Lithium Chemicals Market Size, Share, Trends, & Industry Analysis Report

By Product (Carbonate, Hydroxide, Chloride, Metal, Fluoride, and Others), By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6089

- Base Year: 2024

- Historical Data: 2020-2023

Overview

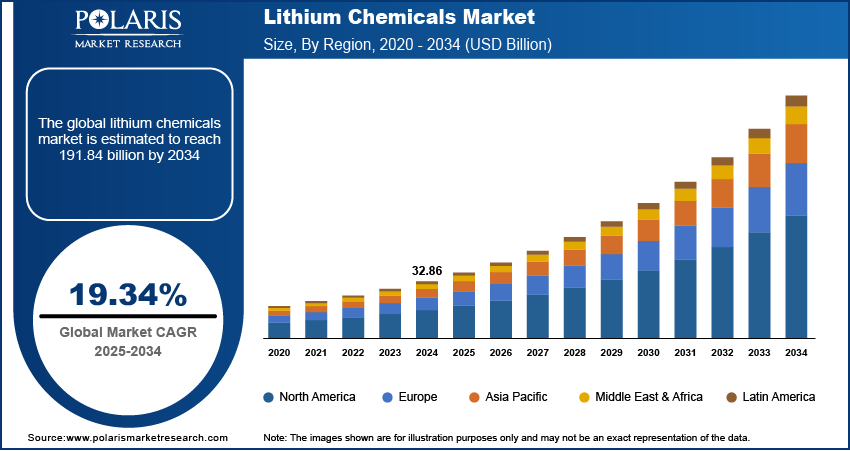

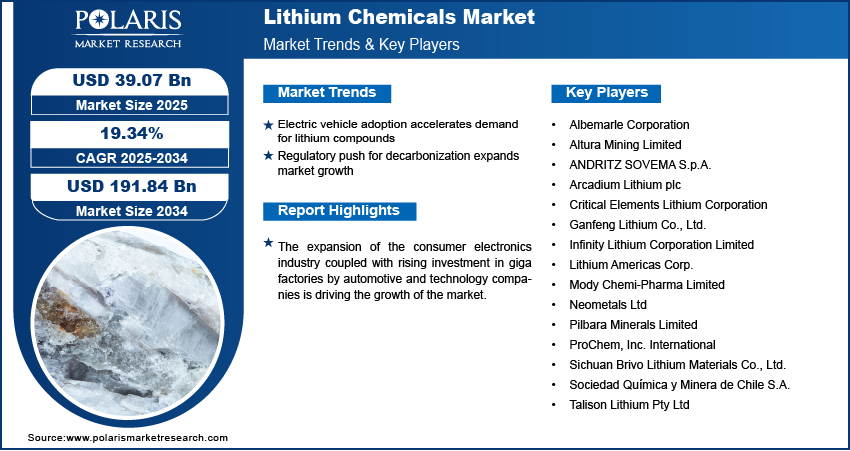

The global lithium chemicals market size was valued at USD 32.86 billion in 2024, growing at a CAGR of 19.34% from 2025–2034. Electric vehicle adoption coupled with regulatory push for decarbonization is propelling the market growth.

Key Insights

- The carbonate segment dominated the market share in 2024.

- The hydroxide segment is projected to grow at the fastest rate over the forecast period, fueled by the growing adoption of high-nickel cathode chemistries such as NCM 811 and NCA.

- The Asia Pacific lithium chemicals market dominated the global market share in 2024.

- China lithium chemicals market held the largest regional share of the Asia Pacific market in 2024, driven by the growing battery production across the country.

- The market in North America is projected to grow at the fastest CAGR during the forecast period, due to favorable policy frameworks and increasing electric vehicle adoption.

- The market in the US is expanding due to the expansion of grid-scale energy storage systems.

Industry Dynamics

- Rising electric vehicle adoption is driving demand for lithium carbonate and lithium hydroxide used in battery cell production.

- Regulatory measures promoting de-carbonization are supporting market growth through increased investment in clean mobility and energy storage.

- Emerging direct lithium extraction (DLE) technologies is creating market opportunities to improve yield and reduce environmental footprint.

- Limited availability of high-grade lithium reserves and delays in the mining project is restraining the market growth.

Market Statistics

- 2024 Market Size: USD 32.86 billion

- 2034 Projected Market Size: USD 191.84 billion

- CAGR (2025-2034): 19.34%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Lithium chemicals are essential compounds used extensively across energy storage, glass & ceramics, pharmaceuticals, and lubricants, with growing prominence in powering the global transition toward clean energy. These compounds, including lithium carbonate, lithium hydroxide, and lithium chloride, serve as foundational materials in the manufacture of high-performance lithium-ion battery, which are crucial for electric vehicles (EVs), consumer electronics, and large-scale energy storage systems.

The expansion of the consumer electronics industry is significantly contributing to the growth of the lithium chemicals market. Devices such as smartphones, laptops, tablets, and wearable electronics rely on compact, high-capacity lithium-ion batteries to deliver long-lasting power in a lightweight form factor. Global demand for connected devices is rapidly increasing across emerging markets, pushing manufacturers to focus on energy-dense battery solutions that incorporate lithium compounds such as lithium cobalt oxide and lithium iron phosphate.

Additionally, the rising investment in giga factories by automotive and technology companies to accelerate lithium battery production is further propelling the market growth. Leading firms such as Tesla, CATL, LG Energy Solution, and BYD are significantly expanding manufacturing footprints through large-scale battery facilities in North America, Europe, and Asia. For instance, in May 2025, the UK government committed USD 1.33 billion in funding for the development of a new EV battery gigafactory in Sunderland. The project, was led by Japanese battery manufacturer AESC, aimed to expand production capacity to support up to 100,000 electric vehicles annually. These gigafactories are designed to secure the supply of lithium-ion batteries for electric vehicles, energy storage systems, and other high-demand applications. Therefore, the demand for lithium chemicals in battery-grade lithium hydroxide and lithium carbonate is boosting the growth of the market.

Drivers & Opportunities

Electric Vehicle Adoption Accelerates Demand for Lithium Compounds: Rising adoption of electric vehicles across the globe is driving substantial growth in lithium chemical consumption. Lithium-ion batteries, which utilize compounds such as lithium carbonate and lithium hydroxide, are widely integrated in EV powertrains due to their high energy density and fast charging capabilities. Automotive OEMs across the US, China, and Europe are expanding EV production capacity to address growing consumer demand. According to data from the International Energy Agency, global electric car production reached 17.3 million units in 2024, marking a 25% increase compared to 2023. This growth was primarily driven by a surge in manufacturing activity in China, which accounted for 12.4 million units of the total output. This production expansion is boosting the requirement for lithium-based battery inputs across the value chain.

Regulatory Push for Decarbonization Expands Market Growth: Government-led initiatives aimed at curbing vehicle emissions are strengthening the growth of the lithium chemicals market. Countries are offering purchase incentives, tax rebates, and stricter regulatory frameworks to accelerate the shift from internal combustion engines to electric mobility. Regulatory frameworks such as the European Union’s “Fit for 55” and China’s New Energy Vehicle policy are increasing lithium deployment in EV batteries used in passenger cars, two-wheelers, and electric buses. Moreover, national renewable integration plans are further accelerating the demand for lithium-based storage technologies in utility-scale energy applications.

Segmental Insights

Product Analysis

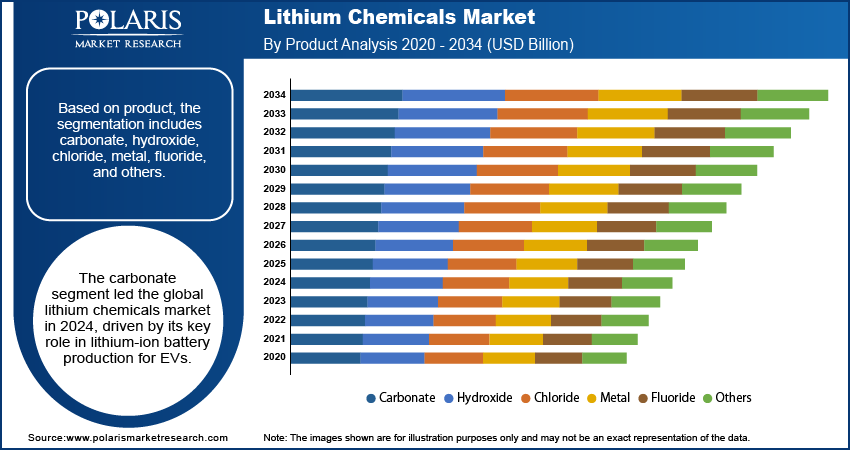

Based on product, the segmentation includes carbonate, hydroxide, chloride, metal, fluoride, and others. The carbonate segment accounted for the largest share of the global lithium chemicals market in 2024. This dominance is attributed to its extensive application in lithium-ion battery production, for consumer electronics and electric vehicles (EVs). Lithium carbonate serves as a crucial precursor for synthesizing lithium cathode materials such as lithium iron phosphate and lithium cobalt oxide.

The lithium hydroxide is projected to register the fastest growth rate over the forecast period. This surge in demand is fueled by the growing adoption of high-nickel cathode chemistries such as NCM 811 and NCA, which require lithium hydroxide for superior thermal stability and energy density. These battery technologies are increasingly preferred in high-performance EVs due to extended range and faster charging capabilities. Automotive OEMs and battery manufacturers are increasingly focusing on energy efficiency, driving a continued shift from lithium carbonate to lithium hydroxide.

Application Analysis

By application, the segmentation includes batteries, glass & ceramics, lubricant, polymers, metallurgy, medical, air treatment, and others. The batteries represented the largest contributor to the lithium chemicals market in 2024. Lithium-ion batteries are crucial in wide range of end uses, from electric vehicles and smartphones to grid-scale energy storage systems. Government initiatives promoting decarbonization and cleaner mobility are significantly increasing the demand for rechargeable batteries. Therefore, it is increasing the demand for battery-grade lithium chemicals such as lithium carbonate and lithium hydroxide.

The glass and ceramics segment is anticipated to grow at a rapid pace during the forecast period. Lithium compounds are used in glass formulations to reduce melting temperatures, improve thermal shock resistance, and enhance durability. The rapid expansion of the construction and electronics industries in developing countries is driving demand for lithium-infused glass and ceramics used in tiles, cooktops, and mobile devices. Furthermore, the automotive and aerospace sectors are adopting lithium-based glass for advanced windshield and display applications, thereby creating new growth avenues for this segment.

End User Analysis

Based on end user channel, the segmentation includes automotive, consumer electronics, energy storage, and others. The automotive sector is dominating the market share in 2024. The rapid penetration of electric vehicles, hybrid vehicles, and plug-in hybrids is significantly boosting the need for lithium-ion batteries. Automakers are increasingly partnering with lithium suppliers to secure long-term supply chains and meet zero-emission targets. This structural shift in vehicle manufacturing from internal combustion engines to electric powertrains is further propelling the market growth.

The energy storage segment is expected to experience the fastest growth during the forecast period. Grid-scale energy storage systems are deployed worldwide to stabilize renewable energy generation and support decentralized power distribution. These systems rely heavily on lithium-ion technology due to its high efficiency, long life cycle, and fast charge-discharge capabilities. Growing adoption of ambitious renewable energy targets across various countries is driving utilities and private operators to invest in battery storage projects, which is further boosting demand for lithium chemicals in stationary storage applications. For instance in 2023, the European Union adopted the revised Energy Performance of Buildings Directive, mandating zero-emission new buildings by 2030 and introducing MEPS and long-term renovation plans.

Regional Analysis

Asia Pacific lithium chemicals market dominated the global market in 2024, due to large-scale government initiatives and abundant raw material availability. Policies such as China’s “New Energy Vehicle” program and India’s Production-Linked Incentive (PLI) schemes accelerated battery manufacturing and electric vehicle adoption, resulting in a sharp rise in lithium chemical consumption. Additionally, Australia’s continued expansion in lithium mining, as the world’s top producer, is supporting downstream chemical conversion, enabling the region to maintain a steady supply of battery-grade lithium compounds for domestic and international use.

China Lithium Chemicals Market Insight

China held a dominating market share in the Asia Pacific lithium chemicals landscape in 2024, driven by the growing battery production across the country. Domestic manufacturers are expanding lithium-ion battery output to meet rising demand from electric vehicles, energy storage systems, and consumer electronics. According to the International Energy Agency global EV outlook 2023 report, approximately 95% of lithium iron phosphate (LFP) batteries used in electric light-duty vehicles were installed in vehicles manufactured in China, with BYD accounting for nearly 50% of that demand. This expansion is increasing the consumption of processed lithium compounds such as lithium carbonate and lithium hydroxide. Additionally, China’s control over the lithium value chain, from mining and chemical refining to cell manufacturing, is supporting a stable supply and reinforcing its position in the global market.

North America Lithium Chemicals Market

The market in North America is projected to grow at the fastest CAGR during the forecast period. This growth is due to favorable policy frameworks and increasing electric vehicle adoption. The US and Canada are witnessing a surge in battery production driven by federal subsidies and incentives introduced under the Inflation Reduction Act. Strategic emphasis on reducing import dependence is pushing lithium mining and chemical refining projects across the region. This shift toward domestic sourcing is facilitating the development of a secure and self-sufficient lithium supply chain.

The US Lithium Chemicals Market Overview

The market in the US is expanding due to the expansion of grid-scale energy storage systems. Utility providers are investing in lithium-based storage technologies to ensure the reliable integration of renewable energy sources. According to the US Energy Information Administration, utility-scale battery storage in the US is projected to reach record growth in 2025, with an expected addition of 18.2 GW to the grid. This follows the record set in 2024, when power providers installed 10.3 GW of new battery storage capacity. In addition, federal funding and regulatory support for domestic critical mineral projects accelerated lithium extraction and processing initiatives. The rising demand from electric vehicle manufacturers and energy storage operators is contributing to the steady growth of lithium chemical consumption across the US.

Europe Lithium Chemicals Market

The lithium chemicals landscape in Europe is projected to hold a substantial share in 2034. This is owing to the strict regulatory mandates and regional sustainability goals across the region. The implementation of the EU Battery Directive and carbon neutrality targets under the Green Deal is boosting investments in electric mobility and clean energy infrastructure. Also, in May 2022, the European Commission proposed raising the EU’s renewable energy target for 2030 to 45% under the REPowerEU Plan, which would require a total installed renewable capacity of 1,236 GW. Countries including Germany, France, and Sweden are expanding lithium-ion battery production facilities, leading to increased demand for sustainably sourced lithium chemicals. Additionally, the growing efforts to localize the battery supply chain and reduce environmental impact are further strengthening the regional market growth.

Key Players & Competitive Analysis Report

The lithium chemicals market is increasingly competitive, fueled by the global shift toward clean energy, electric mobility, and advanced energy storage systems. Leading players are aggressively expanding lithium extraction and processing capacities to meet soaring demand from electric vehicle (EV) manufacturers, battery producers, and energy storage companies. Investments are heavily concentrated in lithium refining technologies, resource exploration, and the development of high-purity compounds such as lithium hydroxide and lithium carbonate, which are essential for high-energy-density batteries. Also, companies are prioritizing vertically integrated supply chains, securing long-term raw material access through joint ventures and acquisitions, and enhancing operational efficiencies to ensure consistent quality and scale.

Major companies operating in the lithium chemicals industry include Albemarle Corporation, Altura Mining Limited, ANDRITZ SOVEMA S.p.A., Arcadium Lithium plc, Critical Elements Lithium Corporation, Ganfeng Lithium Co., Ltd., Infinity Lithium Corporation Limited, Lithium Americas Corp., Mody Chemi-Pharma Limited, Neometals Ltd, Pilbara Minerals Limited, ProChem, Inc. International, Sichuan Brivo Lithium Materials Co., Ltd., Sociedad Química y Minera de Chile S.A. (SQM S.A.), and Talison Lithium Pty Ltd.

Key Players

- Albemarle Corporation

- Altura Mining Limited

- ANDRITZ SOVEMA S.p.A.

- Arcadium Lithium plc

- Critical Elements Lithium Corporation

- Ganfeng Lithium Co., Ltd.

- Infinity Lithium Corporation Limited

- Lithium Americas Corp.

- Mody Chemi-Pharma Limited

- Neometals Ltd

- Pilbara Minerals Limited

- ProChem, Inc. International

- Sichuan Brivo Lithium Materials Co., Ltd.

- Sociedad Química y Minera de Chile S.A. (SQM S.A.)

- Talison Lithium Pty Ltd

Industry Developments

- March 2025: Rio Tinto acquired Arcadium Lithium in a deal valued at USD 6.7 billion, incorporating Arcadium's key lithium assets such as the Rincon project into its operational portfolio. This acquisition strengthens Rio Tinto’s presence in the lithium sector, aligning with rising global demand for battery-grade materials.

- December 2024: Lithium Americas Corp. entered into a strategic joint venture with General Motors for the Thacker Pass lithium project located in Nevada. As part of the agreement, GM committed USD 625 million for a 38% equity stake in the project, which also secured a USD 2.26 billion loan from the U.S. government. Once operational, the mine is projected to yield 40,000 metric tons of lithium carbonate annually.

Lithium Chemicals Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Carbonate

- Hydroxide

- Chloride

- Metal

- Fluoride

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Batteries

- Glass & Ceramics

- Lubricant

- Polymers

- Metallurgy

- Medical

- Air Treatment

- Others

By End-User Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Consumer Electronics

- Energy Storage

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Lithium Chemicals Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 32.86 Billion |

|

Market Size in 2025 |

USD 39.07 Billion |

|

Revenue Forecast by 2034 |

USD 191.84 Billion |

|

CAGR |

19.34% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive 004Candscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 32.86 billion in 2024 and is projected to grow to USD 191.84 billion by 2034.

The global market is projected to register a CAGR of 19.34% during the forecast period.

Asia Pacific dominated the market in 2024, due to large-scale government initiatives and abundant raw material availability.

A few of the key players in the market are Albemarle Corporation, Altura Mining Limited, ANDRITZ SOVEMA S.p.A., Arcadium Lithium plc, Critical Elements Lithium Corporation, Ganfeng Lithium Co., Ltd., Infinity Lithium Corporation Limited, Lithium Americas Corp., Mody Chemi-Pharma Limited, Neometals Ltd, Pilbara Minerals Limited, ProChem, Inc. International, Sichuan Brivo Lithium Materials Co., Ltd., Sociedad Química y Minera de Chile S.A. (SQM S.A.), and Talison Lithium Pty Ltd.

The carbonate segment dominated the market in 2024, attributed to its extensive application in lithium-ion battery production, for consumer electronics and electric vehicles (EVs).

The glass and ceramics segment is projected to grow rapidly, driven by rising demand from construction, electronics, and advanced automotive display applications.