Global Bio-based Chemicals Market Share, Size, Trends, Industry Analysis Report

By Type (Bio-Lubricants, Bio-Solvents, Bioplastics, Bio-Alcohols, Bio-Surfactants, Bio-Based Acids); By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 117

- Format: PDF

- Report ID: PM2128

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

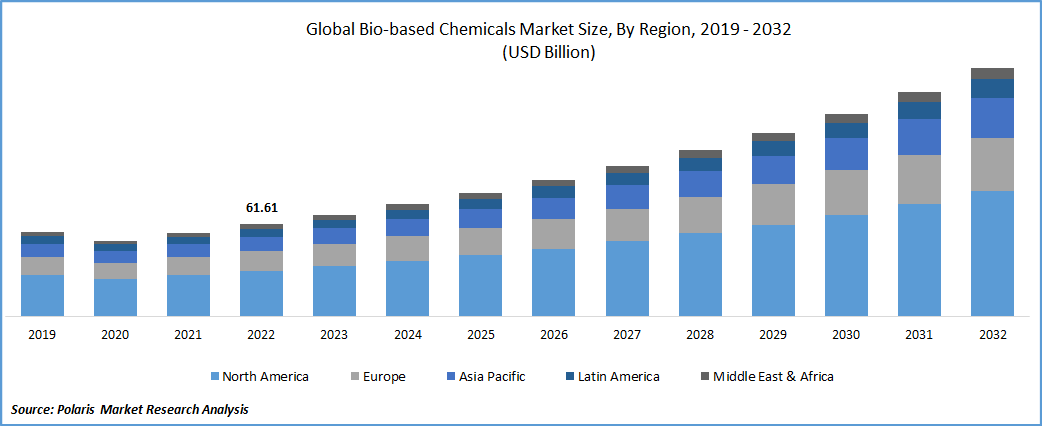

The global bio-based chemicals market was valued at USD 67.9 billion in 2023 and is expected to grow at a CAGR of 10.4% during the forecast period. Bio-based chemicals are a class of chemicals that are derived from renewable biological sources, such as plants, crops, and biomass, as opposed to traditional chemicals that are derived from fossil fuels. These bio-based chemicals are gaining increasing attention and demand in the global market due to their potential to reduce environmental impacts, lower carbon emissions, and contribute to a more sustainable and circular economy.

Know more about this report: Request for sample pages

The industrial overview of global bio-based chemicals is promising, with a growing trend towards sustainable and eco-friendly solutions in various industries. Bio-based chemicals are used in a wide range of applications across different sectors, including automotive, packaging, agriculture, consumer goods, and construction, among others.

One popular product in the field of bio-based chemicals is bio-based plastics, which are used as an alternative to traditional petroleum-based plastics. Bio-based plastics are derived from renewable feedstocks, such as corn, sugarcane, or cellulose, and can be used in a variety of applications, such as packaging, automotive parts, consumer goods, and agricultural films. Bio-based plastics are gaining traction due to their potential to reduce greenhouse gas emissions, lower dependency on fossil fuels, and reduce plastic waste in the environment.

Another important product in the bio-based chemicals market is bio-based solvents. These solvents are used as substitutes for traditional petroleum-based solvents in various applications, such as coatings, adhesives, and cleaning products. Bio-based solvents are derived from renewable sources, such as agricultural crops, and are known for their low toxicity, low VOC (volatile organic compound) emissions, and biodegradability, making them a more environmentally friendly alternative to conventional solvents.

Bio-based chemicals also have applications in the agricultural industry, where they are used as biopesticides, bio stimulants, and fertilizers. Biopesticides are derived from natural sources, such as plant extracts or microorganisms, and are used for pest control in agriculture without leaving harmful residues. Bio stimulants are used to enhance plant growth and increase crop yield, while bio-based fertilizers provide essential nutrients to plants in a sustainable and environmentally friendly manner.

Additionally, bio-based chemicals are used in the production of personal care and household products, where they serve as natural and sustainable alternatives to traditional chemicals. Bio-based ingredients are used in products such as cosmetics, detergents, and cleaning agents, offering consumers more eco-friendly options for their personal care and household needs.

The use of bio-based chemicals in construction materials is also gaining momentum. Bio-based adhesives, coatings, and insulation materials are used in the construction industry as more sustainable and eco-friendly options compared to traditional chemical-based products. These bio-based materials offer reduced carbon footprint, improved indoor air quality, and lower environmental impacts, making them a preferred choice for green building and sustainable construction practices.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Tensiometers are valuable instruments that are used to measure surface tension, which is a crucial property of liquids that affects their behavior and performance in various applications. The use of tensiometers is driven by several growth factors, such as the increasing demand for high-performance materials and the need for precise measurements in various industries.

One of the major growth drivers for tensiometers is the growing demand for high-performance materials in industries such as coatings, adhesives, and pharmaceuticals. Tensiometers play a critical role in the development and production of these materials, as surface tension affects the properties and behavior of these materials. The ability to accurately measure surface tension using tensiometers enables manufacturers to optimize the performance of their products and meet the increasingly stringent requirements of customers.

Another growth driver for tensiometers is the need for precise measurements in various industries, such as biotechnology and environmental science. Tensiometers are used to study the properties of biological membranes, the behavior of cells, and the water-holding capacity of soil, among other applications. Accurate measurements of surface tension using tensiometers are essential in these fields to better understand the behavior and properties of materials and biological systems.

Advancements in technology are also driving growth in the use of tensiometers. New types of tensiometers have been developed that offer improved accuracy, sensitivity, and ease of use. For example, some of the latest tensiometers use advanced sensors and software to automate measurements and provide real-time data analysis. These advancements make it easier and faster to measure surface tension, which is particularly important in industries where time and accuracy are critical.

In conclusion, tensiometers are valuable instruments that are widely used in various industries to measure surface tension, which is a crucial property of liquids. The growing demand for high-performance materials, the need for precise measurements, and advancements in technology are driving growth in the use of tensiometers. As the demand for high-quality and high-performance materials continues to grow, tensiometers will remain an essential tool for researchers and engineers in various fields.

Report Segmentation

The market is primarily segmented based on Type, End User, and region.

|

By Type |

By End Use |

By Region |

|

|

|

Know more about this report: Request for sample pages

The Bio-Lubricants segment is expected to witness the fastest growth in 2022

The key drivers for the rapid growth of the Bio-Lubricants segment are the rising awareness about the environmental impact of conventional lubricants. Conventional lubricants are often derived from fossil fuels and contain toxic additives that can be harmful to the environment and human health. In contrast, bio-lubricants are derived from renewable sources such as vegetable oils, animal fats, and other bio-based feedstocks. They are biodegradable, non-toxic, and have a lower carbon footprint, making them a more sustainable choice for various applications.

Bio-lubricants find extensive applications across industries such as automotive, industrial, marine, and aerospace. In the automotive industry, bio-lubricants are used in engine oils, transmission fluids, and hydraulic fluids. In the industrial sector, they are used in machinery, gearboxes, and hydraulic systems. In the marine industry, bio-lubricants are used in ship engines and other marine applications. In the aerospace sector, they are used in aircraft engines and hydraulic systems. The versatility of bio-lubricants and their compatibility with existing equipment and machinery are driving their adoption in various end-use industries.

Another significant factor driving the growth of the Bio-Lubricants segment is the increasing focus on sustainable and green initiatives by governments and regulatory bodies worldwide. Many countries have introduced stringent regulations to promote the use of bio-based lubricants and reduce the environmental impact of conventional lubricants. For instance, the European Union has set targets to increase the use of bio-based lubricants in various applications to reduce greenhouse gas emissions and promote sustainable practices.

Moreover, advancements in technology and innovation in the bio-lubricants industry have led to the development of high-performance bio-lubricants that offer superior performance compared to conventional lubricants. These bio-lubricants offer improved viscosity, oxidative stability, and wear resistance, making them suitable for a wide range of applications. The growing research and development activities in the bio-lubricants sector are expected to further drive the growth of this segment.

The Automotive segment accounted for the largest market share in 2022

The main factors contributing to the significant market share of bio-based chemicals in the automotive segment is the increasing demand for sustainable materials for automotive manufacturing. Bio-based chemicals are used in the production of bioplastics, biocomposites, and biofoams, which are used as alternative materials for automotive parts, interior components, and packaging. These bio-based materials offer comparable performance to conventional materials while reducing the reliance on fossil fuels and lowering the carbon footprint of the automotive industry.

Moreover, bio-based chemicals are used in the production of biofuels, which are gaining traction in the automotive sector as a renewable and low-carbon alternative to conventional fossil fuels. Biofuels such as bioethanol and biodiesel can be blended with conventional fuels or used as standalone fuels in vehicles, reducing greenhouse gas emissions and contributing to the mitigation of climate change. The automotive industry is increasingly adopting biofuels to meet regulatory requirements and achieve sustainability targets, which has further boosted the demand for bio-based chemicals in this segment.

In addition, the automotive sector is focusing on improving the environmental performance of its maintenance and repair processes, and bio-based chemicals are finding applications in this area as well. Bio-based lubricants, solvents, and other chemicals are used in vehicle maintenance, cleaning, and degreasing, offering a more sustainable alternative to conventional chemicals that may be harmful to the environment and human health.

Furthermore, regulatory support and initiatives promoting the use of bio-based chemicals in the automotive sector have also been driving the bio-based chemicals market growth. Many governments and regulatory bodies have introduced policies and standards to incentivize the use of renewable chemicals in the automotive industry, including bio-based content requirements, carbon reduction targets, and sustainability certifications. These measures have encouraged the adoption of bio-based chemicals in the automotive sector and contributed to their significant market share.

The demand in Europe is expected to witness significant growth during forecast period

The demand for bio-based chemicals in Europe is anticipated to experience significant growth in the coming years. Europe has been at the forefront of sustainability and environmental initiatives, with increasing focus on reducing greenhouse gas emissions, promoting circular economy practices, and adopting bio-based alternatives to conventional chemicals. This has resulted in a favorable environment for the growth of the bio-based chemicals market in the region.

One of the key drivers for the anticipated growth of bio-based chemicals in Europe is the increasing regulatory support and initiatives promoting the use of renewable chemicals. The European Union (EU) has set ambitious targets to reduce greenhouse gas emissions and promote sustainability, including the Circular Economy Action Plan and the European Green Deal. These initiatives aim to increase the use of bio-based chemicals in various applications, such as packaging, textiles, plastics, and automotive, to reduce the reliance on fossil fuels and lower the carbon footprint.

Additionally, the growing consumer awareness and demand for sustainable products in Europe are driving the adoption of bio-based chemicals. Consumers are increasingly seeking eco-friendly and sustainable alternatives to conventional products, including chemicals used in everyday applications. Bio-based chemicals offer a more sustainable choice, as they are derived from renewable sources, biodegradable, and have a lower environmental impact compared to conventional chemicals. This growing consumer preference for sustainable products is expected to propel the demand for bio-based chemicals in Europe.

Moreover, Europe has a strong industrial base with a focus on innovation and technology advancement, which is driving the growth of bio-based chemicals. The region has witnessed significant investments in research and development for the development of bio-based chemicals with improved performance and functionalities. These advancements have resulted in the development of bio-based chemicals that offer comparable or superior performance to conventional chemicals, making them viable alternatives for various applications.

Furthermore, the availability of abundant biomass resources in Europe, such as agricultural and forestry residues, presents opportunities for the production of bio-based chemicals. The region has been investing in biomass-based feedstock cultivation and utilization, and the establishment of bio-refineries for the production of bio-based chemicals. This availability of locally sourced feedstock for bio-based chemical production is expected to drive the growth of the market in Europe.

Competitive Insight

Some of the major players operating in the global market include BASF SE, BioAmber Inc, Braskem SA, Cargill Incorporated, Danimer Scientific Inc., DuPont de Nemours, Evonik Industries, Koninklijke DSM N.V., Methanex Corporation, Mitsubishi Chemical Corporation, Mitsui & Co. Ltd, Natureworks LLC, PTT Global Chemical Co. Ltd., Teijin Ltd., and Vertec BioSolvents.

Recent Developments

- In June 2021, Cargill and Helm Company joined forces to establish a commercial-scale 1,4-butanediol facility under the Qore joint venture, with an investment of US$300 million. This partnership aims to support leading brands in reducing their greenhouse gas emissions by substituting fossil-based chemistries with bio-based intermediates. By doing so, these brands can make a positive impact on the environment while maintaining the quality of their products.

Global Bio-Based Chemicals Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 74.85 billion |

|

Revenue forecast in 2032 |

USD 165.41 billion |

|

CAGR |

10.4% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By End-use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

BASF SE, BioAmber Inc, Braskem SA, Cargill Incorporated, Danimer Scientific Inc., DuPont de Nemours, Evonik Industries, Koninklijke DSM N.V., Methanex Corporation, Mitsubishi Chemical Corporation, Mitsui & Co. Ltd, Natureworks LLC, PTT Global Chemical Co. Ltd., Teijin Ltd., and Vertec BioSolvents. |

FAQ's

The bio-based chemicals market report covering key segments are type, end user, and region.

Global Bio-based Chemicals Market Size Worth $165.41 Billion By 2032.

The global bio-based chemicals market expected to grow at a CAGR of 10.4% during the forecast period.

Europe is leading the global market.

Key driving factors in bio-based chemicals market are growing demand for environment-friendly products.