturing, and logistics industries.

- Asia Pacific is expected to grow at the fastest CAGR, driven by aerospace and defense use of energy efficient motor-based materials.

- The market in China is growing rapidly, due to strong demand from two-wheelers, electric vehicles, and emerging manufacturing sectors.

Industry Dynamics

- Fast-paced urbanization and industrial growth is driving market growth due to increasing energy usage across residential, industrial, and commercial structures.

- Increasing technological development is driving the market expansion. This is due to improvements in motor design, control systems, and materials that enhance efficiency, increase operational life, and maximize performance in a wide range of applications.

- The increasing emphasis on permanent magnet synchronous motors (PMSM) is anticipated to generate promising opportunities within the forecast period.

- The energy efficient motors' high initial costs compared to their conventional counterparts restrict their adoption by cost-conscious industries and small businesses, thus inhibiting market expansion.

Market Statistics

- 2024 Market Size: USD 44.67 Billion

- 2034 Projected Market Size: USD 100.41 Billion

- CAGR (2025–2034): 8.5%

- North America: Largest Market Share

AI Impact on Energy Efficient Motor Market

- AI maximizes performance optimization in the energy-efficient motor market by scrutinizing load patterns and operating conditions. This guarantees maximum energy savings with negligible loss of performance across industries.

- AI-powered adaptive motor control varies speed, torque, and power consumption in real time. It enhances efficiency and system responsiveness to demand and conditions.

- AI-driven analytics detect faults, wear, and electrical issues early. Predictive maintenance strategies extend motor lifespan in manufacturing and HVAC systems.

- AI also enhances operator engagement with smart diagnostics, automated tuning, and real-time feedback. This simplifies energy management and increases reliability in high-energy industries.

The energy-efficient motor industry consists of specialized motors that are designed to reduce energy consumption with high performance and reliability. The motors are used in industrial machinery, HVAC, automotive, and commercial applications to reduce costs, emissions, and satisfy efficiency needs. Built with improved materials, improved winding, and control systems, they provide durability, minimum maintenance, and improved productivity. Characteristics of greater torque, less heat generation, and VFD compatibility make them appropriate for several applications and environmental consciousness.

Global energy transition is pushing adoption with governments and industries adopting decarbonization and net-zero ambitions. Renewable energy expansion, electrification of transport, and emphasis on industrial power reduction are propelling demand. As per International Energy Agency data, energy efficiency is expected to provide more than 40% of the cuts in emissions by 2050, highlighting the role of energy-efficient motors in efforts for sustainability.

Strict regulations and standards for high-efficiency motor technology is further accelerating the market growth. The EU Ecodesign Directive, US DOE regulation, and India's BEE rating are driving more efficient classes of motors. This is leading companies to supply IE3, IE4, and super-premium IE5 versions. Compliance means energy savings, cost savings, and access to government incentives. These policies are driving demand globally and fueling innovation in green motor solutions.

Drivers & Opportunities

Urbanization and Industrialization Accelerating Demand for Energy-Efficient Motors: Urbanization and rising industrial infrastructure are fueling demand for energy-efficient motors. Sectors such as manufacturing, utilities, transport, and building services are adopting such motors to save energy and costs. According to united nations statistics, urban population in cities is projected to extend to 2.5 billion by 2050, mainly in Asia and Africa. This demographic shift is encouraging industries and developers to include effective motors in modern infrastructure for the effective utilization of energy.

Technological Innovation Driving Efficiency Gains and Adoption of Advanced Motors: Technological innovation around motor engineering, digital control, and IoT monitoring is establishing new efficiency standards. Advances in synchronous motors, variable frequency drives, and smart connectivity are improving reliability and lowering lifecycle cost. In June 2025, ABB unveiled a massive synchronous motor under its TIE program to 99.13% efficiency, surpassing the 2017 figure of 99.05%. Installed in an Indian steel mill, it will save 61 GWh of energy, reduce USD 5.9 million of cost expenditure, and prevent 45,000 tons of CO₂ emissions over 25 years. These breakthroughs are driving demand for motors of next-generation that propel decarbonization and make industries competitive.

Segmental Insights

By Efficiency Level

Based on efficiency level, the energy efficient motor market is segmented into IE1 (Standard Efficiency), IE2 (High Efficiency), IE3 (Premium Efficiency), and IE4 (Super Premium Efficiency). IE3 held the largest market share in 2024, supported by regulations propelling adoption in industrialized economies and established cost-performance advantages. These motors are primarily used in HVAC, manufacturing, and pumping installations.

IE4 motors are expected to grow at a rapid pace, driven by sustainability objectives and advancements in technology. The extremely high efficiency positions them best for use in automobile, steel, and chemical sectors where minimizing energy consumption and emissions is essential.

By Product Type

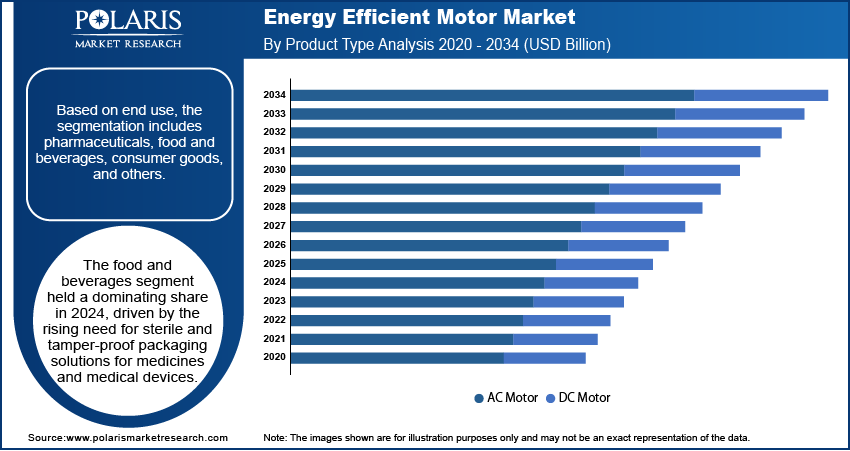

Based on product type, the market is bifurcated into AC motors and DC motors. AC motors dominated the market in 2024, owing to its toughness, lesser maintenance requirements, and wide usage in industrial machinery, transport systems, and commercial appliances.

DC motors are expected to grow steadily, fueled by the increasing application in precision applications such as robotics, electric vehicles, and renewable energy systems. The capability of DC motors to offer variable speed control and high torque is propelling application in technologically advanced industries.

By Application

Based on application, the market is divided into pumps, fans, compressors, refrigeration, material handling, material processing, and others. Pumps accounted for the largest share in 2024, due to its essential use in water supply, wastewater treatment, and process industries. The increased emphasis on energy loss reduction in pumping systems is increasing the demand for high-efficiency motor integration.

The compressors segment is projected grow considerably over the forecast period, due to the increasing demand from oil and gas, food and beverage, and chemical processing industries. Use of premium and super-premium efficiency motors in compressors is facilitating low electricity bills and enhanced operational dependability.

By End-User

Based on end-user, the market is segmented into residential, commercial, and industrial. The industrial segment led the market in 2024, driven by strict energy mandates, cost reduction needs, and sustainability goals. Oil & gas, processing, power generation, and manufacturing sectors are adopting energy-efficient motors to improve reliability, minimize downtime, and boost productivity.

The commercial segment is expected to grow the fastest. Rising use in HVAC equipment, lifts, escalators, and building automation is driving demand. Surging expenditure on smart buildings, coupled with government incentives and corporate environmental initiatives, is further fueling adoption in offices, hospitals, schools, and shopping malls.

Regional Analysis

The North America energy efficient motor market held a strong share in 2024, owing to strict DOE and Natural Resources Canada regulations. Incentives from the government, rebates, and financing plans are encouraging industries and consumers towards efficient technologies. Investment growth towards renewable sources of energy and retrofitting of manufacturing facilities are propelling demand for IE2, IE3, and IE4 motors in HVAC, pumps, compressors, and conveyors.

U.S. Energy Efficient Motor Market Insights

The U.S. market accounted for a major share, supported by rapid adoption of robotics and automation in logistics, manufacturing, and automotive. Industrial robot installations increased 12% to 44,303 units in 2023 and increasing demand for IE3 and IE4 motors for efficiency gains and cost savings. Green building regulations and energy-efficient structures also are driving adoption across the country.

Asia Pacific Energy Efficient Motor Market Outlook

Asia Pacific is projected to grow the fastest, driven by China, India, and Southeast Asia industrialization, urbanization, and infrastructure development. India's PAT scheme and China's efficiency regulations are driving IE3 and IE4 motor adoption in industry, agriculture, and transport. Increasing investment for smart factories and wind and solar power projects is providing further opportunities for growth.

China Energy Efficient Motor Market Analysis

China led the Asia Pacific market in 2024, driven by demand from EVs, two-wheelers, and industrialized manufacturing. EV sales increased by 40% in 2024, influencing motor demand for drive systems. Carbon-neutrality targets, compliance mandates, and EV promotion fuel adoption, while growth in renewables and electric mobility further fueling growth of the market.

Europe Energy Efficient Motor Market Assessment

Europe accounted for a significant share in 2024 due to the EU Ecodesign Directive's requirement for IE2, IE3, and even higher classes. Growth in Industry 4.0 investments and eco-friendly production practices is propelling demand for IE4. Germany, France, and the UK are the leaders for automotive, chemical, and industrial uses. Retrofitting of existing plants with energy-efficient systems is also driving the growth of the market.

Key Players & Competitive Analysis

Global energy efficient motors market is a competitive market dominated by ABB Ltd., Siemens AG, and Mitsubishi Electric Corporation. ABB complements its portfolio with IE4 and IE5 ultra-premium motors for industrial automation and renewable energy while Siemens and Mitsubishi are competing on digital motor technologies, regional growth, and sectorial applications in automotive, HVAC, and manufacturing.

Adoption is on the rise in industrial, commercial, and residential applications due to stringent efficiency requirements and the international drive for carbon savings. Business entities are providing high-performance motors with improved energy saving, power density, and reduced operating expenses. Partnerships with OEMs, automation companies, and utilities are increasing market penetration, while investments in intelligent and environmentally friendly motor technologies promote sustainable objectives.

Prominent companies operating in the energy efficient motor market include ABB Ltd., American Electric Technologies, Inc., Carborundum Universal Limited, Crompton Greaves Consumer Electricals Limited, General Electric Company, Havells India Limited, Johnson Electric Holdings Limited, Kirloskar Electric Company Limited, Mitsubishi Electric Corporation, Nidec Corporation, Regal Rexnord Corporation, Rockwell Automation, Inc., Siemens AG, The Tata Power Company Limited, and Toshiba Corporation.

Key Players

- ABB Ltd.

- American Electric Technologies, Inc.

- Carborundum Universal Limited

- Crompton Greaves Consumer Electricals Limited

- General Electric Company

- Havells India Limited

- Johnson Electric Holdings Limited

- Kirloskar Electric Company Limited

- Mitsubishi Electric Corporation

- Nidec Corporation

- Regal Rexnord Corporation

- Rockwell Automation, Inc.

- Siemens AG

- The Tata Power Company Limited

- Toshiba Corporation

Energy Efficient Motor Industry Developments

In January 2025, Nidec Corporation launched the PrecisionFlow motor, an electronically commutated high-efficiency motor with up to 85% efficiency, in January 2025. The new design is nearly 30% more efficient than conventional PSC motors, offering significant energy savings and operating advantages.

In April 2024, ABB India launched IEC Low Voltage IE4 cast iron super premium efficiency motors (frame sizes 71–132) and IE3 aluminium motors (frame sizes 71–90). Developed for flexibility in applications like pumps and conveyors, these motors give customers increased energy savings, minimized operating costs, lower emissions, and greater reliability and productivity.

Energy Efficient Motor Market Segmentation

By Efficiency Level Outlook (Revenue, USD Billion, 2020–2034)

- IE1 (Standard Efficiency)

- IE2 (High Efficiency)

- IE3 (Premium Efficiency)

- IE4 (Super Premium Efficiency)

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- AC Motor

- DC Motor

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Pumps

- Fans

- Compressor

- Refrigeration

- Material Handling

- Material Processing

- Others

By End-User Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Energy Efficient Motor Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 44.67 Billion |

|

Market Size in 2025 |

USD 48.38 Billion |

|

Revenue Forecast by 2034 |

USD 100.41 Billion |

|

CAGR |

8.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 44.67 billion in 2024 and is projected to grow to USD 100.41 billion by 2034.

The global market is projected to register a CAGR of 8.5% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are ABB Ltd., American Electric Technologies, Inc., Carborundum Universal Limited, Crompton Greaves Consumer Electricals Limited, General Electric Company, Havells India Limited, Johnson Electric Holdings Limited, Kirloskar Electric Company Limited, Mitsubishi Electric Corporation, Nidec Corporation, Regal Rexnord Corporation, Rockwell Automation, Inc., Siemens AG, The Tata Power Company Limited, and Toshiba Corporation.

The IE3 segment dominated the market revenue share in 2024, due to the mandatory adoption in industrialized economies, favorable government regulations, and proven energy savings in heavy-duty applications

The DC motors segment is projected to witness the fastest growth during the forecast period, fueled by the increasing role in precision-driven applications such as robotics, electric vehicles, and renewable energy systems.