Analytical Instrumentation Market Size, Share, Trends, & Industry Analysis By Product, By Technology, By Application, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 123

- Format: PDF

- Report ID: PM6115

- Base Year: 2024

- Historical Data: 2020-2023

Overview

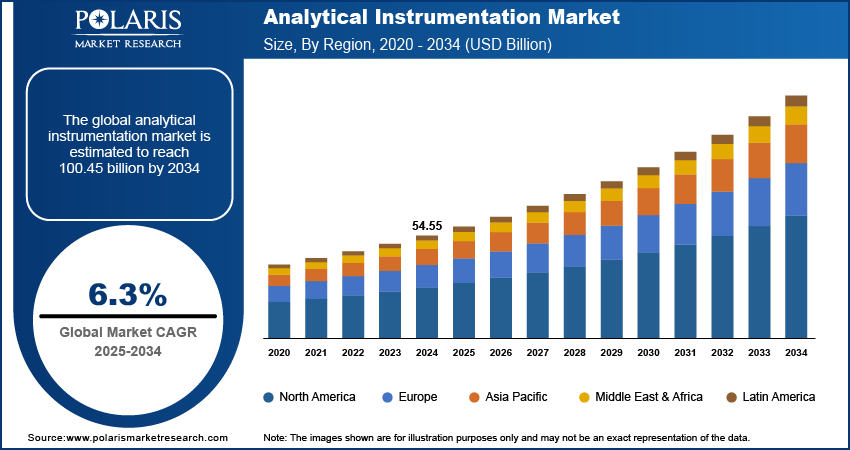

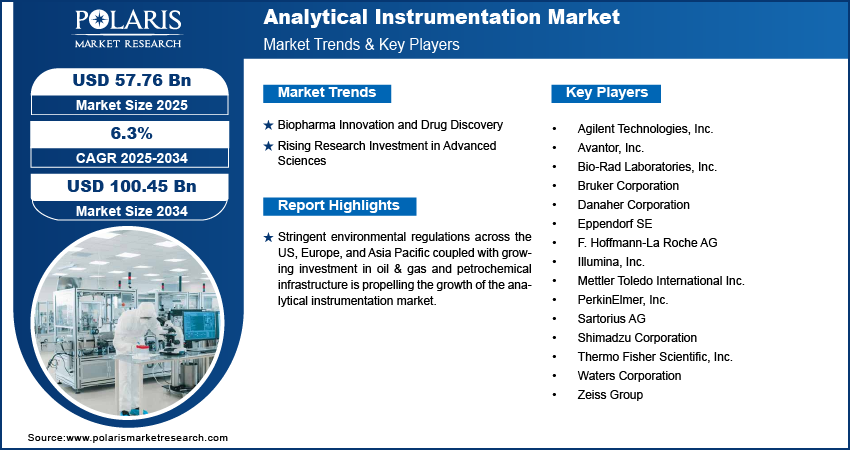

The global analytical instrumentation market size was valued at USD 54.55 billion in 2024, growing at a CAGR of 6.3% from 2025–2034. Biopharma innovation and drug discovery coupled with rising research investment in advanced sciences are driving the growth of the industry.

Key Insights

- The chromatography instruments segment dominated the market share in 2024.

- The polymerase chain reaction (PCR) segment is projected to grow at the fastest rate over the forecast period, due to the surge in molecular diagnostics and genetic analysis, in infectious disease detection and cancer research.

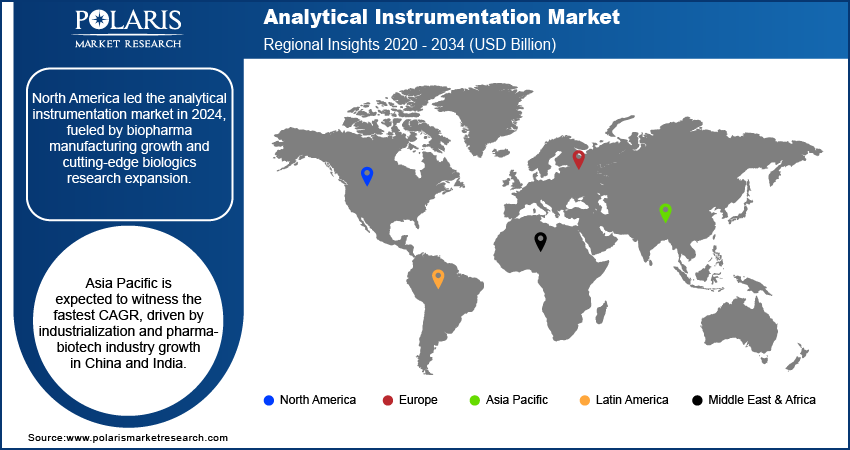

- North America analytical instrumentation market dominated the global market share in 2024.

- The US analytical instrumentation market held largest regional share in 2024, attributed to the robust investment in life sciences research and pharmaceutical innovation.

- The Asia Pacific region is projected to grow at fastest CAGR during the forecast period, driven by rapid industrialization and expansion of pharmaceutical and biotechnology industries in countries such as China and India.

- The market in the China is growing due to the increasing government funding for research infrastructure and growing foreign investments in laboratory development.

Industry Dynamics

- Biopharma innovation and increasing drug discovery activities are propelling demand for analytical instrumentation used in compound screening, molecular profiling, and clinical assay development across pharmaceutical and biotechnology laboratories.

- Rising research investment in advanced sciences, including genomics, proteomics, and materials science, is driving the deployment of high-precision analytical tools in academic institutions and government-funded research organizations.

- High capital investment requirements for state-of-the-art instruments remain a key barrier, particularly for small- and mid-sized labs that struggle with budget constraints and high total cost of ownership.

- Integration of AI and machine learning is opening new opportunities for automation, real-time data analysis, and predictive diagnostics, improving workflow efficiency and reducing manual intervention across research and quality control settings.

Market Statistics

- 2024 Market Size: USD 32.86 billion

- 2034 Projected Market Size: USD 191.84 billion

- CAGR (2025-2034): 6.3%

- North America: Largest market in 2024

Analytical instrumentation refers to a broad range of precision instruments and technologies used to identify, measure and analyze the physical and chemical properties of substances. These tools are fundamental across diverse sectors such as pharmaceuticals, biotechnology, environmental science, food and beverage, petrochemicals and clinical diagnostics. Analytical instruments enable accurate testing, quality assurance, regulatory compliance and research innovation through techniques such as chromatography, spectroscopy, molecular analysis and mass spectrometry.

Stringent environmental regulations across the US, Europe, and Asia Pacific are increasing the demand for air, water, and soil monitoring systems. Governments are implementing emission control standards across industrial, municipal and commercial sectors, which is driving the deployment of analytical instruments for accurate environmental compliance testing. This is contributing to the steady adoption of spectroscopy, chromatography and elemental analysis technologies across public and private testing facilities.

The growing investment in oil & gas and petrochemical infrastructure is boosting the demand for advanced analytical tools in extraction, processing, and refining operations. According to the International Energy Forum, global upstream oil and gas capital expenditure increased by USD 24 billion in 2024, pushing total investment to USD 600 billion for the first time in over ten years. To meet future demand, annual spending is projected to rise further by USD 135 billion, reaching approximately USD 738 billion by 2030. Process analyzers and elemental analysis systems are increasingly utilized to ensure operational safety, process efficiency, and end-product consistency. These instruments are enabling real-time quality control and system optimization in high-volume industrial environments.

Drivers & Opportunities

Biopharma Innovation and Drug Discovery: The rapid growth of the biopharmaceutical and biotechnology industries is generating significant demand for high-precision analytical instrumentation. As per the Pharmaceutical Research and Manufacturers of America, the US biopharmaceutical industry generated over USD 800 billion in direct output in 2022 and contributed an additional USD 850 billion through its suppliers and related sectors. Together, the total impact exceeded USD 1.65 trillion, accounting for 3.6% of the country’s total economic output. Chromatography, electrophoresis, and spectroscopy systems are integrated into workflows for protein characterization, vaccine development, and drug discovery. Rising innovation in biologics and personalized medicine is further increasing the need for reproducible and sensitive testing platforms.

Rising Research Investment in Advanced Sciences: Rising government and academic funding in research domains such as materials science, nanotechnology, and life sciences is accelerating the use of analytical instruments across universities and national laboratories. For instance, in July 2025, Biointelect recieved USD 32.9 million in funding from the Australian Government under the Medical Research Future Fund (MRFF) initiative. The investment is aimed to support the establishment of a national incubator aimed at accelerating the commercialization of vaccine and immune-based therapy research across the country. Research-driven applications require highly sensitive and application-specific tools for structural, elemental, and molecular analysis. This trend is propelling the long-term expansion of the analytical instrumentation market across emerging and developed economies.

Segmental Insights

Product Analysis

Based on product, the segmentation includes molecular analysis instruments, spectroscopy instruments, chromatography instruments, electrochemical analysis instruments, particle counters and analyzers, and other products. The chromatography instruments segment dominated the market in 2024, driven by its widespread application across pharmaceutical, environmental and food safety testing. Chromatography systems are critical for separation and quantification of complex mixtures, supporting stringent regulatory standards and quality assurance protocols. The pharmaceutical industry’s increasing reliance on chromatographic techniques for drug development and impurity profiling has further boosting demand. Additionally, growing investments in biotechnology and life sciences research continue to support the use of gas and liquid chromatography platforms across laboratory and industrial settings, consolidating the segment’s leading position in the analytical instruments industry.

The molecular analysis instruments segment is projected to grow at the fastest CAGR during the forecast period, due to rising demand for genomic and proteomic testing. Increasing adoption of molecular diagnostics in personalized medicine, infectious disease detection, and cancer research is fueling growth. Advancements in real-time PCR, next-generation sequencing, and nucleic acid amplification technologies are driving laboratory upgrades globally. Moreover, the growing focus on precision medicine and high-throughput molecular assays in research and clinical settings is accelerating the deployment of integrated molecular platforms, positioning this segment as the fastest expanding category in the analytical instruments market.

Technology Analysis

By technology, the industry is segmented into polymerase chain reaction (PCR), spectroscopy, microscopy, chromatography, flow cytometry, sequencing, microarray, and others. The chromatography segment held the dominant market share in 2024, supported by extensive usage in pharmaceutical development, environmental monitoring, and food safety testing. High sensitivity and compound separation accuracy make chromatography systems essential across regulatory-driven applications.

The polymerase chain reaction (PCR) segment is expected to register the fastest CAGR during the forecast period. The surge in molecular diagnostics and genetic analysis, in infectious disease detection and cancer research, is driving demand for PCR systems offering rapid and accurate amplification of nucleic acids.

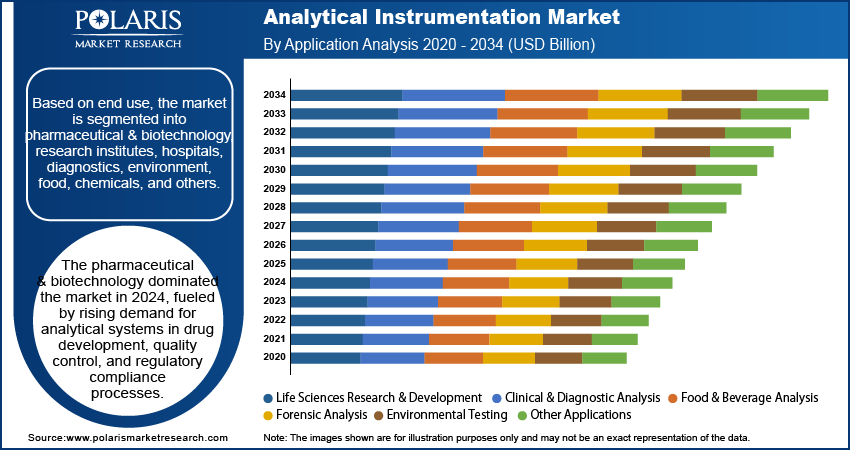

Application Analysis

Based on application, the segmentation includes life sciences research & development, clinical & diagnostic analysis, food & beverage analysis, forensic analysis, environmental testing, and others. The life sciences research & development segment accounted for the largest market share in 2024, due to sustained investments in drug discovery, genomics, proteomics, and cell biology. Research institutions and biotech firms are deploying analytical tools to enhance molecular insights and improve experiment reproducibility.

The clinical & diagnostic analysis segment is projected to grow at the highest CAGR over the forecast period. This growth is driven by the rising prevalence of chronic and infectious diseases, combined with advancements in personalized medicine. Analytical instruments are increasingly integrated into clinical labs for routine biomarker testing, disease profiling, and early diagnosis.

End Use Analysis

By end use, the indsutry is categorized into pharmaceutical & biotechnology industry, research and academic institutes, hospitals & diagnostic laboratories, environmental testing laboratories, food & beverage companies, chemical & petrochemical industries, and other end users. The pharmaceutical & biotechnology industry segment dominated the market in 2024, fueled by rising demand for analytical systems in drug development, quality control, and regulatory compliance processes. These tools support compound screening, process monitoring, and raw material validation in compliance with good manufacturing practice (GMP) standards.

The research and academic institutes segment are expected to witness significant growth during the forecast period. Universities and public-funded labs are increasingly investing in advanced instrumentation for interdisciplinary research spanning chemistry, biology, and materials science. The growing emphasis on high-throughput experimentation, precision measurement, and reproducible results is further driving the demand for sophisticated analytical systems in academic and institutional settings.

Regional Analysis

North America analytical instrumentation market dominated in 2024. This growth is driven by the expansion of biopharmaceutical manufacturing facilities and advanced biologics research centers across the region. The presence of a strong healthcare infrastructure and mature pharmaceutical industry is supporting consistent demand for high-precision analytical tools across drug development and quality assurance activities. Additionally, regulatory agencies such as the US Food and Drug Administration (FDA) continue to enforce stringent product testing and validation standards, pushing the adoption of validated analytical technologies across labs and production environments.

The US Analytical Instrumentation Market Insight

The US dominated North America analytical instrumentation landscape in 2024, attributed to the robust investment in life sciences research and pharmaceutical innovation. Federal research funding and private sector R&D activities are enabling large-scale deployment of instruments across academic, clinical, and industrial settings. For instance, in April 2025, Roche announced plans to invest USD 50 billion in pharmaceuticals and diagnostics in the US over the next five years. The investment focuses on expanding R&D, manufacturing and clinical trials, boosting demand for analytical instruments in the country. In addition, rising advancements in molecular diagnostics, biologics development, and precision medicine are increasing the need for reliable analytical platforms capable of delivering fast and reproducible results.

Asia Pacific Analytical Instrumentation Market

The market in Asia Pacific is projected to grow at the fastest CAGR during the forecast period, driven by rapid industrialization and expansion of pharmaceutical and biotechnology industries in countries such as China and India. The region is witnessing a significant rise in contract research organizations and academic collaborations that are driving the demand for advanced analytical tools. Furthermore, the growing awareness of quality assurance and product safety is further contributing to the increased adoption of regulatory-compliant instrumentation across laboratory and manufacturing facilities.

China Analytical Instrumentation Market Overview

The market in the China is growing due to the increasing government funding for research infrastructure and growing foreign investments in laboratory development. For instance, in June 2025, WuXi Biologics began initiated the construction of a new microbial manufacturing facility in the Wenjiang district of Chengdu, China. The 95,000 m² site features drug substance (DS) and drug product (DP) production capabilities. This new microbial facility is expected to drive demand for analytical instruments used in DS and DP manufacturing. In addition, the rise of domestic pharmaceutical manufacturing and public health initiatives is further accelerating instrument deployment in hospitals, academic labs, and industrial R&D centers.

Europe Analytical Instrumentation Market

The analytical instrumentation landscape in Europe is projected to hold a substantial share in 2034. This is owing to the strong emphasis on regulatory compliance, environmental safety, and sustainable manufacturing practices. Countries including Germany, Switzerland, and the UK are home to leading pharmaceutical and biotechnology hubs, contributing to the steady use of advanced analytical solutions for process monitoring and quality testing. Additionally, regional regulations related to food safety, environmental testing, and pharmaceutical validation are accelerating the adoption of precision instruments that meet EU compliance standards.

Key Players & Competitive Analysis Report

The analytical instrumentation market is moderately competitive, with major players focusing on the development of highly sensitive, accurate, and automated instruments to support advancements in life sciences, pharmaceuticals, environmental monitoring, and industrial quality control. Companies are increasingly investing in digital integration, miniaturization, and real-time data analysis capabilities to improve diagnostic speed, throughput, and reliability across laboratory and field-based applications. Key manufacturers are enhancing R&D capabilities to meet the growing demand for multi-functional and application-specific instruments, in genomics, proteomics, food testing, and clinical diagnostics. Strategic initiatives in the market include expanding manufacturing footprints, upgrading distribution and service networks, and forming collaborations with research institutions and biopharmaceutical companies to drive innovation and market access.

Prominent companies operating in the Analytical Instrumentation market include Agilent Technologies, Inc., Avantor, Inc., Bio-Rad Laboratories, Inc., Bruker Corporation, Danaher Corporation, Eppendorf SE, F. Hoffmann-La Roche AG, Illumina, Inc., Mettler Toledo International Inc., PerkinElmer, Inc., Sartorius AG, Shimadzu Corporation, Thermo Fisher Scientific, Inc., Waters Corporation, and Zeiss Group.

Key Players

- Agilent Technologies, Inc.

- Avantor, Inc.

- Bio-Rad Laboratories, Inc.

- Bruker Corporation

- Danaher Corporation

- Eppendorf SE

- F. Hoffmann-La Roche AG

- Illumina, Inc.

- Mettler Toledo International Inc.

- PerkinElmer, Inc.

- Sartorius AG

- Shimadzu Corporation

- Thermo Fisher Scientific, Inc.

- Waters Corporation

- Zeiss Group

Industry Developments

- June 2025: Bruker Corporation acquired Biocrates Life Sciences AG, a prominent Austrian company specializing in mass spectrometry-based quantitative metabolomics. The acquisition expands Bruker’s multi-omics portfolio by incorporating Biocrates’ metabolite and lipid analysis kits, assays, software, and services.

Analytical Instrumentation Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Molecular Analysis Instruments

- Spectroscopy Instruments

- Chromatography Instruments

- Electrochemical Analysis Instruments

- Particle Counters and Analyzers

- Other Products

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Polymerase Chain Reaction

- Spectroscopy

- Microscopy

- Chromatography

- Flow Cytometry

- Sequencing

- Microarray

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Life Sciences Research & Development

- Clinical & Diagnostic Analysis

- Food & Beverage Analysis

- Forensic Analysis

- Environmental Testing

- Other Applications

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Pharmaceutical & Biotechnology Industry

- Research and Academic Institutes

- Hospitals & Diagnostic Laboratories

- Environmental Testing Laboratories

- Food & Beverage Companies

- Chemical & Petrochemical Industries

- Other End Users

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Analytical Instrumentation Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 54.55 Billion |

|

Market Size in 2025 |

USD 57.76 Billion |

|

Revenue Forecast by 2034 |

USD 100.45 Billion |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 54.55 billion in 2024 and is projected to grow to USD 100.45 billion by 2034.

The global market is projected to register a CAGR of 6.3% during the forecast period.

North America dominated the market in 2024, driven by the expansion of biopharmaceutical manufacturing facilities and advanced biologics research centers across the region.

A few of the key players in the market are Agilent Technologies, Inc., Avantor, Inc., Bio-Rad Laboratories, Inc., Bruker Corporation, Danaher Corporation, Eppendorf SE, F. Hoffmann-La Roche AG, Illumina, Inc., Mettler Toledo International Inc., PerkinElmer, Inc., Sartorius AG, Shimadzu Corporation, Thermo Fisher Scientific, Inc., Waters Corporation, and Zeiss Group.

The chromatography instruments segment held the largest market share in 2024, supported by extensive utilization across pharmaceutical development, environmental monitoring, and food quality testing.

The polymerase chain reaction (PCR) segment is expected to witness the fastest growth during the forecast period, surge in molecular diagnostics and genetic analysis, in infectious disease detection and cancer research.