Ammonium Nitrate Market Size, Share, Trends, Industry Analysis By Product (High Density, Low Density), By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM6114

- Base Year: 2024

- Historical Data: 2020-2023

Overview

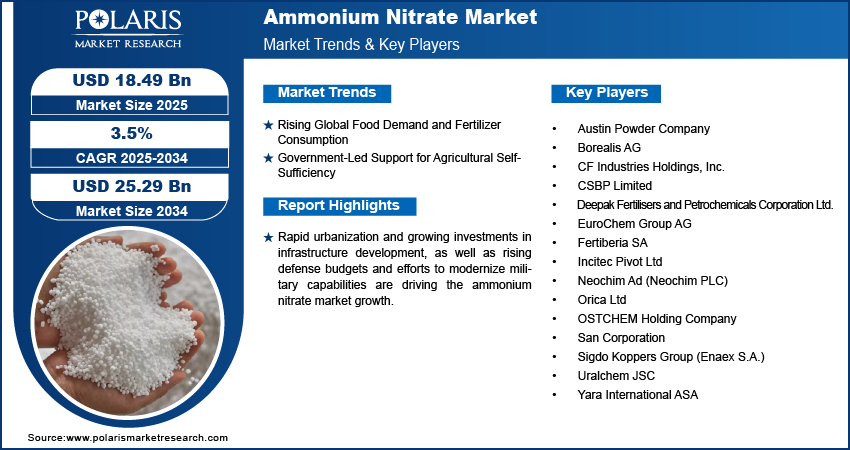

The global ammonium nitrate market size was valued at USD 17.94 billion in 2024, growing at a CAGR of 3.5% from 2025 to 2034. The key drivers of the global ammonium nitrate market include rising demand for high‑efficiency nitrogen fertilizers in agriculture to boost food production, expanding usage in mining and construction for industrial explosives and blasting, and technological innovations improving safety, controlled‑release formulations, and production efficiency

Key Insights

- The high-density segment dominated the market in 2024, owing to its widespread use in explosives manufacturing and civil engineering applications.

- The low-density segment is projected to register a higher CAGR during the forecast period, driven by its increasing use in precision farming and high-efficiency crop production.

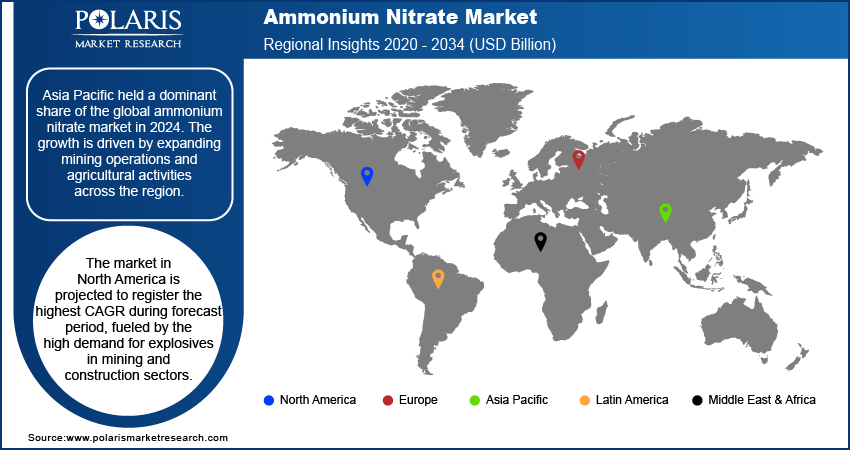

- The Asia Pacific ammonium nitrate market dominated the global market in 2024. The growth is driven by expanding mining operations and agricultural activities across the region.

- The China ammonium nitrate market held the largest regional share of the Asia Pacific market in 2024, attributed to rapid industrialization and growing investments in infrastructure development.

- The market in North America is projected to register the highest CAGR during the forecast period, fueled by the high demand for explosives in the mining and construction sectors.

- The market in the U.S. is expanding due to the presence of major defense contractors and federally funded military programs.

Industry Dynamics

- Rising global food demand and increasing fertilizer consumption are driving the need for efficient nitrogen-based fertilizers such as ammonium nitrate, particularly in regions facing agricultural productivity challenges.

- Government-led support for agricultural self-sufficiency is pushing local production and distribution of ammonium nitrate, backed by subsidies, favorable policies, and public-private partnerships aimed at enhancing food security and rural development.

- Green ammonia integration is emerging as a key opportunity for reducing the environmental footprint of ammonium nitrate production, with several pilot projects exploring the use of renewable hydrogen and electrolysis technologies.

Market Statistics

- 2024 Market Size: USD 17.94 billion

- 2034 Projected Market Size: USD 25.29 billion

- CAGR (2025-2034): 3.5%

- Asia Pacific: Largest market in 2024

.png)

Ammonium nitrate is a nitrogen-rich chemical compound widely used as a key ingredient in fertilizers and industrial explosives. It is crucial in agriculture to improve crop yields through efficient nitrogen delivery. It is also used extensively in mining, quarrying, and civil construction for blasting operations. The strong oxidizing properties of ammonium nitrate, combined with its cost-effectiveness and ease of storage, support its widespread adoption across the farming and industrial sectors. The compound’s versatility and high reactivity under controlled conditions make it a crucial component in global food production and infrastructure development.

Rapid urbanization and growing investments in infrastructure development are increasing the demand for explosives used in construction and civil engineering projects. According to a United Nations report, urban areas are projected to gain an additional 2.5 billion people by 2050, reflecting the ongoing global transition from rural to urban living. Ammonium nitrate is a primary ingredient in blasting agents required for large-scale activities such as tunneling, highway construction, and quarrying. Increasing investments in transportation networks, energy infrastructure, and industrial zones across emerging and developed markets are driving the demand for controlled blasting operations. This trend is supporting the consumption of ammonium nitrate in commercial-grade explosives.

Rising defense budgets and efforts to modernize military capabilities are contributing to increased demand for ammonium nitrate in energetic material production. According to the Stockholm International Peace Research Institute, global military spending rose to USD 2,718 billion in 2024, marking a 9.4% increase in real terms from 2023, representing the sharpest annual rise since the end of the Cold War. It serves as a key component in the formulation of explosives used in ammunition, training devices, and demolition systems. Several countries are expanding their stockpiles and upgrading defense technologies, which includes the procurement of raw materials for weapons manufacturing. The demand from the defense sector, although regulated, continues to provide a stable growth avenue for ammonium nitrate in security-sensitive applications.

Drivers & Opportunities

Rising Global Food Demand and Fertilizer Consumption: The growing global population and increasing pressure on agricultural systems are contributing to the rising demand for high-efficiency fertilizers. According to the United Nations, the global population is expected to keep rising over the next 50 to 60 years, reaching a peak of around 10.3 billion by the mid-2080s. Ammonium nitrate, known for its high nitrogen content and rapid nutrient release, remains a widely used component in commercial and subsistence farming. The need to improve crop yields and maintain soil fertility is accelerating the adoption of nitrogen-based fertilizers, particularly in developing countries facing food security challenges. Intensive cultivation of agricultural land is driving higher usage of ammonium nitrate across multiple crop segments, including cereals, oilseeds, and vegetables.

Government-Led Support for Agricultural Self-Sufficiency: Public sector initiatives focused on improving rural livelihoods and agricultural productivity are enhancing the adoption of ammonium nitrate in fertilizer programs. Several emerging economies, including India, Brazil, and parts of Southeast Asia, are implementing fertilizer subsidy schemes, farm input support systems, and infrastructure development projects aimed at achieving self-sufficiency in food production. For instance, the Indian government introduced the Nutrient Based Subsidy (NBS) scheme for Phosphatic and Potassic (P&K) fertilizers, including Di-Ammonium Phosphate (DAP). Under this initiative, a predetermined subsidy amount is allocated annually or bi-annually based on the nutrient composition of the fertilizer to ensure affordable access for farmers and promote balanced fertilizer usage. These policies are increasing the accessibility and affordability of nitrogen-rich fertilizers, positioning ammonium nitrate as a key input in government-backed agricultural development efforts.

Segmental Insights

Product Analysis

Based on product, the market is segmented into high density and low density. The high-density segment dominated the market in 2024, owing to its widespread use in explosives manufacturing and civil engineering applications. Its uniform granule structure and high oxygen content enable efficient detonation performance in mining and quarrying operations. Also, the segment benefits from growing demand in commercial blasting systems, where controlled energy release and handling safety are essential.

The low-density segment is projected to register the highest CAGR during the forecast period, driven by increasing adoption in agricultural-grade fertilizers. Its porous structure enhances nutrient absorption and soil permeability, making it suitable for high-efficiency crop production. Rising emphasis on precision farming and the need for improved nitrogen delivery in low-moisture soils are further supporting segment growth across emerging economies.

Application Analysis

By application, the market is categorized into fertilizers, explosives, and others. The fertilizers segment accounted for the largest market share in 2024, driven by the growing need to improve soil fertility and agricultural productivity. Ammonium nitrate is widely used as a nitrogen-rich fertilizer in row crops, fruits, and vegetables due to its rapid nutrient availability and ease of blending with other fertilizers. Agricultural economies across Asia Pacific, Latin America, and Eastern Europe continue to expand the usage of nitrogen-based fertilizers to meet rising food security needs.

The explosives segment is expected to register the highest growth rate over the forecast period. Ammonium nitrate is a key component in ANFO (Ammonium Nitrate Fuel Oil), which is commonly used in mining and construction blasting activities. The demand for energy-efficient and cost-effective blasting agents is increasing across the mining sector, in mineral-rich regions such as Australia, China, and South Africa. These trends are accelerating the consumption of ammonium nitrate in industrial-grade explosive formulations.

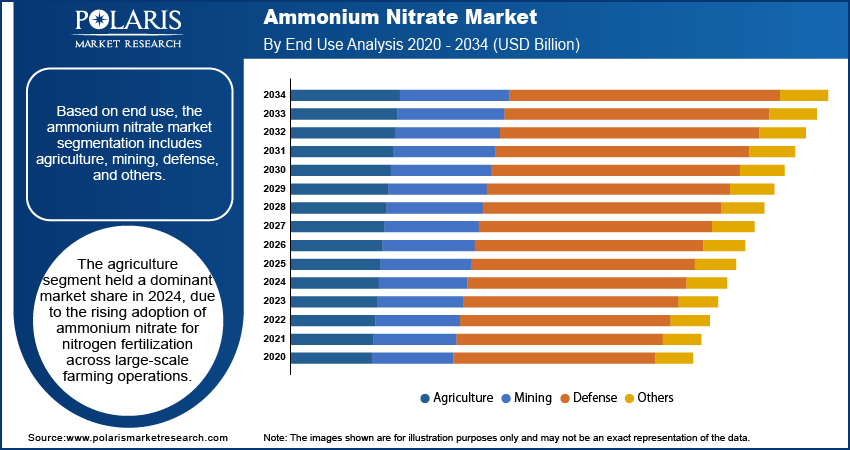

End Use Analysis

In terms of end use, the segmentation includes agriculture, mining, defense, and others. The agriculture segment dominated the market in 2024, due to the rising adoption of ammonium nitrate for nitrogen fertilization across large-scale farming operations. Its rapid solubility and high nitrogen content contribute to higher crop yields and shorter application cycles, which are essential in intensive farming systems. National programs supporting fertilizer subsidies and mechanized farming in countries such as India and Brazil are further driving product demand.

The defense segment is projected to record the highest CAGR during the forecast period, due to the increasing demand for military-grade explosives and propellants. Ammonium nitrate is used in the formulation of composite explosives for defense applications, including demolitions and ammunition. Geopolitical tensions and rising defense budgets across various regions are contributing to higher procurement of raw materials for ammunition and weapons systems, thereby supporting growth in this segment.

Regional Analysis

The Asia Pacific ammonium nitrate market dominated the global market in 2024. The growth is driven by expanding mining operations and agricultural activities across the region. Coal and metal mining remain crucial sectors in countries such as China, India, and Indonesia, creating consistent demand for industrial-grade ammonium nitrate used in blasting operations. Additionally, national policies aimed at achieving agricultural self-sufficiency are pushing the domestic production and application of ammonium nitrate fertilizers. Large-scale farming initiatives and subsidy-driven fertilizer distribution programs continue to support the use of nitrogen-rich compounds in enhancing crop yield and food security.

China Ammonium Nitrate Market Insights

China dominated the Asia Pacific ammonium nitrate market in 2024, attributed to rapid industrialization and growing investments in infrastructure development. In 2024, China’s Belt and Road Initiative (BRI) recorded its highest annual engagement, with ~USD 70.7 billion in construction contracts and around USD 51 billion in investments. Additionally, infrastructure projects, including highways, tunnels, and urban redevelopment, are contributing to steady consumption of explosives-grade ammonium nitrate in civil engineering applications.

North America Ammonium Nitrate Market Trends

The market in North America is projected to register the highest CAGR during the forecast period, fueled by the high demand for explosives in the mining and construction sectors. The U.S. and Canada are major contributors to mineral extraction activities, in copper, gold, and shale reserves, where ammonium nitrate is used in bulk explosives for rock fragmentation. In addition, the region benefits from mechanized agriculture practices that rely on nitrogen-based fertilizers to maintain soil productivity across large crop areas. These factors are contributing to sustained product demand in the agricultural and industrial sectors.

U.S. Ammonium Nitrate Market Overview

The market in the U.S. is expanding due to the presence of major defense contractors and federally funded military programs. These entities are actively supporting the use of energetic materials in various applications, including explosive devices, ordinance manufacturing, and training exercises. In 2025, the U.S. Department of Defense allocated over USD 3.9 billion in its 2025–2026 budget toward hypersonic weapons, including the restart of production for the Air Force's Air-Launched Rapid Response Weapon (ARRW), marking a renewed push in advanced defense capabilities. In addition, sustained investments in national defense and homeland security further accelerate the demand for high-quality ammonium nitrate in specialized formulations designed for controlled detonation and performance consistency.

Europe Ammonium Nitrate Market Outlook

The ammonium nitrate landscape in Europe is projected to hold a substantial share by 2034, owing to the rising focus on the development and use of environmentally compliant ammonium nitrate products. Regulatory frameworks emphasizing safety, emissions control, and nitrate leaching prevention are pushing manufacturers to develop controlled-release and stabilized fertilizer variants. Countries such as Germany, France, and the UK are adopting advanced agricultural practices that prioritize nutrient efficiency and crop-specific nitrogen application. The rising focus on sustainable agriculture and precision farming across the region is driving the adoption of high-efficiency nitrogen fertilizers, propelling the region as a key market for innovation in ammonium nitrate formulations.

Key Players and Competitive Analysis

The ammonium nitrate market is moderately competitive, with leading manufacturers focusing on ensuring high product purity, consistent performance, and compliance with safety and environmental regulations. The compound is primarily used in two major sectors, agriculture and mining, where manufacturers are developing specialized formulations to meet the needs of fertilizer-grade and industrial-grade applications. Also, the companies are enhancing supply chain networks and storage technologies to ensure safe handling and timely delivery, in regions with high seasonal demand. Strategic initiatives among key players include expanding production capacities, securing stable raw material supplies, and improving logistics infrastructure to manage the compound’s storage sensitivity and regulatory handling requirements.

A few prominent companies operating in the ammonium nitrate market include Austin Powder Company; Borealis AG; CF Industries Holdings, Inc.; CSBP Limited; Deepak Fertilisers and Petrochemicals Corporation Limited; EuroChem Group AG; Fertiberia SA; Incitec Pivot Ltd; Neochim Ad (Neochim PLC); Orica Ltd; OSTCHEM Holding Company; San Corporation; Sigdo Koppers Group (Enaex S.A.), Uralchem JSC; and Yara International ASA.

Key Players

- Austin Powder Company

- Borealis AG

- CF Industries Holdings, Inc.

- CSBP Limited

- Deepak Fertilisers and Petrochemicals Corporation Limited

- EuroChem Group AG

- Fertiberia SA

- Incitec Pivot Ltd

- Neochim Ad (Neochim PLC)

- Orica Ltd

- OSTCHEM Holding Company

- San Corporation

- Sigdo Koppers Group (Enaex S.A.)

- Uralchem JSC

- Yara International ASA

Ammonium Nitrate Industry Developments

- January 2024: Incitec Pivot Limited’s subsidiary Dyno Nobel announced a partnership with Saudi Chemical Company Limited (SCCL) to explore the development and operation of a technical ammonium nitrate (TAN) production facility in Saudi Arabia. As part of the collaboration, Dyno Nobel will contribute to project services and lead the Front-End Engineering Design (FEED) phase for a planned 300,000 MTPA TAN plant in Ras Al-Khair.

- January 2024: Ostchem Holding reported a 20% year-on-year increase in its total mineral fertilizer production, reaching 2.1 million tons in 2023. This growth included a 60% rise in ammonium nitrate output, with production climbing to 835,900 tons, underscoring the company’s strengthened capacity in the nitrogen fertilizer segment.

Ammonium Nitrate Market Segmentation

By Product Outlook (Volume, Kilotons; Revenue, USD Billion; 2020–2034)

- High Density

- Low Density

By Application Outlook (Volume, Kilotons; Revenue, USD Billion; 2020–2034)

- Fertilizers

- Explosives

- Others

By End Use Outlook (Volume, Kilotons; Revenue, USD Billion; 2020–2034)

- Agriculture

- Mining

- Defense

- Others

By Regional Outlook (Volume, Kilotons; Revenue, USD Billion; 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Ammonium Nitrate Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 17.94 Billion |

|

Market Size in 2025 |

USD 18.49 Billion |

|

Revenue Forecast by 2034 |

USD 25.29 Billion |

|

CAGR |

3.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 17.94 billion in 2024 and is projected to grow to USD 25.29 billion by 2034.

The global market is projected to register a CAGR of 3.5% during the forecast period.

Asia Pacific dominated the market in 2024, driven by expanding mining operations and agricultural activities across the region.

A few of the key players in the market are Austin Powder Company; Borealis AG; CF Industries Holdings, Inc.; CSBP Limited, Deepak Fertilisers and Petrochemicals Corporation Limited; EuroChem Group AG; Fertiberia SA; Incitec Pivot Ltd; Neochim Ad (Neochim PLC); Orica Ltd; OSTCHEM Holding Company; San Corporation; Sigdo Koppers Group (Enaex S.A.), Uralchem JSC, and Yara International ASA.

The fertilizers segment dominated the market in 2024, supported by the growing need to improve soil fertility and agricultural productivity.

The low-density segment is expected to witness the fastest growth rate during the forecast period, supported by rising usage in precision agriculture and improved nutrient delivery for crops.