2-Methylpiperazine Market Size, Share, Trends, Industry Analysis By Grade (Pharmaceutical Grade, Industrial Grade, Others), By End-User Industry (Pharmaceutical Industry, Chemical Industry), By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 125

- Format: PDF

- Report ID: PM6113

- Base Year: 2024

- Historical Data: 2020-2023

Overview

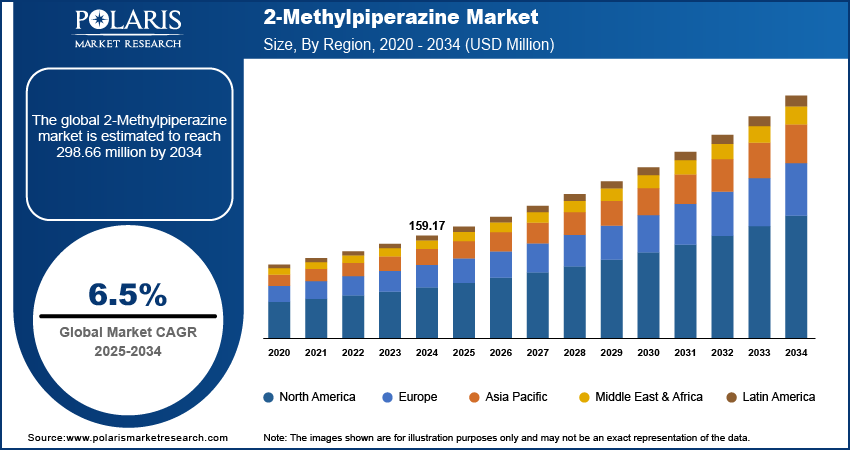

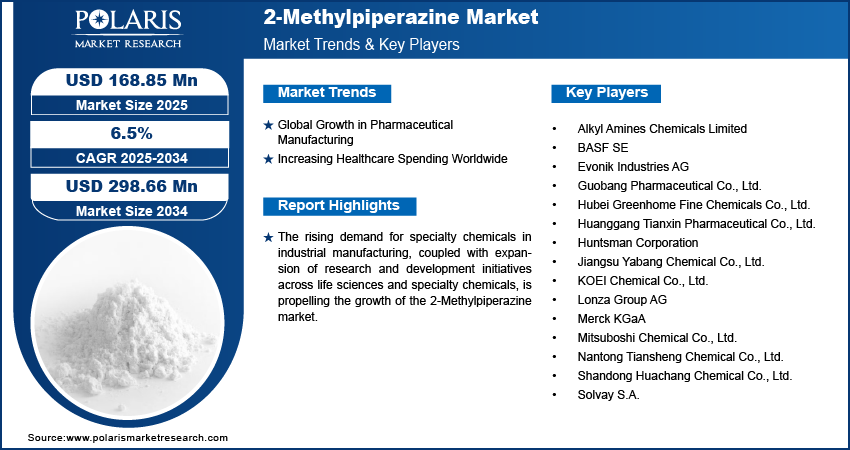

The global 2-Methylpiperazine market size was valued at USD 159.17 million in 2024, growing at a CAGR of 6.5% from 2025 to 2034. The 2-Methylpiperazine market is driven by its rising demand in pharmaceutical intermediates, especially for cancer and CNS drugs. Growth is further fueled by expanding chemical manufacturing, increased R&D investments, and the compound’s versatility in producing specialty and fine chemicals.

Key Insights

- The pharmaceutical grade segment dominated the market share in 2024.

- The industrial grade segment is projected to register the highest growth rate over the forecast period, driven by its increasing use in chemical processing, corrosion inhibitors, and material synthesis across various industrial operations.

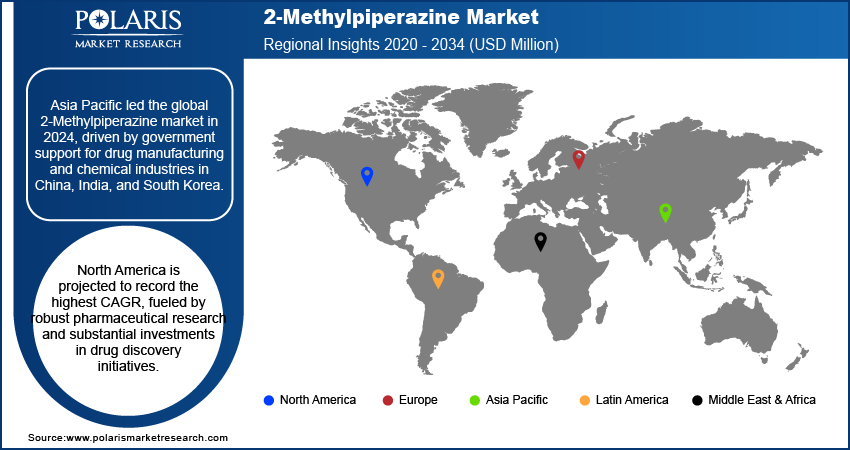

- Asia Pacific dominated the global 2-Methylpiperazine market share in 2024.

- India held the largest share in the Asia Pacific market in 2024, attributed to the rapid expansion of pharmaceutical manufacturing hubs and increasing domestic production of specialty intermediates.

- The market in North America is projected to register the highest CAGR during the forecast period, driven by strong pharmaceutical research activities and high investments in drug discovery programs.

- The market in the U.S. is growing due to the expansion of biotechnology and contract manufacturing organizations that require high-purity synthesis materials to support pharmaceutical and diagnostic innovation.

Industry Dynamics

- Global growth in pharmaceutical manufacturing is fueling demand for 2-Methylpiperazine as a key intermediate in active pharmaceutical ingredient (API) synthesis, in oncology, anti-infective, and CNS drug formulations.

- Increasing healthcare spending worldwide is pushing pharmaceutical companies to expand production capabilities, thereby boosting the consumption of specialty chemicals such as 2-Methylpiperazine across regulated and emerging markets.

- Automation and process optimization are emerging as key opportunity, with the adoption of AI-driven technologies to improve operational efficiency, reduce batch failures, and enhance production yields for high-purity 2-Methylpiperazine.

Market Statistics

- 2024 Market Size: USD 159.17 million

- 2034 Projected Market Size: USD 298.66 million

- CAGR (2025-2034): 6.5%

- Asia Pacific: Largest market in 2024

2-Methylpiperazine is a key intermediate used in the synthesis of active pharmaceutical ingredients, corrosion inhibitors, and specialty chemicals. It is widely utilized in the manufacturing of antihistamines, antipsychotic drugs, and other therapeutic agents due to its nitrogen-rich molecular structure and stable reactivity. The rising focus on cost-effective drug production and chemical synthesis efficiency is contributing to the increasing consumption of 2-Methylpiperazine across the pharmaceutical sector.

The rising demand for specialty chemicals in industrial manufacturing is driving the demand for niche compounds such as 2-Methylpiperazine. Industries are focusing on high-performance, application-specific materials that offer enhanced functional outcomes and better efficiency in end-use processes. According to India Brand Equity Foundation report, the chemicals and petrochemicals sector in India is estimated to receive USD 107.38 billion in investment by the end of 2025 and is projected to reach USD 1 trillion by 2040. The country’s share is projected to reach USD 64 billion by 2025, growing at a CAGR of 12%, with specialty chemicals accounting for 20% of the global USD 4 trillion market. This growth in investment is increasing the demand for intermediates and reagents that serve specialized synthesis requirements in various sectors, including coatings, polymers, and process chemicals.

The expansion of research and development initiatives across life sciences and specialty chemicals propel the growth of the 2-Methylpiperazine market. Governments and private organizations are investing in drug development, biotechnological innovation, and advanced material science to address evolving healthcare and industrial challenges. This is increasing the use of intermediate compounds that enable precise molecular synthesis and improved reaction control. The adaptability of 2-Methylpiperazine in pharmaceutical and chemical research pipelines is contributing to its rising demand in global R&D frameworks.

Drivers & Opportunities

Global Growth in Pharmaceutical Manufacturing: The surge in expansion of pharmaceutical manufacturing across the world is increasing the demand for intermediate chemicals such as 2-Methylpiperazine. Countries in Asia Pacific and Latin America are witnessing strong growth in contract manufacturing and formulation development, fueled by cost advantages and skilled labor availability. In addition, pharmaceutical companies are increasing production capacity to meet rising demand for therapeutic drugs across chronic and infectious disease segments. For instance, in September 2024, SK pharmteco invested USD 260 million to construct a five‑story, 135,800 ft² small‑molecule and peptide production facility in Sejong, South Korea. The site was designed with eight production trains capable of delivering tens of metric tons annually, alongside dedicated peptide R&D labs, CGMP kilo‑labs, and pilot plant infrastructure. This is accelerating the steady consumption of synthesis compounds used in active pharmaceutical ingredient (API) development. 2-Methylpiperazine is integrated into various production processes due to its stable chemical properties and compatibility with multiple drug formulations.

Increasing Healthcare Spending Worldwide: Rising healthcare expenditure across developed and developing economies is creating a favorable environment for the growth of intermediate chemical markets. Public and private sectors are investing in infrastructure development, diagnostics, and novel drug pipelines to improve healthcare outcomes. According to the American Medical Association, the U.S. health spending rose by 7.5% in 2023 to USD 4.9 trillion, up from a 4.6% increase in 2022. These investments are increasing the demand for reliable chemical inputs that enable efficient and scalable production of pharmaceutical compounds. 2-Methylpiperazine is used in the synthesis of several therapeutic agents, making it a valuable input for manufacturers seeking a consistent supply of quality raw materials. Therefore, the growth of healthcare systems is boosting the need for high-purity intermediates, thus fueling the market growth.

Segmental Insights

Grade Analysis

Based on grade, the segmentation includes pharmaceutical grade, industrial grade, and others. The pharmaceutical grade segment dominated the 2-Methylpiperazine market in 2024. This is due to its high purity standards and suitability for use in the synthesis of active pharmaceutical ingredients and therapeutic formulations. Pharmaceutical manufacturers prefer high-grade intermediates that ensure consistent quality and compliance with regulatory standards across global markets.

The industrial grade segment is projected to register the highest CAGR during the forecast period. This growth is driven by its increasing use in chemical processing, corrosion inhibitors, and material synthesis across various industrial operations. The demand for cost-effective and functionally stable intermediates is contributing to the growth of industrial-grade 2-Methylpiperazine in non-pharma applications.

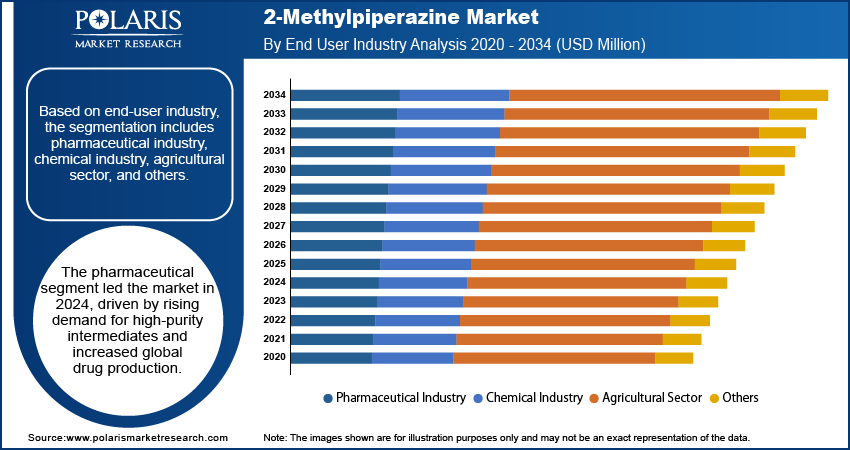

End-User Industry Analysis

By end-user industry, the segmentation includes the pharmaceutical industry, chemical industry, agricultural sector, and others. The pharmaceutical industry held the largest share of the 2-Methylpiperazine market in 2024. This is due to strong demand for high-purity intermediates used in API manufacturing, as well as increasing drug production across global facilities. The rising focus on process efficiency and quality compliance is further supporting the integration of 2-Methylpiperazine in pharma production lines.

The chemical industry is projected to register the fastest growth over the forecast period, driven by the rising use of functional intermediates in specialty chemical manufacturing and formulation development. The compound’s utility in the synthesis of custom reagents, corrosion inhibitors, and advanced materials is driving adoption in chemical production environments.

Regional Analysis

Asia Pacific dominated the global 2-Methylpiperazine market in 2024. This growth is driven by government initiatives supporting domestic drug manufacturing and chemical processing industries across countries such as China, India, and South Korea. Regulatory frameworks and production-linked incentives are pushing pharmaceutical companies to increase local production, which is generating consistent demand for intermediate compounds, including 2-Methylpiperazine. Additionally, the rising population across the region is contributing to an increase in agricultural activity, which is creating additional demand for agrochemicals and crop protection solutions. This is further supporting the use of 2-Methylpiperazine in the formulation of herbicides and fungicides designed for high-yield farming practices.

India 2-Methylpiperazine Market Insights

India dominated the Asia Pacific 2-Methylpiperazine market in 2024, driven by its strong pharmaceutical and agrochemical industries, which are major consumers of the compound as a key intermediate. The country benefits from a well-established chemical manufacturing ecosystem, low production costs, and growing domestic demand for generics and pesticides. Additionally, India’s expanding export capabilities and government support for the chemical sector have strengthened its position in the regional market. With local manufacturers increasing production capacity and leveraging cost advantages, India has emerged as a central hub for 2-Methylpiperazine in the Asia Pacific region. These factors collectively contributed to India’s leadership in the market, both in terms of volume and value.

North America 2-Methylpiperazine Market Analysis

The market in North America is projected to register the highest CAGR during the forecast period, driven by strong pharmaceutical research activities and high investments in drug discovery programs. Manufacturers across the region are focused on the development of next-generation therapeutics, which is increasing the need for reliable and well-characterized chemical intermediates. Also, the well-established agrochemical industry in the region is contributing to market growth. Chemical synthesis are crucial for the production of selective pesticides and herbicides. These formulations rely on compounds such as 2-Methylpiperazine for stability and performance under varied climatic conditions.

U.S. 2-Methylpiperazine Market Overview

The market in the U.S. is growing due to the expansion of biotechnology and contract manufacturing organizations that require high-purity synthesis materials to support pharmaceutical and diagnostic innovation. In April 2025, the U.S. Congress announced an investment of USD 15 billion over five years to boost domestic biotechnology competitiveness by boosting private investments and reducing regulatory obstacles. The funding includes over USD 1 billion channeled through the Department of Defense for biotech applications relevant to national security such as rapid‑response biologics, bio‑based materials, and resilient manufacturing systems. Additionally, increased federal and private investments in life sciences are supporting the development of robust supply chains for specialty chemical intermediates used in drug and material synthesis.

Europe 2-Methylpiperazine Market Assessment

The 2-Methylpiperazine landscape in Europe is projected to hold a substantial share in 2034. This is owing to the strong emphasis on sustainable and high-performance chemical production. Regulatory standards set by the European Medicines Agency and other regional bodies are promoting the adoption of intermediates that meet stringent quality, safety, and environmental benchmarks. The Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation, governed by the European Commission, regulates the safe use, production, and import of chemical substances. Manufacturers are focusing on fine chemical innovation to meet with these evolving standards, thus fueling the market growth.

Key Players and Competitive Analysis

The 2-Methylpiperazine market is moderately competitive, with key players focusing on the production of high-purity, pharmaceutical-grade intermediates to meet the rising demand from drug manufacturers and agrochemical companies. Companies are actively investing in advanced manufacturing technologies and process optimization to ensure consistency, scalability, and regulatory compliance across global markets. Also, the key players are improving supply chain efficiency to meet stringent quality standards required by the pharmaceutical and specialty chemical industries. Strategic initiatives among market participants include expanding production capacities, strengthening regional distribution networks, and forming long-term supply agreements with end-use industries.

A few prominent companies operating in the 2-Methylpiperazine market include Alkyl Amines Chemicals Limited; BASF SE; Evonik Industries AG; Guobang Pharmaceutical Co., Ltd.; Hubei Greenhome Fine Chemicals Co., Ltd.; Huanggang Tianxin Pharmaceutical Co., Ltd.; Huntsman Corporation; Jiangsu Yabang Chemical Co., Ltd.; KOEI Chemical Co., Ltd.; Lonza Group AG; Merck KGaA; Mitsuboshi Chemical Co., Ltd.; Nantong Tiansheng Chemical Co., Ltd.; Shandong Huachang Chemical Co., Ltd.; and Solvay S.A.

Key Players

- Alkyl Amines Chemicals Limited

- BASF SE

- Evonik Industries AG

- Guobang Pharmaceutical Co., Ltd.

- Hubei Greenhome Fine Chemicals Co., Ltd.

- Huanggang Tianxin Pharmaceutical Co., Ltd.

- Huntsman Corporation

- Jiangsu Yabang Chemical Co., Ltd.

- KOEI Chemical Co., Ltd.

- Lonza Group AG

- Merck KGaA

- Mitsuboshi Chemical Co., Ltd.

- Nantong Tiansheng Chemical Co., Ltd.

- Shandong Huachang Chemical Co., Ltd.

- Solvay S.A.

2-Methylpiperazine Industry Developments

February 2025: BASF announced an investment in a new alcoholates plant in Ludwigshafen to produce sodium and potassium methylate. The company stated that the startup of the plant is expected in the second half of 2027 and will reinforce its supply capabilities for methylating agents linked to piperazine chemistry.

2-Methylpiperazine Market Segmentation

By Grade Outlook (Revenue, USD Million, 2020–2034)

- Pharmaceutical Grade

- Industrial Grade

- Others

By End-User Industry Outlook (Revenue, USD Million, 2020–2034)

- Pharmaceutical Industry

- Chemical Industry

- Agricultural Sector

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

2-Methylpiperazine Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 159.17 Million |

|

Market Size in 2025 |

USD 168.85 Million |

|

Revenue Forecast by 2034 |

USD 298.66 Million |

|

CAGR |

6.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 159.17 million in 2024 and is projected to grow to USD 298.66 million by 2034.

The global market is projected to register a CAGR of 6.5% during the forecast period.

Asia Pacific dominated the market in 2024, driven by government initiatives supporting domestic drug manufacturing and chemical processing industries across countries such as China, India, and South Korea.

A few of the key players in the market are Alkyl Amines Chemicals Limited; BASF SE; Evonik Industries AG; Guobang Pharmaceutical Co., Ltd.; Hubei Greenhome Fine Chemicals Co., Ltd.; Huanggang Tianxin Pharmaceutical Co., Ltd.; Huntsman Corporation; Jiangsu Yabang Chemical Co., Ltd.; KOEI Chemical Co., Ltd.; Lonza Group AG; Merck KGaA; Mitsuboshi Chemical Co., Ltd.; Nantong Tiansheng Chemical Co., Ltd.; Shandong Huachang Chemical Co., Ltd.; and Solvay S.A.

The pharmaceutical grade segment dominated the market in 2024, due to its high purity standards and suitability for use in the synthesis of active pharmaceutical ingredients and therapeutic formulations.

The chemical segment is expected to witness the fastest growth during the forecast period, driven by the rising use of functional intermediates in specialty chemical manufacturing and formulation development.