QR Code Payment Market Size, Share, Trends, & Industry Analysis Report

By Offering, By Payment Type, By Transaction Channel (Face-to-face and Remote), By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM6068

- Base Year: 2024

- Historical Data: 2020-2023

Overview

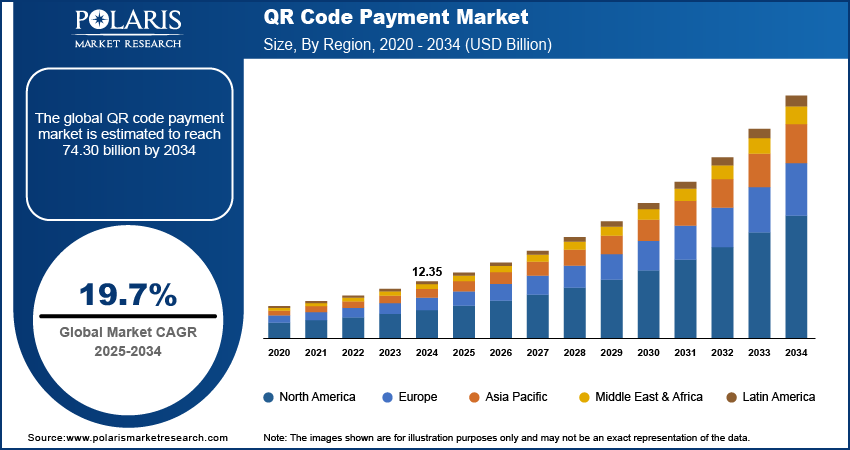

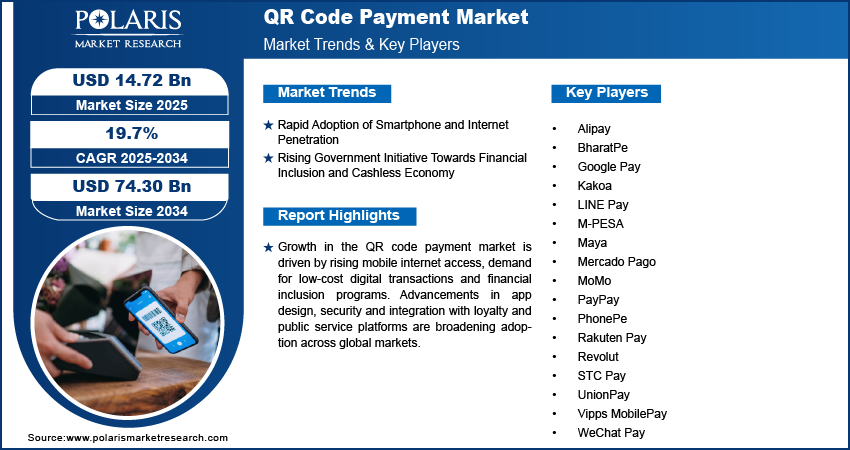

The global QR code payment market size was valued at USD 12.35 billion in 2024, growing at a CAGR of 19.7% from 2025–2034. Rising smartphone and internet penetration combined with government initiative towards financial inclusion and cashless economy is driving widespread adoption of QR code payment systems.

Key Insights

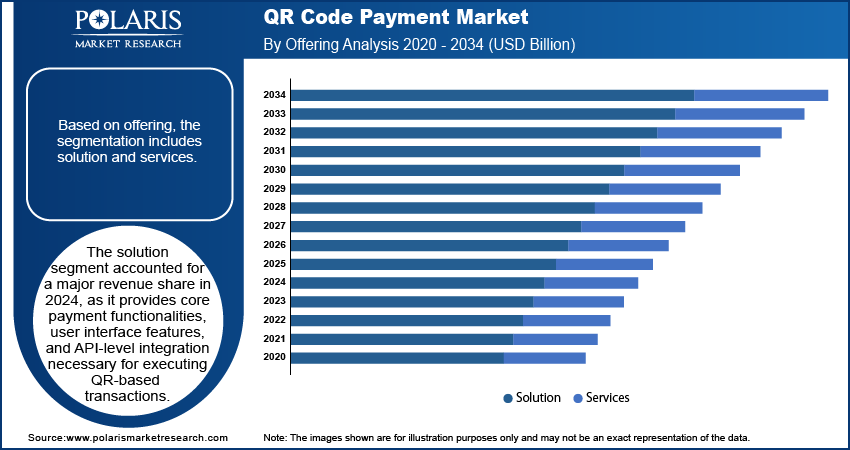

- The solution segment accounted for 68.00% market share in 2024.

- The services segment is projected to grow at the fastest rate over the forecast period, driven by growing demand for system integration, technical support, and real-time monitoring capabilities.

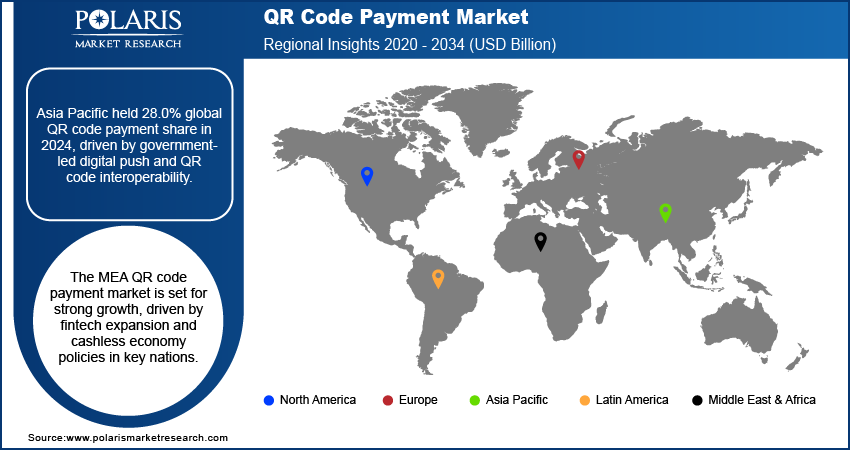

- The Asia Pacific QR code payment market accounted for 28.0% of the global market share in 2024.

- India QR code payment market held largest regional share of the Asia Pacific market in 2024, fueled by large-scale QR standardization efforts and expanding mobile payment adoption across urban and rural regions.

- The market in Middle East & Africa (MEA) is projected to grow at a CAGR of XY% from 2025-2034, owing to rising mobile wallet usage and government-led digitization programs in retail and transport sectors.

- Saudi Arabia market is expanding steadily, due to increasing regulatory support for cashless payments and growing QR code deployment in retail, hospitality, and fuel station networks.

Industry Dynamics

- Rising smartphone and internet penetration is facilitating large-scale adoption of mobile-based QR code payments across emerging economies.

- Growing government initiative towards financial inclusion and cashless economy are accelerating QR payment systems through regulatory support and national-level digital payment infrastructures.

- Increasing adoption of cross-border interoperability initiatives and central bank digital currency (CBDC) pilots present new opportunities for QR code payments in international remittances and digital public infrastructure.

- Data privacy and cybersecurity concerns are limiting QR code payment adoption in regions with weak digital protection laws.

Market Statistics

- 2024 Market Size: 9.12 billion

- 2034 Projected Market Size: 22.12 billion

- CAGR (2025-2034): 19.7%

- North America: Largest market in 2024

QR code payment solutions are rapidly adopted across retail, transportation, hospitality and financial sectors to provide fast and contactless transactions without the need for physical cards or point-of-sale infrastructure. These systems simplify merchant onboarding, reduce operational costs and offer interoperability across multiple payment platforms. QR code-based payments are widely driven by mobile wallets, banking apps and super apps, making them accessible to large and small merchants.

The QR code payment market is expanding due to the growing shift toward digital transactions and increasing smartphone penetration across emerging and developed markets. The rising government initiatives in countries such as India, China, Mexico, Ghana, and Indonesia are accelerating the adoption of interoperable QR payment systems. Regulatory frameworks promoting cashless economies and financial inclusion are driving widespread rollout across urban and rural areas. In addition, growing focus by payment providers to integrate advanced features such as tokenization, real-time fraud detection and biometric system authentication to enhance transaction security fuels the market growth. The focus on low-cost coupled with scalable digital infrastructure is further driving the transition toward QR code-based payment ecosystems.

The increasing demand for frictionless and low-cost digital transactions is accelerating QR code payment integration across dynamic retail and service environments. Enterprises are deploying QR-based solutions to eliminate card infrastructure, reduce transaction processing costs and enable faster checkouts in high-footfall locations. As a result, payment solution providers are offering modular QR systems that support multi-channel acceptance, API-based integrations and real-time transaction analytics. For instance, in January 2024, BharatPe partnered with the Ministry of MSME to support digital empowerment of artisans and small businesses by facilitating QR code-based payments and access to digital commerce. This initiative aims to strengthen financial inclusion by equipping grassroots entrepreneurs with tools for seamless and cashless transactions.

Drivers & Opportunities/Trends

Rapid Adoption of Smartphone and Internet Penetration: The increasing availability of affordable smartphones and improved mobile internet connectivity is accelerating the adoption of QR code-based payment systems. According to GSMA, mobile service subscriptions reached 5.6 billion by the end of 2023, covering 69% of the global population. This figure is projected to rise to 6.3 billion, or 74% of the population, by 2030. Rapid mobile device penetration across urban and rural areas is enabling access to mobile wallets and banking apps that support QR code transactions. This shift is witnessed mainly in emerging economies where mobile-first users bypass traditional banking infrastructure. The growing digital consumer base is creating favorable conditions for scalable QR payment ecosystems to expand interoperable platforms and strengthen digital acceptance. In addition, the service providers are leveraging this trend by offering app-based solutions that simplify merchant onboarding and enable real-time and contactless transactions at low operational costs.

Rising Government Initiative Towards Financial Inclusion and Cashless Economy: Governments across Asia, Europe, and Latin America are promoting QR code payments as part of broader initiatives to enhance financial inclusion and transition to cashless economies. As an example, in May 2025, the European Central Bank (ECB) launched the Digital Euro Innovation Platform to support testing of retail central bank digital currency (CBDC) use cases by private sector participants. This initiative is expected to accelerate integration of digital payments, boosting trust and adoption of QR code-based payment systems across the Eurozone. In addition, regulatory bodies are supporting interoperable QR frameworks, such as India’s BharatQR and Indonesia’s QRIS to standardize digital payment acceptance across all merchant categories. Moreover, the growing public policies to promote micro-merchant digitization, digital infrastructure subsidies and mandates for cashless transactions in public services are fueling QR code payment adoption. These efforts are increasing the volume of digital transactions while improving financial access for unbanked populations through secure and low-cost mobile payment platforms.

Segmental Insights

Offering Analysis

Based on offering, the segmentation includes solution and services. The solution segment accounted for 68.00% revenue share in 2024, due to widespread adoption among retailers, utility providers and financial institutions. Merchants prefer QR code-based payment solutions for their affordability, ease of integration and compatibility with mobile wallets and banking apps. These platforms reduce reliance on hardware by enabling real-time payment processing through mobile apps, which simplifies transactions and lowers costs. The growing demand for cashless retail and payment analytics and rapid adoption of QR code payment in Asia and the Middle East is maintaining segment dominance.

The services segment is projected to grow at the fastest pace during the forecast period. This growth is attributed to rising demand for system integration, API customization and post-deployment support. Hence, businesses across various sectors are rapidly depending on service providers to ensure secure and efficient management of QR code payment infrastructure. In developing regions, small and mid-sized merchants are choosing bundled service offerings that cover onboarding, employee training and adherence to local compliance standards. The rising adoption of recurring payments and growing demand for financial services and multi-channel payment solutions are opening new growth avenues within the services segment.

Payment Type Analysis

Based on payment type, the segmentation includes push payment and pull payment. The push payment segment accounted for 58.01% revenue share in 2024, owing to its widespread usage across retail, food service and peer-to-peer transfers. In this payment model, the user initiates the transaction by scanning the merchant’s QR code through a mobile application, which ensures greater user control, reduces transaction errors and enables faster payment confirmation. Retailers and small businesses prefer push payments due to their operational simplicity, low infrastructure requirements and reduced exposure to payment failures. The growing integration of push-based systems with mobile wallets and government-sponsored payment platforms is growing across developing economies due to limited banking penetration.

The pull payment segment is projected to grow at the fastest pace during the forecast period, driven by its adoption in subscription-based billing, insurance premiums and utility payments. In this model, the merchant or service provider generates a payment request which the user authorizes through their mobile application. It offers automation benefits for recurring transactions which makes it suitable for sectors requiring consistent billing cycles. Financial institutions and digital platforms are adopting the pull payment model to minimize late payments and enhance account management efficiency. Its expanding use in enterprise invoicing and public service billing is contributing to drive segment growth by ensuring timely automated transactions.

Transaction Channel Analysis

Based on transaction channel, the segmentation includes face-to-face and remote. The face-to-face segment accounted for 59.38% revenue share in 2024, driven by physical deployment of static and dynamic QR codes across retail outlets, restaurants and service counters for its convenience and contactless nature. Merchants are using printed or digital QR codes to accept payments without relying on expensive point-of-sale terminals. This segment is expected to expand across developing countries where mobile wallet adoption is high and cashless infrastructure is scaling.

The remote segment is projected to grow at the fastest pace during the forecast period. In this format, QR codes are shared digitally through apps, emails or web pages, allowing users to complete payments from remote locations. The rising adoption of this type of transaction is growing significantly across e-commerce, digital services, and utility payments to reduce payment friction, enable instant billing and ensure secure digital transactions. In addition, the growth in online commerce and mobile-first financial ecosystems is expanding the application of remote QR codes across sectors including healthcare, education and public services.

End User Analysis

By end user, the market includes hospitality & food services, retail & e-commerce, transportation & mobility, healthcare services, government services & utilities, and entertainment & events. The retail & e-commerce segment held the largest revenue share in 2024, due to the high frequency of transactions and increasing digital payment volumes. Merchants across grocery, apparel and electronics sectors are adopting QR code payments to streamline operations and reduce queue times. QR integration with loyalty programs and promotional campaigns is improving customer engagement that is extensively used in organized retail chains and informal trade networks.

The transportation & mobility segment is anticipated to grow at the fastest rate. The QR code payments are rapidly deployed in ticketing systems for buses, metros, taxis and other public transport services to support contactless fare collection. For instance, in March 2025, Taiwan’s Industrial Technology Research Institute (ITRI) partnered with Japanese firm Resonac to jointly develop SiC epitaxial wafer technology aimed at strengthening Taiwan’s semiconductor supply chain. The collaboration focuses on enhancing local production capabilities for power semiconductor materials. In addition, commuters are using mobile wallets and apps to scan QR codes, reducing cash handling and transaction time. Authorities and private operators are implementing QR systems to improve service efficiency and passenger convenience. Urban mobility projects in the Middle East, Southeast Asia, and Latin America are accelerating the shift toward digital transit payments, which is contributing to segment expansion.

Regional Analysis

Asia Pacific QR code payment market accounted for 28.0% of global market share in 2024. The high smartphone penetration and integration of national QR payment frameworks such as BharatQR in India and QRIS in Indonesia are driving large-scale adoption of QR code payments across consumer markets. Moreover, strong government push for financial inclusion and digitization is enabling rapid merchant onboarding and expansion in semi-urban and rural areas. In addition, the presence of large digital wallet ecosystems such as Alipay, PhonePe, Bitget, and WeChat Pay among others is driving transaction growth across retail, food services, public transport as well as crypto payments. In June 2025, Bitget Wallet launched a crypto payment feature in Vietnam by integrating with the national QR code system, VietQR. This enables users to make instant crypto-to-fiat transactions at over 100 million virtual and physical merchants nationwide.

India QR Code Payment Market Insight

India held largest regional share in Asia Pacific QR code payment landscape in 2024, due to national initiatives such as the Unified Payments Interface (UPI) and BharatQR, which standardized merchant and consumer QR transactions. The Digital India program and zero-MDR (merchant discount rate) policy are boosting mass adoption among small retailers and service vendors. Moreover, the rising use of QR payments in toll collection, public transport, and utility payments is boosting the digital payment infrastructure across Tier 1 and Tier 2 cities.

Middle East & Africa (MEA) QR Code Payment Market

The market in Middle East & Africa (MEA) is projected to grow at a significant CAGR from 2025-2034. This growth is witnessed due to national fintech development agendas that are advancing QR payment integration across retail, food service and mobility sectors in countries such as Saudi Arabia and the UAE among others. In July 2025, UAE and India integrated their digital payment systems by linking India's UPI with the UAE's AANI platform. This collaboration enables seamless cross-border transactions without the need for cash or currency exchange. The rise of mobile-first banking and increasing smartphone access in Sub-Saharan Africa is further expanding QR-based digital inclusion. In addition, the growing collaboration between private payment providers and telecom operators to scale interoperable mobile wallet solutions in underserved markets is pushing the adoption of QR-based payments in this region.

Saudi Arabia QR Code Payment Market Overview

The market in Saudi Arabia is expanding due to government initiative towards cashless economy and growing POS modernization across retail and public sectors. The Saudi Payments Network (mada) and regulatory support for QR code interoperability are enabling broad merchant acceptance across food services and fuel stations. Also, rising mobile wallet penetration and strong consumer uptake of digital transactions are contributing QR code payment frequency in urban centers and industrial zones.

North America QR Code Payment Market

The QR code payment landscape in North America is projected to hold a substantial share in 2034. The US and Canada experienced rising merchant acceptance of QR codes due to increasing usage of contactless payments across fast-food chains, events and public venues. According to Clearly Payments Inc., contactless transactions grew from 2.9 billion in 2018 to 17.9 billion in 2023. By 2023, more than 85% of merchants supported contactless payments, up from 40% in 2018. The growth of peer-to-merchant payments via mobile wallets such as PayPal, Apple Pay and Google Pay is further driving transaction value. Furthermore, digital transformation in retail and expanded use of QR codes in loyalty integration and order-ahead services are boosting market expansion.

Key Players & Competitive Analysis Report

The QR code payment market is moderately competitive, with key players focusing on platform innovation, secure API integrations and multi-sector partnerships to expand their transaction footprint. The key players are enhancing user experience through seamless app interfaces, biometric authentication and real-time transaction capabilities to improve adoption across diverse end users. In addition, collaboration with telecom providers, financial institutions and government agencies is enabling the rollout of interoperable QR frameworks and increasing merchant onboarding across regional markets.

Major companies operating in the QR code payment industry include Alipay, BharatPe, Google Pay, Kakoa, LINE Pay, Maya, Mercado Pago, MoMo, M-PESA, PayPay, PhonePe, Rakuten Pay, Revolut, STC Pay, UnionPay, WeChat Pay, and Vipps MobilePay.

Key Players

- Alipay

- BharatPe

- Google Pay

- Kakoa

- LINE Pay

- M-PESA

- Maya

- Mercado Pago

- MoMo

- PayPay

- PhonePe

- Rakuten Pay

- Revolut

- STC Pay

- UnionPay

- Vipps MobilePay

- WeChat Pay

Industry Developments

- July 2025: Alipay partnered with Meizu to introduced smart glasses equipped with voice and QR code payment features, enabling hands-free transactions. This technology aims to enhance user convenience in retail and transit settings.

- May 2025: Korea Financial Telecommunications & Clearings Institute (KFTC) announced to introduce a QR code-based payment system in Indonesia to strengthen cross-border payment connectivity. This initiative aims to promote faster and low-cost transactions between the two countries.

- October 2024: NMB Bank launched Tanzania’s first QR Pay-by-Link (QR-PBL) solution in partnership with Mastercard. This service enables businesses to receive digital payments securely without requiring physical point-of-sale infrastructure.

QR Code Payment Market Segmentation

By Offering Outlook (Revenue, USD Billion, 2020–2034)

- Solution

- Static QR code

- Dynamic QR code

- Services

By Payment Type Outlook (Revenue, USD Billion, 2020–2034)

- Push Payment

- Pull Payment

By Transaction Channel Outlook (Revenue, USD Billion, 2020–2034)

- Face-to-face

- Remote

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitality & Food Services

- Retail & E-commerce

- Transportation & Mobility

- Healthcare Services

- Government Services & Utilities

- Entertainment & Events

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

QR Code Payment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 12.35 Billion |

|

Market Size in 2025 |

USD 14.72 Billion |

|

Revenue Forecast by 2034 |

USD 74.30 Billion |

|

CAGR |

19.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 12.35 billion in 2024 and is projected to grow to USD 74.30 billion by 2034.

The global market is projected to register a CAGR of 19.7% during the forecast period.

Asia Pacific dominated the market in 2024, holding 28.0% share.

A few of the key players in the market are Alipay, BharatPe, Google Pay, Kakoa, LINE Pay, Maya, Mercado Pago, MoMo, M-PESA, PayPay, PhonePe, Rakuten Pay, Revolut, STC Pay, UnionPay, WeChat Pay, and Vipps MobilePay.

The solution segment dominated the market in 2024, holding 68.00% share. This dominance is attributed to high adoption across mobile wallets and banking apps used in merchant and consumer transactions.

The transportation & mobility segment is expected to witness the fastest growth during the forecast period, driven by expanding deployment of QR code payments in ticketing systems, ride-sharing platforms and public transit networks.