Biopesticides Market Share, Size, Trends, Industry Analysis Report

By Type (Bio-fungicides, Bioinsecticides, Bioherbicides, and Others); By Source; By Formulation; By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 118

- Format: PDF

- Report ID: PM2771

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

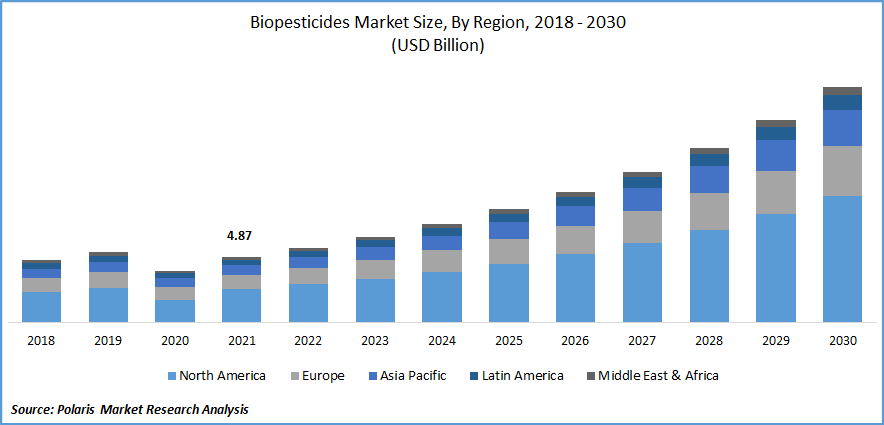

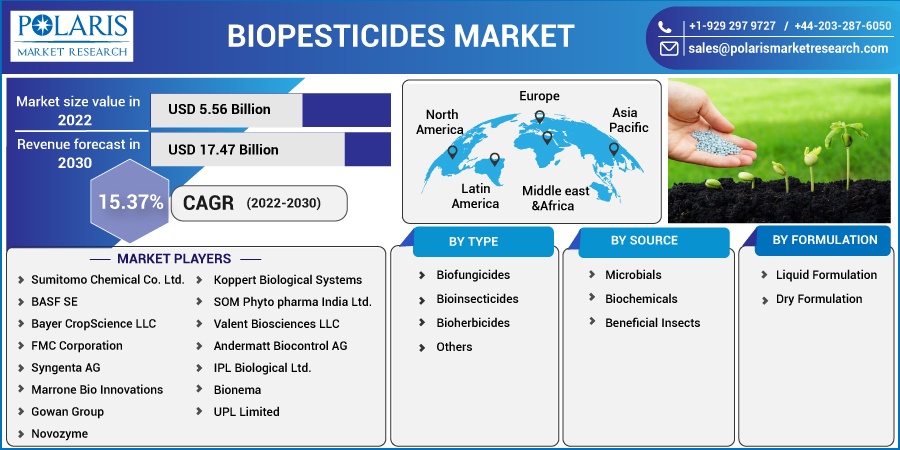

The global biopesticides market was valued at USD 4.87 billion in 2021 and is expected to grow at a CAGR of 15.37% during the forecast period.

The increasing efforts and initiatives by various government bodies and market players to increase the usage and adoption of eco-friendly and more efficient Agri-inputs are the major factors expected to drive the growth of the global market during the forecast period.

Know more about this report: Request for sample pages

Various governments are continuously introducing subsidiaries and schemes for ensuring the growth in the adoption of bio-based crop protection chemicals and boosting the popularity of biopesticides around the globe, which is further likely to propel the demand and growth of the global market at a significant growth rate in the coming years.

The global demand for biopesticides is rapidly increasing with the rising number of environmental and human health concerns across the globe. In addition, increasing number of government approvals and registrations of biopesticides is also a major factor encouraging manufacturers to create more enhanced and innovative biopesticide products to cater to the fostering demand of consumers.

For instance, in May 2022, UPL Ltd., a leading provider of sustainable agriculture products and solutions, announced the launch of its new bio solution ZOATIN. The main aim of this new product launch is to increase crop health and yield.

The sudden outbreak of the COVID-19 pandemic has highly impacted the growth of the global market due to the undertaking of lockdown actions and limiting the transportation and movement of their masses by governments. These actions have significantly affected the production and supply chain of pesticides coupled with the growing worker scarcity. Moreover, disturbances in the global supply chain have resulted in many raw material procurement issues for global market players, mainly for those companies who are dependent on Chinese raw materials for their biopesticides production.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Rapidly growing demand for organic and natural food, along with tremendous growth in organic agriculture around the world, are the major factors projected to drive the growth of the global market over the forecast period. Changes in consumer lifestyles, daily meal requirements, and growing concerns about synthetic foods influence consumers to move towards organic food products. It has led to rapid growth in the adoption and popularity of biopesticides in the last few years.

Furthermore, increasing expenditure on research & development and technological advancements by several key market players, including Bayer AG, UPL Ltd., and BASF SE, has encouraged the usage of biological signals for identifying and triggering RNAi-specific genes, is also likely to be a major factor driving the growth of the global market over the coming years.

For instance, in March 2021, BASF SE announced the launch of its new bio fungicide, named Howler, in Europe and the Middle East Africa region. The product is mainly based on oraphistrain AFS009 and Pseudomonas colors, widely used in golf courses and turfs.

Report Segmentation

The market is primarily segmented based on type, source, formulation, and region.

|

By Type |

By Source |

By Formulation |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Biofungicides Segment is Expected to Witness Fastest Growth

The extensively rising resistance for various chemical fungicides among fungi, coupled with the rising regulations and limitations for the use of many active chemical ingredients, are likely to be the major factor driving the growth of the segment during the forecast period. Various government bodies around the world, especially in developed countries such as United States, Germany, and France, have implied several restrictions on the usage of chemical fungicides to control the rising concerns regarding the environment are expected to increase the adoption of bio fungicides in the coming years.

Moreover, increased grants for research & development and production unit setups, along with the high growth in the production area for organic culture across the globe, are further likely to boost the demand for the segment in the near future. For instance, according to the Research Institute of Organic Culture, in Europe, the organic agriculture area was around 14.4 million hectares in 2017 and increased to 17.1 million hectares in 2020.

Microbials Accounted for the Largest Market Share in 2021

Microbial held the largest market share in 2021 and are anticipated to maintain dominance throughout the forecast period. Several features of microbial biopesticides, including longer lifecycles, lower production cost, and help in pest control, are the key factors projected to fuel the demand and growth of the segment in the coming years at a strong growth rate.

Moreover, increasing need for reducing pollution and global toxic residue level from the environment has resulted in a rapid increase in the demand for biologically-based pesticides among farmers and other consumers as well all around the world. In addition, high growth and development in the microbiology industry with the help of advanced technologies are also contributing significantly to the growth of the market over the coming years.

Liquid Formulation is Expected to Hold the Significant Revenue Share

An extensive rise in the foliar mode of application and ease of application are the major factors propelling the growth and demand of the segment over the forecast period. Liquid formulations are easy to use and convenient to apply, which is further anticipated to boost the demand for these products in the near future. Moreover, it is observed that various microbial ingredients work more efficiently in liquid formulations as compared to dry formulations due to their capabilities to affect the whole crop.

North America Held the Largest Market Share in 2021

Early adoption of advanced technology, stringent rules and regulations on the usage of chemical pesticides for protecting environment, and increasing focus on research & development sector to create greener crop cultivation inputs are the major factors driving the growth of the market in the region.

In addition, a large presence of major market players such as Valent Biosciences LLC., BioWorks Inc., and Marrone Bio Innovations, along with the rising focus on maximizing the utilization of microbe-based pesticides for enhancements and improvements in yield, is positively impacting the growth of the market.

Furthermore, Asia Pacific region is witnessing the fastest CAGR during the forecast period owing to an extensive rise in population, increased awareness regarding health issues associated with synthetic chemicals, and increased consumer disposable income in the region. Additionally, rapidly growing urbanization, change in consumer preferences towards organic and natural food, and easy availability of biopesticides are also expected to be the key driving factors for the regional market growth throughout the forecast period.

Competitive Insight

The major market players are focusing on improving product quality, strategic partnerships, collaborations, research & development, and new product launches for the expansion of their geographical presence and portfolio of offerings and to strengthen their market position.

Major companies in the global market are Sumitomo Chemical, BASF SE, Bayer CropScience, FMC Corporation, Syngenta, Marrone Bio Innovations, Gowan Group, Novozymes, Koppert Biological Systems, SOM Phytopharma, Valent Biosciences, Andermatt Biocontrol, IPL Biological, Bionema, and UPL Limited.

Recent Developments

- In May 2022, UPL Limited entered a strategic partnership with AgBiTech, a global leader in agricultural biological innovation. With this collaboration, UPL will distribute AgBiTech’s bio solutions, starting with the two bioinsecticides, Heligen and Fawligen. The new partnership will help UPL to expand its product offerings in the bioinsecticides segment.

- In January 2022, Syngenta completed the acquisition of two new products, “NemaTrident” and “UniSpore” from Bionema Limited. With this new acquisition, the company mainly aims at growing resistance and a large range of insects and pests across several applications such as horticulture, ornamentals, forestry, and turf amenity.

- In May 2021, FBSciences announced the expansion of its biopesticide product segment, including the latest innovation and commercialization of biologicals. The expansion of product offerings will help the company’s sales to gain significant growth in the number of sales of newly developed and approved nematicide FBS Defense 500.

Biopesticides Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 5.56 billion |

|

Revenue forecast in 2030 |

USD 17.47 billion |

|

CAGR |

15.37% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Type, By Source, By Formulation, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Sumitomo Chemical Co. Ltd., BASF SE, Bayer CropScience LLC, FMC Corporation, Syngenta AG, Marrone Bio Innovations, Gowan Group, Novozymes, Koppert Biological Systems, SOM Phyto pharma India Ltd., Valent Biosciences LLC, Andermatt Biocontrol AG, IPL Biological Ltd., Bionema, and UPL Limited |