Bio-Based Platform Chemicals Market Size, Share, Trends, & Industry Analysis By Product, By Application (Industrial, Agricultural, Pharmaceutical, and Other Applications), and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6116

- Base Year: 2024

- Historical Data: 2020-2023

Overview

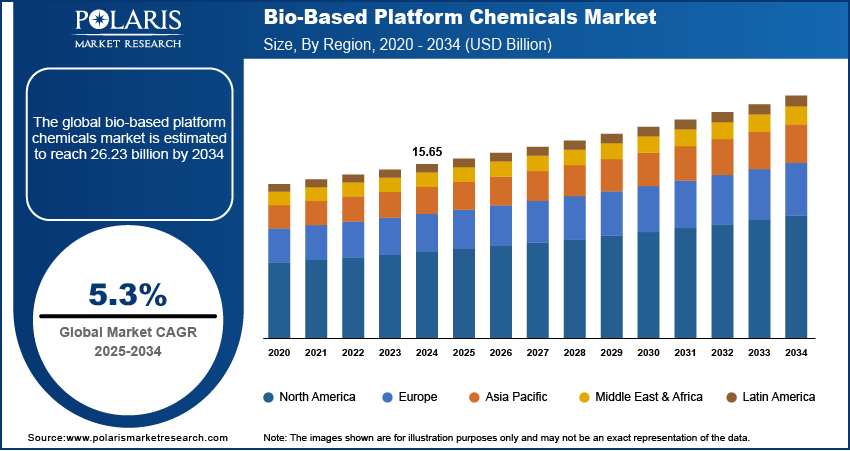

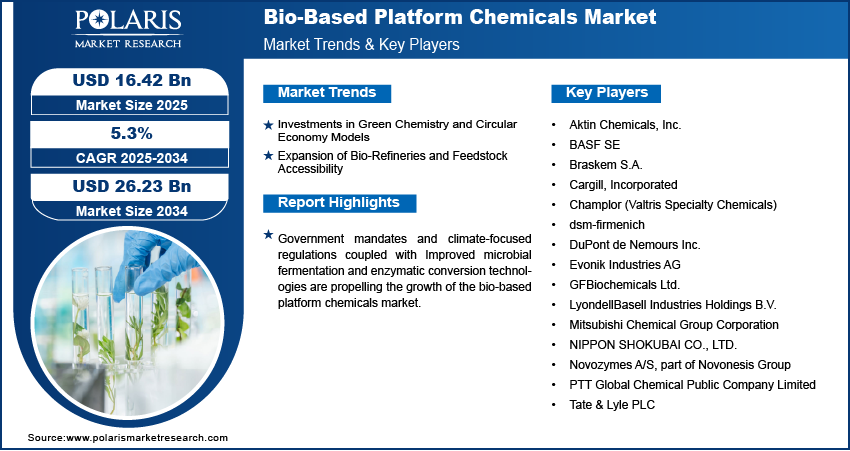

The global bio-based platform chemicals market size was valued at USD 15.65 billion in 2024, growing at a CAGR of 5.3% from 2025–2034. Investments in green chemistry and circular economy models coupled with expansion of bio-refineries and feedstock accessibility are driving the growth of the market.

Key Insights

- The platform chemicals segment dominated the market share in 2024.

- The cosmetics & personal care segment is projected to grow at the fastest rate over the forecast period, due to the increasing consumer preference for natural and non-toxic ingredients in skincare, haircare, and personal hygiene formulations.

- The Asia Pacific bio-based platform chemicals market dominated the global market share in 2024.

- India bio-based platform chemicals market held largest regional share of the Asia Pacific market in 2024, attributed to national-level initiatives focused on building a sustainable bio-economy.

- The market in North America is projected to grow at fastest CAGR during the forecast period, fueled by favorable policy incentives for bio-based chemical production and a strong innovation ecosystem in renewable materials and green chemistry.

- The market in the US is growing due to the presence of advanced bio-refineries, startup clusters, and university-led research programs.

Industry Dynamics

- Rising investments in green chemistry and circular economy models are driving demand for bio-based platform chemicals as industries seek sustainable alternatives to fossil-derived inputs in packaging, personal care, and agriculture sectors.

- Expansion of bio-refineries and improved feedstock accessibility non-food biomass and agricultural residues are strengthening supply chains and enabling economies of scale in bio-based chemical production.

- High production costs remain a key restraint, as advanced bioprocessing technologies and expensive raw materials resulting in higher price points compared to petrochemical counterparts.

- Synthetic biology and metabolic engineering present major growth opportunities by enabling precision fermentation and engineered microbial pathways, which improve yield, reduce waste, and expand the portfolio of viable bio-based intermediates.

Market Statistics

- 2024 Market Size: USD 15.65 billion

- 2034 Projected Market Size: USD 26.23 billion

- CAGR (2025-2034): 5.3%

- Asia Pacific: Largest market in 2024

Bio-based platform chemicals are intermediate compounds derived from renewable biomass sources such as sugars, starches, and cellulose. These chemicals serve as essential building blocks in the production of bioplastics, biofuels, solvents, and specialty chemicals used across industries such as packaging, agriculture, pharmaceuticals, and personal care. The ability of these chemicals to reduce reliance on fossil fuels, lower greenhouse gas emissions, and support circular economy initiatives is driving the adoption in sustainable manufacturing processes. The growing demand for environmentally friendly materials and regulatory push for green alternatives is further boosting the role of bio-based platform chemicals in enabling the transition toward low-carbon and eco-efficient industrial systems.

Government mandates and climate-focused regulations are accelerating the adoption of environmentally responsible chemical production practices. Incentive programs, emissions reduction targets, and green industrial policies are creating favorable conditions for bio-based platform chemicals across various regions. For instance, France released a detailed roadmap to decarbonize its chemical industry, setting a new target to reduce emissions by 31% by 2030. The plan outlined specific measures aimed at cutting emissions across various segments of the sector. These regulatory frameworks are pushing industries to transition toward cleaner technologies and renewable raw materials, supporting long-term sustainability goals and reducing reliance on fossil-based chemical feedstocks.

Improved microbial fermentation and enzymatic conversion technologies are enhancing the scalability and economic viability of bio-based chemical manufacturing. These advancements are enabling higher production yields, cost-efficiency, and process consistency, which are making bio-derived platform chemicals more competitive with traditional petrochemical alternatives. Industrial manufacturers are adopting these biotechnologies to meet performance standards while aligning with sustainable sourcing and production objectives.

Drivers & Opportunities

Investments in Green Chemistry and Circular Economy Models: Growing public and private sector funding is driving the development of low-carbon and circular chemical production platforms. For instance, the European Investment Bank invested approximately USD 5.6 billion between 2020 and 2024, in 153 circular economy projects spanning various industry sectors. Investment initiatives are aimed at accelerating the commercialization of safe, bio-based alternatives and integrating resource-efficient production methods. This growth is contributing to the expansion of platform chemical applications across sectors such as packaging, textiles, coatings, and personal care industry.

Expansion of Bio-Refineries and Feedstock Accessibility: The development of large-scale bio-refineries and improvements in renewable feedstock supply chains are propelling the growth of bio-based platform chemicals. Increased availability of agricultural residues, food processing by-products, and lignocellulosic biomass is strengthening feedstock security for chemical producers. These integrated supply systems are enabling reliable and continuous production of platform chemicals at scale, supporting industries focused on reducing carbon footprints and achieving long-term material sustainability.

Segmental Insights

Product Analysis

Based on product, the market is segmented into platform chemicals, polymers for plastics, paints, coatings, inks & dyes, surfactants, cosmetics & personal care products, adhesives, man-made fibers, and other products. The platform chemicals segment dominated the market in 2024, driven by its extensive utilization as a building block in bio-based production pathways. These chemicals, including succinic acid, 3-hydroxypropionic acid, and itaconic acid, serve as essential intermediates in producing bio-plastics, solvents, and resins. The rising demand for sustainable feedstocks across various end-use sectors is supporting the wide-scale production and commercialization of these bio-derived intermediates.

The cosmetics & personal care products segment is projected to grow at the fastest CAGR during the forecast period. The increasing consumer preference for natural and non-toxic ingredients in skincare, haircare, and personal hygiene formulations is driving product adoption. Bio-based chemicals are integrated into formulations to meet regulatory guidelines and cater to growing demand for organic, plant-based product labels. Expanding middle-class populations, rising disposable incomes, and clean-label movements are further accelerating the demand for bio-based alternatives in the personal care industry. According to the Organisation for Economic Co-operation and Development (OECD), real household income per capita across OECD member countries grew by 1.8% in 2024, a slight increase compared to 1.7% growth recorded in 2023.

Application Analysis

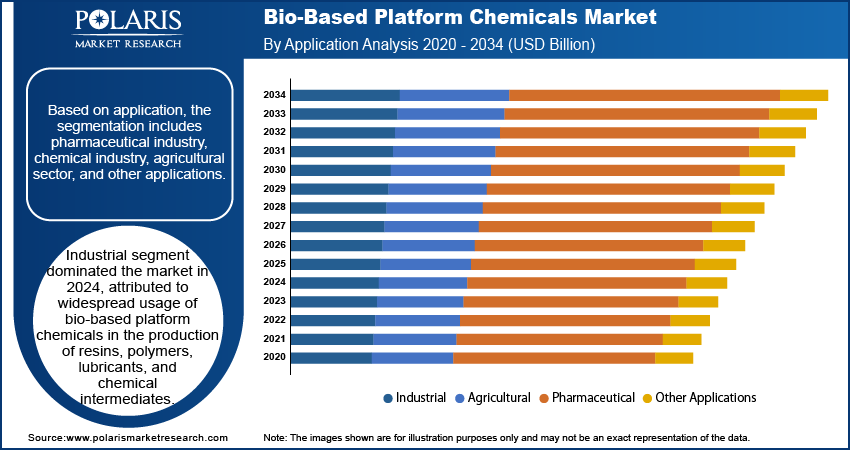

By application, the market is segmented into industrial, agricultural, pharmaceutical, and other applications. The industrial segment held the largest market share in 2024, attributed to widespread usage of bio-based platform chemicals in the production of resins, polymers, lubricants, and chemical intermediates. Industries are shifting toward renewable alternatives to minimize dependency on petroleum-based feedstocks and reduce carbon emissions. In addition, government regulations promoting sustainable manufacturing and the integration of green chemistry principles across industrial value chains are boosting the demand for bio-based chemical inputs.

The pharmaceutical segment is expected to expand at the fastest CAGR during the forecast period. Bio-based platform chemicals are increasingly explored as intermediates in active pharmaceutical ingredient (API) synthesis and drug formulation. The renewable origin and structural versatility support safer and more sustainable production processes. In addition, rising R&D activity focused on green synthesis routes and the growing demand for biocompatible raw materials are accelerating the adoption across pharmaceutical manufacturing.

Regional Analysis

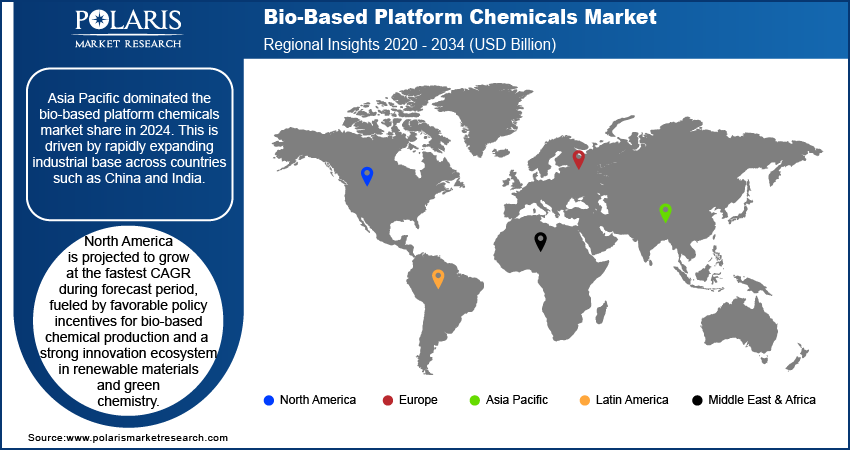

Asia Pacific bio-based platform chemicals market dominated the global market in 2024. This growth is driven by rapidly expanding industrial base across countries such as China and India. The increasing need for renewable feedstocks in chemical manufacturing, personal care, packaging, and textile industries is contributing to the growth of the market growth. In addition, foreign investments and joint ventures are boosting the development of integrated bio-refineries and enhancing technological capabilities. Regional governments are actively promoting green industrialization, further accelerating the production and utilization of bio-derived chemicals.

India Bio-Based Platform Chemicals Market Insight

India dominated in Asia Pacific bio-based platform chemicals landscape in 2024, attributed to national-level initiatives focused on building a sustainable bio-economy. Subsidies for bio-based materials, along with production-linked incentive (PLI) schemes, are pushing local production and downstream integration. According to the Indian Ministry of Science & Technology, India’s bioeconomy grew significantly from USD 10 billion in 2014 to USD 165.7 billion in 2024, contributing 4.25% to the national GDP. The sector recorded a 17.9% CAGR over the past four years, highlighting India’s growing global role in biotechnology. The country now aims to reach USD 300 billion by 2030. This policy environment is attracting investment from domestic and international players, accelerating the deployment of renewable chemical technologies.

North America Bio-Based Platform Chemicals Market

The market in North America is projected to grow at the fastest CAGR during the forecast period, fueled by favorable policy incentives for bio-based chemical production and a strong innovation ecosystem in renewable materials and green chemistry. Federal support through tax credits and grants is promoting the commercialization of renewable chemicals and bioplastics. The region’s focus on reducing carbon emissions and fossil fuel dependency is accelerating the adoption of bio-based chemicals production platforms. In addition, investments in biotechnology and green chemistry research are further enhancing the performance and cost-effectiveness of bio-derived chemicals.

The US Bio-Based Platform Chemicals Market Overview

The market in the US is growing due to the presence of advanced bio-refineries, startup clusters, and university-led research programs. For instance, in July 2024, the US Department of Energy’s Office of Fossil Energy and Carbon Management (FECM) selected 19 projects across 17 US colleges and universities to receive USD 17.4 million in funding. The initiative aims to support novel, early-stage research focused on advancing technologies in fossil energy and carbon management. This move is part of the DOE’s broader efforts to promote innovation in clean energy and emissions reduction. Collaboration between research institutions and industry stakeholders is enabling rapid scaling of next-generation bio-based chemical technologies.

Europe Bio-Based Platform Chemicals Market

The bio-based platform chemicals landscape in Europe is projected to hold a substantial share in 2034, owing to the regulatory mandates and sustainability-driven industrial reforms. EU-wide environmental targets and policies aligned with the European Green Deal are compelling manufacturers to transition toward circular and renewable chemical solutions. The implementation of product carbon footprint standards and extended producer responsibility is driving demand for bio-based inputs across multiple industries. Additionally, growing R&D funding under programs such as Horizon Europe is supporting innovation in green chemistry, biotechnology, and resource-efficient processing. In addition, the prominent countries such as Germany, France, the UK and the Netherlands are investing in infrastructure for sustainable material production, while companies are prioritizing product reformulation to meet evolving environmental standards and consumer preferences.

Key Players & Competitive Analysis Report

The bio-based platform chemicals market is moderately competitive, with leading manufacturers focusing on sustainable production of high-value chemical intermediates derived from renewable feedstocks such as biomass, starch, and agricultural waste. Key players are emphasizing innovations in biotechnology, fermentation, and enzymatic conversion to improve process efficiency, reduce carbon footprint, and meet global demand for green alternatives to petroleum-based chemicals. Also, manufacturers are working to ensure compliance with environmental standards and regulatory frameworks across major regions. Strategic priorities among industry participants include scaling up biorefinery capacities, enhancing partnerships with bioplastics, food, and pharmaceutical manufacturers, and expanding geographic presence through collaborations and acquisitions.

Prominent companies operating in the bio-based platform chemicals market include Aktin Chemicals, Inc., BASF SE, Braskem S.A., Cargill, Incorporated, Champlor (Valtris Specialty Chemicals), dsm-firmenich, DuPont de Nemours Inc., Evonik Industries AG, GFBiochemicals Ltd., LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Group Corporation, NIPPON SHOKUBAI CO., LTD., Novozymes A/S (part of Novonesis Group), PTT Global Chemical Public Company Limited, and Tate & Lyle PLC.

Key Players

- Aktin Chemicals, Inc.

- BASF SE

- Braskem S.A.

- Cargill, Incorporated

- Champlor (Valtris Specialty Chemicals)

- dsm-firmenich

- DuPont de Nemours Inc.

- Evonik Industries AG

- GFBiochemicals Ltd.

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Group Corporation

- NIPPON SHOKUBAI CO., LTD.

- Novozymes A/S, part of Novonesis Group

- PTT Global Chemical Public Company Limited

- Tate & Lyle PLC

Industry Developments

- December 2024: Tate & Lyle entered into a strategic partnership with BioHarvest Sciences to co-develop next-generation plant-based ingredients for the food and beverage industry. Leveraging BioHarvest’s Botanical Synthesis platform, the collaboration aims to produce non-GMO, sustainable plant-derived molecules without cultivating the entire plant thereby lowering land and water consumption.

- September 2024: Lygos’ collaborated with CJ BIO to produce Soltellus biodegradable polymers and Ecoteria malonates at the Fort Dodge biorefinery complex. The partnership includes plans to scale up production of bio-based aspartic acid.

Bio-Based Platform Chemicals Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Platform Chemicals

- Polymers for Plastics

- Paints, Coatings, Inks & Dyes

- Surfactants

- Cosmetics & Personal Care Products

- Adhesives

- Artificial Fibers

- Other Products

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Industrial

- Agricultural

- Pharmaceutical

- Other Applications

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Bio-Based Platform Chemicals Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 15.65 Billion |

|

Market Size in 2025 |

USD 16.42 Billion |

|

Revenue Forecast by 2034 |

USD 26.23 Billion |

|

CAGR |

5.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 15.65 billion in 2024 and is projected to grow to USD 26.23 billion by 2034.

The global market is projected to register a CAGR of 5.3% during the forecast period.

Asia Pacific dominated the market in 2024, driven by rapidly expanding industrial base across countries such as China and India.

A few of the key players in the market are Aktin Chemicals, Inc., BASF SE, Braskem S.A., Cargill, Incorporated, Champlor (Valtris Specialty Chemicals), dsm-firmenich, DuPont de Nemours Inc., Evonik Industries AG, GFBiochemicals Ltd., LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Group Corporation, NIPPON SHOKUBAI CO., LTD., Novozymes A/S (part of Novonesis Group), PTT Global Chemical Public Company Limited, and Tate & Lyle PLC.

The industrial segment dominated the market in 2024, attributed to widespread usage of bio-based platform chemicals in the production of resins, polymers, lubricants, and chemical intermediates.

The cosmetics & personal care segment is expected to witness the fastest growth during the forecast period, due to the increasing consumer preference for natural and non-toxic ingredients in skincare, haircare, and personal hygiene formulations.